Goldman Sachs' Pay Fight Centers On CEO's Role And Compensation

Table of Contents

The CEO's Compensation Package: A Detailed Breakdown

Base Salary, Bonuses, and Stock Options

The CEO's compensation package is a complex structure comprised of several key components:

- Base Salary: (Insert Hypothetical Amount, e.g., $2 million). This represents the fixed annual payment.

- Bonuses: (Insert Hypothetical Amount, e.g., $10 million). These are performance-based payments, typically tied to the firm's overall profitability and the CEO's individual performance metrics.

- Stock Options: (Insert Hypothetical Amount, e.g., $20 million). This component grants the CEO the right to purchase company stock at a predetermined price, incentivizing long-term growth.

Compared to previous years, this compensation package represents a (Insert Percentage, e.g., 15%) increase, significantly exceeding industry benchmarks for similarly sized financial institutions. The performance metrics tied to the bonus and stock options remain largely undisclosed, fueling much of the controversy.

Justification for the CEO's Pay

Goldman Sachs justifies the CEO's substantial compensation by highlighting:

- Strong Financial Performance: The firm's recent financial results, including record profits and growth in key sectors, are cited as evidence of the CEO's effective leadership.

- Strategic Vision and Leadership: The CEO is credited with implementing successful strategies, navigating challenging market conditions, and driving innovation within the company.

- Market Competitiveness: The firm argues that the compensation package is necessary to attract and retain top talent in a highly competitive market for executive leadership.

However, critics argue that these justifications are insufficient, pointing to the significant pay gap between the CEO and average employees, as well as the lack of transparency surrounding performance metrics.

Employee Dissatisfaction and Morale

The Pay Gap and Its Impact

The vast disparity between the CEO's compensation and the average employee salary at Goldman Sachs has sparked significant discontent. Data suggests a (Insert Hypothetical Ratio, e.g., 300:1) ratio between the CEO's pay and the median employee salary. This considerable gap negatively impacts employee morale, leading to decreased productivity, higher turnover rates, and a general sense of unfairness. Anecdotal evidence suggests growing resentment amongst employees.

Internal Opposition and Union Activity

While no formal union activity has been reported, there are indications of growing internal opposition to the CEO's compensation. Internal discussions, though largely private, suggest considerable frustration among employees. The lack of transparency regarding the CEO's performance metrics further fuels the discontent. Potential legal challenges or regulatory scrutiny surrounding executive compensation practices are also possibilities.

Shareholder Activism and Pressure

Shareholder Concerns and Dissenting Votes

A significant portion of shareholders (Insert Hypothetical Percentage, e.g., 20%) voted against the CEO's compensation package, expressing concerns about its size and lack of transparency. Dissenting shareholders argue that the package is excessive and doesn't align with the company's long-term interests or the interests of all stakeholders. This could lead to increased shareholder activism and pressure on the board of directors to reconsider future compensation decisions.

Impact on Stock Price and Investor Confidence

The controversy surrounding Goldman Sachs CEO compensation has had a measurable impact on the company's stock price and investor confidence. While the immediate impact may be minimal, long-term consequences could include a decline in investor trust, making it more challenging for the firm to attract investors and secure future funding. Analyst opinions are divided, with some expressing concern and others downplaying the impact.

Conclusion

The controversy surrounding Goldman Sachs CEO compensation highlights the growing tension between executive pay, employee morale, and shareholder value. The sheer size of the CEO's package, the lack of transparency around its justification, and the resulting employee and shareholder discontent present significant challenges for the firm. The long-term impact on Goldman Sachs' financial health and reputation remains to be seen. What are your thoughts on the ongoing debate surrounding Goldman Sachs CEO compensation? Share your insights in the comments below!

Featured Posts

-

Suriye De Ramazan Bayrami Ne Zaman Pazartesi Kutlamalari Basliyor

Apr 23, 2025

Suriye De Ramazan Bayrami Ne Zaman Pazartesi Kutlamalari Basliyor

Apr 23, 2025 -

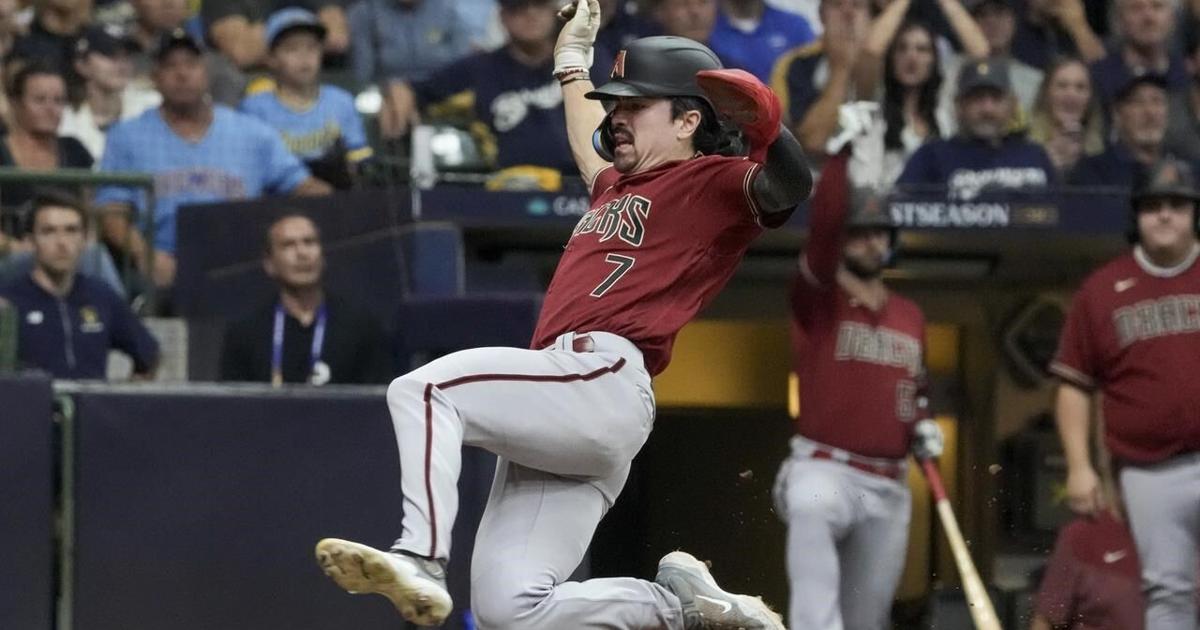

Josh Naylors Game Changing Rbi In Diamondbacks Win Over Brewers

Apr 23, 2025

Josh Naylors Game Changing Rbi In Diamondbacks Win Over Brewers

Apr 23, 2025 -

Jumat Wage And Senin Legi Analisa Kecocokan Pasangan Berdasarkan Primbon Jawa

Apr 23, 2025

Jumat Wage And Senin Legi Analisa Kecocokan Pasangan Berdasarkan Primbon Jawa

Apr 23, 2025 -

Erase Yourself From The Internet A Guide To Online Privacy

Apr 23, 2025

Erase Yourself From The Internet A Guide To Online Privacy

Apr 23, 2025 -

Approfondir La Carte Blanche Selon Marc Fiorentino

Apr 23, 2025

Approfondir La Carte Blanche Selon Marc Fiorentino

Apr 23, 2025