High Stock Market Valuations: Why Investors Shouldn't Panic, According To BofA

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Necessarily Overvalued

BofA's analysis suggests that while high stock market valuations are a valid concern, they don't automatically signal an impending market crash. Their rationale rests on several key pillars, which we will examine below.

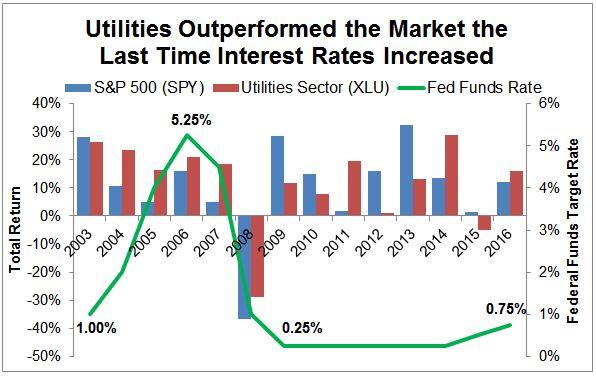

The Role of Low Interest Rates

Low interest rates play a significant role in supporting current stock valuations. When interest rates are low, bond yields – the return on investment in bonds – also remain low. This makes stocks, with their potential for higher returns, a more attractive investment option. This dynamic influences investor behavior, pushing more capital into the equity market and thereby driving up valuations. BofA's report highlights the inverse relationship between interest rates and stock valuations, citing data showing that historically, periods of low interest rates have been accompanied by higher stock market multiples. Understanding the interplay between low interest rates, bond yields, and discounted cash flow analysis is crucial for interpreting current market conditions.

- Low interest rates increase the present value of future cash flows.

- Reduced bond yields make stocks relatively more appealing.

- This leads to higher demand and subsequently higher stock prices.

Strong Corporate Earnings Growth

Another key factor supporting BofA's argument is the robust growth in corporate earnings. Many companies have reported strong revenue growth and increased earnings per share (EPS), justifying, to some extent, the current valuations. Certain sectors, such as technology and healthcare, have been particularly strong performers, contributing significantly to overall earnings growth. BofA's data illustrates this positive trend visually, showing a significant upward trajectory in corporate profits over the past few quarters. This sustained growth in corporate profits and revenue offers a compelling counterpoint to concerns solely focused on high price-to-earnings ratios.

- Strong EPS growth across various sectors.

- Increased revenue and profitability bolster market confidence.

- Positive sector performance mitigates valuation concerns.

Long-Term Growth Potential

BofA's perspective also emphasizes the long-term growth potential of the economy and specific sectors. They identify several industries poised for significant future growth, suggesting that current valuations are not necessarily detached from underlying fundamentals. This outlook emphasizes the importance of adopting a long-term investment horizon, recognizing that market fluctuations are a normal part of the investment cycle. Rather than reacting to short-term volatility, investors should focus on the long-term prospects of their investments and the overall economic trajectory.

- Identifying growth sectors for long-term investment.

- Focusing on companies with sustainable competitive advantages.

- Maintaining a long-term perspective to weather short-term market swings.

Managing Risk in a High-Valuation Market

While BofA's analysis offers a reassuring perspective, it's crucial to acknowledge the valid concerns associated with high valuations. Proactive risk management remains essential, even in a positive market outlook.

Diversification Strategies

Diversification is a cornerstone of risk management. Spreading investments across different asset classes, such as bonds, real estate, and alternative investments, can help mitigate the impact of market fluctuations. A well-diversified portfolio reduces reliance on any single asset class and helps to cushion against losses in specific sectors.

- Allocate assets across different asset classes (stocks, bonds, real estate, etc.).

- Consider global diversification to reduce country-specific risk.

- Rebalance your portfolio periodically to maintain your target asset allocation.

Value Investing Approach

Value investing focuses on identifying undervalued companies with strong fundamentals. This approach involves in-depth analysis of a company's financial statements, competitive landscape, and management quality to determine its intrinsic value. By focusing on undervalued stocks, investors can potentially generate returns even in a high-valuation market. This requires diligent stock screening and fundamental analysis, but it offers a potential hedge against market overvaluation.

- Focus on companies trading below their intrinsic value.

- Thoroughly analyze financial statements and industry trends.

- Look for companies with strong competitive advantages and durable business models.

Avoiding Emotional Decision-Making

Perhaps the most critical aspect of navigating high stock market valuations is avoiding emotional decision-making. Panic selling driven by fear is often counterproductive, leading to losses that could have been avoided with a more disciplined approach. Maintaining a long-term investment strategy based on a well-defined risk tolerance is crucial.

- Develop a well-defined investment plan and stick to it.

- Avoid impulsive decisions based on short-term market fluctuations.

- Regularly review your investment strategy but avoid making drastic changes based on emotions.

Conclusion: High Stock Market Valuations: A Call for Calculated Action, Not Panic

BofA's analysis highlights that while high stock market valuations are a legitimate concern, they don't automatically necessitate panic selling. Factors such as low interest rates, strong corporate earnings, and long-term growth potential offer a counterbalance to the prevailing anxieties. However, responsible investors should still implement prudent risk management strategies, including diversification and a value investing approach. Most importantly, avoid emotional reactions and maintain a disciplined, long-term investment strategy. Understand the nuances of high stock market valuations. Don't panic – plan strategically. Learn more about navigating high stock market valuations and develop a robust investment strategy today!

Featured Posts

-

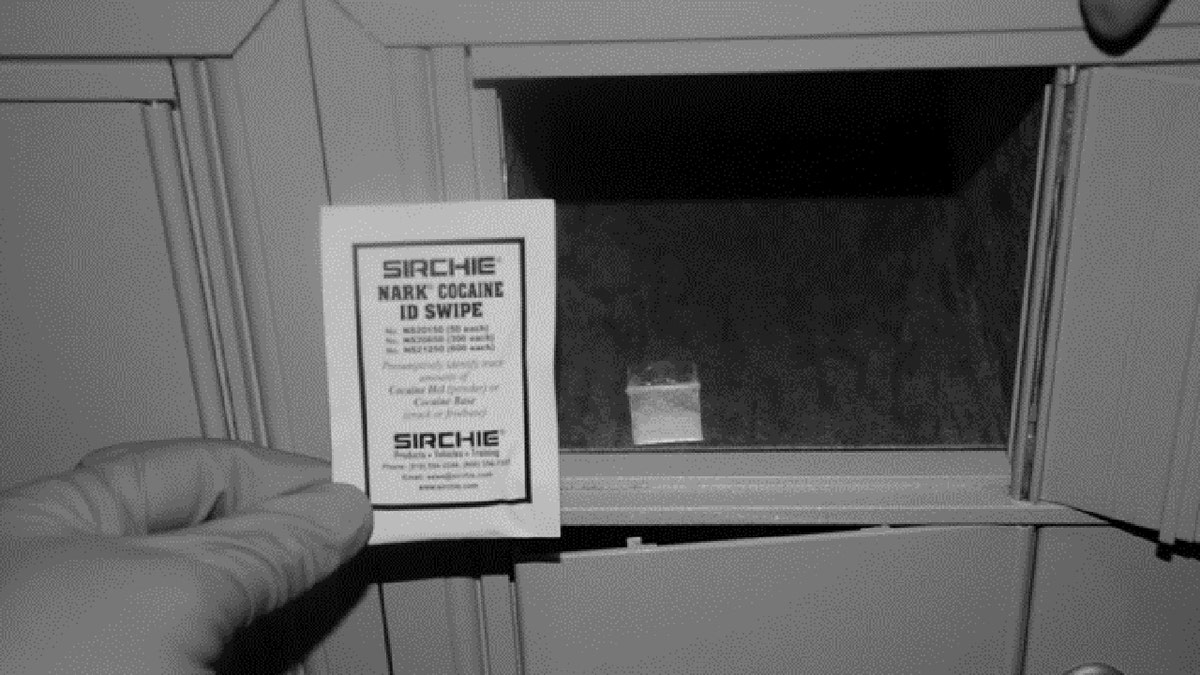

Cocaine At White House Secret Service Ends Investigation

Apr 22, 2025

Cocaine At White House Secret Service Ends Investigation

Apr 22, 2025 -

Assessing The Impact Of Trumps Trade Actions On Us Financial Power

Apr 22, 2025

Assessing The Impact Of Trumps Trade Actions On Us Financial Power

Apr 22, 2025 -

Higher Stock Prices Higher Risks What Investors Need To Know

Apr 22, 2025

Higher Stock Prices Higher Risks What Investors Need To Know

Apr 22, 2025 -

Controversy Erupts Hegseths Signal Chat And Allegations Of Pentagon Dysfunction

Apr 22, 2025

Controversy Erupts Hegseths Signal Chat And Allegations Of Pentagon Dysfunction

Apr 22, 2025 -

The Complexities Of Automating Nike Sneaker Manufacturing

Apr 22, 2025

The Complexities Of Automating Nike Sneaker Manufacturing

Apr 22, 2025