Fremantle Q1 Revenue Down 5.6%: Impact Of Buyer Budget Cuts

Table of Contents

Declining Television Advertising Revenue

The shrinking television advertising market is a primary culprit behind Fremantle's Q1 revenue decline. Broadcasters and traditional television networks are facing increasing competition from streaming platforms, resulting in reduced advertising spend. This directly impacts revenue streams for production companies like Fremantle, which rely heavily on advertising revenue to fund their productions.

- Reduced Advertiser Spend: Major broadcasters have reported significant cuts in their advertising budgets, leading to fewer opportunities for Fremantle to secure lucrative advertising deals for their shows.

- Impact on Specific Shows: Several Fremantle shows, including [Insert example of a Fremantle show potentially impacted], have experienced reduced advertising revenue, impacting their profitability and potentially leading to shorter seasons or cancellations.

- Program Cancellations: The decline in advertising revenue has forced some broadcasters to cancel or postpone less profitable programs, further impacting Fremantle's production pipeline and overall revenue.

Reduced Commissioning Budgets Across Key Markets

The decrease in commissioning budgets is another significant factor affecting Fremantle's performance. Across key markets like the US, UK, and Australia, major players—both broadcasters and streaming platforms—have tightened their purse strings, leading to fewer new projects being commissioned.

- US Market Slowdown: The US market, a key source of revenue for Fremantle, has witnessed a marked decrease in commissioning budgets, resulting in fewer opportunities for new shows and formats.

- UK and Australian Impacts: Similar trends are observed in the UK and Australian markets, with broadcasters and streaming services prioritizing cost-effectiveness over ambitious new productions.

- Project Delays and Cancellations: Several Fremantle projects have been delayed or cancelled outright due to these reduced commissioning budgets, directly impacting revenue and future production plans.

Streaming Platform Strategies and Impact

The evolving strategies of streaming platforms are also contributing to Fremantle's challenges. While streaming has expanded the market for content, the competitive landscape has led to shifts in platform priorities and content acquisition strategies.

- Focus on Original Programming: Many streaming platforms are increasingly focusing on their own original programming, reducing their reliance on acquiring external content from companies like Fremantle.

- Subscription Model Pressures: The pressure to maintain subscriber numbers while managing costs has forced some streaming platforms to become more selective about the content they acquire.

- Impact on Fremantle's Business Model: This shift towards original programming and tighter budgets necessitates Fremantle to adapt its business model and explore new avenues for content distribution and revenue generation.

Fremantle's Response and Future Outlook

Fremantle is actively responding to these challenges by implementing several strategic initiatives. The company is focusing on cost optimization, exploring new revenue streams, and diversifying its content portfolio.

- Cost Optimization Measures: Fremantle is implementing measures to streamline production processes and reduce operational costs.

- Diversification Strategies: The company is expanding into new genres and formats, exploring opportunities in digital media, and seeking partnerships to broaden its reach.

- New Revenue Streams Exploration: Fremantle is actively exploring new revenue streams, such as licensing its formats internationally and expanding its branded entertainment offerings.

Conclusion: Navigating the Challenges of Budget Cuts in the Fremantle Q1 Results

The 5.6% decline in Fremantle's Q1 revenue clearly reflects the significant impact of buyer budget cuts across the television and film industry. Declining television advertising revenue, reduced commissioning budgets, and shifting streaming platform strategies all contributed to this challenging quarter. The long-term consequences for Fremantle and the broader media landscape remain uncertain, demanding adaptation and innovative solutions. To stay informed about Fremantle's financial performance and the evolving trends in the media industry, subscribe to our newsletter and follow us on social media for ongoing analysis of the impact of budget cuts and the future of television. Stay updated on Fremantle's financial performance and the broader implications of these budget cuts in the media industry.

Featured Posts

-

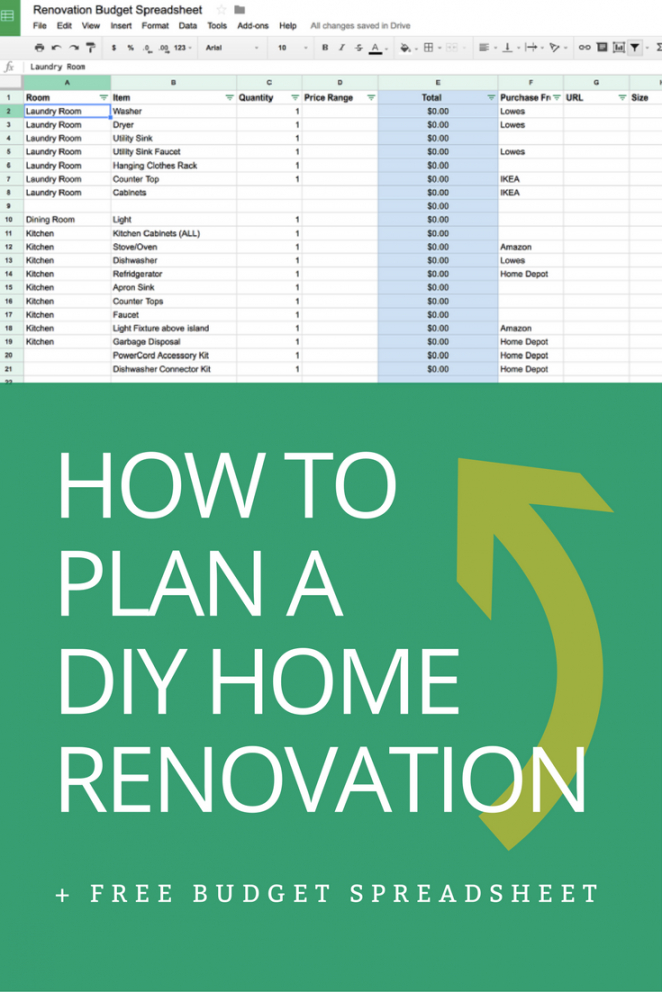

Understanding International Tariff Fluctuations An Fp Video Analysis

May 20, 2025

Understanding International Tariff Fluctuations An Fp Video Analysis

May 20, 2025 -

The Enduring Appeal Of Agatha Christies Poirot A Critical Analysis

May 20, 2025

The Enduring Appeal Of Agatha Christies Poirot A Critical Analysis

May 20, 2025 -

Big Bear Ai Holdings Bbai Stock Plunge In 2025 Reasons And Analysis

May 20, 2025

Big Bear Ai Holdings Bbai Stock Plunge In 2025 Reasons And Analysis

May 20, 2025 -

Wwe Raw Recap Rollins And Breakker Bully Sami Zayn

May 20, 2025

Wwe Raw Recap Rollins And Breakker Bully Sami Zayn

May 20, 2025 -

Nagelsmann Names Goretzka For Nations League

May 20, 2025

Nagelsmann Names Goretzka For Nations League

May 20, 2025