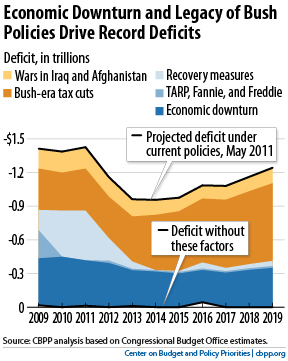

Dissecting The GOP Tax Cuts: A Deficit Projection Analysis

Initial Projections and Assumptions

The initial projections from the Congressional Budget Office (CBO), a nonpartisan agency, played a crucial role in shaping the public discourse surrounding the TCJA. These projections, however, relied on several key assumptions that proved to be crucial in understanding the subsequent outcome.

-

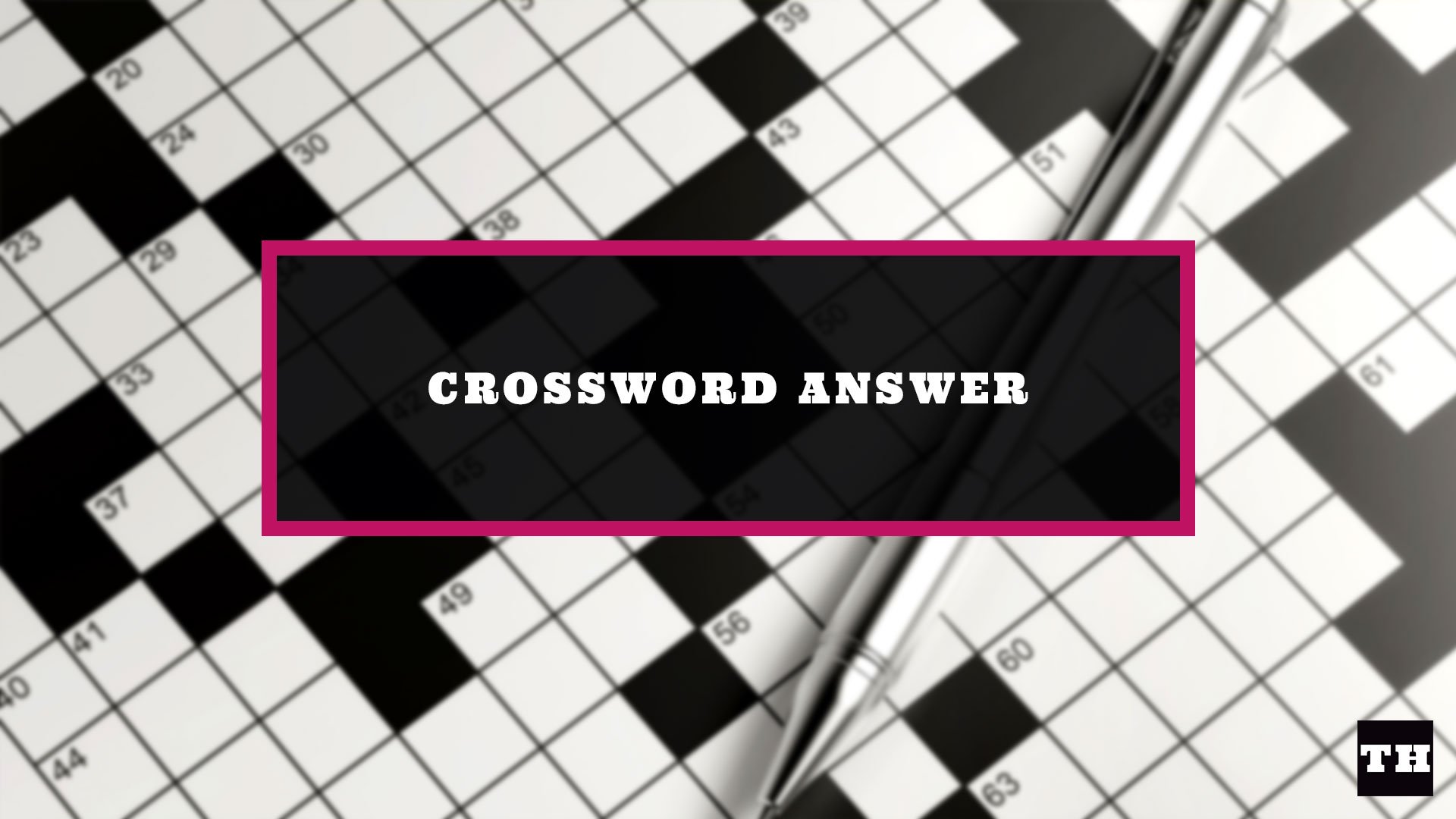

Initial CBO projections of increased deficits: The CBO initially projected substantial increases in the federal budget deficit over the following decade due to the tax cuts. These projections varied depending on the specific economic scenario used.

-

Assumptions regarding economic growth rates: The CBO's projections were heavily reliant on assumptions about future economic growth. Higher growth rates were projected to offset some of the revenue losses from the tax cuts through increased tax collections. However, these optimistic growth forecasts were a source of subsequent debate.

-

Projected impact on individual and corporate tax revenue: The TCJA significantly lowered both individual and corporate tax rates. The CBO projected the impact of these reductions on overall tax revenue, taking into account anticipated behavioral changes by taxpayers and businesses.

-

Limitations of initial modeling and potential biases: It's important to acknowledge that all economic models have limitations. The CBO's initial projections, while detailed, did not fully account for all potential economic complexities, and some critics argued that the model exhibited biases.

Actual Revenue Data vs. Projections

Comparing actual revenue collected since the TCJA's implementation with the CBO's initial projections reveals some critical discrepancies.

-

Analysis of actual tax revenue collected annually since 2017: Analyzing the yearly revenue data provides a clear picture of whether the tax cuts generated the projected economic growth and consequent tax revenue increases.

-

Discussion of any significant discrepancies between projected and actual revenue: Significant differences between the projected and actual tax revenue need thorough examination. Were the discrepancies minor deviations or substantial departures from initial forecasts?

-

Factors contributing to variations (e.g., economic slowdowns, changes in tax compliance): Various factors could explain the variations. Economic slowdowns, changes in investor behavior, and shifts in tax compliance patterns all played a role in the final revenue figures.

-

Data visualization (charts and graphs) comparing projected vs. actual revenue: Visual representations, like charts and graphs, are effective tools to highlight the differences between projected and actual revenue streams, making the comparison easier to understand. (Note: Charts and graphs would be included here in a published article.)

Impact on Specific Sectors of the Economy

The GOP tax cuts had varying impacts on different sectors of the economy.

-

Analysis of corporate investment and job growth following the tax cuts: Did the corporate tax cuts lead to increased investment and job creation as proponents claimed? Analyzing data on capital expenditures and employment figures can shed light on this.

-

Impact on individual taxpayers across different income brackets: The effects on individuals were not uniform. Analyzing the impact on various income brackets is crucial to assess the distributive effects of the tax cuts.

-

Sector-specific analysis of the effect on economic activity: Some sectors might have benefited more than others. Examining sector-specific data provides a more nuanced understanding of the overall economic impact.

-

Discussion of unintended consequences or unexpected outcomes: Were there any unintended consequences? Did the tax cuts lead to unforeseen economic shifts or distortions?

Long-Term Deficit Implications

The long-term fiscal consequences of the TCJA remain a significant concern.

-

Long-term CBO projections or alternative model estimations: Long-term projections are inherently uncertain, but analyzing CBO and other models helps in assessing the potential long-term debt accumulation.

-

Potential impacts on future government spending and programs: Increased national debt can constrain future government spending on vital social programs and infrastructure projects.

-

Risk of reduced credit ratings and increased borrowing costs: A growing national debt can lead to reduced credit ratings, forcing the government to pay higher interest rates on its borrowing.

-

Intergenerational equity implications of the increased debt: The burden of the increased national debt will likely fall on future generations, raising serious questions about intergenerational equity.

Alternative Economic Models and Perspectives

The CBO is not the only source of economic analysis. Alternative models and perspectives offer varying insights.

-

Review of alternative economic models and their predictions: Comparing the CBO's projections with those of other reputable economic models helps in understanding the range of possible outcomes.

-

Comparison of different forecasting methodologies and their limitations: Different economic models use different methodologies and assumptions. Understanding these differences is essential in evaluating their predictions.

-

Consideration of differing viewpoints on the effectiveness of supply-side economics: The TCJA was largely based on supply-side economics, which emphasizes the role of tax cuts in stimulating economic growth. Analyzing different viewpoints on the effectiveness of this approach provides a more balanced perspective.

-

Discussion of the role of fiscal policy in economic growth: The impact of fiscal policy, including tax cuts, on economic growth is a complex issue with varying perspectives.

Conclusion

This analysis of the GOP tax cuts and their projected deficit impact reveals a complex picture. While initial projections and actual data show significant increases in the national debt, the long-term consequences remain subject to debate. Different economic models offer varied perspectives on the overall economic effects. Further research and monitoring of economic indicators are crucial to fully understand the lasting impact of the TCJA. Understanding the implications of the GOP Tax Cuts Deficit is crucial for informed policymaking and responsible fiscal management. Continue to stay informed about the ongoing effects of these tax changes by researching further analyses and government reports related to the GOP tax cuts and the national deficit.

Investigation Uncovers Millions In Losses Due To Office365 Hacks

Investigation Uncovers Millions In Losses Due To Office365 Hacks

Projet Du 4eme Pont D Abidjan Un Apercu Complet Des Delais Et Des Couts

Projet Du 4eme Pont D Abidjan Un Apercu Complet Des Delais Et Des Couts

Nyt Mini Crossword Clues And Answers March 20 2025

Nyt Mini Crossword Clues And Answers March 20 2025

Robin Roberts Message To Fans Following Gma Layoffs

Robin Roberts Message To Fans Following Gma Layoffs

Analyontas Ta Tampoy Krisima Stoixeia Stoys Fonoys

Analyontas Ta Tampoy Krisima Stoixeia Stoys Fonoys