Deutsche Bank FIC Traders: A Rising Global Force

Table of Contents

Strategic Initiatives Driving Growth

Deutsche Bank's strategic growth in FIC trading isn't accidental; it's the result of calculated and impactful initiatives designed to maximize market share and competitive advantage. These initiatives focus on strategic investments in high-growth areas, intelligent risk management, and a keen eye for market opportunities. This proactive approach has propelled Deutsche Bank to the forefront of the global financial landscape.

- Targeted Acquisitions: The bank has strategically acquired smaller firms specializing in niche areas within FIC trading. These acquisitions brought in specialized expertise and pre-existing client bases, accelerating Deutsche Bank's market penetration.

- Technological Investment: Significant investment in cutting-edge technology platforms has been crucial. This commitment to innovation provides a significant competitive edge.

- Niche Market Focus: Deutsche Bank hasn't tried to be everything to everyone. Instead, they've identified and successfully targeted underserved market niches, capitalizing on opportunities often overlooked by larger competitors.

- Robust Risk Management: Improved risk management strategies are fundamental to Deutsche Bank's success. By mitigating potential losses effectively, they’ve fostered a sustainable and profitable growth trajectory. This disciplined approach instills confidence in clients and investors alike.

Technological Advancements and Algorithmic Trading

The adoption of advanced technologies is a cornerstone of Deutsche Bank's FIC trading success. The integration of Artificial Intelligence (AI), Machine Learning (ML), and sophisticated algorithms in high-frequency trading (HFT) has revolutionized their operational efficiency and profitability.

- Sophisticated Algorithms: Implementation of sophisticated trading algorithms ensures optimized execution, maximizing returns and minimizing slippage.

- AI-driven Predictive Modeling: AI is used extensively for predictive modeling and risk assessment, providing traders with valuable insights and improving decision-making.

- High-Speed Infrastructure: Investment in high-speed, low-latency trading infrastructure is paramount in the highly competitive world of HFT. This ensures that Deutsche Bank traders are always ahead of the curve.

- Proprietary Technology Development: Deutsche Bank's commitment to developing proprietary trading technology provides a unique competitive advantage, differentiating them from competitors reliant on third-party solutions.

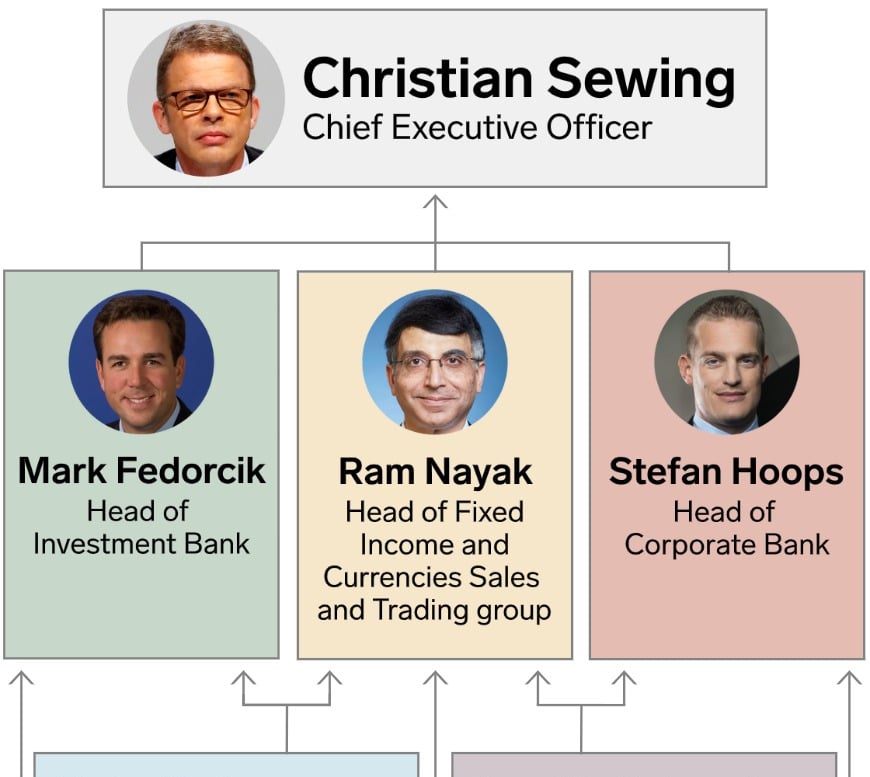

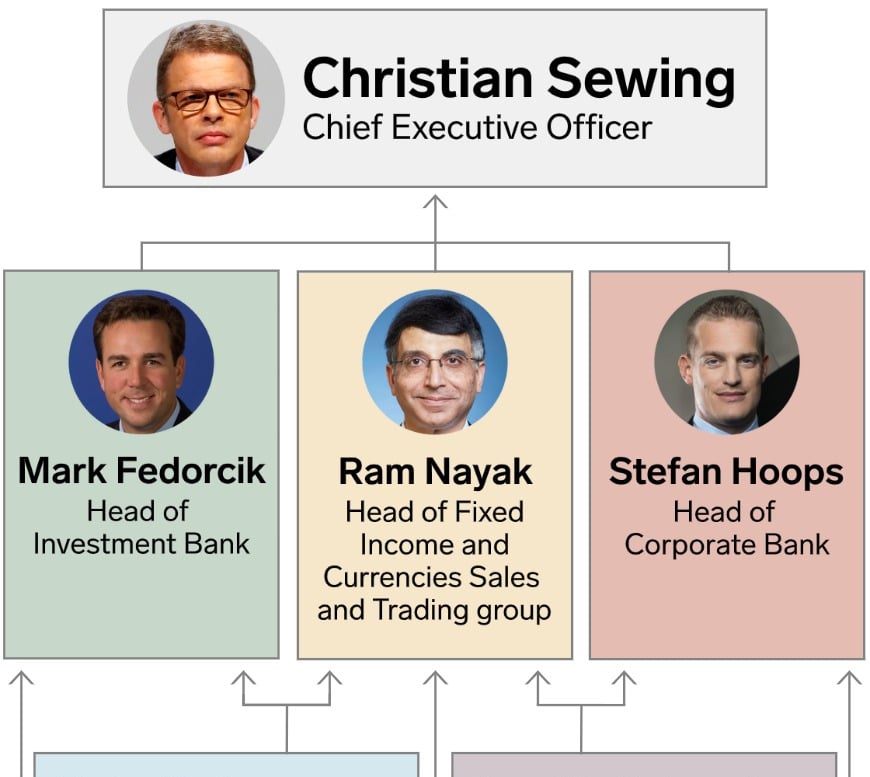

The Expertise of Deutsche Bank FIC Traders

The success of Deutsche Bank's FIC trading division rests heavily on the exceptional talent and experience of its traders. Attracting and retaining top talent is a high priority, fostering a collaborative environment that encourages innovation and excellence.

- Recruitment of Top Talent: Deutsche Bank actively recruits highly experienced traders from other leading institutions, bringing in a wealth of knowledge and expertise.

- Continuous Professional Development: The bank invests heavily in ongoing training and development programs, ensuring that its traders remain at the forefront of industry knowledge and best practices.

- Collaborative Work Environment: A collaborative and innovative work environment is cultivated, encouraging the free exchange of ideas and fostering teamwork.

- Analytical and Problem-Solving Skills: Strong analytical and problem-solving skills are emphasized, ensuring that traders can effectively navigate the complexities of the global financial markets.

Deutsche Bank FIC Traders' Impact on Global Markets

Deutsche Bank's FIC division is making a significant impact on global financial markets. Their substantial trading volume and innovative strategies influence price discovery and contribute significantly to market liquidity.

- Market Liquidity: Deutsche Bank's FIC trading contributes significantly to market liquidity, ensuring efficient and smooth functioning of financial markets.

- Price Discovery Influence: Their trading activity directly influences pricing in various asset classes, impacting market dynamics globally.

- Major Global Transactions: The division is increasingly involved in major global financial transactions, solidifying their position as a key market player.

- Innovative Trading Strategies: Deutsche Bank's FIC traders are known for developing and implementing innovative trading strategies, setting new benchmarks within the industry.

Conclusion

The rise of Deutsche Bank's FIC trading division is a testament to strategic planning, technological innovation, and the exceptional skills of its traders. Their targeted initiatives, adoption of cutting-edge technology, and commitment to attracting top talent have propelled them to become a major force in global finance. This success story is a compelling narrative of growth and influence within the complex world of Fixed Income Currencies trading.

Call to Action: Learn more about the exciting opportunities at Deutsche Bank's leading FIC trading team. Explore career opportunities and discover how you can become part of this rising global force in financial markets. Find out more about Deutsche Bank FIC Traders today!

Featured Posts

-

Jon Jones Nate Diaz Fight Confirmed Dispelling Aspinall Speculation

May 30, 2025

Jon Jones Nate Diaz Fight Confirmed Dispelling Aspinall Speculation

May 30, 2025 -

Understanding Live Now Pay Later Services A Comprehensive Overview

May 30, 2025

Understanding Live Now Pay Later Services A Comprehensive Overview

May 30, 2025 -

Des Moines Shooting Prompts Cancellation Of Middle School Track Meet

May 30, 2025

Des Moines Shooting Prompts Cancellation Of Middle School Track Meet

May 30, 2025 -

Udstilling Ditte Okman Praesenterer Kare Quist Han Taler Udenom

May 30, 2025

Udstilling Ditte Okman Praesenterer Kare Quist Han Taler Udenom

May 30, 2025 -

Tennis Dispute Djokovics Player Union Initiates Legal Action

May 30, 2025

Tennis Dispute Djokovics Player Union Initiates Legal Action

May 30, 2025