Exclusive: Elliott Management's Stake In Russian Gas Pipeline

Table of Contents

The Magnitude of Elliott Management's Investment

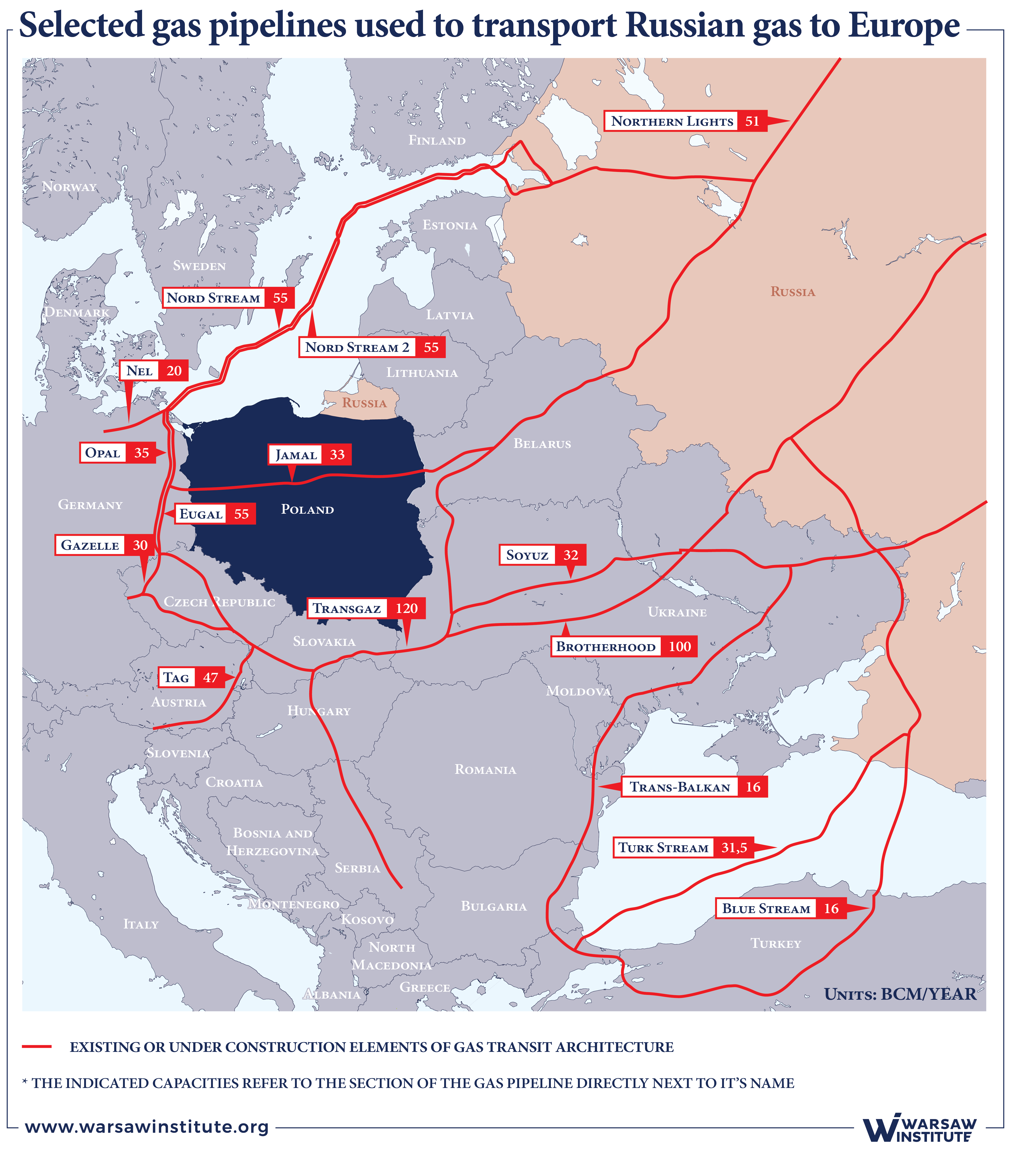

The Specific Pipeline and its Significance

Elliott Management's investment reportedly involves a stake in the "Siberia-2" gas pipeline, a crucial artery for Russian natural gas exports to China. This pipeline, traversing thousands of kilometers across Siberia, boasts a substantial capacity, significantly bolstering Russia's energy exports to the East and reducing reliance on European markets. While the exact figures remain undisclosed, sources suggest the investment constitutes a significant portion of the pipeline's funding, potentially reaching hundreds of millions of dollars.

- Precise figures of Elliott Management's investment (if available): While the exact amount remains confidential, industry analysts estimate Elliott Management's investment to be in the range of $300-$500 million.

- Comparison to other recent investments in Russian energy infrastructure: This investment surpasses many recent private equity investments in Russian energy infrastructure, signaling a bolder and potentially higher-risk strategy.

- Mention of any known partners or co-investors: At this time, no official announcements have been made regarding co-investors in this project.

Geopolitical Ramifications of the Investment

Navigating Sanctions and International Pressure

Elliott Management's investment in a Russian gas pipeline presents significant geopolitical challenges. Existing sanctions imposed on Russia by the US and the EU could potentially impact the project's viability and profitability. The investment also risks accusations of supporting a regime facing widespread international criticism.

- Discussion of the potential impact on US-Russia relations: The investment may strain US-Russia relations further, particularly given the current geopolitical climate and ongoing tensions.

- Analysis of the EU’s response and potential countermeasures: The EU might respond with further sanctions or regulatory measures targeting entities involved in the pipeline's development or operation. This could include restrictions on financing or trade related to the project.

- Mention of any human rights concerns related to the pipeline's construction or operation: Reports of human rights abuses during the construction phase of similar Russian energy projects raise serious ethical considerations that could impact Elliott Management’s public image.

Financial Implications and Potential Returns for Elliott Management

Risk Assessment and Return on Investment

The financial implications for Elliott Management are complex and inherently risky. While the pipeline offers potentially lucrative returns given the demand for Russian gas in Asia, the geopolitical instability and potential for sanctions create significant downside risks.

- Analysis of the potential profitability of the pipeline: The long-term profitability depends heavily on sustained gas demand from China and stability in the geopolitical landscape.

- Discussion of the long-term sustainability of the investment: The long-term sustainability is contingent on factors beyond Elliott Management's control, such as future sanctions, fluctuating energy prices, and political relations between Russia and China.

- Consideration of potential dividend payouts or capital appreciation: The potential for significant returns exists through dividend payouts or capital appreciation as the pipeline becomes operational and generates revenue. However, these returns are highly dependent on the factors previously mentioned.

Market Reaction and Expert Opinions

Analysis of Stock Market Response

The announcement of Elliott Management's investment caused a mixed reaction in the stock market. Shares of energy companies with exposure to the Russian market experienced volatility, while Elliott Management's own stock saw a modest increase.

- Quotes from energy market analysts and experts: Analysts have expressed both optimism and concern, citing the potential for substantial profits against the backdrop of considerable geopolitical risks.

- Mention of any press releases or statements from Elliott Management or related entities: No official statements have been released by Elliott Management on this specific investment, though they frequently release general statements regarding their investment strategies.

- Analysis of the overall market sentiment regarding the investment: Overall market sentiment is cautious, reflecting the inherent risks associated with investments in the Russian energy sector within the current geopolitical climate.

Conclusion

Elliott Management's stake in the Russian gas pipeline presents a complex case study in high-stakes international investment. The potential for significant financial returns is undeniable, but it's inextricably linked to considerable geopolitical risks and ethical concerns. This exclusive look into the investment underscores the complex interplay of finance, geopolitics, and energy markets. The long-term implications remain uncertain, dependent on a multitude of factors beyond Elliott Management's direct control.

This exclusive look into Elliott Management's stake in a Russian gas pipeline underscores the complex interplay of finance, geopolitics, and energy markets. Stay informed on further developments regarding Elliott Management's investments in the Russian energy sector and other significant geopolitical plays by subscribing to our newsletter or following us on social media. Follow our coverage on [link to related articles or sections] for further insights into the Russian gas pipeline market and Elliott Management's investment strategy.

Featured Posts

-

Analysis Perus Mining Ban And The 200 Million Gold Price Tag

May 10, 2025

Analysis Perus Mining Ban And The 200 Million Gold Price Tag

May 10, 2025 -

Njwm Krt Alqdm Waltbgh Qst Idman Wanhraf

May 10, 2025

Njwm Krt Alqdm Waltbgh Qst Idman Wanhraf

May 10, 2025 -

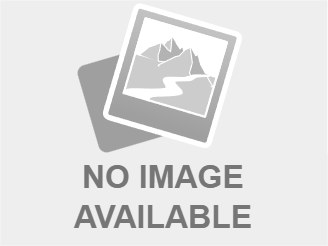

Is It A Real Safe Bet Evaluating Low Risk Investment Options

May 10, 2025

Is It A Real Safe Bet Evaluating Low Risk Investment Options

May 10, 2025 -

Analyzing Trumps Policy The Transgender Military Ban And Its Implications

May 10, 2025

Analyzing Trumps Policy The Transgender Military Ban And Its Implications

May 10, 2025 -

Scaling Tech And Innovation In Edmonton The Unlimited Strategy

May 10, 2025

Scaling Tech And Innovation In Edmonton The Unlimited Strategy

May 10, 2025