Gold Market Forecast: Assessing The Impact Of Recent Price Drops In 2025

Table of Contents

Analyzing the Recent Gold Price Drops

Several interconnected factors contributed to the recent decline in gold prices. Let's delve into the key drivers:

Geopolitical Factors

Global geopolitical instability significantly impacts gold's safe-haven status. When uncertainty rises, investors flock to gold as a hedge against risk. However, recent periods of relative calm (relative, that is) have led some investors to shift funds elsewhere.

- Impact of political instability and uncertainty on gold investment: Periods of heightened geopolitical tension usually result in increased gold demand, pushing prices up. Conversely, a perception of reduced global risk can cause prices to fall.

- Analysis of specific geopolitical events and their correlation with price drops: The easing of certain tensions, while others remain, has complex effects on the gold market. For example, a de-escalation in one region might not offset anxieties in another.

- Bullet points:

- Ukraine conflict: While the conflict continues, its initial impact on gold prices has lessened as the situation has become somewhat normalized.

- US-China relations: Ongoing trade tensions and geopolitical competition can still influence investor sentiment and gold prices.

- Middle East tensions: The ongoing instability in the Middle East remains a wildcard, capable of influencing gold prices significantly should the situation escalate.

Inflation and Interest Rates

The relationship between inflation, interest rates, and gold prices is complex but crucial.

- The relationship between inflation, interest rates, and gold prices: High inflation erodes the purchasing power of fiat currencies, making gold, which historically holds its value, more attractive. However, rising interest rates can make bonds more appealing, potentially diverting investment away from gold.

- How rising interest rates affect the attractiveness of gold as an investment: Higher interest rates increase the opportunity cost of holding non-interest-bearing assets like gold. This can suppress demand and thus prices.

- Discussion of potential future inflation scenarios and their impact on gold: Predicting inflation is notoriously difficult. High inflation scenarios could support gold prices, while lower-than-expected inflation could negatively impact them.

- Bullet points:

- Federal Reserve policy: The Federal Reserve's decisions on interest rates have a profound impact on the US dollar and, consequently, gold prices.

- Inflation rates in key economies: Inflation in major economies like the US, Eurozone, and China directly influences global demand for gold as a hedge against inflation.

- Bond yields: Attractive bond yields can compete with gold as a safe-haven investment, influencing gold's price.

Dollar Strength

Gold is often priced in US dollars, creating an inverse relationship.

- Gold's inverse relationship with the US dollar: A strong dollar typically puts downward pressure on gold prices, as it makes gold more expensive for holders of other currencies.

- Impact of a strong dollar on gold demand and pricing: A stronger dollar reduces the appeal of gold as an investment for international buyers.

- Predictions for the US dollar's strength in 2025 and its consequences for gold: The future strength of the dollar is uncertain and depends on various factors such as economic growth, interest rates, and geopolitical events. A stronger dollar in 2025 would likely weigh on gold prices.

- Bullet points:

- USD index: Tracking the US Dollar Index is crucial for understanding its impact on gold.

- Currency fluctuations: Major currency shifts can significantly affect gold pricing.

- Global economic growth: Strong global growth can support the dollar, potentially harming gold prices.

Factors Potentially Influencing Gold Prices in 2025

Looking ahead to 2025, several factors could shape gold prices:

Supply and Demand Dynamics

The interplay between supply and demand will be key.

- Analysis of global gold mine production and its influence on supply: Increases in gold production can put downward pressure on prices, while production constraints can lead to price increases.

- Examination of factors affecting gold demand from central banks and jewelers: Central bank purchases of gold can significantly influence prices, while shifts in jewelry demand, particularly in key markets like India and China, also play a major role.

- Bullet points:

- Mining production forecasts: Forecasts from mining companies and industry analysts give an indication of future gold supply.

- Jewelry demand trends: Economic growth in key jewelry markets influences demand.

- Technological advancements in mining: Improvements in mining technology can increase production, impacting prices.

Technological Advancements

Technological progress is impacting gold mining.

- Impact of technological advancements on gold mining efficiency: New technologies can lead to increased gold extraction and potentially lower production costs, influencing prices.

- Potential for new gold discoveries and their influence on supply: Major new gold discoveries could significantly impact the overall supply, potentially affecting prices.

- Bullet points:

- Artificial intelligence in mining: AI is improving exploration and extraction techniques.

- Improved exploration techniques: New technologies make finding new gold deposits easier and more efficient.

Investment Sentiment

Investor confidence is paramount.

- Impact of investor sentiment on gold prices: Positive investor sentiment can drive up demand and prices, while negative sentiment can lead to price drops.

- Role of institutional investors and their trading activity: Large institutional investors' actions significantly affect market trends.

- Bullet points:

- ETF holdings: Changes in gold ETF holdings reflect investor sentiment.

- Hedge fund positions: Hedge fund activity can signal shifts in market direction.

- Investor confidence indices: Various indices track overall investor confidence, providing insights into market sentiment towards gold.

Gold Market Forecast for 2025: Potential Scenarios

Predicting the future is inherently uncertain, but we can outline potential scenarios:

Bullish Scenario:

A bullish scenario for gold in 2025 would involve sustained inflation, a weakening US dollar, escalating geopolitical tensions, and strong demand from central banks and investors. This could lead to significantly higher gold prices.

Bearish Scenario:

A bearish scenario would involve lower-than-expected inflation, a strong US dollar, reduced geopolitical uncertainty, and weaker-than-anticipated demand. This could push gold prices considerably lower.

Neutral Scenario:

A neutral scenario would see a balance between bullish and bearish factors, resulting in moderate price fluctuations around current levels or a slight increase or decrease.

(Include price charts and graphs to visualize potential scenarios here – this would require external data and chart creation software).

Conclusion

The gold market forecast for 2025 remains complex, a delicate dance between geopolitical events, monetary policies, and investor sentiment. Recent price drops have injected uncertainty, but a careful analysis of the key influencing factors allows for informed speculation. Whether this represents a buying opportunity or a precursor to further declines depends significantly on how these factors unfold. Stay informed about the latest developments in the gold market, regularly reassess your gold investment strategy, and consult with financial advisors before making any significant decisions. Understanding the intricacies of the gold market forecast 2025 is vital for navigating this dynamic market and making well-informed choices regarding your gold investments.

Featured Posts

-

Gypsy Rose Blanchard And Ken Urker Examining The Wedding Timeline

May 06, 2025

Gypsy Rose Blanchard And Ken Urker Examining The Wedding Timeline

May 06, 2025 -

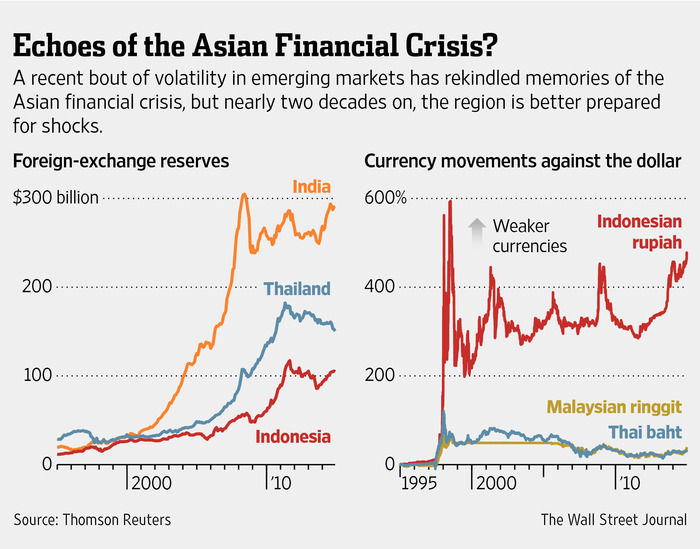

Asian Currency Markets In Turmoil The Dollars Role

May 06, 2025

Asian Currency Markets In Turmoil The Dollars Role

May 06, 2025 -

Reaktsiya Stivena Kinga Na Diyi Trampa Ta Maska

May 06, 2025

Reaktsiya Stivena Kinga Na Diyi Trampa Ta Maska

May 06, 2025 -

Sabrina Carpenter Fortnite Skins Where To Find Them And How Much They Cost

May 06, 2025

Sabrina Carpenter Fortnite Skins Where To Find Them And How Much They Cost

May 06, 2025 -

Hos Olmayan Koku Isletmeniz Icin Riskler Ve Coezuemler

May 06, 2025

Hos Olmayan Koku Isletmeniz Icin Riskler Ve Coezuemler

May 06, 2025