HMRC System Failure: Thousands Affected By Website Crash In UK

Table of Contents

Extent of the HMRC System Failure

The HMRC website crash affected a significant number of users across the UK. While precise figures are still emerging, reports suggest tens of thousands were unable to access key services for an extended period. The outage impacted a wide range of HMRC services, causing considerable disruption for both individuals and businesses.

- Estimate of affected users: Reports indicate tens of thousands of users were affected, though the precise number remains unclear pending official confirmation from HMRC.

- Specific services impacted: The outage affected access to personal tax accounts, business tax accounts, online tax return filing (particularly crucial for the upcoming self-assessment deadline), online tax payments, and access to PAYE information.

- Geographical spread of the disruption: The disruption appeared to be nationwide, affecting users across the UK.

- Duration of the outage: The outage lasted for several hours, causing significant delays and frustration for those attempting to access vital tax services.

Causes of the HMRC Website Crash

The exact cause of the HMRC website crash remains unclear at this time. However, several possibilities are being explored. HMRC has yet to release an official statement detailing the root cause, leading to speculation regarding technical issues, a potential cyberattack, or even unplanned system maintenance that went drastically wrong. Transparency from HMRC on this matter is crucial to restore public confidence.

- Possible technical causes: Server overload, software bugs, or database failures are all potential technical causes that could lead to such a widespread outage.

- Potential for a cyberattack: While not confirmed, the possibility of a cyberattack targeting the HMRC system cannot be ruled out. A thorough investigation is necessary to determine the cause definitively.

- Mention of any official statements released by HMRC: As of the writing of this article, no official statement detailing the root cause has been released by HMRC. The lack of communication is concerning and adds to the frustration felt by affected users.

- Lack of transparency from HMRC (if applicable): The absence of a clear and timely explanation from HMRC regarding the cause of the outage is a significant concern and raises questions about the resilience of the UK's tax system infrastructure.

Impact on Taxpayers and Businesses

The HMRC system failure has had a wide-ranging impact on taxpayers and businesses across the UK. The inability to access vital online services has created significant challenges, leading to potential financial penalties and considerable stress.

- Potential penalties for late tax submissions: The disruption caused by the outage could result in penalties for taxpayers who missed filing deadlines due to the system failure. Many are anxiously awaiting official confirmation from HMRC regarding potential deadline extensions.

- Disruption to business cash flow: Businesses reliant on timely tax processing face disruptions to their cash flow, particularly those making payments or claiming refunds during the outage.

- Increased stress and anxiety for affected taxpayers: The inability to access critical tax information adds to the stress and anxiety experienced by taxpayers, especially during already demanding tax periods.

- Impact on self-employed individuals and small businesses: Self-employed individuals and small businesses are particularly vulnerable to the disruption caused by the HMRC system failure, as they often rely on online access for managing their finances and meeting tax obligations.

HMRC's Response to the System Failure

At the time of writing, HMRC's official response to the system failure has been limited. The lack of timely communication and clear explanation of the situation has only amplified the frustration felt by affected taxpayers and businesses. A swift and transparent response, including information on potential compensation and deadline extensions, is urgently needed.

- Summary of HMRC’s public statement (if available): As of now, a comprehensive public statement detailing the cause of the outage and outlining support measures is lacking.

- Effectiveness of their customer support channels: The effectiveness of HMRC's customer support channels during the outage remains to be evaluated. Many users reported difficulties in reaching support staff.

- Measures taken to prevent future outages: It is crucial that HMRC undertakes a thorough review of its systems to identify vulnerabilities and implement measures to prevent similar outages from occurring in the future. Investing in robust infrastructure and disaster recovery plans is paramount.

- Any offered compensation or extensions to deadlines: At this time, no official announcement has been made regarding compensation or extensions to filing deadlines. Taxpayers are eagerly awaiting clarification on this matter.

Conclusion

The widespread HMRC system failure represents a significant disruption to thousands of UK taxpayers and businesses, highlighting the vulnerability of vital online government services. The consequences range from missed deadlines and potential penalties to widespread frustration and uncertainty. The lack of transparency and timely communication from HMRC has only exacerbated the situation. A comprehensive investigation into the cause of the failure and robust measures to prevent future occurrences are crucial.

Call to Action: Stay informed about the ongoing situation by regularly checking the official HMRC website and social media channels for updates regarding the resolution of the HMRC system failure and any extensions to filing deadlines. Monitor this website for further updates on this evolving story. Contact HMRC directly if you have experienced difficulties due to the outage.

Featured Posts

-

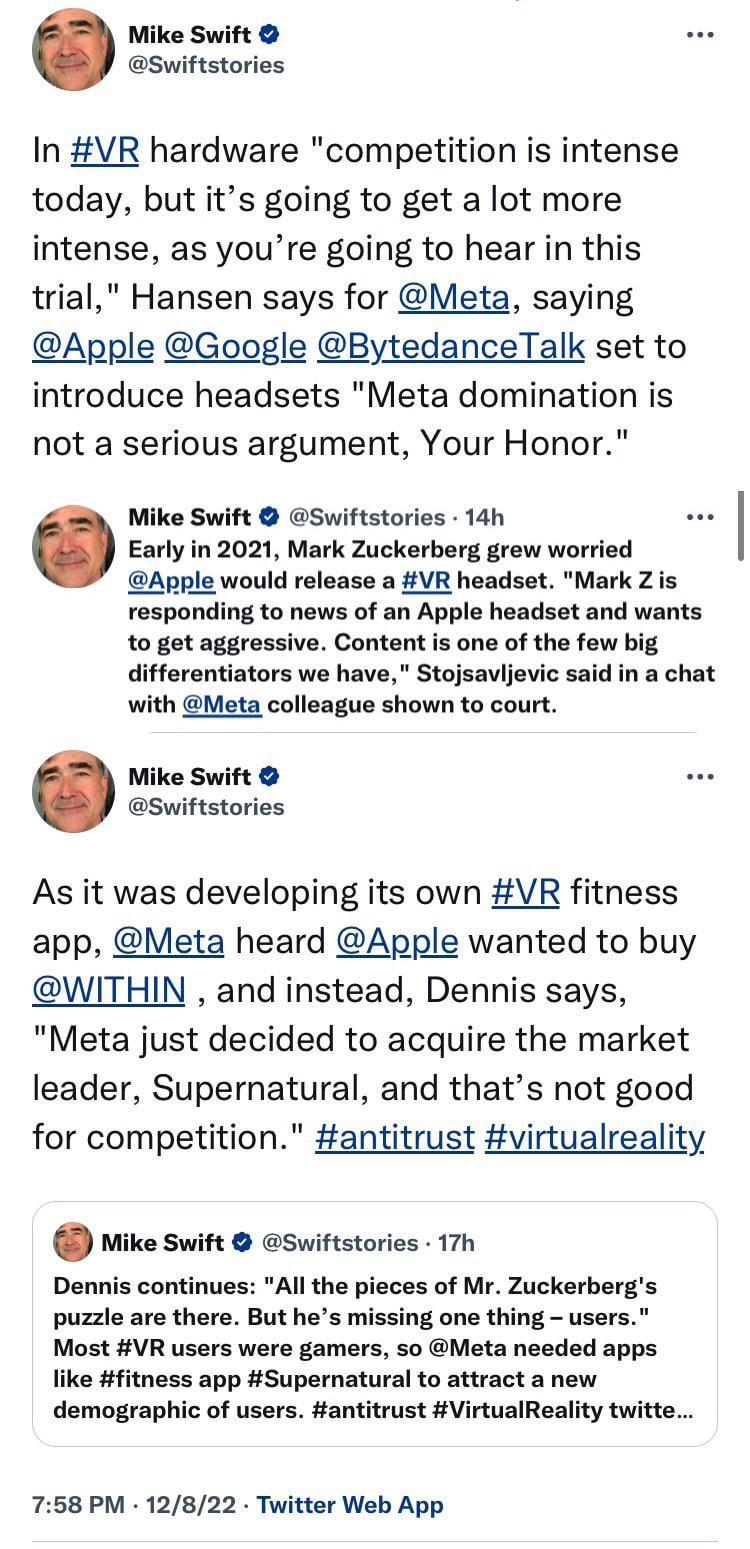

Ftcs Defense Strategy In Meta Monopoly Case

May 20, 2025

Ftcs Defense Strategy In Meta Monopoly Case

May 20, 2025 -

Affaire Jaminet Accord Trouve Pour Le Remboursement Des 450 000 E

May 20, 2025

Affaire Jaminet Accord Trouve Pour Le Remboursement Des 450 000 E

May 20, 2025 -

Big Bear Ai Stock Plunges After Disappointing Q1 Earnings

May 20, 2025

Big Bear Ai Stock Plunges After Disappointing Q1 Earnings

May 20, 2025 -

Projet Du 4eme Pont D Abidjan Un Apercu Complet Des Delais Et Des Couts

May 20, 2025

Projet Du 4eme Pont D Abidjan Un Apercu Complet Des Delais Et Des Couts

May 20, 2025 -

Biarritz Logements Saisonniers Budgets Et Sainte Eugenie Au Conseil Municipal

May 20, 2025

Biarritz Logements Saisonniers Budgets Et Sainte Eugenie Au Conseil Municipal

May 20, 2025