HMRC Child Benefit: Responding To Official Correspondence

Table of Contents

Understanding Your HMRC Child Benefit Letter

The first step in effectively responding to HMRC Child Benefit correspondence is understanding the letter itself. HMRC sends various letters concerning Child Benefit, each with a specific purpose. These may include confirmation letters, notifications of changes to your payments, requests for information, or adjustments to your entitlement.

It’s essential to read your letter thoroughly. Pay close attention to the specific request or information being sought. Misunderstanding the content can lead to delays and potential complications with your Child Benefit payments.

Common reasons for receiving HMRC Child Benefit correspondence include:

- Changes in family circumstances: Births, deaths, marriages, divorces, or changes in address all impact your eligibility for Child Benefit.

- Income changes affecting eligibility: Changes to your income or your partner's income could alter your Child Benefit payments.

- Verification of information: HMRC may periodically request verification of information to ensure accuracy.

- Overpayment or underpayment notifications: HMRC may inform you of overpayments that need to be repaid or underpayments they need to correct.

It's vital to identify genuine HMRC communication. Look for the official HMRC letterhead, a unique reference number, and avoid clicking on any links unless you're sure they lead to a secure HMRC online portal. Beware of phishing attempts imitating HMRC correspondence.

Gathering Necessary Information Before Responding

Before responding to any HMRC Child Benefit letter, gather all relevant documents. Having the correct information readily available streamlines the process and ensures an accurate response. This preparation is crucial for a timely and efficient resolution.

Here's a checklist of essential documents:

- National Insurance numbers for yourself and your partner.

- Recent bank statements showing your account details.

- Payslips for both you and your partner, covering the relevant periods.

- Birth certificates for all children claiming Child Benefit.

- Marriage certificates (if applicable).

- Any previous correspondence from HMRC regarding Child Benefit.

Organizing this information logically, perhaps using a file or folder system, makes it easy to reference when composing your response.

Crafting Your Response to HMRC Child Benefit Correspondence

When responding to HMRC Child Benefit correspondence, clarity, conciseness, and politeness are essential. Your aim is to provide the requested information accurately and efficiently.

You can respond via letter, the HMRC online portal, or by telephone. The preferred method is often outlined in the original communication. For written responses, follow these tips:

- Use formal language and tone. Avoid slang or informal expressions.

- Quote the letter's reference number clearly at the top of your response.

- Answer all questions fully and accurately. Don't leave anything ambiguous.

- Provide supporting documentation as requested, ensuring clear copies.

Using HMRC's online services can offer a quicker and more convenient way to respond, especially for simple queries or updates.

Following Up on Your Response to HMRC Child Benefit

After sending your response, keep records of all correspondence – including sent and received letters, emails, and online portal interactions. This documentation is essential for tracking the progress of your case.

HMRC usually responds within a reasonable timeframe, often specified in the original letter. However, if you haven't received a response within the expected timeframe, follow up. This can be done through the same communication channels you initially used, clearly referencing the previous correspondence.

If you still haven't received a response after a reasonable period of following up, you may need to consider escalation procedures, potentially contacting HMRC directly through alternative channels.

Seeking Further Assistance with HMRC Child Benefit

HMRC provides comprehensive online help resources. You can find answers to many common queries on their website. If you still require assistance, don't hesitate to contact them directly using the contact details provided on their website.

For complex situations or if you are unsure how to proceed, seeking advice from a qualified tax advisor is recommended. They can offer expert guidance on navigating HMRC Child Benefit complexities and help ensure you receive the correct payments.

Conclusion: Effective Communication is Key for Your HMRC Child Benefit

Effectively responding to HMRC Child Benefit correspondence is vital for maintaining accurate and trouble-free payments. By understanding the different types of letters, gathering necessary information, crafting a clear and concise response, and following up appropriately, you can avoid potential issues. Proactively managing your HMRC Child Benefit communications protects your entitlement. Need help navigating your HMRC Child Benefit letters? Don't hesitate to seek professional assistance!

Featured Posts

-

Mick Schumacher Separacion Y Nueva Vida Amorosa En Aplicacion De Citas

May 20, 2025

Mick Schumacher Separacion Y Nueva Vida Amorosa En Aplicacion De Citas

May 20, 2025 -

I Kakodaimonia Ton Sidirodromon Aitia Kai Lyseis

May 20, 2025

I Kakodaimonia Ton Sidirodromon Aitia Kai Lyseis

May 20, 2025 -

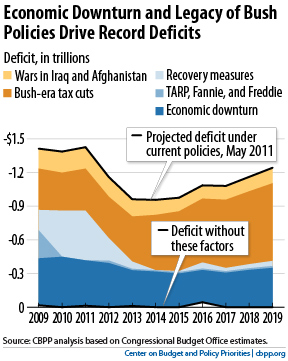

Dissecting The Gop Tax Cuts A Deficit Projection Analysis

May 20, 2025

Dissecting The Gop Tax Cuts A Deficit Projection Analysis

May 20, 2025 -

Wwe Raw Zoey Stark Suffers Injury

May 20, 2025

Wwe Raw Zoey Stark Suffers Injury

May 20, 2025 -

Rio De Janeiro Incendio Em Escola Da Tijuca Causa Alarmes

May 20, 2025

Rio De Janeiro Incendio Em Escola Da Tijuca Causa Alarmes

May 20, 2025