Honeywell And Johnson Matthey: £1.8 Billion Deal Imminent?

Table of Contents

The Rumours and Speculation: Why is a Honeywell-Johnson Matthey Deal Being Discussed?

Whispers of a Honeywell-Johnson Matthey deal have emerged from various sources, including prominent financial press outlets and insightful analyst reports. The primary driver behind this potential acquisition seems to be Honeywell’s strategic ambition to bolster its presence in the rapidly expanding clean energy and emissions control markets.

The rationale for Honeywell’s interest is multifaceted:

- Market Domination: Acquiring Johnson Matthey’s Clean Air division would significantly expand Honeywell’s market share in the lucrative automotive catalyst and industrial emission control sectors.

- Technological Advancement: Johnson Matthey possesses cutting-edge catalyst technology crucial for meeting increasingly stringent emission regulations worldwide. This technology would provide a significant boost to Honeywell's existing portfolio.

- Synergistic Growth: The combination of Honeywell's established expertise and Johnson Matthey's innovative technology presents significant synergies, particularly in research and development. This could lead to faster innovation and the development of more efficient and cost-effective clean technologies.

- Previous Interactions: While not explicitly stated, past collaborations or interactions between the two companies might have laid the groundwork for this potential deal, fostering a level of trust and understanding.

Key factors fueling the speculation include:

- Increased demand for emission control technologies driven by stricter environmental regulations globally.

- Honeywell's pre-existing portfolio in automotive and industrial emissions solutions, providing a solid foundation for expansion.

- Johnson Matthey's strong market position and reputation for advanced catalyst technology.

- Potential for substantial synergies between the two companies' R&D efforts leading to accelerated innovation.

Financial Implications of a £1.8 Billion Deal

A £1.8 billion deal would have significant financial ramifications for both Honeywell and Johnson Matthey. For Honeywell, the acquisition represents a substantial investment, potentially impacting its debt levels and share price in the short term. However, the long-term benefits could be considerable.

-

Honeywell's Perspective: The expected return on investment (ROI) would hinge on the successful integration of Johnson Matthey's Clean Air division and the realization of anticipated synergies. This could involve cost savings, increased market share, and the introduction of new products.

-

Johnson Matthey's Perspective: The sale would likely result in a substantial influx of cash, potentially boosting Johnson Matthey's share price. However, it would also mean the loss of a significant part of their business, impacting future revenue streams. The £1.8 billion price tag will be scrutinized to ensure fair valuation of the Clean Air division.

Financial aspects to consider include:

- Expected ROI for Honeywell following the acquisition and integration.

- Impact on Johnson Matthey’s share price and future financial performance.

- Honeywell’s debt levels post-acquisition and their impact on credit ratings.

- Potential for future dividends or share buybacks following the transaction.

Regulatory and Antitrust Concerns

A deal of this magnitude would undoubtedly face rigorous scrutiny from various regulatory bodies. Antitrust reviews by the EU Commission and the UK's Competition and Markets Authority (CMA), among others, would be crucial. These bodies would assess the potential impact on market competition and consumer prices.

-

Competitive Landscape: The merger could lead to significant market consolidation, potentially reducing competition and raising concerns about monopolistic practices.

-

Employee Impacts: The integration process could lead to job losses or restructuring within the combined entity, raising concerns about employee security and potential redundancies.

Key regulatory concerns:

- Potential antitrust challenges from regulatory bodies like the EU Commission and the CMA.

- Timeline for regulatory approval, which could significantly impact the deal's completion.

- Mitigation strategies Honeywell might employ to address regulatory concerns and secure approval.

Future Outlook: What Happens After the Honeywell-Johnson Matthey Deal?

If the deal proceeds, the combined entity would be a formidable force in the automotive catalyst and clean energy sectors. The integration of Johnson Matthey’s technology and Honeywell's market reach could lead to significant growth opportunities.

-

Market Consolidation: The combined entity would likely solidify its position in the market, leading to increased competition and potentially driving innovation within the industry.

-

Technological Innovation: Significant investment in R&D could lead to breakthroughs in emission control technologies, accelerating the transition to cleaner energy sources.

Long-term implications:

- Market consolidation and intensified competition within the industry.

- Accelerated technological innovation and substantial R&D investments.

- Significant changes to the existing supply chain and distribution networks.

- Potential for developing new products and expanding into new geographic markets.

Conclusion: The Honeywell and Johnson Matthey Deal – A Game Changer?

The potential £1.8 billion Honeywell-Johnson Matthey deal presents both significant opportunities and challenges. While the acquisition promises substantial growth and technological advancements for Honeywell, it also raises concerns about market competition and regulatory hurdles. The ultimate success of the deal will depend on a successful integration process and the ability to navigate the regulatory landscape effectively.

What are your thoughts on the potential Honeywell and Johnson Matthey merger? Share your predictions using #Honeywell #JohnsonMatthey #Merger #Acquisition #CleanEnergy

Featured Posts

-

Female Pub Landlords Explosive Reaction To Staff Notice

May 23, 2025

Female Pub Landlords Explosive Reaction To Staff Notice

May 23, 2025 -

El Coe Actualiza El Nivel De Alerta 9 Provincias Amarillas 5 Verdes

May 23, 2025

El Coe Actualiza El Nivel De Alerta 9 Provincias Amarillas 5 Verdes

May 23, 2025 -

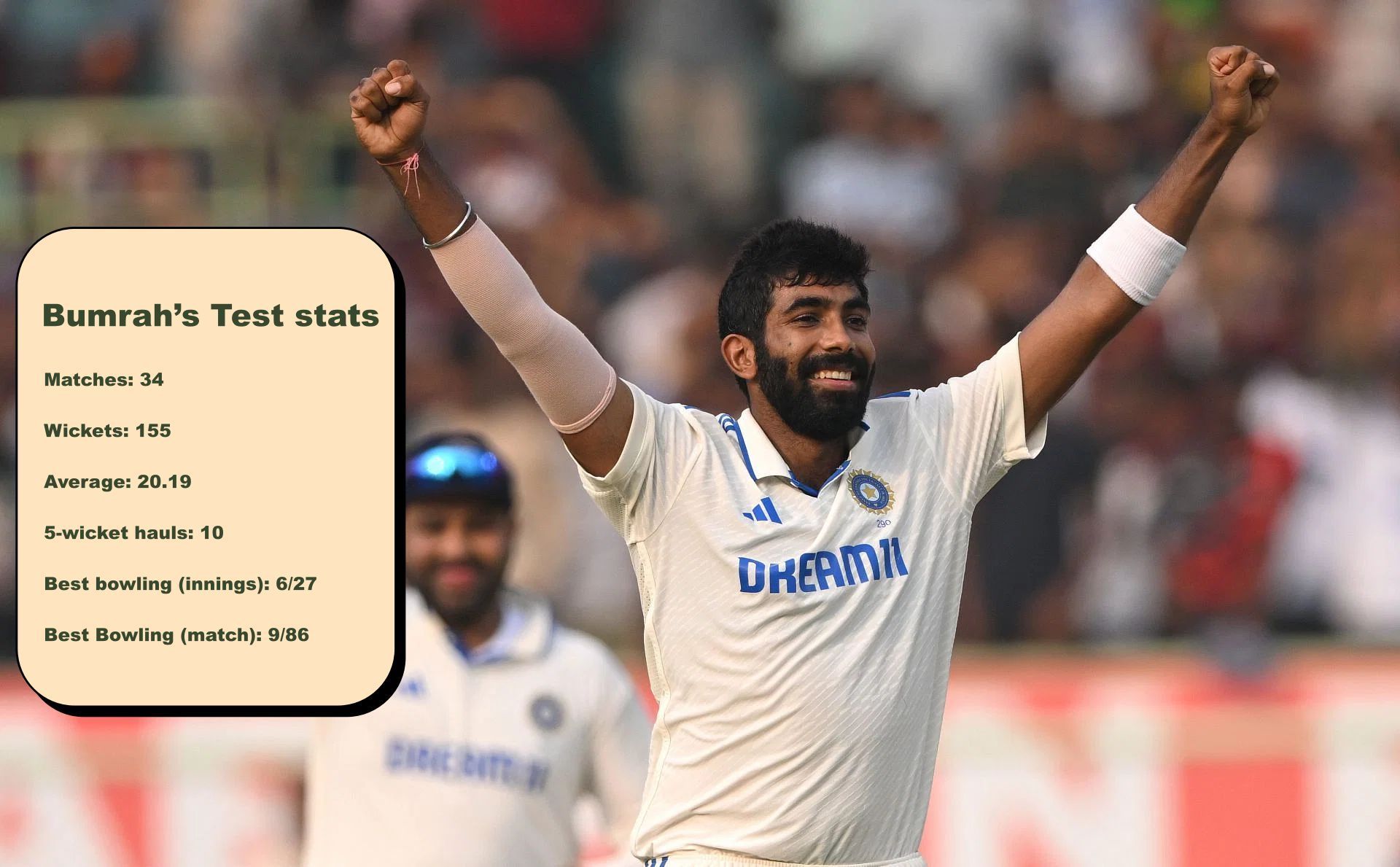

Jasprit Bumrah Remains Worlds No 1 Test Bowler

May 23, 2025

Jasprit Bumrah Remains Worlds No 1 Test Bowler

May 23, 2025 -

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Technologies A Deep Dive

May 23, 2025

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Technologies A Deep Dive

May 23, 2025 -

Abrz Snae Alaflam Aldhyn Ahtdnthm Qmrt

May 23, 2025

Abrz Snae Alaflam Aldhyn Ahtdnthm Qmrt

May 23, 2025