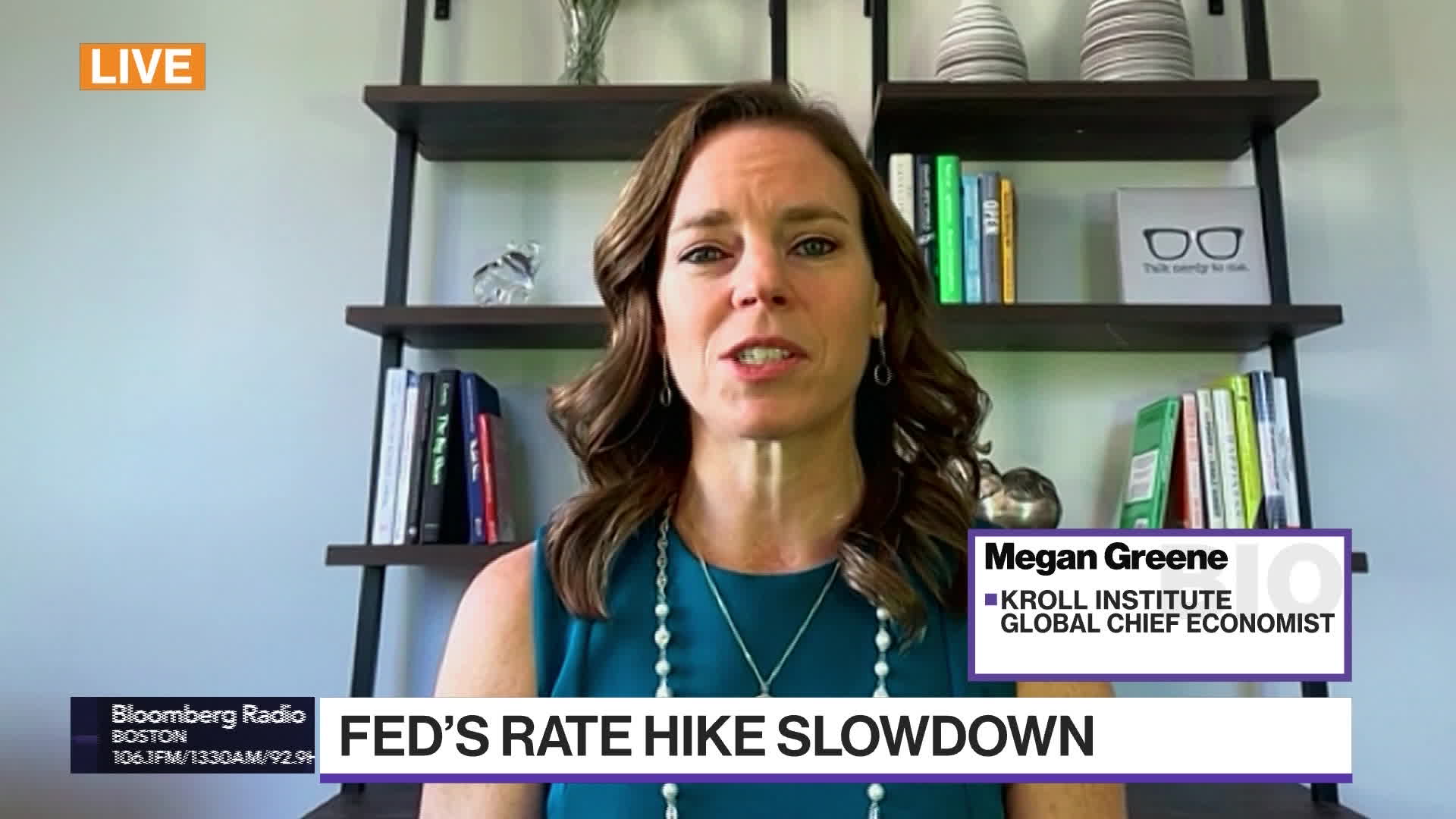

Greene Advocates For Moderate QE In Response To Future Economic Shocks

Table of Contents

The Rationale Behind Greene's Moderate QE Proposal

The current economic climate presents several vulnerabilities. Global supply chain disruptions, geopolitical instability, and lingering effects of the COVID-19 pandemic contribute to an uncertain economic landscape. While economic growth remains a priority, the risk of inflation looms large. This precarious situation necessitates a carefully calibrated response to any future economic downturn.

Both aggressive and insufficient QE measures carry significant risks. Aggressive QE, characterized by large-scale asset purchases, can fuel inflation if not managed properly, potentially eroding purchasing power and destabilizing markets. Conversely, minimal QE might prove insufficient to stimulate economic activity during a severe downturn, prolonging the recession and increasing unemployment.

- Potential for inflation with aggressive QE: Rapid expansion of the money supply can outpace the growth of goods and services, driving up prices.

- Risk of insufficient stimulus with minimal QE: A timid approach may fail to provide the necessary boost to aggregate demand, leading to prolonged economic stagnation.

- The need for a balanced approach to navigate economic uncertainty: Finding the "sweet spot" between insufficient and excessive stimulus is crucial for maintaining economic stability.

Greene argues for a measured and targeted approach, focusing on specific sectors or industries in most need of support. This targeted approach aims to maximize the effectiveness of QE while minimizing potential negative side effects. The focus isn't on a blanket injection of liquidity but rather a surgical intervention aimed at bolstering key areas of the economy.

Key Features of Greene's Moderate QE Plan

Greene's proposed moderate QE plan differs significantly from previous, more expansive initiatives. It outlines specific parameters, including asset purchase targets, a defined timeline, and clear mechanisms for monitoring and adjusting the policy as needed.

- Specific asset classes targeted: The plan might prioritize government bonds and mortgage-backed securities, focusing on assets directly impacting market liquidity and credit availability.

- Proposed timeframe for implementation: A clearly defined timeline with pre-determined end dates aims to limit the duration of the program and minimize potential long-term risks.

- Mechanisms for monitoring and adjusting the policy: Regular assessments and data analysis would allow policymakers to adapt the program in response to changing economic conditions.

The criteria for triggering QE implementation would likely involve a combination of economic indicators, such as a significant decline in GDP, a sharp increase in unemployment, or a significant contraction in credit markets. The exit strategy, including tapering (gradual reduction of asset purchases), would be crucial to avoid abrupt market shocks and manage the transition back to normal monetary policy.

Potential Benefits and Drawbacks of Greene's Proposal

Moderate QE offers several potential benefits, including stimulating economic growth, boosting employment, and enhancing market stability. However, potential drawbacks must also be considered.

- Potential for stimulating economic growth: By increasing liquidity and lowering borrowing costs, moderate QE could encourage investment and spending, driving economic expansion.

- Reduced risk of inflationary pressures: Compared to aggressive QE, a moderate approach minimizes the risk of triggering runaway inflation.

- Potential for market manipulation or unintended consequences: The targeted nature of the plan could unintentionally distort markets or favor certain sectors over others.

- Concerns about government debt and long-term economic implications: QE increases government debt, potentially impacting future fiscal sustainability.

The feasibility of implementing Greene's plan depends on several factors, including the cooperation of the central bank, the political climate, and the overall economic situation. Political challenges could involve disagreements on the appropriate level of intervention and the specific sectors targeted for support.

Comparison with Alternative Economic Policies

Greene's proposal should be compared with alternative policy responses to economic shocks, such as fiscal stimulus and interest rate adjustments.

- Fiscal stimulus vs. monetary policy (QE): Fiscal stimulus involves direct government spending or tax cuts, while monetary policy (QE) focuses on influencing interest rates and money supply.

- Advantages and disadvantages of each approach: Fiscal stimulus is direct and immediate but can increase government debt, while monetary policy is less direct but can avoid immediate debt increases.

- Potential for synergistic effects: Combining fiscal and monetary policies can create synergistic effects, amplifying the overall impact of the response.

The appropriateness of Greene's approach depends on the nature of the economic shock. For example, during a demand-side shock, fiscal stimulus might be more effective, while a supply-side shock could benefit more from moderate QE focusing on specific sectors. International cooperation and coordination are essential for managing global economic shocks effectively.

Conclusion

Representative Greene’s proposal for moderate quantitative easing offers a nuanced approach to managing future economic shocks, balancing the need for stimulus with the risks of inflation and excessive government debt. The plan's success will hinge on careful implementation, ongoing monitoring, and a well-defined exit strategy. While challenges remain, the proposal presents a valuable framework for discussion and further refinement.

Call to Action: Learn more about the implications of Representative Greene's moderate QE proposal and its potential impact on the economy. Engage in the conversation and contribute your insights to the debate surrounding quantitative easing and its role in economic stability.

Featured Posts

-

Christian Yelichs First Homer Since Back Surgery A Welcome Return

Apr 23, 2025

Christian Yelichs First Homer Since Back Surgery A Welcome Return

Apr 23, 2025 -

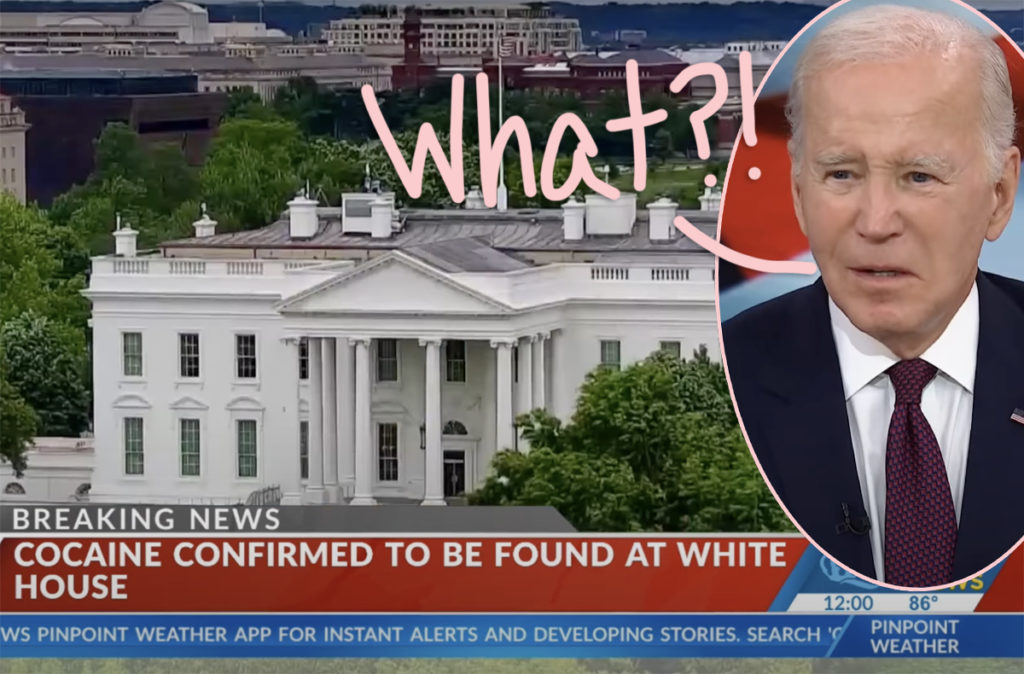

Cocaine Found At White House Secret Service Ends Investigation

Apr 23, 2025

Cocaine Found At White House Secret Service Ends Investigation

Apr 23, 2025 -

Scouting Report Strengths And Weaknesses Of Michael Lorenzen

Apr 23, 2025

Scouting Report Strengths And Weaknesses Of Michael Lorenzen

Apr 23, 2025 -

Die 50 2025 Teilnehmer Sendetermine Streaming Optionen Im Ueberblick

Apr 23, 2025

Die 50 2025 Teilnehmer Sendetermine Streaming Optionen Im Ueberblick

Apr 23, 2025 -

Lumina Gold Sold To Chinas Cmoc For 581 Million Analysis Of The Transaction

Apr 23, 2025

Lumina Gold Sold To Chinas Cmoc For 581 Million Analysis Of The Transaction

Apr 23, 2025