Gaining Access To Elon Musk's Private Company Investments

Table of Contents

Understanding the Exclusivity of Elon Musk's Investments

Gaining access to Elon Musk's private company investments isn't a simple matter; it's a realm reserved for a select few. The world of private investments, particularly those associated with high-profile entrepreneurs like Musk, operates under a different set of rules than the public stock market.

The High Barrier to Entry

These investments are generally unavailable to the public due to regulatory restrictions and the nature of private equity.

- Only accredited investors (typically individuals with a net worth exceeding $1 million, excluding primary residence, or an annual income exceeding $200,000 for individuals or $300,000 for couples for the past two years) are eligible to participate in most private investment offerings. This is dictated by the Securities and Exchange Commission (SEC) to protect less sophisticated investors from high-risk investments.

- Significant capital requirements: Investments often involve substantial capital commitments, far beyond the reach of most retail investors. We are talking hundreds of thousands, or even millions, of dollars per investment.

- Invitation-only or pre-existing relationships: Access is primarily through invitation-only funding rounds or established relationships with venture capital firms who have pre-existing relationships with the companies and founders. These firms often manage large sums of capital from high-net-worth individuals and institutional investors.

Identifying Potential Investment Opportunities

Before you can even think about participating, you need to know where to look. Identifying potential opportunities before they become public requires diligence and a keen eye.

- Monitor news and industry publications: Stay informed about funding rounds and investments through reputable financial news sources and industry-specific publications focusing on venture capital and technology.

- Network with VCs and angel investors: Cultivate relationships with venture capitalists (VCs) and angel investors who specialize in early-stage technology investments. These individuals often have access to deals before they become publicly available.

- Attend industry conferences and networking events: Networking is crucial. Attend relevant industry conferences and events to connect with investors, entrepreneurs, and other key players in the venture capital ecosystem.

Strategies for Accessing Elon Musk's Private Company Investments

While access is exclusive, there are strategic approaches to increase your chances. These strategies require dedication, substantial resources, and a long-term perspective.

Networking and Relationship Building

Building a strong network within the venture capital and investment communities is paramount. This is not something that happens overnight.

- Attend industry events: Actively participate in conferences, workshops, and networking events focused on venture capital, technology, and private equity.

- Develop relationships with VCs and angel investors: Build meaningful connections with key individuals who can provide access to exclusive investment opportunities.

- Leverage professional networks: Utilize LinkedIn and other professional platforms to connect with individuals in the investment world.

Becoming an Accredited Investor

Meeting the requirements to become an accredited investor is the first hurdle.

- Meet the SEC's net worth or income requirements: Ensure you meet the financial thresholds established by the SEC to qualify as an accredited investor.

- Understand the responsibilities and risks: Accredited investor status doesn't eliminate risk; it simply acknowledges your capacity to bear it.

- Seek professional financial advice: Consult with a qualified financial advisor to understand the implications and make informed investment decisions.

Investing Through Venture Capital Funds

Investing through established venture capital funds provides a path to potentially access deals indirectly.

- Diversification: VC funds offer diversification across multiple companies, reducing risk compared to direct investments in a single entity.

- Higher management fees: VC funds charge management fees, which can impact overall returns.

- Potential for lower returns (but reduced risk): Returns might be lower than direct investments, but the risk is also significantly reduced due to diversification.

Risks and Considerations in Pursuing These Investments

Before diving in, understand the inherent risks associated with these types of private investments.

High Risk, High Reward

Investing in early-stage companies, especially those associated with Elon Musk's ventures, is inherently speculative.

- Risk of failure: Early-stage companies have a high failure rate. Many will not succeed.

- Limited liquidity: Selling private investments can be challenging, as there isn't a readily available public market.

- Market volatility: Market conditions can significantly impact the value of private investments.

Due Diligence is Crucial

Thorough research is non-negotiable. Don't rely solely on hype or reputation.

- Understand the business model, financials, and competitive landscape: Conduct in-depth due diligence on any potential investment.

- Assess the management team: Evaluate the experience, track record, and capabilities of the company's leadership.

- Seek expert advice: Consult with financial and legal professionals before making any investment decisions.

Conclusion

Gaining access to Elon Musk's private company investments requires significant financial resources, a sophisticated understanding of the private investment market, and a robust network. The potential returns are substantial, but investors must also be prepared for the significant risks involved. If you're an accredited investor with a high-risk tolerance and a desire to participate in potentially lucrative private investments, begin building your network and conducting thorough due diligence. Understanding the intricacies of accessing Elon Musk's private company investments is the first step toward potentially significant returns. Remember, always seek professional advice before making any investment decisions related to Elon Musk's private company investments or any other high-risk ventures.

Featured Posts

-

Concerns Over Fan Violence Lead To Tightened Security At Ajax Az Match

Apr 26, 2025

Concerns Over Fan Violence Lead To Tightened Security At Ajax Az Match

Apr 26, 2025 -

Arctic Gas Trade Reliant On European Shipyard Capacity

Apr 26, 2025

Arctic Gas Trade Reliant On European Shipyard Capacity

Apr 26, 2025 -

Sinners How Cinematography Showcases The Mississippi Deltas Expansiveness

Apr 26, 2025

Sinners How Cinematography Showcases The Mississippi Deltas Expansiveness

Apr 26, 2025 -

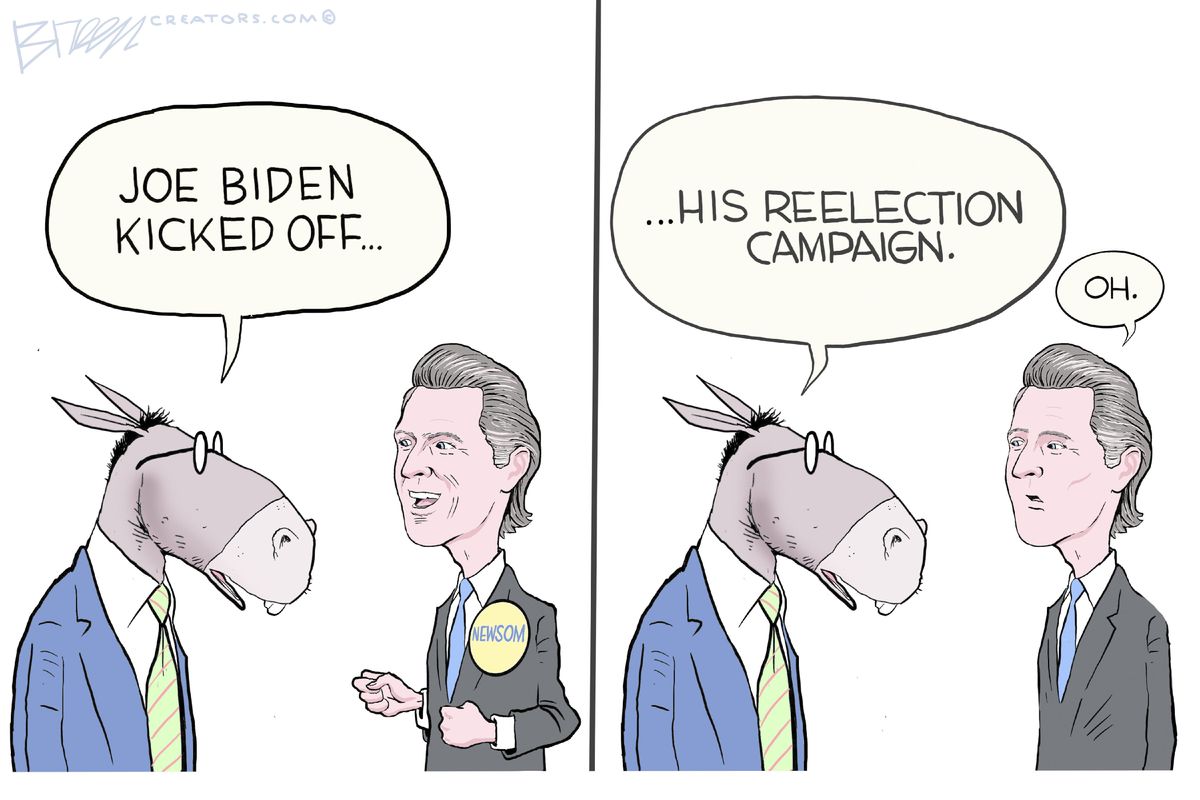

Backlash Mounts Against Newsom Over Toxic Democrats Statement

Apr 26, 2025

Backlash Mounts Against Newsom Over Toxic Democrats Statement

Apr 26, 2025 -

Chat Gpt And Open Ai The Ftc Investigation Explained

Apr 26, 2025

Chat Gpt And Open Ai The Ftc Investigation Explained

Apr 26, 2025