Deutsche Bank London: €18 Million Fixed Income Bonus Mystery

Table of Contents

The €18 Million Question: Who Received the Bonus and Why?

The core of this mystery lies in the complete lack of public information regarding the recipients of this substantial bonus. Deutsche Bank has remained tight-lipped, fueling speculation and raising concerns among employees, analysts, and the public. Who were the lucky few to receive such a significant windfall?

- Potential Beneficiaries: The €18 million could have been distributed among a select group of high-performing individuals within the fixed income division. This could include senior managers, specific trading teams specializing in high-yield bonds or derivatives, or even entire departments exceeding expectations. Alternatively, it might represent a smaller number of exceptionally lucrative deals or strategies.

- Lack of Transparency Breeds Suspicion: The absence of transparency surrounding bonus allocation is a major cause for concern. Such secrecy fosters an environment of suspicion and fuels accusations of unfairness and favoritism. It raises questions about whether performance truly justified such a large payout for a few, particularly in contrast to potential job cuts or salary freezes for others within the bank.

- Comparison with Other Institutions: The size of this bonus, compared to bonus structures at other leading financial institutions, is also a significant point of discussion. Was this payout in line with industry standards, given Deutsche Bank’s performance, or does it represent an outlier demanding further scrutiny?

Deutsche Bank's Fixed Income Performance in 2023 (and beyond): Contextualizing the Bonus

To understand the context of this €18 million bonus, a close examination of Deutsche Bank's fixed income performance in the relevant period is crucial. Did the division’s performance genuinely warrant such a substantial reward?

- Key Performance Indicators (KPIs): To evaluate the justification for this bonus, it's crucial to examine key performance indicators (KPIs) specific to the fixed income division. These could include trading volume, profitability on specific asset classes, risk-adjusted returns, and market share.

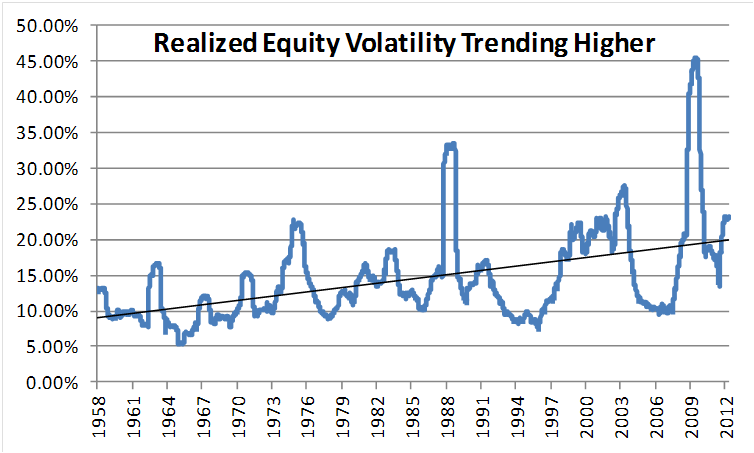

- Market Conditions and Their Impact: Market conditions play a crucial role in financial performance. Examining the market environment during this period – considering factors like interest rate changes, volatility, and geopolitical events – is vital to assessing whether the €18 million bonus accurately reflects performance.

- Competitive Benchmarking: Comparing Deutsche Bank's fixed income performance and compensation structures to those of its competitors is critical for determining whether the €18 million bonus aligns with industry norms and practices.

Regulatory Scrutiny and Potential Fallout: The Legal Ramifications

The €18 million bonus payout may invite regulatory scrutiny and potential legal ramifications. Several aspects need careful investigation.

- Relevant Financial Regulations: Various financial regulations govern bonus payouts, particularly concerning risk-taking and responsible compensation practices. The bonus' size and the lack of transparency might trigger investigations into potential breaches of these regulations.

- Potential Fines and Penalties: Depending on the findings of any investigations, Deutsche Bank could face significant fines and penalties for non-compliance with regulations or internal policies concerning bonus payouts.

- Impact on Investor Confidence: The controversy surrounding the €18 million bonus could negatively impact investor confidence in Deutsche Bank, leading to decreased stock value and potential difficulties in attracting future investments.

The Public Perception and Media Coverage: Fueling the Mystery

Media coverage and public reaction have amplified the mystery surrounding the Deutsche Bank London €18 million fixed income bonus.

- Media Scrutiny: The intense media scrutiny of this event has played a crucial role in bringing the issue to public attention and fueling debate. News articles, analyses, and editorials have heightened public awareness and fueled demands for transparency.

- Social Media Reaction: Social media has provided a platform for public discussion and outrage regarding the large bonus payout. This public opinion has added pressure on Deutsche Bank to address the issue and increase transparency.

- Impact on Brand Reputation: The negative media attention and public sentiment surrounding this event can significantly damage Deutsche Bank's brand reputation, impacting its ability to attract and retain talent, as well as its overall standing in the financial market.

Conclusion: Unraveling the Deutsche Bank London €18 Million Fixed Income Bonus Mystery – A Call to Action

The €18 million fixed income bonus mystery at Deutsche Bank's London office highlights the urgent need for greater transparency and accountability in the financial sector. The lack of public information surrounding the recipients and the justification for such a large payout raises serious concerns about fairness, ethics, and regulatory compliance. We need further investigation to shed light on this situation. Share your thoughts on this matter and demand greater transparency in banking bonus structures. Let's collectively push for a more ethical and accountable financial industry where such large payouts are justified and clearly explained to the public. The Deutsche Bank London €18 million fixed income bonus, and similar situations, deserve thorough scrutiny and appropriate action.

Featured Posts

-

Live Music Stocks Surge Pre Market Monday Following A Volatile Week

May 30, 2025

Live Music Stocks Surge Pre Market Monday Following A Volatile Week

May 30, 2025 -

Jon Joness Hasbulla Fight Injury Details Revealed

May 30, 2025

Jon Joness Hasbulla Fight Injury Details Revealed

May 30, 2025 -

Hanouna Et Le Pen Vers Un Nouveau Proces En Appel En 2026

May 30, 2025

Hanouna Et Le Pen Vers Un Nouveau Proces En Appel En 2026

May 30, 2025 -

Decouverte D Une Bombe A La Gare Du Nord Informations Sur Les Perturbations

May 30, 2025

Decouverte D Une Bombe A La Gare Du Nord Informations Sur Les Perturbations

May 30, 2025 -

Vivian Jenna Wilson From Elon Musks Daughter To Aspiring Model

May 30, 2025

Vivian Jenna Wilson From Elon Musks Daughter To Aspiring Model

May 30, 2025