Elon Musk's Net Worth Falls Below $300 Billion: Tesla, Tariffs, And Market Impacts

Table of Contents

Tesla's Stock Performance and its Impact on Musk's Wealth

Elon Musk's wealth is intrinsically linked to Tesla's success. Any significant shift in Tesla's stock price directly translates into a considerable change in his net worth.

Tesla Stock Volatility:

Tesla's share price has demonstrated considerable volatility in recent times. This volatility directly impacts Elon Musk's net worth, as he owns a substantial stake in the company.

- Recent Price Drops: Several instances of sharp price drops have been observed, often correlated with specific news events.

- Production Issues: Challenges related to production targets and supply chain disruptions have contributed to negative investor sentiment and subsequent stock price declines.

- Increased Competition: The growing number of competitors in the electric vehicle (EV) market adds pressure on Tesla's market share, potentially influencing investor confidence.

- Regulatory Concerns: Ongoing regulatory scrutiny and investigations can also lead to market uncertainty and stock price fluctuations. These factors significantly impact Tesla's market capitalization, and consequently, Elon Musk's net worth.

Impact of Competition:

The electric vehicle market is becoming increasingly crowded. Tesla, once the undisputed leader, now faces stiff competition from established automakers and new EV startups.

- Rivian and Lucid: Companies like Rivian and Lucid Motors are emerging as significant competitors, challenging Tesla's dominance in certain market segments.

- Traditional Automakers: Established automakers are rapidly expanding their EV offerings, putting further pressure on Tesla's market share and profitability. This intensified competition directly impacts Tesla's share price and Elon Musk's net worth.

The Role of Tariffs and Global Economic Uncertainty

Global economic factors, particularly tariffs and geopolitical instability, significantly influence Tesla's operations and, in turn, Elon Musk's wealth.

Tariffs and Supply Chain Disruptions:

Tariffs imposed on raw materials, components, or finished Tesla vehicles can substantially increase production costs, impacting profitability and subsequently affecting the company's stock valuation.

- Impact on Production Costs: Tariffs directly increase the cost of manufacturing, potentially reducing profit margins.

- Supply Chain Challenges: Global supply chain disruptions, exacerbated by geopolitical events and trade wars, further complicate Tesla's production and delivery timelines. These disruptions can lead to delays and increased costs, adding downward pressure on the Tesla share price.

Geopolitical Factors and Market Sentiment:

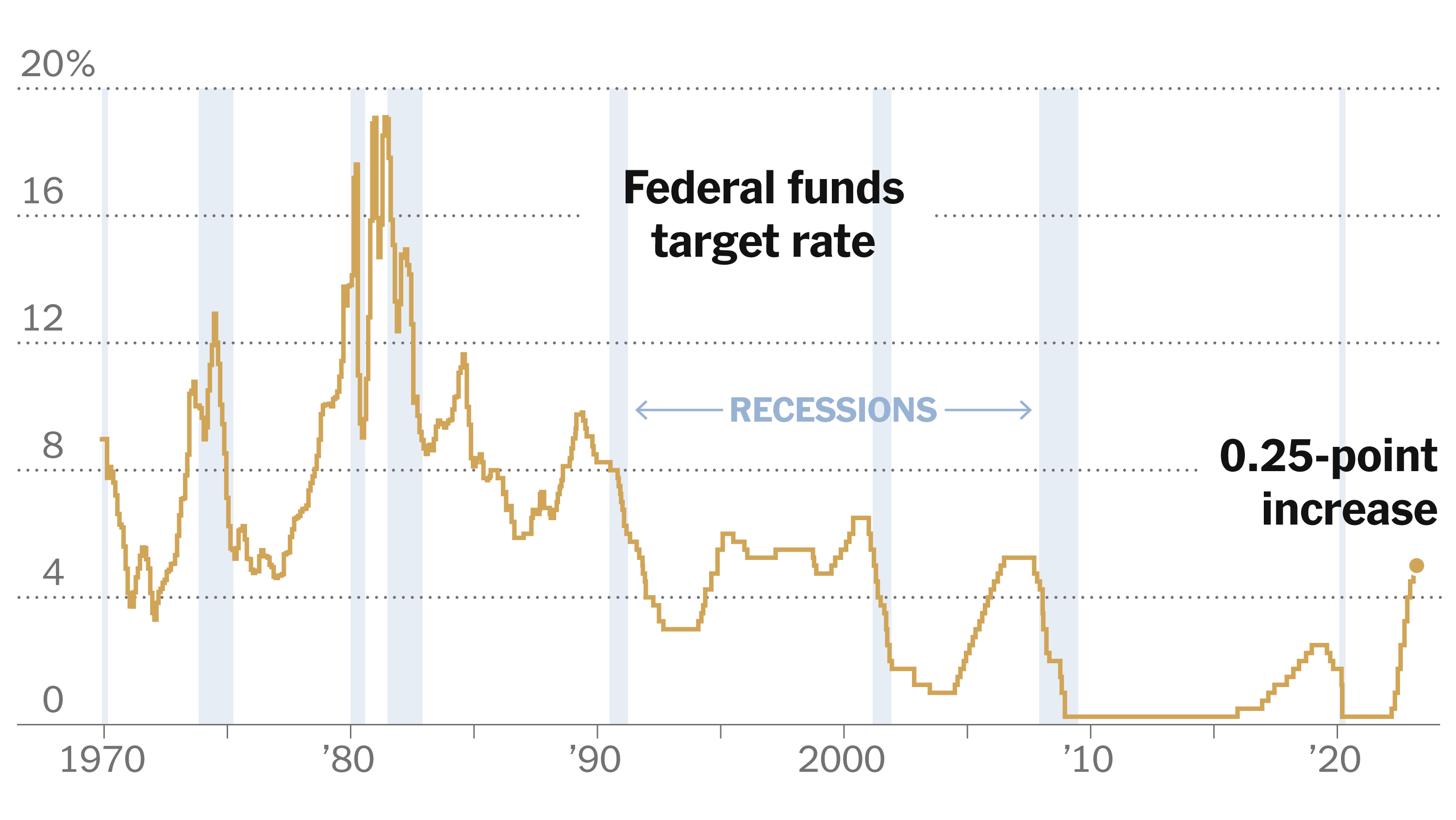

Global economic uncertainty, including inflation, rising interest rates, and geopolitical tensions, can negatively affect investor confidence in Tesla and other high-growth tech stocks.

- Inflationary Pressures: High inflation erodes purchasing power and can impact consumer spending on luxury goods like Tesla vehicles.

- Interest Rate Hikes: Rising interest rates increase borrowing costs, potentially slowing down economic growth and impacting investor sentiment.

- Geopolitical Risks: International conflicts and trade disputes create uncertainty in the global economy, reducing investor confidence and negatively impacting Tesla's stock price.

Broader Market Impacts and the Future of Tesla

The decline in Elon Musk's net worth is not solely attributable to Tesla-specific issues; broader market trends have also played a significant role.

Overall Market Trends:

The recent downturn in the broader stock market, particularly affecting high-growth technology stocks, has significantly contributed to the decrease in Tesla's valuation.

- Market Downturn: A general market downturn, often influenced by macroeconomic factors like inflation and interest rate hikes, disproportionately impacts companies with high valuations, like Tesla.

- Tech Stock Valuation: High-growth technology stocks, often valued based on future expectations, are especially sensitive to shifts in investor sentiment and interest rates.

Future Outlook and Predictions:

Despite the recent challenges, Tesla remains a significant player in the electric vehicle market, and its long-term growth prospects are still being debated.

- Tesla's Future Strategies: Tesla's future success depends on its ability to navigate challenges, innovate, and expand its market share.

- New Product Launches and Expansion: Future product launches, expansion into new markets, and advancements in battery technology are crucial for Tesla's continued growth. These factors will greatly influence future stock performance and, consequently, Elon Musk’s net worth.

Conclusion: Elon Musk's Net Worth and the Tesla Story Continues

The recent decline in Elon Musk's net worth is a complex story, reflecting the interplay of Tesla's stock performance, the impact of global tariffs, and broader market forces. While the drop below $300 billion is significant, it doesn't diminish Tesla's position as a key player in the rapidly evolving electric vehicle market. The future of Tesla, and consequently Elon Musk's net worth, remains a captivating and dynamic narrative. To stay updated on the ongoing developments regarding Elon Musk's net worth, Tesla's stock price, and the broader electric vehicle market, follow reputable financial news sources and industry publications. Subscribe to newsletters and keep abreast of the latest news to fully grasp this ever-changing landscape.

Featured Posts

-

Putins Victory Day Ceasefire A Strategic Calculation

May 09, 2025

Putins Victory Day Ceasefire A Strategic Calculation

May 09, 2025 -

U S Federal Reserve Rate Decision Weighing Economic Pressures

May 09, 2025

U S Federal Reserve Rate Decision Weighing Economic Pressures

May 09, 2025 -

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 09, 2025

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 09, 2025 -

Post Trade Deadline Nhl 2025 Playoff Predictions And Team Analysis

May 09, 2025

Post Trade Deadline Nhl 2025 Playoff Predictions And Team Analysis

May 09, 2025 -

Draisaitls Injury Will The Edmonton Oilers Star Be Ready For The Playoffs

May 09, 2025

Draisaitls Injury Will The Edmonton Oilers Star Be Ready For The Playoffs

May 09, 2025