Should I Invest In Palantir Stock? A Risk Assessment

Table of Contents

Palantir's Business Model and Growth Potential

Palantir Technologies operates in a niche market, providing sophisticated data analytics solutions to both government and commercial clients. This dual-pronged approach presents both opportunities and challenges.

Government Contracts

Palantir's substantial revenue stream historically stemmed from lucrative government contracts, particularly with intelligence agencies and defense departments. This reliance, however, presents inherent risks.

- Percentage of revenue from government contracts: While this percentage has been declining as Palantir expands its commercial offerings, government contracts still form a significant portion of their revenue.

- Key government clients: The company boasts a diverse portfolio of government clients globally, reducing over-reliance on any single entity.

- Contract renewal rates: Maintaining high contract renewal rates is crucial for Palantir's stability, reflecting both the efficacy of its solutions and the strength of its client relationships.

- Potential for expansion into new government sectors: Palantir continually seeks expansion into new government sectors, leveraging its data analytics capabilities for broader applications within law enforcement, healthcare, and other areas. This demonstrates growth potential but also dependence on government budgets and priorities. Keywords: Government contracts, defense spending, intelligence agencies, data analytics, cybersecurity.

Commercial Market Expansion

Palantir's success hinges on its ability to conquer the competitive commercial market. This presents significant challenges but also holds immense growth potential.

- Key commercial clients: Palantir's client roster is growing, incorporating major players in various sectors like finance and healthcare. This diversification is crucial for mitigating risks associated with reliance on government contracts.

- Growth rate in commercial revenue: The rate of growth in Palantir's commercial sector is a key indicator of its long-term sustainability and investor confidence.

- Competition in the commercial market: The commercial market is intensely competitive, with established players like Salesforce and Microsoft offering similar services. Palantir needs to differentiate its offerings to thrive.

- Potential for disruptive innovation: Palantir’s commitment to continuous innovation, including AI and machine learning integration, is key to maintaining its competitive edge. Keywords: Commercial clients, software as a service (SaaS), data mining, financial services, healthcare.

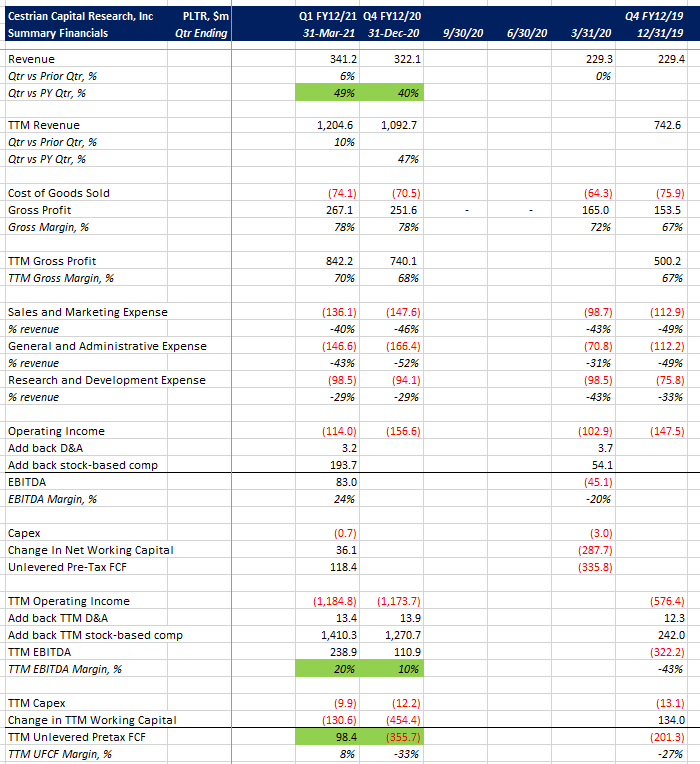

Financial Performance and Valuation

Understanding Palantir's financial health is critical for assessing its investment potential.

Revenue and Profitability

Analyzing Palantir's financial history offers insights into its growth trajectory and profitability.

- Revenue growth: Consistent revenue growth demonstrates market demand and business health.

- Profit margins: Profit margins reflect Palantir's ability to translate revenue into profit. Improving margins is a significant sign of financial strength.

- Debt levels: High debt levels can increase financial risk, impacting investor confidence.

- Cash flow: Positive and consistent cash flow is essential for sustainable growth and investment in future innovation.

- Analyst estimates: Keeping abreast of analyst predictions helps gauge market sentiment and future performance expectations. Keywords: Revenue growth, profitability, earnings per share (EPS), price-to-earnings ratio (P/E), debt-to-equity ratio.

Stock Valuation and Risk

Evaluating Palantir's stock valuation against various metrics is crucial for determining its inherent risk.

- Current stock price: The current market price reflects investor sentiment and perceived future value.

- Market capitalization: Market capitalization provides a snapshot of the company's overall size and worth.

- Valuation multiples compared to competitors: Comparing Palantir's valuation metrics (like P/E and P/S ratios) to competitors reveals whether it's overvalued or undervalued.

- Potential for overvaluation or undervaluation: Thorough analysis considering all factors is needed to ascertain whether Palantir's current stock price accurately reflects its intrinsic value. Keywords: Stock valuation, market capitalization, price-to-sales ratio (P/S), risk assessment, investment risk.

Competitive Landscape and Disruptive Technologies

Palantir operates in a dynamic and competitive environment.

Key Competitors

Understanding Palantir's competitive landscape is essential for assessing its long-term prospects.

- List major competitors: Palantir faces competition from established players and agile startups in various niches. Identifying key competitors and their strengths and weaknesses is vital.

- Their market share: Analyzing market share helps understand Palantir's position and growth potential relative to its rivals.

- Competitive advantages and disadvantages compared to Palantir: Palantir's unique selling proposition, along with its strengths and weaknesses in relation to its competitors, is a key determinant of its future market success. Keywords: Competitors, market share, competitive analysis, competitive advantage, disruptive technologies.

Technological Innovation

Palantir's ability to innovate is central to its long-term survival.

- Research and development spending: Significant investments in R&D are crucial for maintaining a technological edge.

- Patents: A strong patent portfolio protects Palantir's intellectual property and provides a competitive advantage.

- New product launches: Continuous product innovation keeps Palantir ahead of its rivals.

- Ability to adapt to changing technological landscape: The ability to adapt to changes in the technological landscape, including advancements in AI and machine learning, is essential for long-term success. Keywords: Artificial intelligence (AI), machine learning (ML), big data analytics, technological innovation, disruption.

Conclusion

Investing in Palantir stock presents both significant opportunities and considerable risks. While its innovative technology and expansion into the commercial market offer considerable growth potential, its dependence on government contracts and a fiercely competitive landscape necessitate caution. The financial performance and valuation must be meticulously evaluated before making any investment decision. Ultimately, whether investing in Palantir stock is a wise move depends heavily on your personal risk tolerance and investment strategy.

Final Thoughts: Remember that the technology sector is inherently volatile, and investing in any growth stock carries inherent risks. Palantir, while promising, is not immune to market fluctuations and competitive pressures.

Call to Action: Before making any decision regarding Palantir stock, conduct thorough independent research. Consult reputable financial news sources, review Palantir's SEC filings, and speak with a qualified financial advisor to determine if this investment aligns with your individual risk profile and financial goals. Don't hesitate to delve deeper into Palantir's financials and its competitive landscape to make an informed decision about Palantir stock.

Featured Posts

-

Luis Enriques Psg Project A Winning Season In Ligue 1

May 10, 2025

Luis Enriques Psg Project A Winning Season In Ligue 1

May 10, 2025 -

Nottingham Hospital Staff Access To Attack Victim Records Investigation Update

May 10, 2025

Nottingham Hospital Staff Access To Attack Victim Records Investigation Update

May 10, 2025 -

Leon Draisaitls Hart Trophy Nomination A Stellar Season For The Edmonton Oilers

May 10, 2025

Leon Draisaitls Hart Trophy Nomination A Stellar Season For The Edmonton Oilers

May 10, 2025 -

Dakota Johnsons Shifting Roles A Relationship Based Analysis

May 10, 2025

Dakota Johnsons Shifting Roles A Relationship Based Analysis

May 10, 2025 -

How Did Donald Trumps First 100 Days Impact Elon Musks Net Worth

May 10, 2025

How Did Donald Trumps First 100 Days Impact Elon Musks Net Worth

May 10, 2025