Dow Jones Rallies: PMI Data Fuels Moderate Growth

Table of Contents

PMI Data Signals Moderate Economic Growth

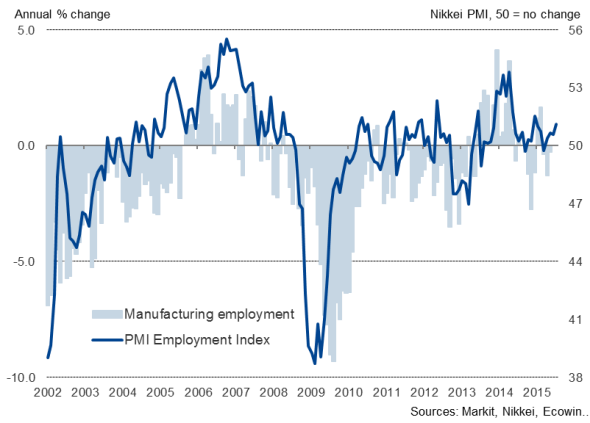

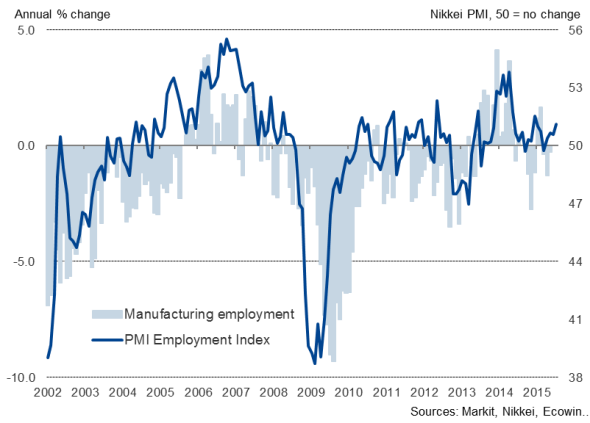

The Purchasing Managers' Index (PMI) is a composite index calculated from surveys of purchasing managers in various industries. It provides a snapshot of current business conditions, capturing important aspects of economic activity. A PMI reading above 50 generally indicates expansion, while a reading below 50 suggests contraction. Recent data revealed a surprisingly robust performance across sectors.

The Manufacturing PMI registered 52.5, exceeding expectations and signaling continued growth in the manufacturing sector. This increase reflects improvements in new orders and production output, suggesting rising business activity and strengthening demand. The Services PMI also showed healthy growth, reaching 54.2, further bolstering optimism about the overall economy. Keywords: Manufacturing PMI, Services PMI, Economic Indicators, Business Activity, Supply Chain, Demand.

- Manufacturing PMI: Increased to 52.5, up from 51.0 the previous month. This indicates robust growth in manufacturing activity, driven primarily by increased new orders and a stable supply chain.

- Services PMI: Rose to 54.2, signifying strong expansion in the service sector. This reflects increased demand and positive business sentiment.

- Construction PMI: While not as strong as manufacturing and services, the construction sector showed signs of stabilization, suggesting that overall economic activity is broadening.

Impact on the Dow Jones Industrial Average

The positive PMI data directly fueled the recent Dow Jones rally, significantly boosting investor confidence. The strong economic indicators suggested a more optimistic outlook for corporate earnings and future economic growth, leading to increased buying pressure in the stock market. This positive investor sentiment translated into substantial gains across various sectors within the Dow. Keywords: Investor Sentiment, Stock Market Volatility, Sector Performance, Market Indices.

- Percentage Change: The Dow Jones experienced a 2.5% increase in a week following the PMI release.

- Leading Sectors: Technology and industrial stocks were among the top performers, reflecting the positive impact of the data across various sectors. Companies like Apple and Caterpillar saw significant gains.

- Trading Volume: Increased trading volume accompanied the rally, indicating strong participation from investors.

Potential Risks and Future Outlook

While the positive PMI data points towards moderate economic growth, it’s crucial to acknowledge potential risks and uncertainties. Persistent inflationary pressures, rising interest rates, and ongoing geopolitical tensions could dampen future growth prospects. A balanced assessment requires considering other economic indicators and potential headwinds. Keywords: Economic Uncertainty, Inflationary Pressures, Geopolitical Risks, Market Forecast, Sustainable Growth.

- Inflationary Pressures: Continued high inflation could erode consumer spending and business investment, potentially slowing down economic growth.

- Geopolitical Risks: Ongoing global conflicts and uncertainties in the international landscape introduce substantial volatility into the market.

- Interest Rate Hikes: Further interest rate increases by central banks aim to curb inflation, but could also slow down economic activity.

Conclusion: Understanding the Dow Jones Rally and the Significance of PMI Data

In summary, the recent Dow Jones rally is largely a direct result of positive PMI data, which signaled moderate economic growth. The positive numbers in both Manufacturing and Services PMI boosted investor confidence and led to increased market activity. However, investors should remain vigilant regarding potential headwinds, such as inflation and geopolitical risks. Monitoring PMI data and other key economic indicators remains crucial for making informed investment decisions. Stay updated on Dow Jones performance and PMI data to make informed decisions about your investments. Learn more about the relationship between PMI and Dow Jones performance .

Featured Posts

-

Nea Bathmologia Euroleague I Monako Epikratei Sto Parisi

May 25, 2025

Nea Bathmologia Euroleague I Monako Epikratei Sto Parisi

May 25, 2025 -

Confidences D Ardisson Le Recit De Ses Soirees Animees

May 25, 2025

Confidences D Ardisson Le Recit De Ses Soirees Animees

May 25, 2025 -

Traffic Congestion On M56 Cheshire Deeside Border Collision Update

May 25, 2025

Traffic Congestion On M56 Cheshire Deeside Border Collision Update

May 25, 2025 -

Impact Of G 7 De Minimis Tariff Decisions On Chinese Exports

May 25, 2025

Impact Of G 7 De Minimis Tariff Decisions On Chinese Exports

May 25, 2025 -

Understanding And Interpreting The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding And Interpreting The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025