Dogecoin's Recent Decline: Analyzing The Correlation With Tesla And Elon Musk

Table of Contents

Elon Musk's Influence on Dogecoin's Price

Elon Musk, CEO of Tesla and SpaceX, has undeniably played a significant role in Dogecoin's price trajectory. His pronouncements, often via Twitter, have sent shockwaves through the cryptocurrency market, highlighting the power of social media influence on market sentiment.

Musk's Tweets and their Impact

Musk's tweets regarding Dogecoin have consistently demonstrated a remarkable ability to sway its price. A single tweet mentioning Dogecoin, either positively or negatively, can trigger dramatic price swings. This "Elon Musk effect" highlights the vulnerability of meme coins like Dogecoin to the whims of influential figures.

- Positive Impacts: Several instances exist where Musk's supportive tweets caused a surge in Dogecoin's price. For example, [insert example of a tweet and its subsequent price increase]. This highlights the power of positive sentiment driving market speculation.

- Negative Impacts: Conversely, critical or even ambivalent tweets from Musk have often led to significant price drops. [Insert example of a negative tweet and its price consequence]. This underscores the risk associated with relying on a single individual's pronouncements to dictate investment strategies.

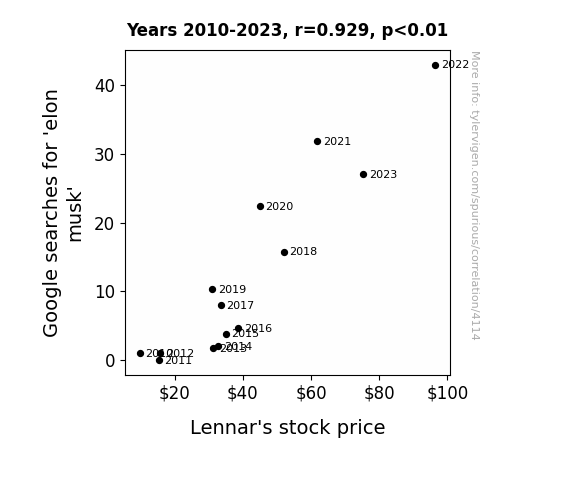

- Sentiment Analysis: Analyzing the sentiment of Musk's tweets regarding Dogecoin reveals a clear correlation between positive sentiment and price increases, and vice-versa. This further emphasizes the direct impact of his pronouncements on market psychology and Dogecoin price volatility.

- Market Manipulation Concerns: While the correlation is clear, the question of potential market manipulation remains. The SEC and other regulatory bodies have yet to formally investigate this connection, but it remains a significant factor in understanding Dogecoin price movement.

Tesla's Acceptance of Dogecoin (Past and Present)

Tesla's past acceptance of Dogecoin as payment for select merchandise caused a considerable price surge. This demonstrated a level of mainstream acceptance, bolstering investor confidence. However, Tesla's subsequent scaling back of this initiative had a noticeable impact on Dogecoin's price, underlining the importance of real-world utility in influencing cryptocurrency valuations.

- Past Acceptance: The initial acceptance of Dogecoin boosted the coin's legitimacy and fueled significant price appreciation. This showcased the potential impact of corporate adoption on cryptocurrency markets.

- Current Status: Tesla's current stance on accepting Dogecoin needs to be detailed here. Analyzing any changes in policy and the subsequent impact on the Dogecoin price is crucial.

- Future Potential: Future integration of Dogecoin into Tesla's ecosystem could significantly affect its price. Speculation surrounding potential uses, such as payment for services or integration with Tesla's energy solutions, could influence investor sentiment and market price.

Macroeconomic Factors Affecting Dogecoin's Price

Dogecoin's price is not immune to broader macroeconomic trends. Several external factors significantly influence its value.

Overall Cryptocurrency Market Trends

The overall performance of the cryptocurrency market significantly impacts Dogecoin's price. A bearish market generally negatively affects Dogecoin, while a bullish market tends to lead to price increases.

- Bitcoin Correlation: Bitcoin, the largest cryptocurrency by market capitalization, has a strong correlation with Dogecoin. Bitcoin's price movements often foreshadow similar movements in Dogecoin's price.

- Regulatory Changes: Regulatory news and changes within the cryptocurrency space influence overall market sentiment, impacting Dogecoin’s price. Increased regulatory scrutiny can lead to price drops, while positive regulatory developments can have the opposite effect.

Inflation and Interest Rate Hikes

Macroeconomic factors such as inflation and interest rate hikes impact cryptocurrency markets, including Dogecoin.

- Inflation's Influence: During periods of high inflation, investors might seek alternative assets, potentially leading to increased interest in Dogecoin and other cryptocurrencies.

- Risk-Off Sentiment: Interest rate hikes often create a risk-off sentiment in the market, causing investors to move away from higher-risk assets like Dogecoin. This leads to decreased demand and price drops.

Speculation and Market Sentiment

Dogecoin's nature as a meme coin significantly exposes its price to speculation and market sentiment.

The Role of Meme Culture and Social Media

Dogecoin's origins in internet meme culture contribute to its volatility. Social media trends and online communities play a substantial role in driving speculation and price fluctuations.

- Social Media Hype: Positive news or hype on social media platforms can rapidly increase demand and push up the price.

- Community Influence: Online communities and forums influence market sentiment through discussions and predictions, impacting buying and selling decisions.

Whale Activity and Market Manipulation Concerns

The existence of large investors ("whales") raises concerns about potential price manipulation in Dogecoin. Significant buy or sell orders by whales can destabilize the market.

- Impact of Large Orders: Large sell orders can trigger panic selling and significant price drops. Conversely, large buy orders can create artificial price increases.

- Market Stability Concerns: This potential for manipulation represents a considerable risk for investors.

Conclusion: Understanding Dogecoin's Price Fluctuations

Dogecoin's price is a complex interplay of Elon Musk's influence, macroeconomic factors, and market sentiment. While Musk's tweets and Tesla's actions have a demonstrably significant impact, macroeconomic conditions and broader cryptocurrency market trends also play crucial roles. The inherent volatility of Dogecoin, exacerbated by its meme-coin status and susceptibility to speculation and potential whale manipulation, makes it a high-risk investment.

Therefore, before investing in Dogecoin, it's vital to conduct thorough research and understand these complexities. Stay informed about Dogecoin's price, analyze Dogecoin market trends, and understand the risks of Dogecoin investments. Only then can you make informed decisions aligned with your risk tolerance.

Featured Posts

-

Punjab Government Announces Skill Development Initiative For Transgender Community

May 10, 2025

Punjab Government Announces Skill Development Initiative For Transgender Community

May 10, 2025 -

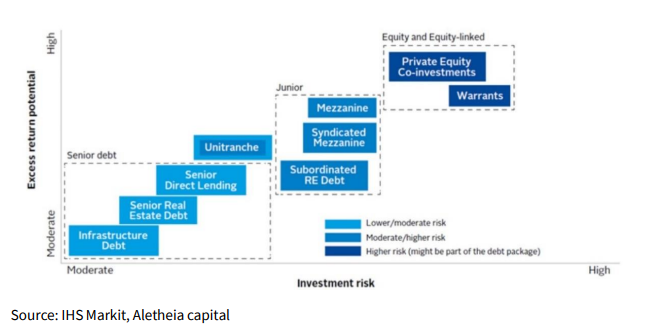

5 Key Actions To Secure A Role In The Booming Private Credit Sector

May 10, 2025

5 Key Actions To Secure A Role In The Booming Private Credit Sector

May 10, 2025 -

Harry Styles Snl Impression A Reaction That Broke The Internet

May 10, 2025

Harry Styles Snl Impression A Reaction That Broke The Internet

May 10, 2025 -

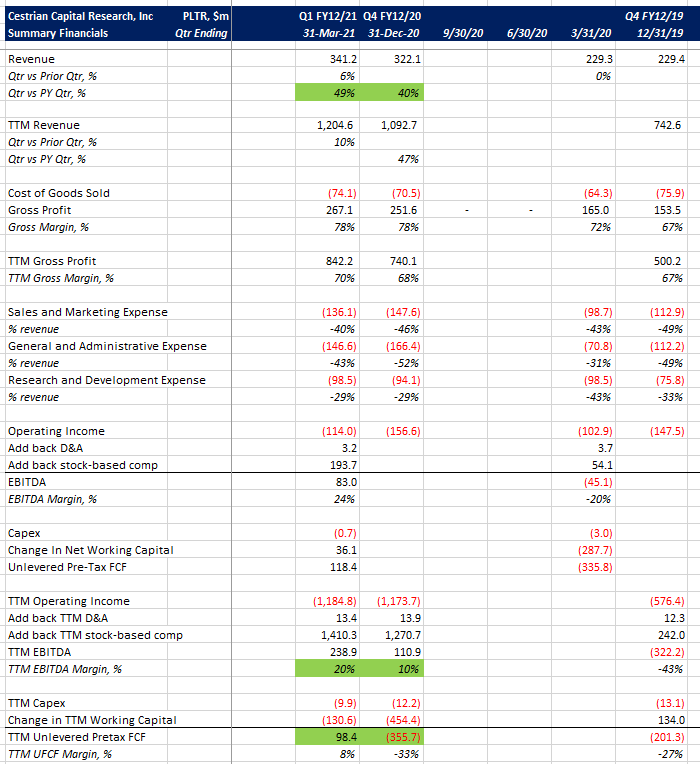

Should I Invest In Palantir Stock A Risk Assessment

May 10, 2025

Should I Invest In Palantir Stock A Risk Assessment

May 10, 2025 -

The Snl Impression That Left Harry Styles Dejected

May 10, 2025

The Snl Impression That Left Harry Styles Dejected

May 10, 2025