Financing 270MWh Battery Energy Storage Systems (BESS) In Belgium

Table of Contents

Understanding the Belgian Energy Market and BESS Investment Landscape

The Belgian energy market is undergoing a significant transformation, driven by the increasing adoption of renewable energy sources like solar and wind power. This transition presents both challenges and opportunities, with the need for robust energy storage solutions to address intermittency and ensure grid stability becoming increasingly critical. Investing in BESS is key to tackling this challenge.

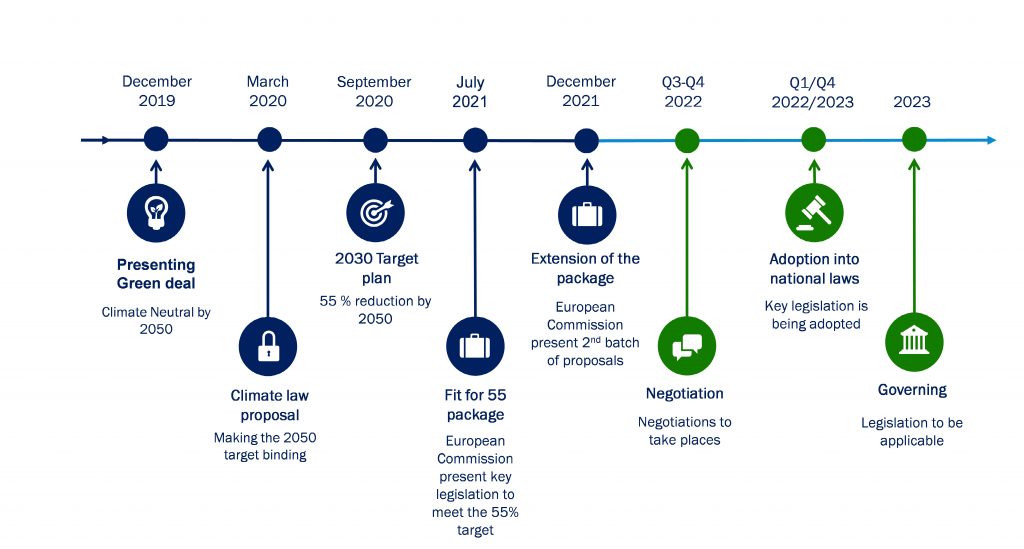

Regulatory Framework and Incentives for BESS Deployment

The Belgian government recognizes the crucial role of BESS in its energy transition strategy and has implemented several supportive measures. The regulatory landscape is continuously evolving, but key aspects include grid connection regulations, permitting processes, and importantly, financial incentives designed to stimulate BESS deployment.

- Government Subsidies and Tax Breaks: Belgium offers various regional and national subsidies, tax advantages, and accelerated depreciation schemes for renewable energy projects incorporating energy storage, including BESS. Specific programs often change, so staying updated on the latest offerings from the Flemish, Walloon, and Brussels regions is crucial.

- Relevant Legislation: Key legislation impacting BESS projects includes regulations related to grid connection procedures, environmental permits, and safety standards. Understanding these regulations is vital for successful project development and securing funding.

- Examples of Specific Subsidies: (This would require up-to-date research and links to relevant government websites. Examples could include specific regional programs for renewable energy integration or energy storage deployment.) [Insert Links Here]

Market Demand and Investment Opportunities

The demand for energy storage in Belgium is rapidly increasing due to several factors:

- Growth of Renewable Energy: The increasing share of intermittent renewable energy sources (solar and wind) necessitates effective energy storage solutions to manage supply fluctuations and ensure grid stability.

- Peak Demand Management: BESS can play a vital role in optimizing grid operations by managing peak demand periods, reducing reliance on fossil fuel peaker plants.

- Ancillary Services: BESS can provide crucial ancillary services to the grid, enhancing its overall resilience and efficiency, thus creating additional revenue streams for project owners.

The potential return on investment (ROI) for a 270MWh BESS project in Belgium is attractive due to these market drivers. However, a thorough financial model, considering various factors like energy prices, grid tariffs, and operational costs, is essential for accurate assessment. [Insert Statistics on Renewable Energy Growth and Projected BESS Capacity Growth in Belgium Here, if available].

Exploring Financing Options for 270MWh BESS Projects

Securing funding for a large-scale BESS project requires a diversified approach to financing, combining different funding sources to optimize the capital structure.

Equity Financing

Equity financing involves attracting investors who acquire ownership in the project in exchange for capital. This can be a crucial component of the funding mix, particularly for projects with high upfront capital expenditure (CAPEX).

- Potential Equity Partners: Private equity firms specializing in infrastructure investments, energy-focused funds, and strategic industrial partners are potential equity sources.

- Advantages: Equity financing reduces debt burden and enhances project credibility.

- Disadvantages: Equity dilution and potential loss of control are key considerations.

Debt Financing

Debt financing involves borrowing funds, requiring repayment with interest over a specified period. Several debt options are available for BESS projects:

- Bank Loans: Traditional bank loans are a common source of debt financing, often requiring strong project sponsors and robust financial projections.

- Project Finance Loans: These loans are structured around the specific cash flows of the project, reducing reliance on the sponsor's balance sheet.

- Green Bonds: These bonds specifically target environmentally friendly projects and can attract investors seeking sustainable investment opportunities. Green bonds for BESS are becoming increasingly popular.

- Potential Lenders: Banks specializing in infrastructure financing, export credit agencies, and specialized financial institutions are potential lenders.

Public Funding and Grants

Numerous public funding opportunities exist at the national, regional, and European Union (EU) levels, significantly reducing the financial burden on project developers.

- EU Grants: The EU offers various grant programs supporting renewable energy projects and energy storage initiatives. Eligibility criteria and application processes need careful consideration.

- Regional Subsidies: Both the Flemish, Walloon, and Brussels regions may offer specific subsidies and incentives targeting energy storage projects within their territories.

- Potential Challenges: The application processes for public funding can be complex and competitive.

Structuring the Financing Deal for Optimal Returns

Optimal structuring of the financing deal is vital to maximize project profitability and mitigate financial risks.

Financial Modeling and Due Diligence

Robust financial modeling is paramount for successful project financing. This involves:

- Key Financial Metrics: Accurate forecasting of key financial metrics, including internal rate of return (IRR), net present value (NPV), and payback period, are crucial for attracting investors and securing funding.

- Comprehensive Due Diligence: Thorough technical, environmental, and legal due diligence is necessary to identify and mitigate potential risks before committing to the project.

Risk Mitigation Strategies

BESS projects are subject to several risks:

- Technology Risk: Technological advancements in battery technology and potential obsolescence should be considered.

- Regulatory Risk: Changes in regulations or policies can impact project economics.

- Market Risk: Fluctuations in energy prices and demand can affect project profitability.

Risk mitigation strategies include:

- Insurance: Insurance policies can protect against various risks, including equipment failure, construction delays, and regulatory changes.

- Hedging: Hedging strategies can mitigate the impact of energy price volatility.

- Power Purchase Agreements (PPAs): Securing long-term PPAs can provide price stability and predictable revenue streams.

Conclusion

Securing financing for a 270MWh Battery Energy Storage System (BESS) in Belgium demands a comprehensive understanding of the market dynamics, regulatory framework, and available funding mechanisms. By effectively combining equity and debt financing, leveraging government incentives and grants, and implementing robust risk management strategies, developers can successfully secure the necessary capital to deploy these crucial energy storage assets. To learn more about optimizing your financing strategy for your BESS project in Belgium, contact us today for a consultation. We specialize in helping clients navigate the complexities of financing Battery Energy Storage Systems (BESS) and secure the funding needed to successfully deploy their projects.

Featured Posts

-

Uk Energy Policy Reform A Change Of Course Guido Fawkes

May 03, 2025

Uk Energy Policy Reform A Change Of Course Guido Fawkes

May 03, 2025 -

Mental Health Services In Ghana Examining The Severe Shortage Of Psychiatrists

May 03, 2025

Mental Health Services In Ghana Examining The Severe Shortage Of Psychiatrists

May 03, 2025 -

Dual Sense Ps 5 Controller Colors Your 2025 Purchase Guide

May 03, 2025

Dual Sense Ps 5 Controller Colors Your 2025 Purchase Guide

May 03, 2025 -

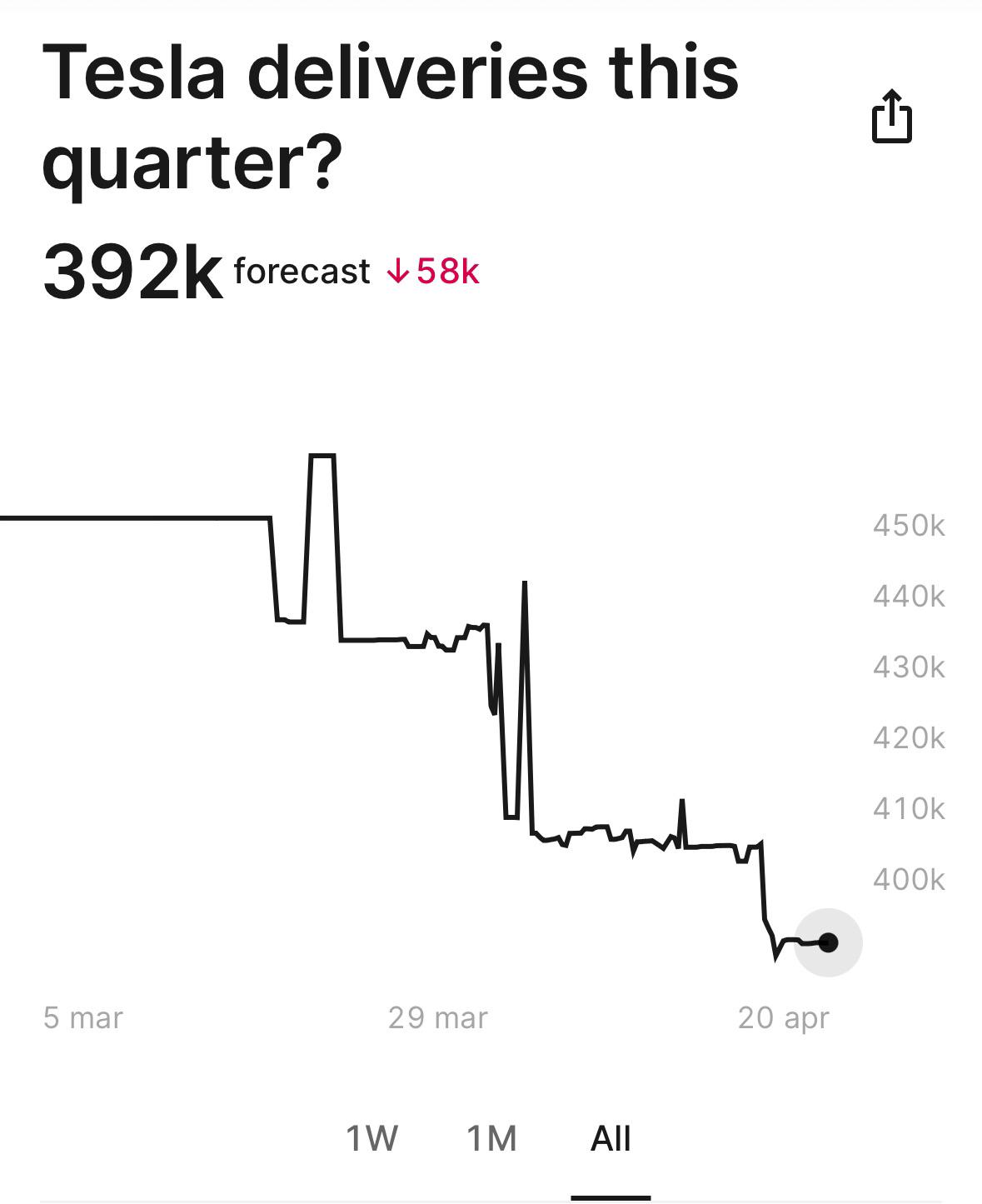

Tesla Ceo Search Exclusive Update On Elon Musks Succession

May 03, 2025

Tesla Ceo Search Exclusive Update On Elon Musks Succession

May 03, 2025 -

A Generations Wellbeing The Critical Need To Invest In Childhood Mental Health

May 03, 2025

A Generations Wellbeing The Critical Need To Invest In Childhood Mental Health

May 03, 2025