Flat Stock Market Close: India-Pakistan Tensions Impact Trading

Table of Contents

Geopolitical Uncertainty and Investor Sentiment

Heightened India-Pakistan tensions significantly impact investor confidence, creating a climate of uncertainty and risk aversion. This is reflected in decreased trading volumes and a cautious approach by both domestic and foreign investors. The "flight-to-safety" phenomenon, where investors move funds into safer assets like government bonds, is clearly observable. This shift away from riskier equities contributes to the subdued market performance. Sectors like banking and defense are particularly sensitive to geopolitical instability.

- Decreased Foreign Institutional Investor (FII) investment: FIIs, often major players in the Indian stock market, tend to withdraw investments during periods of heightened geopolitical risk, leading to decreased liquidity.

- Increased risk aversion among domestic investors: Domestic investors also react to the uncertainty, adopting a "wait-and-see" approach, resulting in lower trading activity and a dampened market response.

- Short-term market fluctuations due to news cycles: The market reacts to the constant stream of news regarding the India-Pakistan situation, resulting in short-term fluctuations that ultimately average out to a relatively flat close.

Impact on Specific Sectors

The impact of India-Pakistan tensions is not uniform across all sectors. While some experience a greater impact than others, the overall effect contributes to the flat market close.

- Defense sector performance analysis: The defense sector often sees increased activity during geopolitical crises, as investors anticipate increased government spending and contracts. However, the overall market sentiment might still dampen the potential gains.

- Impact on IT and export-oriented sectors: These sectors are indirectly affected, as broader economic uncertainty and potential disruptions to trade could negatively impact their performance.

- Effect on the banking and financial services industry: Increased risk aversion can lead to tighter credit conditions and reduced lending, impacting the profitability of these institutions.

Government Response and Policy Implications

The Indian government plays a crucial role in maintaining market stability during times of geopolitical stress. While there haven't been any major policy interventions announced directly in response to the current tensions, the government's ongoing efforts to promote economic growth and investor confidence are relevant. Statements from government officials assuring market stability and emphasizing the country's economic resilience are important factors influencing investor sentiment.

- Government measures to boost investor confidence: The government might employ measures like tax breaks or incentives to attract investments and mitigate the negative impact of geopolitical uncertainties.

- Regulatory actions to mitigate market volatility: Regulatory bodies may take steps to ensure fair and orderly trading, preventing panic selling or manipulation.

- Potential long-term economic consequences: Sustained geopolitical tensions could have longer-term consequences on economic growth and foreign investment, requiring proactive government measures.

Comparison with Previous Tensions

Comparing the current market reaction to past instances of India-Pakistan tensions reveals interesting insights. While historical data shows a tendency for market volatility during similar events, the current response is relatively muted. This difference might be attributed to various factors, including improved investor sophistication, stronger regulatory frameworks, and a more diversified economy.

- Historical data on market reactions to similar events: Analyzing past market responses provides a benchmark for understanding the current situation and identifying any deviations.

- Identifying key differences in investor behavior: Changes in investor behavior over time could be a crucial factor in explaining the muted response despite heightened tensions.

- Long-term effects of past geopolitical crises on the Indian stock market: Analyzing the long-term effects of previous crises helps to assess potential future consequences.

Conclusion: Understanding the Impact of India-Pakistan Tensions on Stock Market Closes

In conclusion, while escalating India-Pakistan tensions create a climate of uncertainty, the Indian stock market’s relatively flat close today highlights the complex interplay of factors influencing market behavior. Investor sentiment, sector-specific impacts, and government responses all contribute to the overall market performance. Monitoring geopolitical events remains crucial for investors, and understanding the nuances of geopolitical risk assessment is essential for informed investment strategies. Stay informed about India-Pakistan relations and their evolving impact on the Indian stock market. Subscribe to our market updates for timely analysis and insights on navigating geopolitical risks affecting your investments. Understanding the impact of India-Pakistan tensions on market volatility is key for successful market analysis.

Featured Posts

-

Antipremiya Zolotaya Malina Kto Poluchil Nagrady Vklyuchaya Dakotu Dzhonson

May 10, 2025

Antipremiya Zolotaya Malina Kto Poluchil Nagrady Vklyuchaya Dakotu Dzhonson

May 10, 2025 -

Fyraty Mn Alahly Almsry Ila Alerby Kyf Kan Adawh

May 10, 2025

Fyraty Mn Alahly Almsry Ila Alerby Kyf Kan Adawh

May 10, 2025 -

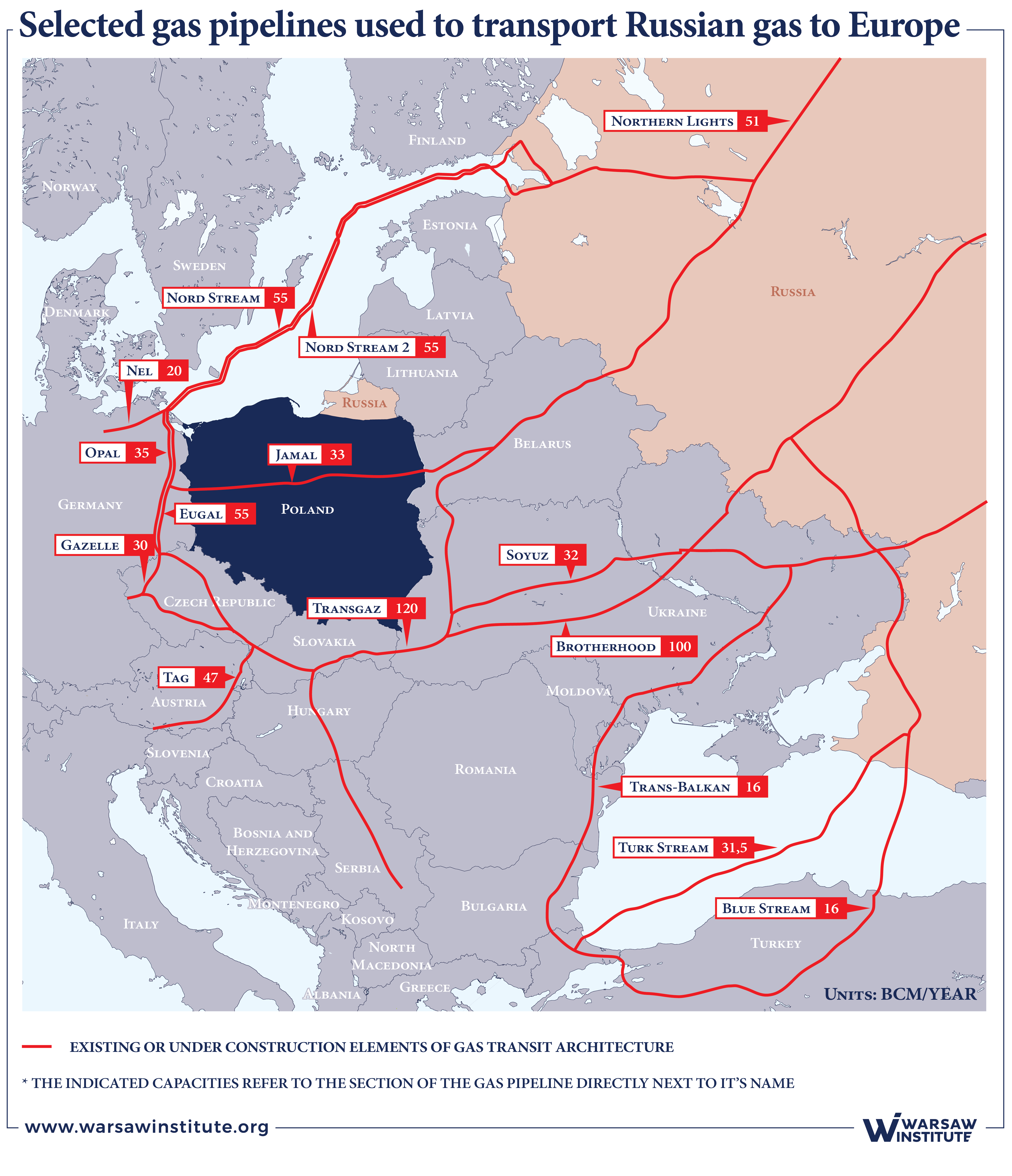

Exclusive Elliott Managements Stake In Russian Gas Pipeline

May 10, 2025

Exclusive Elliott Managements Stake In Russian Gas Pipeline

May 10, 2025 -

Kimbal Musk Examining The Life And Work Of Elons Less Known Brother

May 10, 2025

Kimbal Musk Examining The Life And Work Of Elons Less Known Brother

May 10, 2025 -

The Heartbreaking Aftermath Of A Racist Hate Crime

May 10, 2025

The Heartbreaking Aftermath Of A Racist Hate Crime

May 10, 2025