FTC's Appeal Against Microsoft-Activision Merger Approval

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core argument rests on the assertion that the Microsoft-Activision merger would stifle competition and harm consumers. Their case hinges on several key claims, primarily focused on the potential for anti-competitive behavior.

-

Market dominance concerns regarding Call of Duty: The FTC argues that Microsoft's ownership of Activision Blizzard, and specifically the immensely popular Call of Duty franchise, would give them an unfair advantage, potentially leading to exclusivity deals and the exclusion of competitors. This raises serious concerns about "Call of Duty exclusivity" and the potential for Microsoft to leverage its market power to harm rivals.

-

Potential for higher game prices: The FTC contends that reduced competition could lead to significantly higher prices for games, impacting consumers directly. This is a central element of their "competition concerns" related to the merger.

-

Reduced innovation in the gaming market: A lack of competition, the FTC argues, would likely stifle innovation. With less pressure to compete, Microsoft might reduce investment in research and development, ultimately leading to a less dynamic and innovative gaming market.

-

Exclusion of competitors from key platforms: The FTC fears that Microsoft could leverage its ownership of Activision Blizzard's intellectual property to exclude competitors from key platforms like Xbox and its cloud gaming services. This "antitrust lawsuit" focuses on the potential for this type of anti-competitive behavior.

The FTC's legal filings contain numerous quotes outlining these concerns, emphasizing the potential for substantial harm to the competitive landscape of the gaming industry. The "gaming industry regulation" debate has intensified significantly due to this case.

Microsoft's Defense and Counterarguments

Microsoft has vigorously defended the merger, arguing that it will benefit both gamers and the industry as a whole. Their counterarguments attempt to address the FTC's concerns head-on.

-

Arguments against market dominance: Microsoft claims that even with the acquisition, they wouldn't achieve market dominance. They point to the robust competition already existing within the gaming market.

-

Promises to maintain Call of Duty availability across platforms: A significant part of Microsoft's defense involves their commitment to continue making Call of Duty available across various platforms, including PlayStation. This promise directly addresses the FTC's worries about "Call of Duty exclusivity."

-

Claims of benefits for gamers and developers: Microsoft asserts that the merger will lead to benefits for gamers through enhanced experiences and for developers through access to greater resources.

-

Mention of potential job creation and economic growth: Microsoft highlights the potential for job creation and economic growth stemming from the merger, emphasizing the broader economic benefits.

Microsoft's official statements and press releases offer detailed rebuttals to the FTC’s claims, emphasizing the positive aspects of the merger. Their defense strategy focuses on portraying the "merger defense" in a positive light and highlighting the "competitive landscape" even with the acquisition.

The Appeal Process and Potential Outcomes

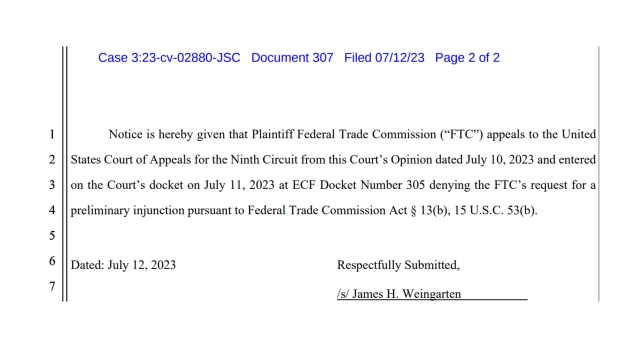

The FTC's appeal is now undergoing legal proceedings. The timeline is uncertain, but the process involves several stages including briefings, oral arguments, and ultimately a court decision.

-

Timeline of the appeal process: The timeline of the appeal process is complex and subject to change depending on the court's scheduling.

-

Possible outcomes: The court could reverse the initial approval, uphold the approval, or modify it with conditions. This "merger approval" decision will have significant ramifications.

-

Impact on future mergers and acquisitions in the gaming industry: The outcome of this appeal will set a precedent for future mergers and acquisitions in the gaming sector, shaping the regulatory landscape.

-

Precedents set by similar antitrust cases: The court will likely consider precedents set in similar "antitrust law" cases when making its decision.

This "legal proceedings" phase is critical, and the "court decision" will significantly impact the gaming industry's future.

Implications for the Gaming Industry and Consumers

The outcome of the FTC's appeal will have profound consequences for gamers, developers, and the broader gaming industry.

-

Potential changes to game pricing and availability: Depending on the court's decision, game prices and availability could be affected, potentially impacting consumer spending.

-

Impact on competition and innovation: The ruling will influence the level of competition and innovation within the gaming market.

-

Effects on the future of cloud gaming and subscription services: The merger's impact on the future of cloud gaming and subscription services is also a key consideration.

-

Wider implications for regulatory oversight of tech mergers: The case sets a significant precedent for how tech mergers are regulated, influencing future regulatory oversight.

The "gamer impact," "industry implications," and the "future of gaming" are all at stake in this high-profile case.

Conclusion: The Future of the FTC's Appeal Against Microsoft-Activision Merger Approval

The FTC's Appeal Against Microsoft-Activision Merger Approval represents a pivotal moment for the gaming industry and antitrust law. Both the FTC and Microsoft have presented compelling arguments, highlighting the complexities and potential ramifications of this massive merger. The appeal's outcome will have a lasting impact on competition, innovation, and the overall gaming experience. The potential changes to game pricing, availability, and the competitive landscape are substantial. To stay informed about the progress of this significant case and its potential effects on the gaming landscape, follow updates from reputable news sources covering antitrust law and legal proceedings related to the tech industry. The future of gaming hinges on the resolution of the FTC's Appeal Against Microsoft-Activision Merger Approval.

Featured Posts

-

Ronaldos Treatment Castros Sharp Criticism Of Ten Hag

May 23, 2025

Ronaldos Treatment Castros Sharp Criticism Of Ten Hag

May 23, 2025 -

Ftc To Challenge Ruling Allowing Microsoft Activision Deal

May 23, 2025

Ftc To Challenge Ruling Allowing Microsoft Activision Deal

May 23, 2025 -

Impact Of G 7 De Minimis Tariff Changes On Chinese Goods

May 23, 2025

Impact Of G 7 De Minimis Tariff Changes On Chinese Goods

May 23, 2025 -

Deciphering Big Rig Rock Report 3 12 And Laser 101 7 Data

May 23, 2025

Deciphering Big Rig Rock Report 3 12 And Laser 101 7 Data

May 23, 2025 -

Alashtbah Fy Ilyas Rwdryjyz Akhr Alttwrat Fy Qdyt Mqtl Mwzfy Alsfart Alisrayylyt Fy Washntn

May 23, 2025

Alashtbah Fy Ilyas Rwdryjyz Akhr Alttwrat Fy Qdyt Mqtl Mwzfy Alsfart Alisrayylyt Fy Washntn

May 23, 2025