Goldman Sachs' Exclusive Tariff Advice: Navigating Trump's Trade Policies

Table of Contents

Understanding the Impact of Trump's Tariffs

Goldman Sachs' expertise likely extended to providing detailed analyses of how these tariffs affected specific sectors, offering crucial insights for informed decision-making.

Sector-Specific Analysis

The firm's analysis undoubtedly covered a wide range of sectors, providing tailored advice based on the unique challenges faced by each industry. This likely included:

- Manufacturing Tariffs: The impact on manufacturing varied significantly depending on the specific products and reliance on imported components. Goldman Sachs likely assessed the increased costs, potential loss of competitiveness, and implications for investment decisions.

- Agricultural Tariffs: The agricultural sector faced unique challenges with retaliatory tariffs from trading partners. Goldman Sachs’ advice likely included strategies for diversifying markets, exploring alternative export destinations, and securing government assistance programs.

- Tech Tariffs: The technology sector, heavily reliant on global supply chains, faced disruptions due to tariffs on components and finished goods. Goldman Sachs probably provided analysis on shifting supply chains, renegotiating contracts, and exploring domestic sourcing options.

- Predicted Economic Consequences: Beyond specific sectors, Goldman Sachs' analysis likely included macroeconomic forecasts assessing the overall impact of tariffs on inflation, economic growth, and employment.

Global Supply Chain Disruptions

The imposition of tariffs significantly disrupted global supply chains, forcing businesses to re-evaluate their sourcing strategies. Goldman Sachs likely advised clients on:

- Supply Chain Diversification: Reducing reliance on single-source suppliers and geographically diversifying supply chains to mitigate the impact of future trade disruptions.

- Production Relocation: Assessing the feasibility and cost-effectiveness of relocating production facilities to countries with more favorable trade relationships.

- Negotiation with Suppliers: Strategies for negotiating with suppliers to share the burden of increased tariffs or find alternative, more cost-effective solutions.

Goldman Sachs' Recommended Mitigation Strategies

Navigating the challenges posed by Trump's trade policies required a multifaceted approach encompassing financial strategies and meticulous legal compliance.

Financial Strategies

Goldman Sachs likely recommended a range of financial strategies to help clients manage the financial risks associated with tariffs:

- Hedging Strategies: Implementing hedging techniques to mitigate the impact of currency fluctuations and price volatility resulting from tariff increases. This might include using derivatives like futures and options contracts.

- Investment Diversification: Diversifying investments across different asset classes and geographies to reduce overall portfolio risk in the face of trade uncertainty.

- Insurance Options: Exploring insurance products designed to cover potential losses arising from trade disputes or tariff-related disruptions.

- Stress Testing Scenarios: Developing stress test scenarios to assess the resilience of their businesses to various tariff-related shocks and potential economic downturns.

Legal and Regulatory Compliance

Understanding and adhering to complex tariff regulations was crucial. Goldman Sachs' expertise likely helped clients with:

- Understanding Tariff Codes: Navigating the complexities of the Harmonized System (HS) codes to ensure accurate classification of goods and avoid penalties.

- Filing for Exemptions: Assisting clients in identifying and applying for tariff exemptions or exclusions based on specific circumstances.

- Navigating Trade Agreements: Leveraging knowledge of existing trade agreements (e.g., NAFTA/USMCA) to identify potential benefits and minimize negative impacts.

- Legal Challenges: Providing guidance on pursuing legal challenges to tariffs that were deemed unfair or discriminatory.

Long-Term Strategic Implications

Adapting to the new trade environment required long-term strategic adjustments and considering geopolitical factors.

Restructuring Business Models

Goldman Sachs likely provided advice on adapting business models for long-term sustainability in the changed trade environment:

- Business Model Transformation: Rethinking business models to reduce dependence on imported goods or explore alternative value chains.

- Long-Term Investment Strategies: Developing long-term investment strategies that account for the potential for future trade policy changes.

- Market Diversification: Expanding into new markets to reduce reliance on any single export destination.

- New Product Development: Investing in research and development to create new products or services less susceptible to trade restrictions.

Geopolitical Considerations

Goldman Sachs' advice likely encompassed an understanding of the broader geopolitical context:

- International Trade Relations: Analyzing the impact of Trump's trade policies on international trade relations and predicting potential future shifts in global trade dynamics.

- Impact on Foreign Investment: Assessing the implications for foreign direct investment flows and the attractiveness of different countries as investment destinations.

- Risks of Trade Wars: Evaluating the risks of escalating trade wars and developing contingency plans to mitigate potential negative impacts.

- Potential Future Policy Shifts: Anticipating potential changes in trade policy under different administrations or international agreements and developing adaptive strategies.

Conclusion

Goldman Sachs' exclusive tariff advice provided crucial guidance to its clients navigating the challenging landscape of Trump's trade policies. By understanding the sector-specific impacts, implementing effective mitigation strategies like tariff hedging and supply chain diversification, and considering long-term strategic implications, businesses could better weather the storm. Successfully navigating future trade uncertainties requires a proactive approach to understanding tariff implications and utilizing expert advice, much like the guidance offered by Goldman Sachs. To learn more about effectively managing trade risks, explore further resources on navigating tariffs and other trade policy changes.

Featured Posts

-

Russias Military Strategy And The Implications For Europe

Apr 29, 2025

Russias Military Strategy And The Implications For Europe

Apr 29, 2025 -

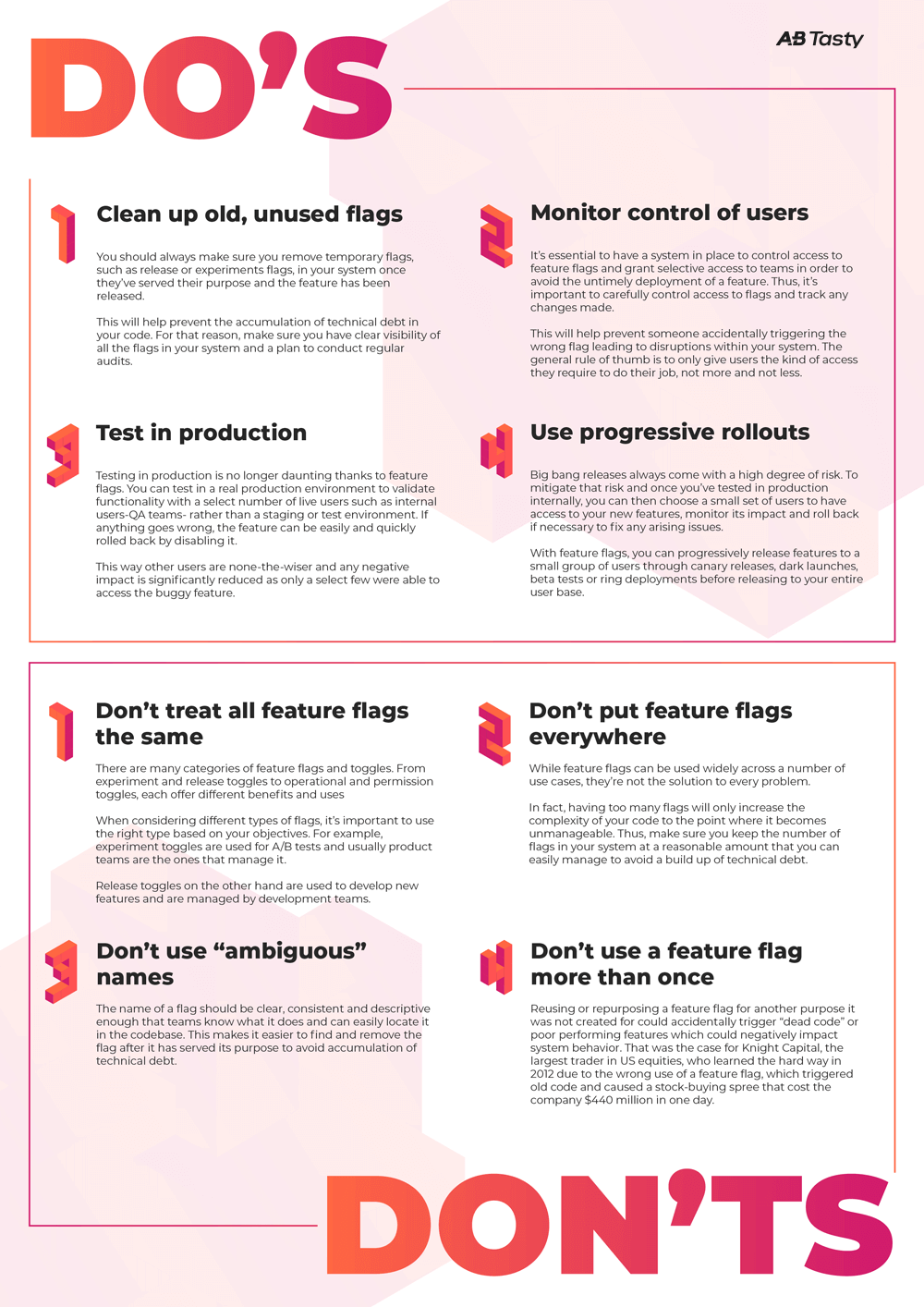

Crack The Code 5 Dos And Don Ts To Secure A Private Credit Role

Apr 29, 2025

Crack The Code 5 Dos And Don Ts To Secure A Private Credit Role

Apr 29, 2025 -

Helmeyers Pledge A Future With Fc Barcelona

Apr 29, 2025

Helmeyers Pledge A Future With Fc Barcelona

Apr 29, 2025 -

Macario Martinezs Overnight Success A Story Of Perseverance And Recognition

Apr 29, 2025

Macario Martinezs Overnight Success A Story Of Perseverance And Recognition

Apr 29, 2025 -

Office365 Data Breach Leads To Multi Million Dollar Loss Federal Charges Filed

Apr 29, 2025

Office365 Data Breach Leads To Multi Million Dollar Loss Federal Charges Filed

Apr 29, 2025

Latest Posts

-

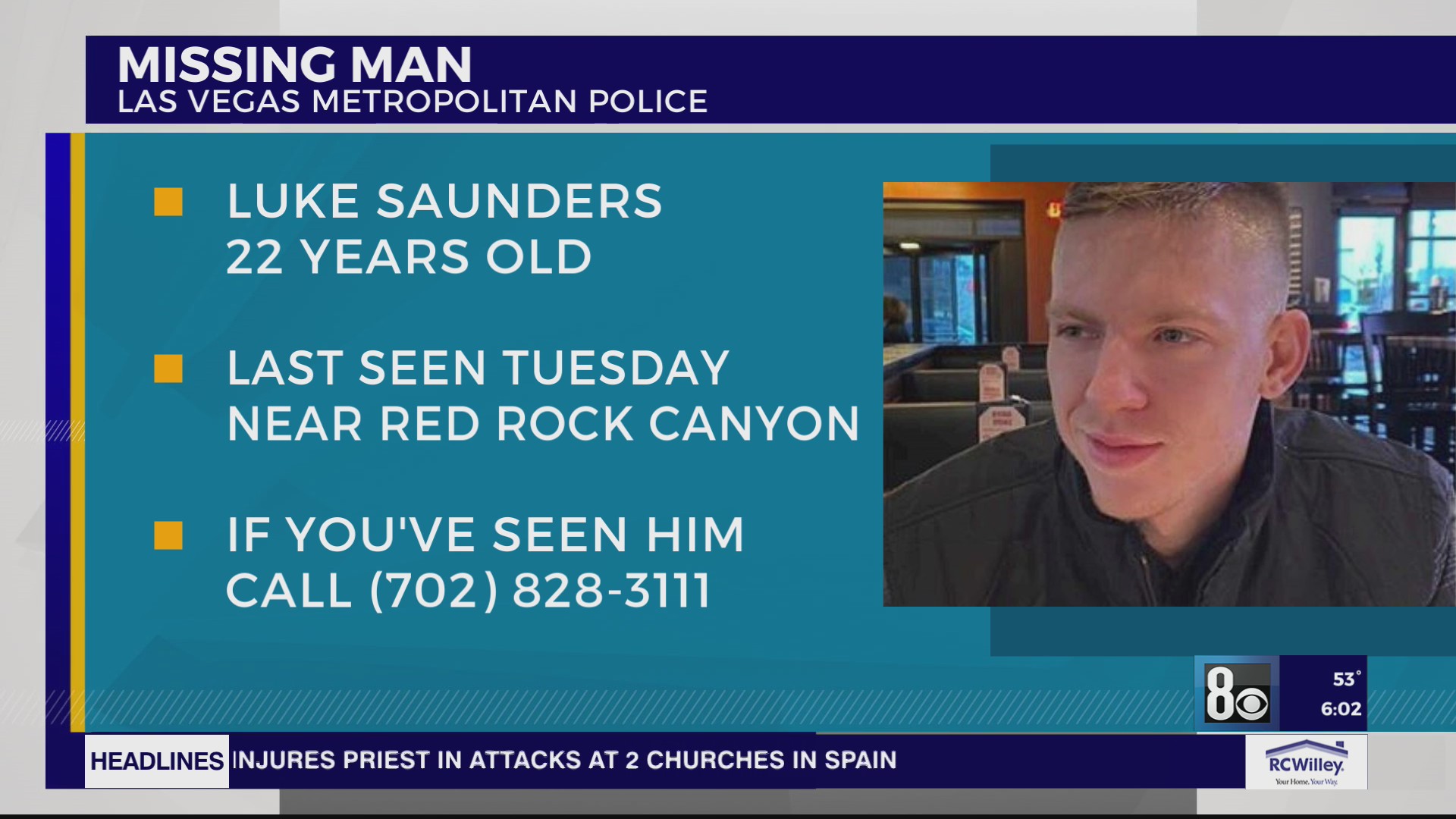

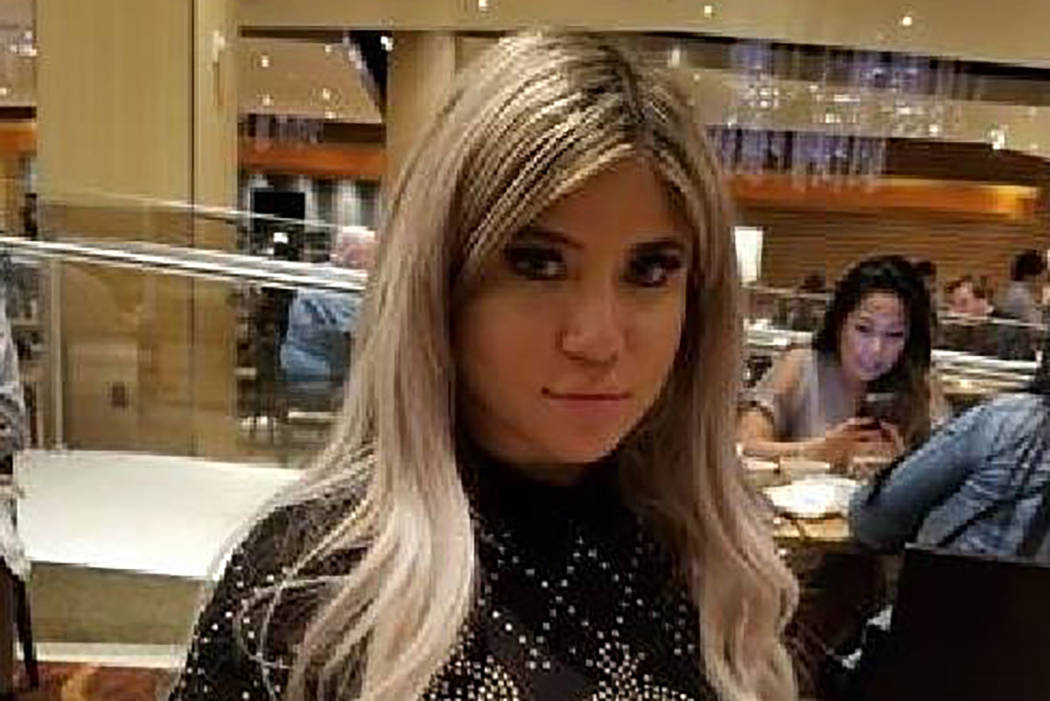

Urgent Appeal British Paralympian Missing In Las Vegas For Over A Week

Apr 29, 2025

Urgent Appeal British Paralympian Missing In Las Vegas For Over A Week

Apr 29, 2025 -

Las Vegas Police Search For Missing British Paralympian A Week Of Uncertainty

Apr 29, 2025

Las Vegas Police Search For Missing British Paralympian A Week Of Uncertainty

Apr 29, 2025 -

British Paralympian Missing In Las Vegas Search Intensifies After Week Without Contact

Apr 29, 2025

British Paralympian Missing In Las Vegas Search Intensifies After Week Without Contact

Apr 29, 2025 -

Missing In Las Vegas The Case Of The British Paralympian

Apr 29, 2025

Missing In Las Vegas The Case Of The British Paralympian

Apr 29, 2025 -

Family Appeals For Information On Missing British Paralympian In Las Vegas

Apr 29, 2025

Family Appeals For Information On Missing British Paralympian In Las Vegas

Apr 29, 2025