G-7 De Minimis Tariffs On Chinese Goods: Key Discussion Points

Table of Contents

The Current Landscape of De Minimis Tariffs in G7 Nations

The current de minimis thresholds for imports from China vary significantly across G7 nations, leading to inconsistencies in market access and competitiveness. This disparity creates an uneven playing field for businesses operating within the G7 bloc and importing from China. Let's examine the current situation:

- USA: [Insert current threshold and link to relevant US government resource]

- Canada: [Insert current threshold and link to relevant Canadian government resource]

- UK: [Insert current threshold and link to relevant UK government resource]

- France: [Insert current threshold and link to relevant French government resource]

- Germany: [Insert current threshold and link to relevant German government resource]

- Italy: [Insert current threshold and link to relevant Italian government resource]

- Japan: [Insert current threshold and link to relevant Japanese government resource]

These varying thresholds directly impact businesses. A higher de minimis value allows for more goods to enter duty-free, potentially boosting import volumes and lowering prices for consumers. Conversely, lower thresholds increase the likelihood of tariffs impacting smaller shipments, increasing import costs for businesses and potentially leading to higher prices for consumers. This inconsistency undermines the principle of a level playing field for businesses operating within the G7.

Economic Impacts of Varying De Minimis Tariffs

Harmonizing or diverging de minimis tariffs has significant economic consequences. Harmonization could lead to greater predictability and transparency in trade, potentially stimulating increased trade volumes between the G7 and China. However, it also raises concerns about potential losses for domestic industries in some G7 countries if cheaper Chinese imports flood the market.

Divergence, on the other hand, maintains existing market advantages for certain G7 members but exacerbates the uneven competition among businesses. This can affect:

- Consumer Prices: Lower tariffs generally lead to lower prices for consumers. Inconsistencies in tariff policies can lead to price disparities across G7 countries for the same products.

- Import Costs for Businesses: Fluctuating de minimis thresholds create uncertainty for businesses, making it difficult to accurately estimate import costs and potentially impacting profitability.

- Trade Volumes: Harmonization could lead to increased trade volumes, while divergence might hinder growth depending on the specific thresholds applied.

Reliable data on the precise economic impact requires in-depth analysis, but the potential consequences are undeniable and necessitate careful consideration.

Political and Geopolitical Considerations

The setting of de minimis tariffs is rarely purely economic. Political factors and geopolitical considerations heavily influence these decisions. Trade tensions between the G7 and China often play a significant role in shaping tariff policies. Some nations may view tariffs as a tool for:

- Protecting Domestic Industries: Lowering thresholds acts as a protective measure for local producers, shielding them from cheaper imports.

- Geopolitical Leverage: Tariffs can be utilized as a bargaining chip in broader geopolitical negotiations.

- Addressing Unfair Trade Practices: Tariffs can be employed to counter what a nation perceives as unfair trade practices by China.

- National Security Concerns: In certain sectors deemed critical for national security, stricter tariffs can be justified.

Understanding the intricate interplay of political and economic factors is crucial for interpreting the ongoing debates surrounding G7 de minimis tariffs on Chinese goods.

The Path Towards Harmonization (or Divergence): Future Outlook

The future of G7 de minimis tariffs on Chinese goods remains uncertain. Discussions within the G7 regarding harmonization are ongoing, but reaching a consensus presents significant challenges due to varying national interests and priorities.

Several potential scenarios exist:

- Harmonization: A unified approach would streamline trade and create a more level playing field, but achieving this requires overcoming considerable political hurdles.

- Regional Agreements: G7 members may pursue bilateral or multilateral agreements on specific product categories, creating a patchwork of varying thresholds.

- Continued Divergence: The current situation of varying thresholds might persist, leading to ongoing complexities for businesses.

Alternative approaches, such as improved transparency and dispute resolution mechanisms, could also mitigate the negative effects of tariff variations.

Implications for Businesses Importing from China

The evolving landscape of G7 de minimis tariffs significantly impacts businesses importing from China. Staying informed about regulatory changes is crucial for effective compliance and risk management. Businesses should:

- Monitor Tariff Updates: Closely follow changes in de minimis thresholds and related regulations in all relevant G7 countries.

- Consult Customs Experts: Seek professional advice to navigate the complexities of international trade regulations.

- Develop Contingency Plans: Prepare for potential changes in tariffs that might affect import costs and profitability.

- Diversify Sourcing: Consider diversifying sourcing to reduce reliance on any single country.

Proactive risk management strategies are essential to ensure business continuity in this volatile environment.

Conclusion: Understanding and Adapting to G-7 De Minimis Tariffs on Chinese Goods

This article has highlighted the complexities of G-7 De Minimis Tariffs on Chinese Goods, emphasizing the significant economic, political, and business implications of the varying thresholds across G7 nations. The diverse interests of G7 members, along with the geopolitical dynamics with China, create a challenging environment for businesses involved in importing goods. For companies involved in this trade, staying abreast of the developments surrounding G-7 de minimis tariffs is crucial for success. To stay informed, subscribe to relevant trade newsletters, follow industry organizations specializing in international trade, and regularly review the government resources linked in this article. Understanding and adapting to the evolving landscape of G-7 de minimis tariffs on Chinese goods is paramount for businesses to navigate this dynamic international trade environment successfully.

Featured Posts

-

Crawleys Resilience Prevents Gloucestershire County Win

May 23, 2025

Crawleys Resilience Prevents Gloucestershire County Win

May 23, 2025 -

Memorial Day 2025 Sales Event Deals You Wont Want To Miss

May 23, 2025

Memorial Day 2025 Sales Event Deals You Wont Want To Miss

May 23, 2025 -

Goroskopy I Predskazaniya Polniy Goroskop Na Mesyats

May 23, 2025

Goroskopy I Predskazaniya Polniy Goroskop Na Mesyats

May 23, 2025 -

Zimbabwes Fast Bowler A Rapid Rise In Rankings

May 23, 2025

Zimbabwes Fast Bowler A Rapid Rise In Rankings

May 23, 2025 -

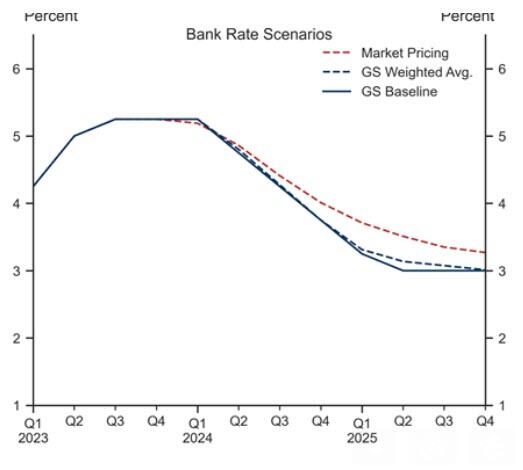

Pound Gains Momentum After Uk Inflation Report Boe Rate Cut Speculation Eases

May 23, 2025

Pound Gains Momentum After Uk Inflation Report Boe Rate Cut Speculation Eases

May 23, 2025