Economists React: Unpacking The Bank Of Canada's Interest Rate Decision

Table of Contents

The Bank of Canada's Announcement: A Detailed Look

The Bank of Canada's most recent announcement (insert date here) saw a [insert percentage]% increase in its key interest rate, bringing the target overnight rate to [insert new rate]%. This decision follows a period of [describe recent economic trends, e.g., persistent inflation, strong economic growth, or weakening growth].

- Specific percentage change in the interest rate: [insert percentage]% increase.

- Key reasons cited by the Bank of Canada for their decision: The Bank cited persistent inflationary pressures, exceeding the 2% target, as the primary driver for the rate hike. They also pointed to a robust labor market and strong consumer spending as contributing factors. The Bank noted concerns about lingering supply chain disruptions and elevated energy prices continuing to fuel inflation.

- Any revised economic forecasts provided by the Bank of Canada: The Bank revised its forecast for GDP growth [upward/downward] to [insert percentage]% for [year] and [insert percentage]% for [year]. Inflation is projected to [increase/decrease] to [insert percentage]% by [year].

- Mention of any changes to quantitative easing (QE) programs: The Bank of Canada [continued/ended/modified] its quantitative easing program, stating [insert details from the statement].

Economists' Reactions: A Spectrum of Opinions

Economists' responses to the Bank of Canada interest rate decision were largely mixed, reflecting the complexities of the current economic climate. While some lauded the move as necessary to curb inflation, others expressed concerns about its potential negative impacts on economic growth.

- Quotations from prominent economists, highlighting differing viewpoints on the decision: "The Bank of Canada's decision was a necessary step to combat inflation," stated [Economist Name], Chief Economist at [Institution]. Conversely, [Economist Name], from [Institution], cautioned, "This aggressive rate hike risks triggering a recession, particularly given the already high household debt levels."

- Mention of specific economic indicators economists are focusing on: Economists are closely monitoring key economic indicators such as the Consumer Price Index (CPI), Gross Domestic Product (GDP), and unemployment rates to gauge the effectiveness of the rate hike. They are particularly focused on whether inflation shows signs of cooling without triggering a significant economic slowdown.

- Discussion of any dissenting opinions and their reasoning: Some economists argued that the Bank of Canada's reaction is too aggressive, suggesting a more gradual approach might be less disruptive to the economy. They highlight the risk of overcorrection, potentially leading to a deeper recession than necessary.

Positive Reactions & Their Rationale

Economists supporting the rate hike generally believe it's a necessary tool to control inflation and maintain long-term economic stability.

- Examples of positive economic impacts predicted: They predict that the higher interest rates will help cool down an overheated economy, curb inflation, and prevent a wage-price spiral. A stable inflation rate is considered essential for long-term economic health and investment.

- Supporting data points referenced by economists (if available): Supporters often cite historical data showing a correlation between higher interest rates and reduced inflation, while cautioning that the current economic context needs careful observation.

Negative Reactions & Their Rationale

Economists expressing concern about the rate increase warn of potential negative consequences for the Canadian economy.

- Examples of negative economic impacts predicted: They fear that higher borrowing costs could dampen consumer spending, significantly impact the already cooling housing market, reduce business investment, and potentially trigger a recession. The impact on household debt is also a major concern.

- Supporting data points referenced by economists (if available): These economists might point to the significant levels of household debt in Canada, arguing that higher interest rates could lead to defaults and financial distress for many households.

Implications for the Canadian Economy

The Bank of Canada interest rate decision will likely have far-reaching consequences across various sectors of the Canadian economy.

- Impact on consumer spending: Higher interest rates are expected to curb consumer spending as borrowing becomes more expensive. This could lead to a slowdown in economic growth.

- Impact on housing market: The already cooling housing market is likely to experience further deceleration, potentially leading to a correction in house prices.

- Impact on businesses and investment: Increased borrowing costs may discourage business investment and expansion, potentially leading to job losses.

- Impact on the Canadian dollar: The interest rate hike may strengthen the Canadian dollar relative to other currencies.

Looking Ahead: Future Interest Rate Predictions

Predicting future interest rate adjustments remains a challenge, with various financial institutions offering diverse forecasts.

- Consensus forecasts from various financial institutions: Forecasts for future interest rate changes vary widely, with some predicting further rate hikes while others anticipate a pause or even potential rate cuts depending on inflation data and economic growth.

- Factors that could influence future decisions: Future decisions will depend heavily on incoming economic data, particularly inflation figures and GDP growth. Global economic conditions and geopolitical events will also play a significant role.

- Potential scenarios (e.g., further rate hikes, rate cuts): The Bank of Canada may continue to raise interest rates if inflation proves persistent. However, if economic growth slows significantly, they may opt to pause or even cut rates to stimulate the economy.

Conclusion

The Bank of Canada interest rate decision has prompted a range of reactions from economists, reflecting the complexity of the current economic situation. While some see the rate hike as a necessary step to curb inflation, others worry about the potential for negative economic consequences. The potential impacts on consumer spending, the housing market, businesses, and the Canadian dollar are substantial and warrant careful monitoring. The future direction of interest rates will depend critically on upcoming economic data and global events.

Call to action: Stay informed about the evolving economic landscape and the Bank of Canada's future interest rate decisions. Follow our updates for continued analysis and expert commentary on the Bank of Canada interest rate decision and its impact on your finances. Subscribe to our newsletter for the latest insights.

Featured Posts

-

Vehicle Subsystem Malfunction Delays Blue Origin Launch

Apr 22, 2025

Vehicle Subsystem Malfunction Delays Blue Origin Launch

Apr 22, 2025 -

Pope Franciss Papacy A Defining Conclave

Apr 22, 2025

Pope Franciss Papacy A Defining Conclave

Apr 22, 2025 -

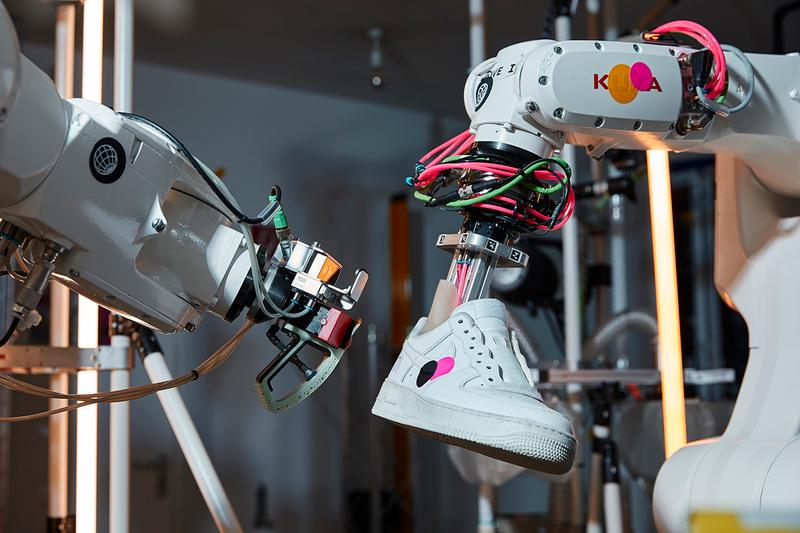

Addressing The Challenges Of Robotic Nike Shoe Production

Apr 22, 2025

Addressing The Challenges Of Robotic Nike Shoe Production

Apr 22, 2025 -

Trump Administration To Slash Another 1 Billion In Harvard Funding

Apr 22, 2025

Trump Administration To Slash Another 1 Billion In Harvard Funding

Apr 22, 2025 -

Turning Poop Into Podcast Gold How Ai Simplifies Scatological Document Analysis

Apr 22, 2025

Turning Poop Into Podcast Gold How Ai Simplifies Scatological Document Analysis

Apr 22, 2025