Finding The Real Safe Bet: Strategies For Conservative Investing

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific investment strategies, understanding your risk tolerance is paramount. Risk tolerance refers to your comfort level with the possibility of losing money. This is different from risk capacity, which is the amount of loss you can realistically afford. Accurately assessing your risk tolerance is crucial for choosing investments aligned with your personality and financial goals. A proper risk assessment ensures you won't panic and make rash decisions during market downturns.

- Defining Risk Tolerance: Your risk tolerance dictates how much fluctuation you can handle in your investment portfolio. A low risk tolerance suggests a preference for stable investments with minimal volatility, even if it means lower potential returns.

- Risk Tolerance vs. Risk Capacity: While risk tolerance is psychological, risk capacity is financial. You might tolerate some risk, but your capacity might be limited by your overall financial situation.

- Assessing Your Risk Tolerance: Many online questionnaires can help you determine your risk profile. Consider these questions:

- How comfortable are you with potential losses?

- What is your investment time horizon? (Short-term, mid-term, or long-term?)

- What are your financial goals? (Retirement, education, etc.?)

- Online Risk Assessment Tools: Several reputable financial institutions offer free online risk tolerance assessments. Using these tools can provide valuable insights into your investment preferences.

Diversification: Spreading Your Investments

A core principle of successful investing, regardless of your risk tolerance, is diversification. This means spreading your investments across various asset classes to mitigate risk. "Don't put all your eggs in one basket" is a timeless adage that perfectly encapsulates this crucial concept. A diversified portfolio reduces your dependence on any single investment's performance.

- Asset Classes for Conservative Portfolios: Conservative investors often favor:

- Bonds: These fixed-income securities generally offer lower risk than stocks. Government bonds are considered particularly safe.

- Government Securities: These are considered extremely low-risk due to the backing of the government. Examples include Treasury bills, notes, and bonds.

- Blue-Chip Stocks: While stocks carry more risk than bonds, established, large-cap companies (blue-chip stocks) are generally considered more stable than smaller companies.

- Real Estate Investment Trusts (REITs): REITs invest in income-producing real estate and can offer diversification benefits, but they are subject to market fluctuations.

- Examples of Diversified Conservative Portfolios: A balanced portfolio might include a mix of government bonds, high-yield savings accounts, and a small allocation to blue-chip stocks. The specific allocation depends on your risk tolerance and financial goals.

- Professional Portfolio Management: For those seeking expert guidance, a financial advisor can help create a diversified portfolio tailored to your individual needs and risk profile.

Low-Risk Investment Options

Several low-risk investment options are well-suited for conservative investors. While these investments generally offer lower returns than higher-risk options, they prioritize capital preservation. It's important to remember that even low-risk investments carry some degree of risk.

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts, providing a safe place to park your money with easy access. Interest rates can fluctuate, however.

- Certificates of Deposit (CDs): CDs offer a fixed interest rate for a specific term (e.g., 6 months, 1 year, 5 years). Early withdrawal usually incurs penalties, so consider your liquidity needs before investing in CDs.

- Government Bonds: These bonds are backed by the government, making them very low-risk. They offer a fixed interest rate and return your principal at maturity. However, interest rates and bond prices can fluctuate.

- Treasury Inflation-Protected Securities (TIPS): TIPS protect your investment from inflation by adjusting the principal based on inflation rates. This is particularly attractive during periods of high inflation.

- Money Market Accounts: Similar to savings accounts, money market accounts offer relatively high liquidity and competitive interest rates, although rates fluctuate.

Long-Term Strategies for Conservative Investing

Conservative investing is a marathon, not a sprint. A long-term perspective is crucial for success. The power of compounding, where your earnings generate further earnings over time, is a significant advantage of long-term investing.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals (e.g., monthly). This strategy mitigates the risk of investing a lump sum at a market high.

- Reinvesting Dividends and Interest: Reinvesting your earnings helps accelerate wealth accumulation through the power of compounding.

- Setting Realistic Financial Goals: Clearly defined financial goals (e.g., retirement planning, down payment on a house) are essential for creating a long-term investment strategy.

- Long-Term Investment Strategies for Conservative Investors: A long-term strategy might involve gradually increasing your investment contributions over time, rebalancing your portfolio periodically, and reviewing your asset allocation based on your changing circumstances and goals.

Conclusion

Finding the right approach to conservative investing involves understanding your risk tolerance, diversifying your investments, selecting appropriate low-risk options, and adopting a long-term perspective. By carefully considering these strategies, you can build a secure financial future. Remember, while this guide offers valuable insights, seeking professional financial advice tailored to your specific circumstances is highly recommended. Take the first step towards finding your real safe bet in conservative investing today! Begin building your secure financial future with these conservative investing strategies.

Featured Posts

-

Silnye Snegopady Preduprezhdenie Dlya Yaroslavskoy Oblasti

May 09, 2025

Silnye Snegopady Preduprezhdenie Dlya Yaroslavskoy Oblasti

May 09, 2025 -

Debate Erupts Jeanine Pirro On Due Process And El Salvador Prison Transfers

May 09, 2025

Debate Erupts Jeanine Pirro On Due Process And El Salvador Prison Transfers

May 09, 2025 -

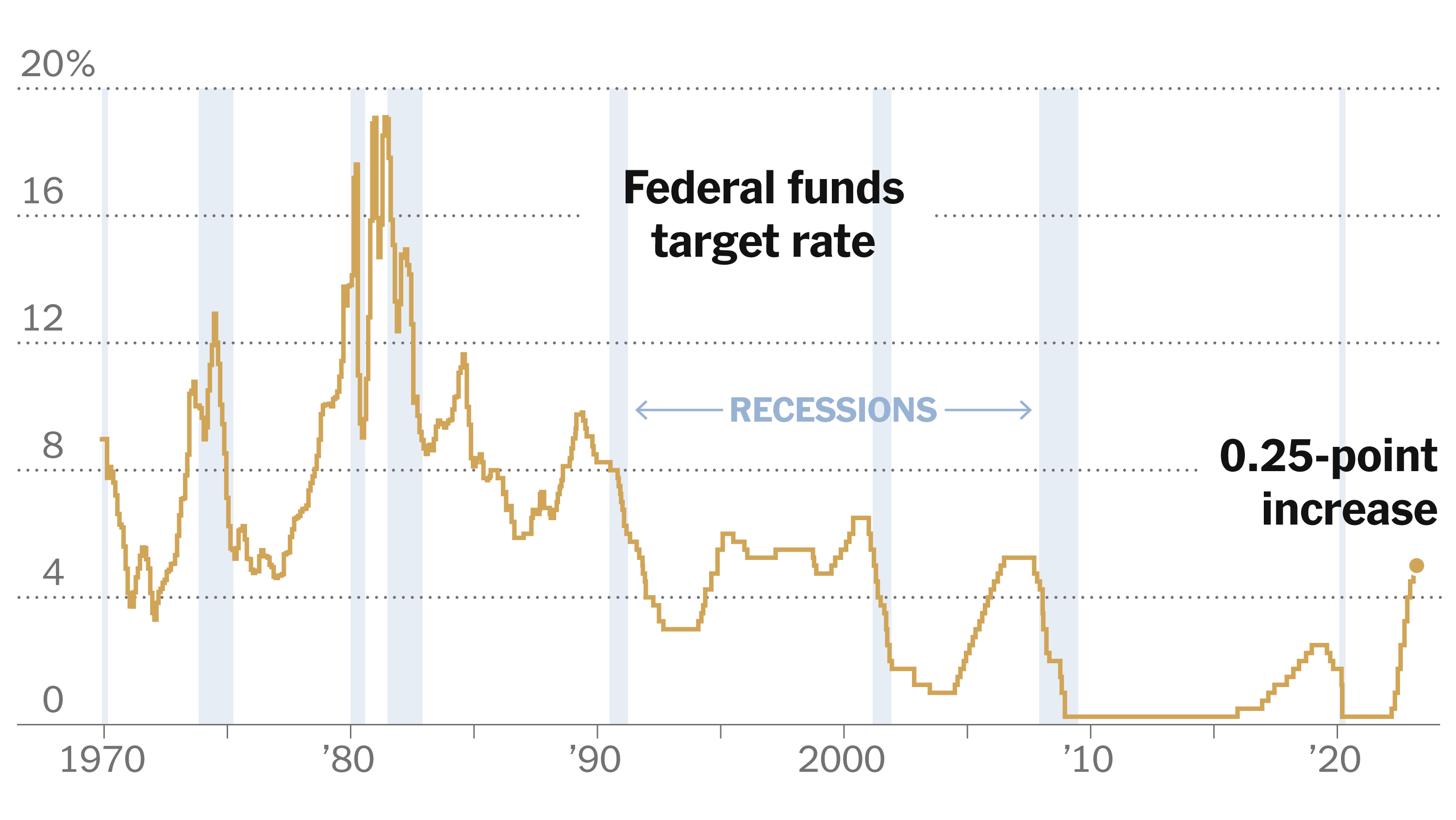

U S Federal Reserve Rate Decision Weighing Economic Pressures

May 09, 2025

U S Federal Reserve Rate Decision Weighing Economic Pressures

May 09, 2025 -

Snls Impression Of Harry Styles The Singers Disappointed Response

May 09, 2025

Snls Impression Of Harry Styles The Singers Disappointed Response

May 09, 2025 -

110 Potential Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025

110 Potential Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025