Do Film Tax Credits Work? A Minnesota Case Study

Table of Contents

The Structure of Minnesota's Film Tax Credit Program

Understanding the mechanics of the Minnesota film tax credit is crucial to assessing its effectiveness. The program offers a percentage-based tax credit to qualifying film productions shot within the state. This incentivizes filmmakers to choose Minnesota as a filming location, boosting the local economy.

- Credit Percentage Offered: The exact percentage offered can fluctuate, so checking the Minnesota Department of Revenue's website for the most up-to-date information is vital. Historically, it has ranged from a certain percentage of qualified spending.

- Types of Productions Eligible: The program generally includes feature films, television shows, commercials, and documentaries. Specific eligibility criteria may apply, such as minimum spending thresholds or adherence to certain production standards.

- Requirements for Claiming the Credit: To claim the credit, productions must meet specific requirements, including demonstrable spending within Minnesota and employing a minimum number of in-state workers. These stipulations aim to ensure that the tax credits directly benefit the Minnesota economy.

- Process for Applying and Receiving the Credit: The application process typically involves submitting detailed documentation of production spending and employment records. A thorough understanding of the application guidelines is essential for producers seeking to utilize the Film Tax Credits Minnesota program.

Economic Impact Assessment: Jobs and Spending

Analyzing the economic impact of Minnesota's film tax credit requires examining both direct and indirect job creation and spending. While precise figures can be difficult to isolate, studies can offer valuable insights.

- Number of Jobs Created Directly by Film Productions: Direct employment includes on-set crew, actors, and production staff. Data on this aspect, often collected by the Minnesota Film Office, would provide a clear picture of jobs directly attributable to film productions utilizing the credits.

- Estimate of Indirect Job Creation: The film industry generates significant indirect employment. This includes jobs in supporting industries such as catering, hotels, transportation, equipment rentals, and local businesses providing goods and services to productions. This multiplier effect significantly amplifies the economic benefit.

- Analysis of the Types of Jobs Created: Examining the skill level of jobs created is crucial. Does the program attract high-skilled, high-paying jobs or primarily low-skilled, temporary positions? This affects the long-term economic benefit for Minnesota.

- Data on Spending by Productions Within the State: Tracking spending by productions within Minnesota, from hotel accommodations to equipment rentals, paints a clearer picture of the program's direct contribution to the state's economy.

Positive Impacts of the Minnesota Film Tax Credit Program

Proponents of the Film Tax Credits Minnesota program cite several potential benefits.

- Increased Visibility and Tourism: Film productions can showcase Minnesota's landscapes and attractions, leading to increased tourism and positive media attention. This boosts the state's image and attracts visitors.

- Development of Local Film Infrastructure and Expertise: The program can stimulate the growth of a local film industry, fostering the development of infrastructure, training programs, and expertise. This creates a more sustainable film ecosystem within Minnesota.

- Attraction of High-Skilled Jobs: By attracting film productions, the state can attract a skilled workforce, leading to long-term economic benefits. These jobs often pay higher salaries than many other sectors.

- Potential for Economic Multiplier Effects: The money spent by productions circulates through the local economy, creating a ripple effect that supports numerous businesses and industries.

Negative Impacts and Criticisms of the Minnesota Film Tax Credit Program

Despite potential benefits, the Minnesota film tax credit program faces criticism.

- Cost to Taxpayers Versus Return on Investment: A crucial question is whether the financial incentives provided by the program generate a sufficient return on investment for taxpayers. Rigorous cost-benefit analysis is needed to determine the program's overall value.

- Potential for Fraud or Abuse of the Program: Any incentive program carries the risk of fraud or abuse. Robust oversight and enforcement mechanisms are essential to prevent misuse of taxpayer funds.

- Opportunity Cost: Critics argue that the funds allocated to the film tax credit program could be used more effectively in other areas to address pressing social or economic needs. This represents a significant consideration when evaluating the program's efficacy.

- Whether the Credit Disproportionately Benefits Large Productions Over Smaller, Local Projects: A concern is whether the program primarily benefits large, out-of-state productions, rather than nurturing the growth of smaller, local film projects.

Comparison to Other States' Film Tax Credit Programs

Comparing Minnesota's program to similar initiatives in other states provides valuable context.

- Comparison of Credit Amounts and Eligibility Requirements Across States: Examining how Minnesota's program stacks up against other states' film tax credit programs reveals if the incentives are competitive and effectively attract productions.

- Analysis of the Effectiveness of Different Program Designs: Analyzing the design of programs in other states – including variations in credit amounts, eligibility criteria, and administrative structures – can identify best practices and potential areas for improvement in Minnesota.

- Identification of Best Practices From Other States: Learning from the successes and failures of other states' film tax credit programs can guide future refinements and adjustments to Minnesota's approach.

Conclusion

This case study reveals a complex picture regarding the effectiveness of Film Tax Credits Minnesota. While the program offers potential benefits, such as job creation and economic stimulus, concerns about cost-effectiveness and potential for abuse remain. The data currently available is insufficient to definitively conclude whether the program achieves its intended goals. Further in-depth analysis, focusing on a detailed cost-benefit analysis and a more robust assessment of indirect economic impacts, is essential. The strengths and weaknesses of the program highlight the need for continuous monitoring and evaluation. Further research is needed to fully understand the long-term impact of Minnesota film tax credits. Continued monitoring and evaluation are crucial to optimize the program for maximum effectiveness and ensure that taxpayer money is being spent wisely. Let's continue the discussion on the future of Film Tax Credits Minnesota and advocate for data-driven policymaking.

Featured Posts

-

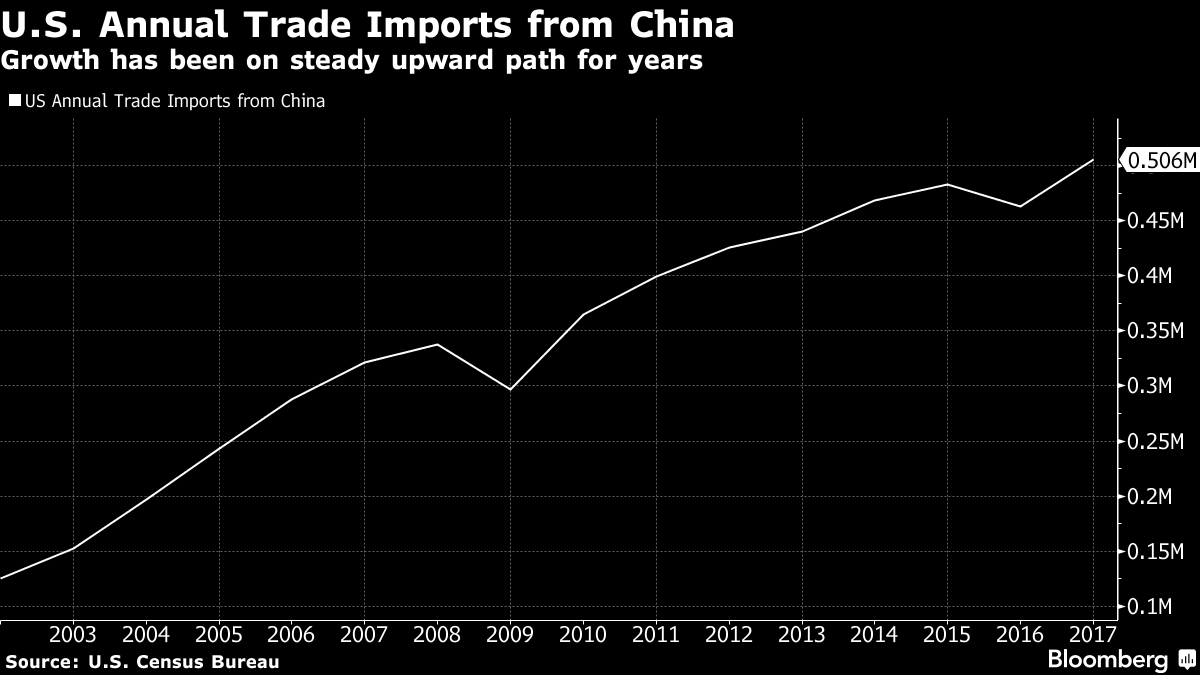

The Long Term Consequences Of Trumps China Tariffs On Us Economic Growth

Apr 29, 2025

The Long Term Consequences Of Trumps China Tariffs On Us Economic Growth

Apr 29, 2025 -

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025 -

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025 -

D C Black Hawk Crash Investigation Reveals Pilots Pre Crash Decisions

Apr 29, 2025

D C Black Hawk Crash Investigation Reveals Pilots Pre Crash Decisions

Apr 29, 2025 -

Are Trump Tariffs To Blame For Temus Higher Prices In The Us

Apr 29, 2025

Are Trump Tariffs To Blame For Temus Higher Prices In The Us

Apr 29, 2025