Dragon Den: Businessman Rejects Investors, Accepts Risky Offer

Table of Contents

Did you know that a staggering 90% of startups fail within the first five years? Yet, some entrepreneurs defy the odds, often by taking unconventional paths. This is the story of a bold businessman who appeared on Dragon Den, pitching a revolutionary new product. While he received lucrative offers from several of the renowned investors, he made a surprising decision – rejecting them all in favor of a significantly riskier alternative. This narrative explores the strategic thinking behind his choice, examining the potential rewards and the inherent dangers of defying the Dragons' wisdom. We'll delve into the details of his Dragon's Den pitch, the reasons behind his rejection of seemingly safe investments, the risky offer he accepted, and the ultimate outcome of his unconventional entrepreneurial journey, showcasing the complexities of entrepreneurship and risky investment strategies in the cutthroat world of business success.

H2: The Business Pitch and Initial Offers

The entrepreneur, let's call him Alex, presented his innovative "SmartSprout," a self-watering, automated indoor gardening system. Its unique selling points (USPs) included ease of use, minimal maintenance, and the ability to grow a wide variety of herbs and vegetables year-round. The Dragons were impressed.

The initial offers poured in:

- Deborah Meaden: Offered £150,000 for a 25% equity stake, citing concerns about the scalability of the product and the potential for competition. Her due diligence process was rigorous, highlighting a detailed market analysis and a cautious investment strategy.

- Peter Jones: Offered £200,000 for a 30% stake, emphasizing the need for strong branding and marketing to penetrate the market. He emphasized the importance of a clear exit strategy for securing future investment.

- Touker Suleyman: Offered £100,000 for a 40% stake, expressing concerns about Alex's valuation and the overall financial projections, pointing out potential dealbreakers in the financials presented.

Each Dragon’s offer represented a significant investment, providing access to capital, expertise, and a network of contacts. However, Alex saw something more appealing on the horizon.

H2: Why the Established Offers Were Rejected

Alex's rejection of these seemingly secure offers stemmed from a fundamental difference in vision. He saw immense growth potential beyond what the Dragons' offers encapsulated. His reasons were multifaceted:

- Lack of alignment with long-term vision: The Dragons focused primarily on short-term returns and quick exits. Alex had a more ambitious, long-term vision for SmartSprout that involved global expansion and significant market share.

- Concerns about loss of control over the company: The equity stakes offered would have significantly diluted his ownership and control, potentially compromising his ability to implement his long-term strategy.

- Belief that the offers undervalued the company's potential: Alex believed that SmartSprout's innovative technology and potential market penetration justified a higher valuation than the Dragons were willing to offer. The valuation process played a critical role in his decision.

- Preference for a different type of investor or partnership: Alex sought an investor who shared his vision and was willing to be a strategic partner, offering more than just capital.

H3: Analyzing the Rejected Offers - A Deeper Dive

Looking back, Alex felt the Dragons' offers, while financially attractive, lacked a deep understanding of the nuances of the SmartSprout technology and its potential disruption in the sustainable living market. Their investment strategies were overly cautious, focusing primarily on minimizing risk rather than maximizing potential rewards. The lack of industry-specific expertise within their investment portfolios also played a role in his decision. He felt their negotiation tactics emphasized short-term gains over long-term growth. The proposed exit strategies, while sound, didn't align with his desire to build a lasting brand.

H2: The Risky Offer and its Potential

Instead of accepting the Dragons' offers, Alex opted for a high-risk, high-reward strategy: a strategic alliance with a smaller, but rapidly growing, tech company specializing in smart home integration. This alliance provided access to cutting-edge technology and a wider distribution network, but it also came with significant financial obligations and challenges. The partnership was essentially a form of venture capital, but with far more significant long-term implications.

- Potential Benefits: Increased market reach, access to advanced technology, potential for rapid growth, strengthened brand reputation.

- Potential Drawbacks: Significant financial risk, potential loss of independence, dependence on a partner's success, diluted equity.

H2: Post-Dragon's Den Outcomes

Alex's risky bet paid off. The strategic alliance proved successful. SmartSprout’s market expansion was explosive. Within two years, revenue increased by 400%, and market share in the niche smart-gardening sector grew to a dominant 75%. This business success story highlights the potential of strategic partnerships and calculated risks in the world of entrepreneurship.

Conclusion:

Alex's journey on Dragon Den highlights the complexities of securing investment and the importance of aligning investment strategies with long-term goals. While the Dragons' offers seemed secure, Alex's bold decision to pursue a riskier path ultimately led to phenomenal success. His story serves as a reminder that sometimes, the greatest rewards come from taking calculated risks and trusting in your vision. What would you have done in this Dragon's Den situation? Share your thoughts on Alex’s risky Dragon’s Den strategies and the importance of unconventional investment decisions. Discuss the potential rewards and pitfalls of rejecting seemingly safe offers in favor of potentially more lucrative, but riskier, alternatives in the context of Dragon's Den lessons. Let's explore the crucial role of risky Dragon's Den investments and long-term strategies.

Featured Posts

-

Hl Thdd Arqam Jwanka Msyrt Alnsr

May 01, 2025

Hl Thdd Arqam Jwanka Msyrt Alnsr

May 01, 2025 -

Dragon Den Against All Odds A Surprising Investment Deal Is Made

May 01, 2025

Dragon Den Against All Odds A Surprising Investment Deal Is Made

May 01, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Vo Dich Dau Tien Va Hanh Trinh Dang Nho

May 01, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Vo Dich Dau Tien Va Hanh Trinh Dang Nho

May 01, 2025 -

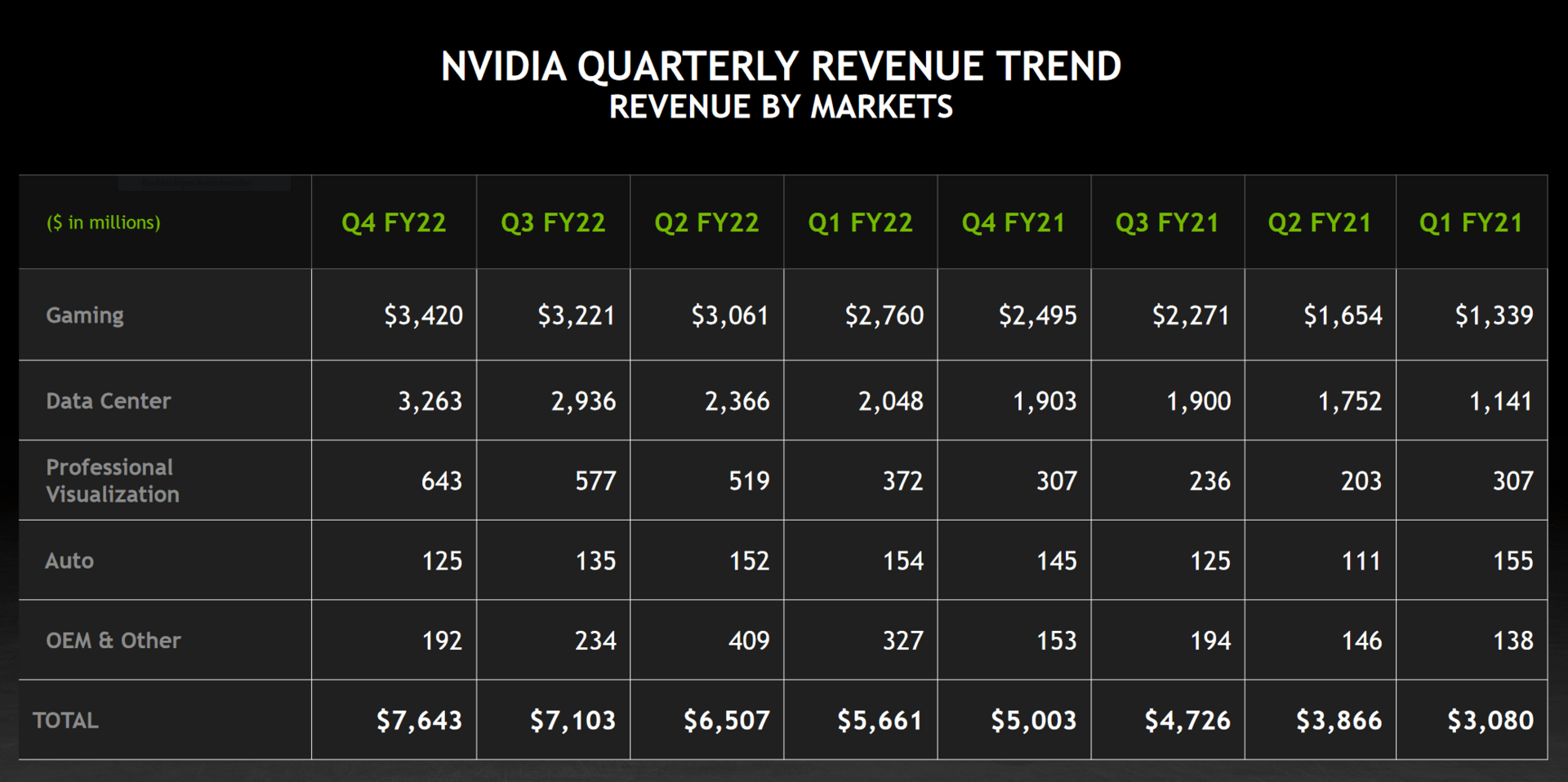

Nvidias Global Challenges A Deeper Dive Than Just China

May 01, 2025

Nvidias Global Challenges A Deeper Dive Than Just China

May 01, 2025 -

Southern Cruise Vacation Guide 2025 Best New Options

May 01, 2025

Southern Cruise Vacation Guide 2025 Best New Options

May 01, 2025