ETFs To Consider For Exposure To Uber's Autonomous Driving Initiatives

Table of Contents

Understanding Uber's Autonomous Driving Technology and its Market Potential

Uber's ATG is pushing the boundaries of autonomous vehicle technology, developing self-driving systems intended for ride-sharing and delivery services. The potential market disruption is immense; analysts predict a massive expansion of the autonomous vehicle market in the coming decades. This growth will be driven by factors such as increased efficiency, reduced accidents, and the potential for lower transportation costs. However, significant challenges remain. Commercialization requires overcoming technological hurdles, navigating complex regulatory landscapes, and addressing public safety concerns.

- Market size projections: Some forecasts project the autonomous vehicle market to reach hundreds of billions, even trillions, of dollars in value by 2030.

- Key competitors: Uber faces stiff competition from established automakers like Waymo (Google), Tesla, and Cruise, as well as other tech giants and startups developing autonomous driving solutions.

- Regulatory hurdles: Government regulations regarding safety standards, testing procedures, and liability issues significantly impact the timeline for widespread adoption of autonomous vehicles.

Identifying Relevant ETFs with Exposure to Uber's Autonomous Driving Efforts

Gaining direct exposure to Uber's ATG through its stock is one option, but investing in relevant ETFs offers diversification and exposure to a wider range of companies contributing to the autonomous driving ecosystem. Several ETFs focus on sectors crucial to the development and deployment of self-driving technology. These indirect investments mitigate risk compared to concentrating solely on a single company.

Here are examples of potential ETF investment strategies (Please conduct thorough due diligence before investing. This information is for educational purposes only and does not constitute financial advice.):

-

ARKW(ARK Innovation ETF): This ETF invests in disruptive innovation, with holdings often including companies developing key technologies like AI, robotics, and autonomous vehicle components. Its expense ratio is relatively high, reflecting its focus on high-growth, potentially higher-risk companies. Exposure to Uber's autonomous driving initiatives comes indirectly through companies supplying crucial technologies. -

FXAIX(Fidelity 500 Index Fund): While not strictly focused on autonomous vehicles, this broad-market ETF provides diversified exposure to the overall technology sector, including companies that might benefit from the rise of self-driving cars. Its lower expense ratio makes it a more conservative choice for broad market participation. The indirect exposure to autonomous driving technology is a smaller component of the fund’s overall holdings. -

VGT(Vanguard Information Technology ETF): This ETF offers diversified exposure to the information technology sector, encompassing companies involved in software, hardware, and internet services relevant to autonomous driving. The expense ratio is competitive, offering a balance between diversification and cost-effectiveness. LikeFXAIX, exposure to Uber’s advancements is less direct but still represents a piece of the broader technological landscape needed to support the self-driving industry.

Assessing Risk and Diversification Strategies

Investing in autonomous driving technology, even through ETFs, carries inherent risks. Technological setbacks, regulatory uncertainty, and intense competition can significantly impact the performance of these investments. Therefore, diversification is crucial to mitigate potential losses.

- Risk tolerance assessment: Investors should carefully assess their risk tolerance before investing in this high-growth, high-risk sector.

- Risk mitigation strategies: Diversification across various ETFs, asset classes (e.g., bonds, real estate), and geographic regions helps reduce portfolio volatility.

- Balanced portfolio construction: Combining autonomous driving ETFs with more conservative investments creates a balanced portfolio that aligns with individual risk profiles.

Conclusion: Investing in the Future of Autonomous Driving with ETFs

Uber's autonomous driving ambitions represent a significant potential for growth in the transportation sector. Investing in carefully selected ETFs offers a diversified approach to participating in this exciting technological revolution. Remember, thorough research and understanding the associated risks are paramount. Explore ETFs for autonomous driving exposure by researching the options outlined above and others available in the market, focusing on your investment goals and risk tolerance. Find the best ETFs for Uber's autonomous driving initiatives by conducting your due diligence and constructing a well-diversified portfolio that aligns with your financial strategy. Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Snl Audiences Unexpected Outburst Leaves Cast And Crew Shocked

May 18, 2025

Snl Audiences Unexpected Outburst Leaves Cast And Crew Shocked

May 18, 2025 -

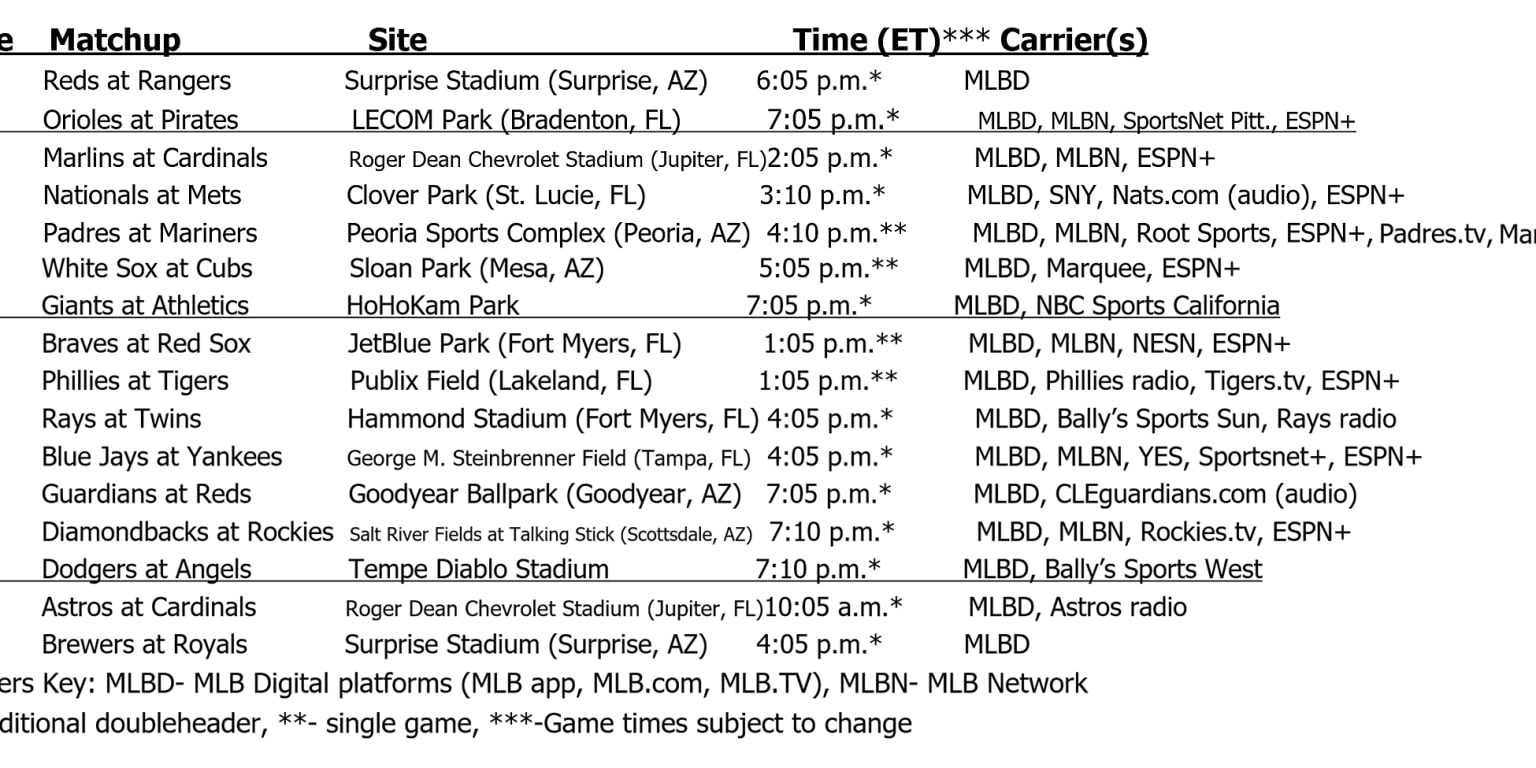

The Ultimate Guide To Spring Breakout 2025 Rosters

May 18, 2025

The Ultimate Guide To Spring Breakout 2025 Rosters

May 18, 2025 -

Mike Myers And Colin Mochrie Toronto Charity Comedy Event Announced

May 18, 2025

Mike Myers And Colin Mochrie Toronto Charity Comedy Event Announced

May 18, 2025 -

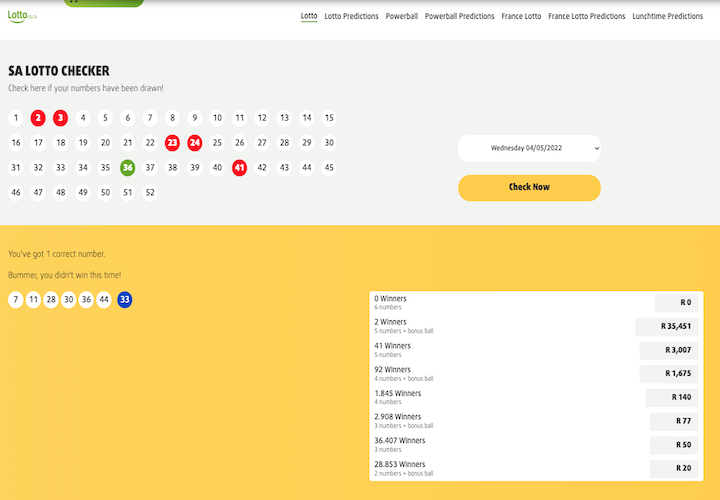

Check Your Lotto Tickets Results For April 12 2025

May 18, 2025

Check Your Lotto Tickets Results For April 12 2025

May 18, 2025 -

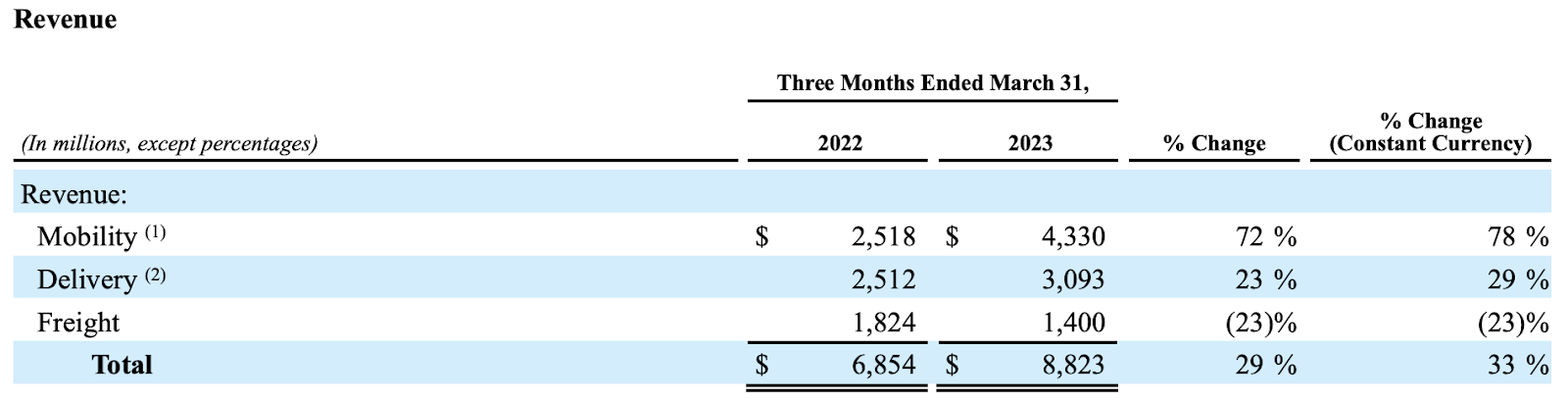

Is Uber Stock Recession Resistant A Deep Dive

May 18, 2025

Is Uber Stock Recession Resistant A Deep Dive

May 18, 2025