Did The Bank Of Canada Misstep? Rosenberg's Perspective

Table of Contents

Rosenberg's Criticism of the Bank of Canada's Interest Rate Hikes

Rosenberg has been a vocal critic of the Bank of Canada's aggressive interest rate hikes. He argues that these increases were premature and risked triggering an unnecessary recession.

The Argument That Rate Hikes Were Premature

Rosenberg's primary contention is that the Bank overreacted to inflationary pressures. He points to several factors:

- Inflation already peaking: He argued that inflation had already peaked or was nearing its peak before the most aggressive rate hikes, suggesting that further increases were unwarranted.

- Risk of recession: He consistently warned that rapid interest rate increases would significantly dampen economic growth, potentially triggering a recession. This concern stems from the impact of higher borrowing costs on businesses and consumers.

- Lag effect of monetary policy: Rosenberg highlights the inherent lag between policy changes and their effect on the economy, arguing that the Bank's actions might have been too forceful given this time delay.

Supporting Rosenberg's claims, several economic indicators initially seemed to corroborate his concerns. While the Consumer Price Index (CPI) remained elevated, GDP growth slowed, and the unemployment rate showed signs of increasing. However, counterarguments exist. Some economists argued that the inflation rate remained stubbornly high, necessitating more decisive action from the Bank to curb rising prices. The debate hinges on interpreting the interplay of these indicators and projecting their future trajectory.

Concerns About the Impact on the Canadian Housing Market

The Bank of Canada's interest rate hikes have had a considerable impact on the Canadian housing market. Rosenberg voiced significant concerns about the potential negative consequences:

- Housing affordability: Rising interest rates dramatically increase mortgage payments, making homeownership less affordable for many Canadians, particularly first-time buyers.

- Price corrections: Higher borrowing costs can lead to a decrease in housing demand, potentially causing price corrections in some areas.

- Construction slowdown: Reduced demand and higher financing costs can also significantly impact housing starts and construction activity.

Rosenberg's projections (while not always publicly stated as specific numerical forecasts) consistently pointed towards a significant correction in the housing market, a sentiment echoed by many analysts and reflected in declining housing starts and sales data. This contraction, however, might be viewed differently depending on whether one considers it a necessary correction of an overheated market or a damaging blow to economic growth.

Assessing the Bank of Canada's Inflation Control Strategy

The Bank of Canada's primary mandate is to control inflation. Let's analyze the effectiveness of its strategy:

Evaluation of the Effectiveness of the Bank of Canada's Monetary Policy Tools

The Bank employed several tools in its attempt to manage inflation:

- Interest rate adjustments: The primary tool, adjusting the overnight rate to influence borrowing costs across the economy.

- Quantitative tightening: Reducing its holdings of Government of Canada bonds to decrease the money supply.

The effectiveness of these measures is debatable. The lag effect of monetary policy – the delay between a policy change and its impact – makes accurate prediction and assessment challenging. Moreover, external factors like global supply chain disruptions and geopolitical events can significantly influence inflation rates, making it difficult to isolate the impact of the Bank's policies. Visualizing the interplay between interest rate changes and inflation using charts and graphs would significantly aid in understanding this complex relationship.

Comparison with Other Central Banks' Approaches

Comparing the Bank of Canada's approach with other major central banks provides valuable context. The US Federal Reserve, for instance, adopted a similarly aggressive approach, while the European Central Bank responded more cautiously. A comparative analysis reveals similarities and differences in strategies and outcomes, highlighting the influence of regional economic conditions and political considerations on monetary policy decisions. Analyzing these differences, particularly the eventual outcomes of each approach, offers valuable insights into the Bank of Canada's choices and their consequences.

The Potential Economic Consequences of the Bank of Canada's Actions

The Bank of Canada's actions have sparked considerable debate regarding the potential economic consequences:

Analysis of the Risks of a Recession in Canada

Several indicators suggest a potential recession:

- Inverted yield curve: A situation where long-term bond yields fall below short-term yields, often considered a predictor of economic downturns.

- Weakening consumer confidence: Concerns about job security and rising costs impact consumer spending, a significant driver of economic growth.

Rosenberg's forecasts consistently highlighted the increased risk of a recession. He emphasized the cumulative impact of higher interest rates, reduced consumer spending, and the potential for significant job losses. While some argue that a mild recession might be necessary to curb inflation, others, including Rosenberg, believe the Bank's actions risked a more severe downturn. The government's potential mitigation strategies, such as fiscal stimulus packages, might help to soften the blow but add another layer of complexity to the situation.

Long-Term Effects on Economic Growth and Employment

The long-term effects of the Bank's policies on economic growth and job creation remain uncertain. Rosenberg's perspective focuses on the potential for sustained lower growth and higher unemployment as a consequence of overly aggressive monetary tightening. Analyzing long-term economic growth forecasts and employment rate projections provides valuable insight into the potential consequences of the Bank's strategy. This necessitates careful consideration of the trade-offs between controlling inflation in the short term and ensuring long-term economic prosperity and stable employment.

Conclusion: Was the Bank of Canada Wrong? A Verdict Based on Rosenberg's Insights

This article has examined David Rosenberg's critique of the Bank of Canada's recent monetary policy decisions, focusing on interest rate hikes, inflation control strategies, and their potential economic consequences. Rosenberg's perspective, while not universally accepted, highlights the complexities and risks associated with aggressive interest rate increases. While the Bank's aim to curb inflation is understandable, the debate centers on whether its approach was appropriately calibrated to the economic realities and whether the potential negative consequences outweigh the benefits. The long-term effects remain to be seen.

To engage further with this ongoing debate about the Bank of Canada misstep, we encourage you to research David Rosenberg's publications and actively follow current economic data releases. Consider participating in discussions within economic forums or exploring further readings on monetary policy and its impacts on the Canadian economy. The debate surrounding the Bank of Canada's monetary policy and its potential missteps is crucial for understanding Canada's economic future.

Featured Posts

-

We Now Know How Ai Thinks And Its Barely Thinking At All

Apr 29, 2025

We Now Know How Ai Thinks And Its Barely Thinking At All

Apr 29, 2025 -

Mlb

Apr 29, 2025

Mlb

Apr 29, 2025 -

Starbucks Workers Reject Proposed Pay Raise From Company

Apr 29, 2025

Starbucks Workers Reject Proposed Pay Raise From Company

Apr 29, 2025 -

Willie Nelson New Music And A Family Controversy

Apr 29, 2025

Willie Nelson New Music And A Family Controversy

Apr 29, 2025 -

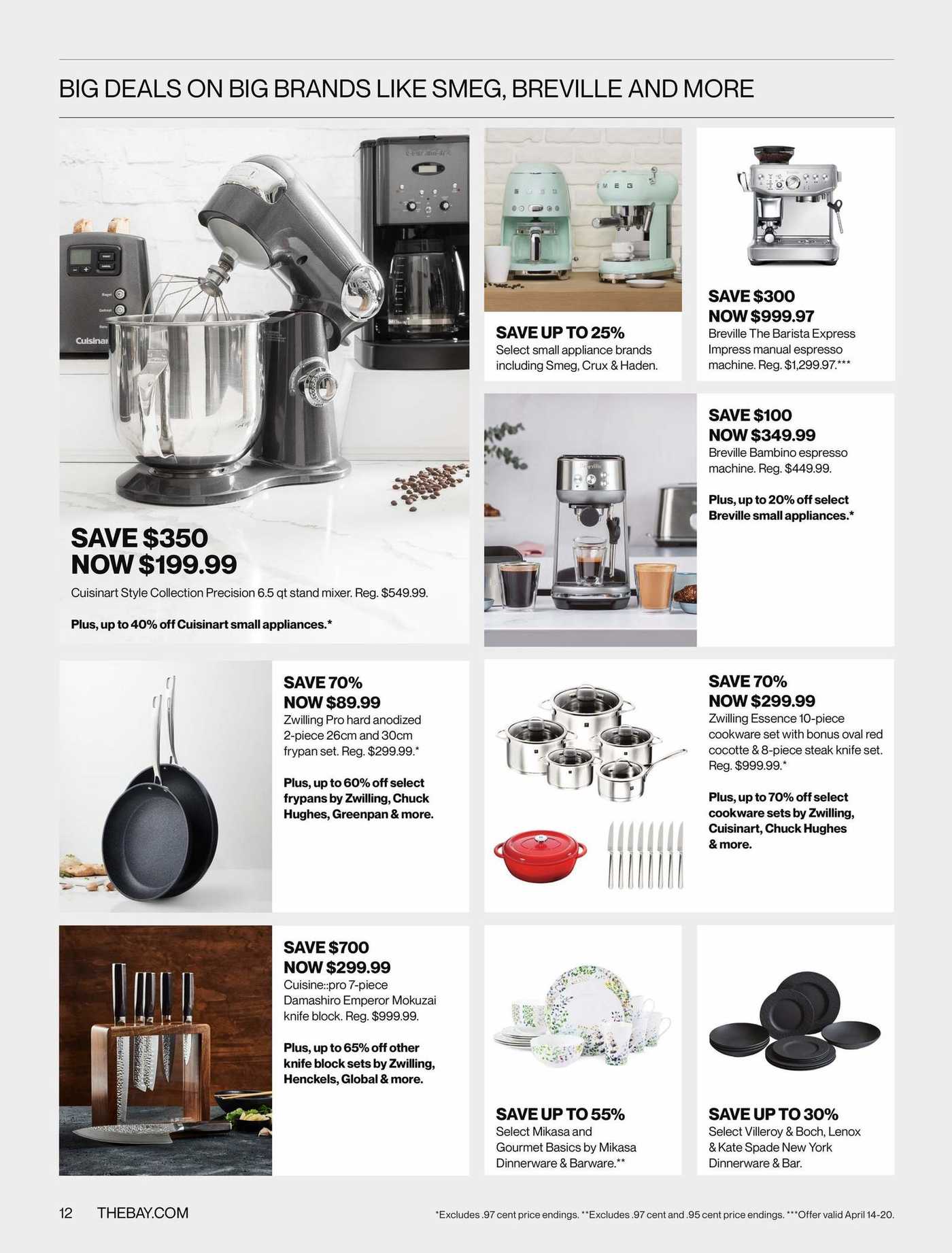

Final Days Of Hudsons Bay Huge Savings Up To 70

Apr 29, 2025

Final Days Of Hudsons Bay Huge Savings Up To 70

Apr 29, 2025