XRP Price Prediction: Will XRP Hit $10? Ripple's Dubai License And Resistance Breakout

Table of Contents

Ripple's Recent Developments and Their Impact on XRP Price

Ripple's actions significantly impact XRP's value. Recent strategic moves and ongoing legal challenges create a complex picture that needs careful consideration when forming an XRP price prediction.

The Significance of the Dubai License

Ripple securing a virtual asset license in Dubai is a game-changer. This strategic move provides Ripple with a regulated gateway to operate within a major global financial hub known for its forward-thinking approach to fintech.

- Increased Market Access: The Dubai license opens doors to a vast new market, allowing Ripple to expand its reach and potentially onboard new clients and partners in the Middle East and beyond.

- Improved Investor Confidence: Operating within a regulated framework increases investor confidence, potentially attracting more institutional investment into XRP.

- Potential Partnerships in the Region: The license could facilitate lucrative partnerships with banks and financial institutions based in Dubai and the wider region, fueling XRP adoption. This will be a significant boost to the XRP price prediction.

Other Positive Ripple Developments

Beyond the Dubai license, other positive developments further influence XRP price prediction. These developments showcase Ripple's continued progress and innovation.

- Strategic Partnerships: New partnerships with payment providers and financial institutions demonstrate the growing acceptance and utility of Ripple's technology.

- Technological Advancements: Improvements to RippleNet and the development of new products enhance the platform's capabilities and attract further adoption.

- Positive Legal Developments: While the SEC lawsuit remains a concern (discussed below), any positive legal developments, such as favorable court rulings or settlements, can have an immediate positive impact on XRP's price.

Addressing Ongoing Legal Challenges

The ongoing SEC lawsuit against Ripple casts a shadow on any XRP price prediction. The uncertainty surrounding the outcome significantly affects investor sentiment and price volatility.

- Current Status: The case is currently ongoing, with both sides presenting their arguments. The outcome remains uncertain.

- Positive Scenario: A favorable ruling could lead to a significant price surge, as the uncertainty surrounding XRP’s legal status would be lifted.

- Negative Scenario: An unfavorable ruling could result in a substantial price drop, at least in the short term. The long-term impact would depend on the specifics of the ruling.

Technical Analysis: Can XRP Breakout of Resistance?

Technical analysis provides another lens through which to view the XRP price prediction. Identifying key resistance levels and analyzing volume and momentum helps gauge the potential for a price breakout.

Identifying Key Resistance Levels

Examining XRP's price chart reveals several key resistance levels that need to be overcome for a significant price increase.

- Price Levels: Analyzing historical price data identifies significant resistance levels at approximately $0.50, $0.75, and $1.00. Breaking above these levels could signal further upward momentum.

- Chart Patterns: The appearance of bullish chart patterns, like pennants or triangles, can suggest an impending price breakout.

- Technical Indicators: Moving averages (e.g., 50-day, 200-day MA) and the Relative Strength Index (RSI) provide additional insights into price trends and momentum. (Include illustrative charts here).

Volume and Momentum

Analyzing trading volume and momentum helps confirm the strength of any potential breakout.

- Volume Surges: Significant increases in trading volume alongside price increases are a bullish sign, indicating strong buying pressure.

- Momentum Shifts: Positive momentum, indicated by consistently rising prices, suggests a sustained upward trend. Conversely, negative momentum could signal weakening support.

Predicting Future Price Movements Based on Technical Analysis

Based on the current technical analysis, a cautious approach is warranted.

- Possible Price Targets: A successful breakout above key resistance levels could lead to price targets in the $1-$2 range in the short to medium term.

- Timeframes: The timeframe for reaching these targets is uncertain and depends on various factors, including market sentiment and overall cryptocurrency market performance.

- Scenarios: The XRP price prediction will vary significantly based on the outcome of the SEC lawsuit and the broader cryptocurrency market conditions.

Factors that Could Drive XRP to $10 (or Prevent It)

Reaching $10 for XRP is an ambitious target, requiring a confluence of positive factors. However, several obstacles could prevent it.

Widespread Adoption and Institutional Investment

Mass adoption by financial institutions and businesses is crucial for driving XRP's price to such lofty heights.

- Use Cases: The potential use cases for XRP in cross-border payments and other financial transactions are key drivers of demand.

- Institutional Investors: Increased interest and investment from large financial institutions could significantly boost XRP's price.

Regulatory Clarity and Market Sentiment

Regulatory clarity is essential for investor confidence.

- Positive Regulatory Developments: Favorable regulatory decisions, both in the US and globally, could attract significant institutional investment.

- Market Sentiment: Positive market sentiment, fueled by positive news and growing adoption, is critical for pushing the price higher. Negative news can quickly reverse this.

Competition and Market Dynamics

XRP faces competition from other cryptocurrencies, and the broader market conditions significantly impact its price.

- Competitors: Other cryptocurrencies with similar functionalities pose a competitive threat.

- Market Trends: Overall cryptocurrency market trends and macroeconomic factors play a significant role in XRP's price movement.

Conclusion: XRP Price Prediction: Final Thoughts and Call to Action

Predicting the future price of XRP is inherently challenging, due to the complex interplay of legal, technological, and market factors. While reaching $10 is a significant hurdle, a combination of positive developments – including a favorable resolution to the SEC lawsuit, increased adoption, and sustained positive market sentiment – could potentially drive the price significantly higher. Based on our analysis, a more conservative XRP price prediction would be in the $1-$2 range in the medium term (1-2 years), with a longer-term outlook dependent upon the successful navigation of legal hurdles and continued growth in adoption. However, reaching $10 remains a distant prospect.

We encourage you to conduct your own research, stay informed about Ripple's progress, and closely monitor the XRP price prediction. Share your thoughts and predictions in the comments below! What's your XRP price prediction for the next year?

Featured Posts

-

Michael Sheens Port Talbot Home Paying Off Neighbours 1m Debt

May 01, 2025

Michael Sheens Port Talbot Home Paying Off Neighbours 1m Debt

May 01, 2025 -

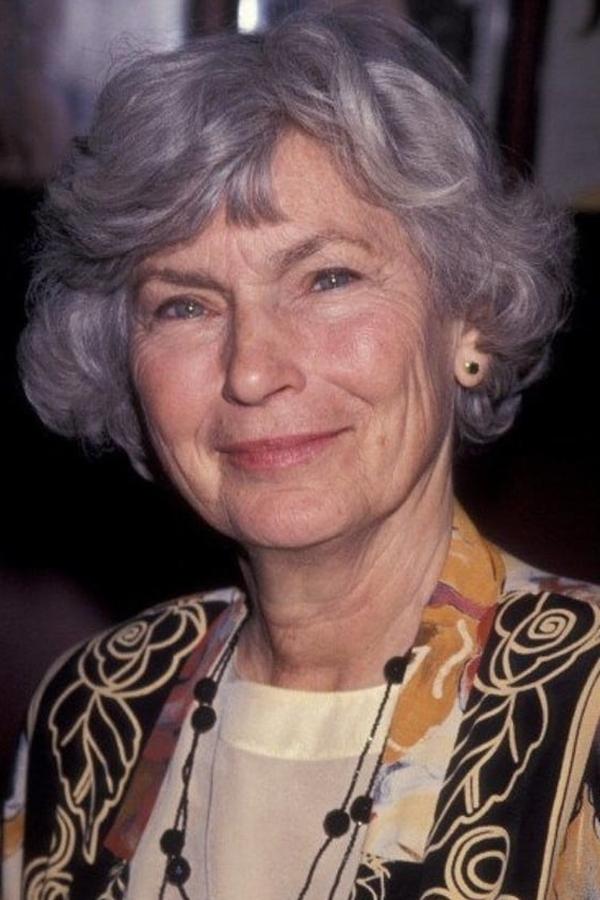

Remembering Priscilla Pointer A Celebrated Career Ends At 100

May 01, 2025

Remembering Priscilla Pointer A Celebrated Career Ends At 100

May 01, 2025 -

Priscilla Pointer Dead At 100 Remembering The Actress From Carrie

May 01, 2025

Priscilla Pointer Dead At 100 Remembering The Actress From Carrie

May 01, 2025 -

Recordati And The Italian Pharmaceutical Market An M And A Strategy For Tariff Uncertainty

May 01, 2025

Recordati And The Italian Pharmaceutical Market An M And A Strategy For Tariff Uncertainty

May 01, 2025 -

Dragon Den Businessman Rejects Investors Accepts Risky Offer

May 01, 2025

Dragon Den Businessman Rejects Investors Accepts Risky Offer

May 01, 2025