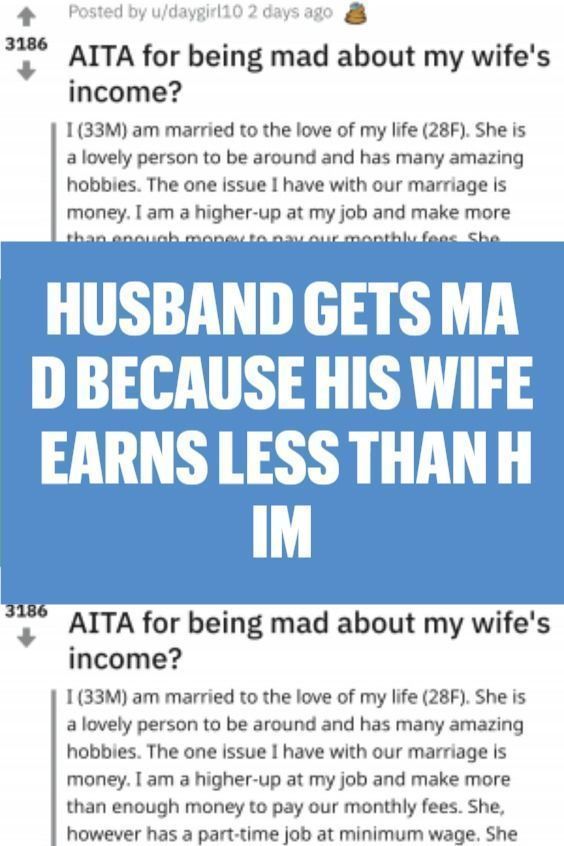

Financial Imbalance: When One Earns Less Than Their A-List Partner

Table of Contents

- Identifying the Root Causes of Financial Imbalance

- Career Choices and Paths

- Unrealistic Expectations and Societal Pressures

- Communication Breakdown

- Strategies for Managing Financial Imbalance in Relationships

- Joint Budgeting and Financial Planning

- Addressing Power Dynamics

- Exploring Financial Independence and Security

- Seeking Professional Help: Therapists and Financial Advisors

- Couple's Therapy

- Financial Advisors

- Conclusion

Identifying the Root Causes of Financial Imbalance

Financial imbalance isn't always about individual failings; it often stems from a confluence of factors. Let's explore some key contributors:

Career Choices and Paths

Differing career paths significantly impact earning potential. High-paying professions often require extensive education, specialized skills, and long hours, while many lower-paying jobs offer less opportunity for advancement.

- Examples of high-paying careers: Doctors, lawyers, engineers, software developers, investment bankers.

- Examples of lower-paying careers: Teachers, social workers, retail workers, hospitality staff, artists.

- Impact of career breaks: Taking time off for childcare or other family responsibilities can significantly impact long-term earning potential, exacerbating income disparity.

- Role of education and training: Higher levels of education and specialized training often correlate with higher earning potential. This disparity can lead to financial imbalance within a relationship.

Unrealistic Expectations and Societal Pressures

Societal pressures and unrealistic expectations play a significant role in creating and perpetuating financial imbalance.

- Impact of societal norms: Traditional gender roles often dictate career choices and earning potential, leading to imbalances.

- Pressure to achieve a certain lifestyle: The pressure to maintain a specific lifestyle, often fueled by social media portrayals, can increase financial stress.

- Influence of social media: Constant exposure to images of lavish lifestyles can create unrealistic expectations and fuel feelings of inadequacy, especially for the lower-earning partner.

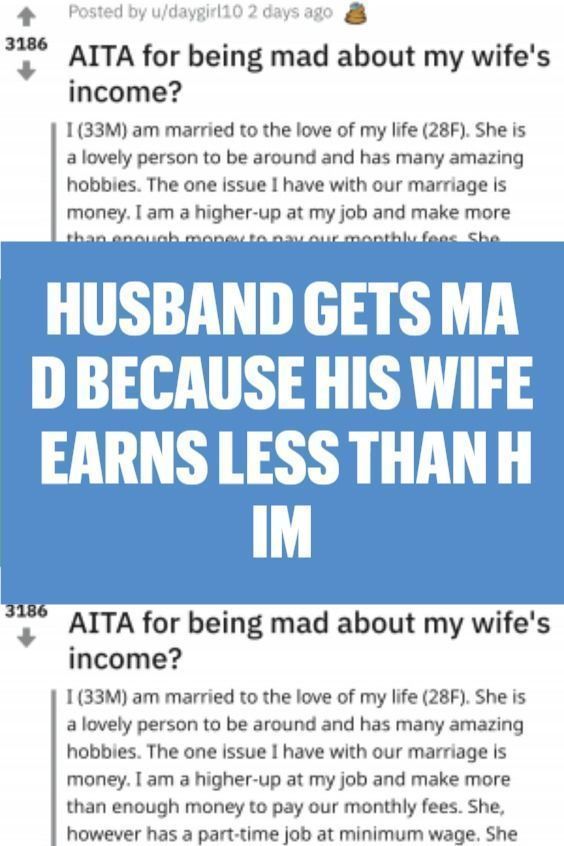

Communication Breakdown

Open and honest communication is paramount in navigating financial imbalance. A lack of communication can quickly escalate minor financial disagreements into major relationship conflicts.

- Importance of transparent budgeting: Creating a shared budget allows both partners to understand the financial landscape.

- Discussing financial goals: Openly discussing short-term and long-term financial goals is vital for aligning expectations and minimizing conflict.

- Addressing concerns regarding income disparity: Creating a safe space to voice concerns and anxieties about the income gap is crucial.

- Identifying potential financial insecurities: Addressing any feelings of insecurity or inadequacy linked to earning potential is essential for building trust and fostering a healthy relationship.

Strategies for Managing Financial Imbalance in Relationships

Successfully navigating financial imbalance requires proactive strategies and a commitment to working together.

Joint Budgeting and Financial Planning

A joint budget is the cornerstone of managing financial imbalance. It provides transparency and allows for informed decision-making.

- Steps to create a joint budget: Track income and expenses, allocate funds for shared expenses (mortgage, utilities, groceries), and individual needs (personal spending, hobbies).

- Allocating funds for shared expenses and individual needs: Finding a balance that ensures fairness and addresses each partner's individual financial needs.

- Setting financial goals together: Working collaboratively towards shared financial goals (saving for a house, retirement, vacations).

- Strategies for tracking expenses: Utilizing budgeting apps or spreadsheets to monitor spending and stay on track.

Addressing Power Dynamics

Financial imbalance can sometimes create power imbalances within a relationship. Addressing these power dynamics is crucial.

- Techniques for promoting equal decision-making: Ensuring both partners have an equal say in financial matters, regardless of income levels.

- Ensuring both partners feel heard and valued: Creating a safe space for open communication and mutual respect.

- Seeking professional guidance if needed: Consulting with a therapist or financial advisor to help navigate complex power dynamics.

Exploring Financial Independence and Security

Even with a joint budget, it's essential for the lower-earning partner to maintain some degree of financial independence.

- Pursuing personal financial goals: Setting individual savings goals, regardless of the couple's overall financial picture.

- Building emergency savings: Creating an emergency fund to cover unexpected expenses.

- Investing for the future: Exploring investment opportunities to build long-term financial security.

- Exploring professional development opportunities: Investing in education and training to increase earning potential.

Seeking Professional Help: Therapists and Financial Advisors

Addressing financial imbalance can be challenging, and seeking professional help can significantly improve outcomes.

Couple's Therapy

A therapist can provide a safe and neutral space to discuss sensitive financial issues and resolve conflicts.

- Benefits of couple's therapy: Improved communication, conflict resolution skills, addressing underlying emotional issues related to money.

- Addressing underlying emotional issues related to money: Identifying and addressing any anxieties, insecurities, or resentment associated with financial disparities.

- Improving communication skills: Learning techniques for effective communication about finances and other relationship matters.

Financial Advisors

A financial advisor can provide expert guidance on budgeting, investing, and long-term financial planning.

- Assisting with budgeting: Developing a comprehensive budget tailored to the couple's specific financial situation.

- Investment strategies: Guidance on diversifying investments and building long-term wealth.

- Debt management: Strategies for managing and reducing debt.

- Tax planning: Optimizing tax strategies to minimize tax liabilities.

- Estate planning: Planning for the future and ensuring financial security in the event of unexpected circumstances.

Conclusion

Financial imbalance in relationships is a complex issue, but it's manageable with proactive steps. Open communication, joint financial planning, and addressing potential power imbalances are crucial. Remember that seeking professional help from a therapist or financial advisor can significantly improve your ability to tackle financial imbalance and strengthen your relationship. Don't let income disparity undermine your happiness; actively manage income disparity and improve your relationship finances. Start addressing financial stress today by creating a joint budget and fostering open communication. Take control of your relationship finances and build a more secure and fulfilling future together. For further resources, explore reputable financial planning websites and articles on couples therapy. Let's work together to address financial imbalance and build stronger, more secure relationships.

Anadolu Ajansi Ndan Gazze Deki Kanalizasyon Krizine Dair Analiz

Anadolu Ajansi Ndan Gazze Deki Kanalizasyon Krizine Dair Analiz

Postman Clever Tips Hidden Features You Never Knew Existed

Postman Clever Tips Hidden Features You Never Knew Existed

Swissquote Bank Euro Strength Against Weakening Us Dollar

Swissquote Bank Euro Strength Against Weakening Us Dollar

Analyse Cr Edit Mutuel Am Impacts Geopolitiques Sur L Environnement Maritime

Analyse Cr Edit Mutuel Am Impacts Geopolitiques Sur L Environnement Maritime

Paige Bueckers A Husky Of Honor Dom Amore

Paige Bueckers A Husky Of Honor Dom Amore