Dow Futures And Dollar Weaken Following Moody's Rating Cut

Table of Contents

Moody's Rationale Behind the US Credit Rating Downgrade:

Fiscal Challenges and Debt Ceiling Debates:

Moody's downgrade reflects deep-seated concerns about the US government's fiscal trajectory. The escalating national debt and recurring debt ceiling debates have created a climate of uncertainty, eroding confidence in the government's ability to manage its finances effectively. The long-term consequences of this fiscal irresponsibility could be severe, potentially leading to higher interest rates, increased inflation, and slower economic growth.

- Key Concerns from Moody's:

- Persistent high and rising government debt burden.

- Erosion of governance strength and fiscal strength.

- Continued political polarization hindering effective fiscal policy.

Political Polarization and Governance Concerns:

The intense political polarization in the US has hampered the government's ability to address its fiscal challenges proactively. Repeated brinkmanship over the debt ceiling demonstrates a lack of bipartisan cooperation, increasing uncertainty and credit risk. This political dysfunction contributes significantly to the negative outlook for the US economy.

- Examples of Political Roadblocks:

- Frequent government shutdowns due to budget impasses.

- Last-minute debt ceiling deals, increasing uncertainty.

- Lack of long-term fiscal planning and strategic debt reduction.

Comparison with other countries' ratings:

While the US remains a global economic powerhouse, the downgrade places it in a less favorable position compared to other major economies. This relative decline in creditworthiness could impact its borrowing costs and overall economic standing. [Insert chart comparing US credit rating to other major economies like Germany, Japan, UK, etc.].

Market Reactions: Dow Futures and Dollar's Decline:

Immediate Impact on Dow Futures:

Following Moody's announcement, Dow Futures experienced a sharp decline, reflecting investor anxieties. The percentage drop [insert percentage and timeframe] signifies a significant loss of confidence in the US economy's future prospects. This immediate market reaction underscores the gravity of the credit rating downgrade.

- Reactions across Market Sectors:

- Sharp decline in equity markets.

- Increased volatility in bond markets.

- Flight to safety in gold and other safe-haven assets. [Insert chart showing Dow Futures performance before and after the announcement].

Weakening of the US Dollar:

The downgrade directly impacted the US dollar's value, causing it to weaken against other major currencies. This reflects reduced investor confidence in the US economy and its ability to manage its debt. The weaker dollar could impact international trade and investment flows, potentially making US exports more competitive but imports more expensive.

- Expert Opinions on the Dollar's Future:

- [Quote from a financial expert on the dollar's short-term outlook].

- [Quote from another expert on the dollar's long-term trajectory]. [Insert chart showing the US dollar's performance against other major currencies].

Impact on other markets and asset classes:

The ripple effects of the downgrade extend far beyond Dow Futures and the dollar. Global bond yields experienced fluctuations, with increased demand for safe-haven assets like gold. Other asset classes also reacted, showing the interconnectedness of global financial markets. For example, [mention specific examples of movements in other markets such as bond yields or gold prices, with supporting data]. [Insert chart showing the movement in other asset classes].

Expert Opinions and Future Outlook:

Analyst Predictions and Market Sentiment:

Financial analysts hold varied opinions on the long-term impact of the downgrade. Some believe the market's reaction is overblown, while others foresee sustained negative consequences. Market sentiment is currently characterized by [describe prevailing sentiment: cautious optimism, pessimism, etc.].

- [Include quotes from reputable financial experts expressing their views on the future implications of the downgrade].

Potential Strategies for Investors:

Navigating this market volatility requires a cautious approach. Investors should consider diversification strategies to mitigate risk. Risk management techniques, such as hedging, become crucial in times of uncertainty.

- Strategies for Investors:

- Diversify your investment portfolio across different asset classes.

- Consider hedging strategies to protect against potential losses.

- Seek professional financial advice before making any significant investment decisions.

Conclusion: Navigating the Uncertainty Following Moody's Downgrade of US Credit Rating

Moody's downgrade of the US credit rating, driven by fiscal challenges and political gridlock, has significantly impacted Dow Futures and weakened the US dollar. Market reaction has been immediate and significant, highlighting the seriousness of the situation. While expert opinions differ on the future trajectory, maintaining a cautious approach and staying informed is crucial. Monitoring market developments related to Dow Futures and the US dollar is essential for informed investment decisions. Seek professional financial advice before making any investment decisions related to Dow Futures, the dollar, and the broader US economy. Continue monitoring the situation and consider subscribing to reliable financial news sources for updates on market analysis and Moody's rating changes.

Featured Posts

-

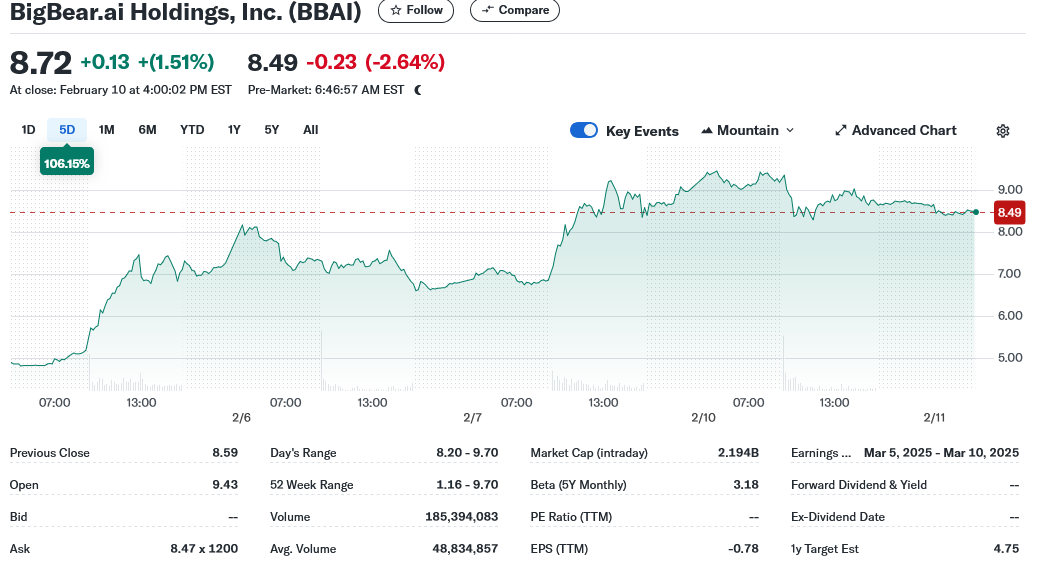

Big Bear Ai Bbai Stock Performance In 2025 A Comprehensive Review

May 20, 2025

Big Bear Ai Bbai Stock Performance In 2025 A Comprehensive Review

May 20, 2025 -

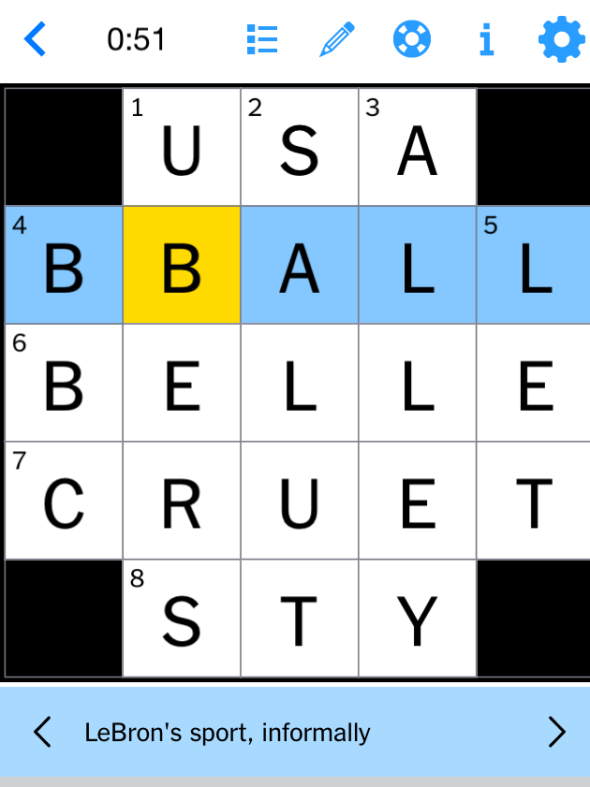

Nyt Mini Crossword Answers For March 13 Complete Solutions And Hints

May 20, 2025

Nyt Mini Crossword Answers For March 13 Complete Solutions And Hints

May 20, 2025 -

D Wave Quantum Qbts Stocks Recent Performance Causes And Implications

May 20, 2025

D Wave Quantum Qbts Stocks Recent Performance Causes And Implications

May 20, 2025 -

Mirra Andreeva Biografiya Pobedy I Luchshie Matchi Voskhodyaschey Zvezdy Tennisa

May 20, 2025

Mirra Andreeva Biografiya Pobedy I Luchshie Matchi Voskhodyaschey Zvezdy Tennisa

May 20, 2025 -

Home Office Vs Kancelaria Ako Optimalizovat Efektivitu Prace

May 20, 2025

Home Office Vs Kancelaria Ako Optimalizovat Efektivitu Prace

May 20, 2025