Ethereum Price Forecast: 1.11 Million ETH Accumulated, Bullish Momentum Builds

Table of Contents

H2: Massive ETH Accumulation: A Bullish Signal?

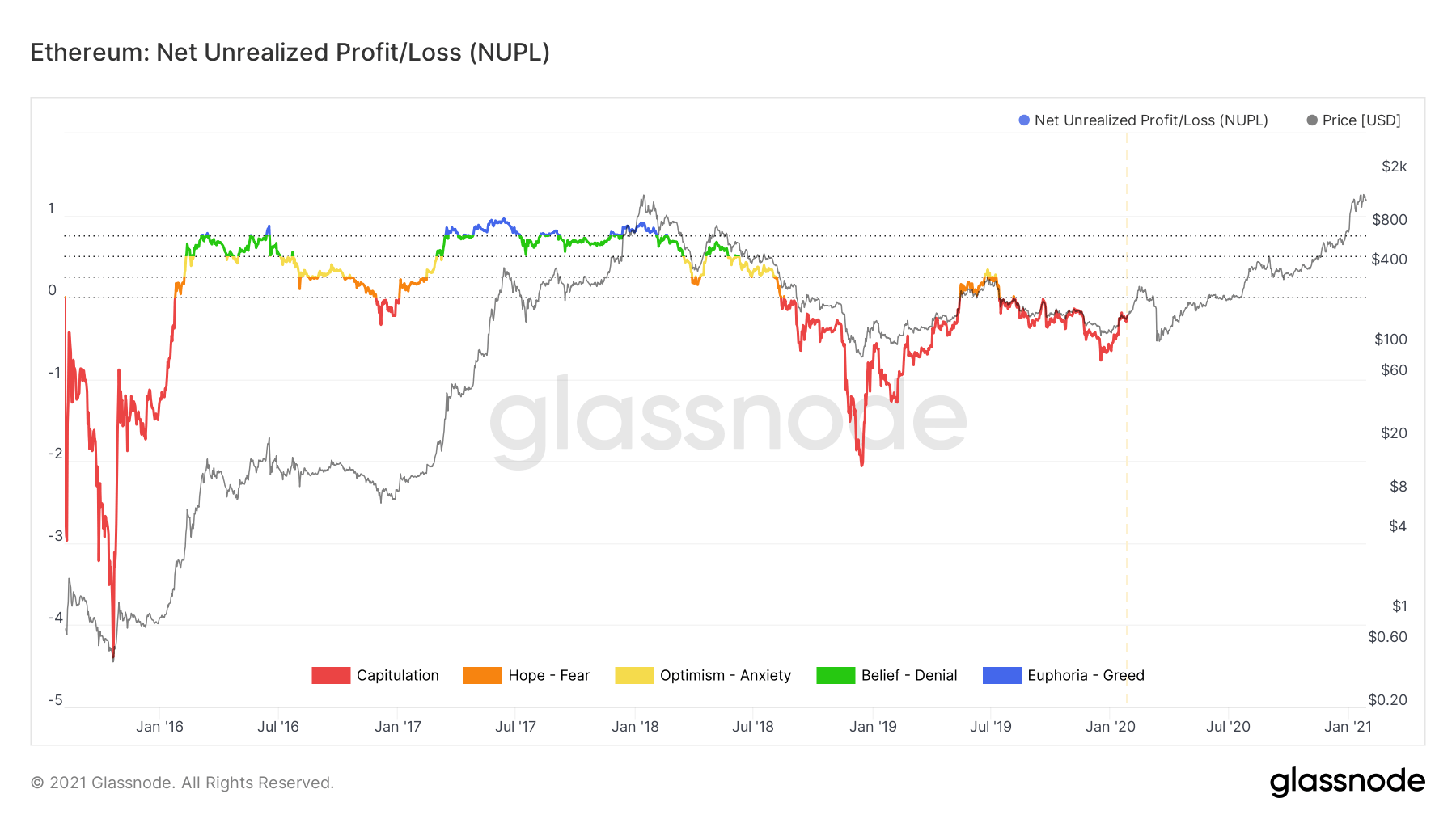

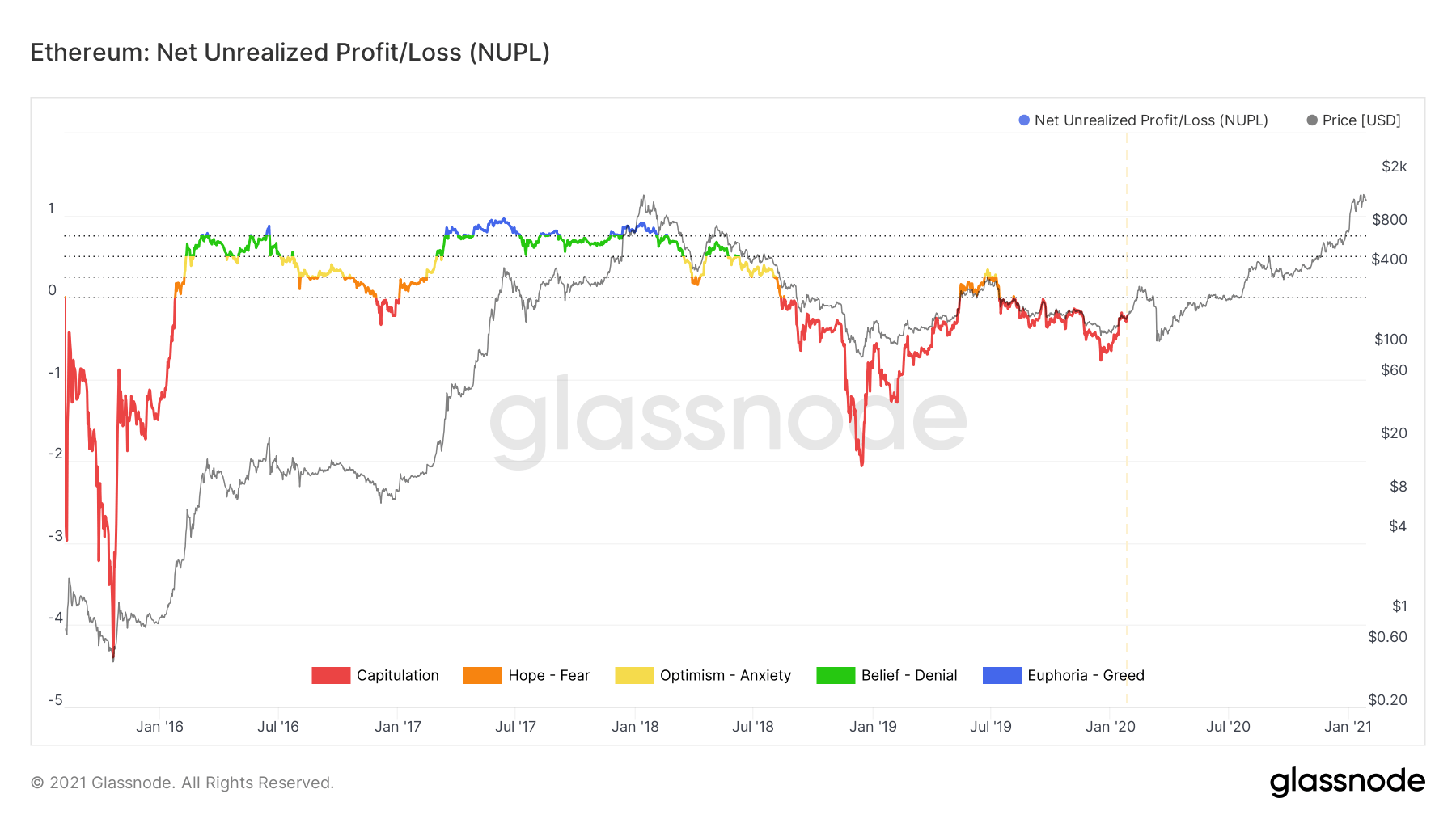

The accumulation of over 1.11 million ETH represents a substantial increase in holdings by large investors. This significant buying pressure is often interpreted as a bullish signal, suggesting a potential price increase in the near future. Understanding the source and implications of this accumulation is crucial for any Ethereum price forecast.

-

Source of Data: This accumulation data is derived from various on-chain analytics platforms, tracking the movement of ETH across different wallets and exchanges. Data from Glassnode, Nansen, and similar sources provides valuable insights into the behavior of large ETH holders, often referred to as "whales."

-

Potential Implications: Historically, large-scale accumulation by whales has preceded significant price increases. These entities often accumulate before anticipated positive events, aiming to capitalize on subsequent price appreciation. This suggests a belief among these market participants that the price of ETH is poised for significant growth.

-

Theories Behind the Accumulation: Several theories attempt to explain this massive ETH accumulation. One theory posits anticipation of upcoming Ethereum upgrades, enhancing the network's capabilities and thus driving demand. Another suggests increased institutional investment, with large firms adding ETH to their portfolios due to its growing prominence in the DeFi ecosystem and its role as a layer-1 blockchain. [Insert relevant image/graph showing ETH accumulation over time here]

H2: Ethereum's Upcoming Upgrades and Their Impact on Price

Ethereum's ongoing development roadmap includes several key upgrades that are expected to significantly improve its performance and usability. These upgrades directly contribute to the Ethereum price forecast, creating a positive outlook.

-

Shanghai Upgrade and Beyond: The Shanghai upgrade, already implemented, enabled staked ETH withdrawals. This has been a key catalyst for positive price action. Future upgrades will focus on enhanced scalability, potentially through solutions like sharding.

-

Improved Scalability and Efficiency: Upgrades aim to drastically increase transaction throughput, reducing congestion and lowering gas fees. This makes ETH more accessible and cost-effective for a wider range of applications and users.

-

Enhanced Security and Decentralization: Continued development strengthens Ethereum's security and decentralization, making it more resistant to attacks and enhancing its long-term viability. [Link to official Ethereum documentation or relevant news articles here]

H2: Macroeconomic Factors and Their Influence on Ethereum's Price

The cryptocurrency market, including Ethereum, is susceptible to macroeconomic trends. Understanding the current economic climate helps refine the Ethereum price forecast.

-

Inflation and Interest Rates: High inflation and rising interest rates can negatively impact risk assets, including cryptocurrencies. A "risk-off" sentiment may lead to investors selling off their holdings, including ETH.

-

Global Economic Uncertainty: Geopolitical instability and recessionary fears can also trigger a sell-off in the crypto market. Conversely, periods of stability can lead to increased investor confidence and potential price appreciation.

-

Correlation with Traditional Markets: While cryptocurrencies are not always directly correlated with traditional markets, there can be periods of significant influence. For example, a stock market downturn might trigger a decline in the Ethereum price as investors reallocate funds to safer assets.

H3: The Role of Institutional Investors in the ETH Rally

The growing interest of institutional investors is a significant factor influencing the Ethereum price forecast.

-

Increased Institutional Adoption: More and more institutional investors are allocating assets to Ethereum, recognizing its potential and technological advancements. This influx of capital can drive significant price appreciation.

-

Large-Scale Institutional Investments: Large institutional purchases can create substantial buying pressure, pushing the price higher. This is particularly relevant given the current accumulation trend.

-

News and Reports: Recent news and reports highlighting institutional investment in Ethereum further strengthen the bullish narrative. [Mention any relevant news or reports here]

H2: Technical Analysis: Chart Patterns and Price Predictions

Technical analysis provides another lens through which to view the Ethereum price forecast. However, it is crucial to remember that these are predictions, not guarantees.

-

Price Predictions: Various analysts have offered price predictions, ranging from conservative estimates to more bullish outlooks. It's essential to consider multiple sources and understand the underlying assumptions. [Cite sources for different price predictions here]

-

Support and Resistance Levels: Identifying key support and resistance levels on the Ethereum price chart can help anticipate potential price movements.

-

Caution Regarding Predictions: Price predictions are inherently uncertain. Market conditions can shift rapidly, influencing price action. It is advisable to treat all predictions with a degree of skepticism.

3. Conclusion:

This article has explored several key factors influencing the Ethereum price forecast. The substantial ETH accumulation, the positive impact of upcoming upgrades, the macroeconomic climate, and the role of institutional investors all contribute to the overall outlook. The significant accumulation of ETH suggests a potential bullish trend. However, the cryptocurrency market remains volatile, and careful consideration of all relevant factors is essential.

Call to Action: Stay informed about the evolving Ethereum price forecast. Continue researching the latest developments and analysis surrounding ETH to make informed investment decisions. Learn more about the factors influencing the Ethereum Price Forecast and stay ahead of the curve.

Featured Posts

-

Andor Season 2 Premiere Date What To Remember Before Watching

May 08, 2025

Andor Season 2 Premiere Date What To Remember Before Watching

May 08, 2025 -

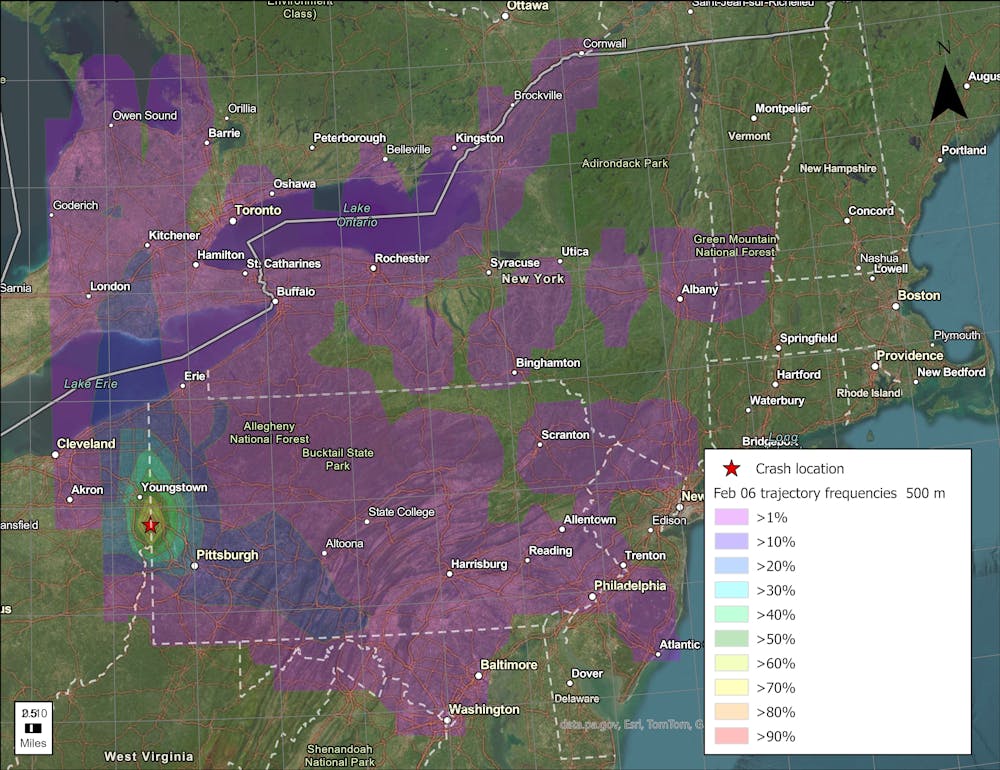

Investigation Into Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

May 08, 2025

Investigation Into Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

May 08, 2025 -

Liberation Day Tariffs Their Long Term Effects On Stock Market Investments

May 08, 2025

Liberation Day Tariffs Their Long Term Effects On Stock Market Investments

May 08, 2025 -

Mondays Market Hit Deciphering Scholar Rock Stocks Performance

May 08, 2025

Mondays Market Hit Deciphering Scholar Rock Stocks Performance

May 08, 2025 -

Jayson Tatum Injury Update Will He Play Tonight Against The Nets

May 08, 2025

Jayson Tatum Injury Update Will He Play Tonight Against The Nets

May 08, 2025