Hong Kong Chinese Stocks Rally Amidst Improved US-China Relations

Table of Contents

Easing Geopolitical Tensions Boost Investor Confidence

Reduced geopolitical tensions between the US and China have significantly boosted investor confidence in Hong Kong and mainland Chinese markets. The easing of trade tensions and improved diplomatic communication are key contributors to this positive sentiment. This translates directly into increased foreign direct investment (FDI) and a more favorable outlook for economic growth.

- Specific examples of eased tensions: Recent high-level talks have resulted in a reduction of certain tariffs, and both countries have shown a commitment to increased dialogue on critical issues.

- Positive statements from US and Chinese officials: Public statements emphasizing cooperation and mutual benefit have helped calm market anxieties. The shift towards constructive engagement has been widely welcomed by investors.

- Impact on foreign direct investment (FDI): The improved relationship is attracting significant foreign investment into both Hong Kong and China, fueling economic activity and boosting stock prices. This renewed confidence is crucial for sustained market growth. The reduced geopolitical risk is a major factor.

Strong Economic Fundamentals Fuel Market Growth

Beyond the geopolitical improvements, the underlying strength of the Chinese and Hong Kong economies is a significant driver of the market rally. Solid economic fundamentals, independent of external factors, are supporting this growth.

- Positive economic indicators: Recent data reveals strong GDP growth, robust consumer spending, and positive industrial output, all signaling a healthy economic outlook.

- Sectors driving economic growth: The technology, manufacturing, and renewable energy sectors are experiencing particularly strong growth, contributing significantly to the overall economic expansion.

- Government policies supporting economic expansion: Government initiatives aimed at stimulating economic activity and fostering innovation are playing a crucial role in supporting this positive trend. These policies actively address economic growth and bolster consumer confidence.

Increased Accessibility and Regulatory Changes

Recent regulatory changes and improved market access have made investing in Hong Kong Chinese stocks more appealing to international investors. These changes are further contributing to the market rally.

- Regulatory reforms: Streamlined listing rules and increased market transparency have made the market more attractive to foreign investors. These reforms directly address market access and improve regulatory transparency.

- Impact of improved access for international investors: Easier access for international investors is leading to greater liquidity and a broader base of capital in the market.

- Initiatives to attract foreign capital: The Hong Kong government has actively implemented initiatives to attract foreign capital, further strengthening the market’s appeal.

Sector-Specific Performance: Identifying Top Performers

The rally isn't uniform across all sectors. Certain sectors within the Hong Kong Chinese stock market have outperformed others, offering valuable insights into specific investment opportunities.

- Top-performing sectors: The technology, renewable energy, and certain segments of the financial sector have seen exceptional gains. This sector performance reflects the underlying strength of these industries.

- Reasons for strong performance: Innovation, strong growth potential, and government support have driven the impressive performance of these sectors.

- Examples of companies that have seen significant gains: Specific examples of companies that have experienced significant growth can be highlighted here, illustrating the opportunities available within different sectors and providing concrete examples of successful investment strategies.

Risks and Potential Challenges Remain

While the outlook is positive, it's crucial to acknowledge the ongoing challenges and potential risks associated with investing in Hong Kong Chinese stocks. A balanced perspective is essential for informed investment decisions.

- Geopolitical uncertainties: While relations have improved, residual geopolitical uncertainties remain and could impact market sentiment.

- Potential economic headwinds: Global economic slowdowns or domestic economic challenges could impact growth and negatively affect stock prices. These are key investment risks to consider.

- Regulatory risks: Changes in regulations or unexpected policy shifts could impact market performance. It is crucial to analyze and manage market volatility.

Conclusion: Navigating the Opportunities in Hong Kong Chinese Stocks

The recent rally in Hong Kong Chinese stocks is a result of a confluence of factors, including improved US-China relations, strong economic fundamentals, regulatory reforms, and sector-specific growth. However, potential risks and challenges remain. Before investing in this dynamic market, thorough research and careful consideration of both opportunities and risks are crucial. This includes evaluating investment opportunities and implementing effective risk management strategies. Conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions in the Hong Kong stock market or investing in Chinese stocks. The potential for growth is significant, but careful analysis is paramount for successful Chinese stock investment.

Featured Posts

-

Kci Johna Travolte Ella Bleu Prerasla Je U Pravu Ljepoticu

Apr 24, 2025

Kci Johna Travolte Ella Bleu Prerasla Je U Pravu Ljepoticu

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 9 Episode Summary Steffy Finn Liam And Bill

Apr 24, 2025

The Bold And The Beautiful Wednesday April 9 Episode Summary Steffy Finn Liam And Bill

Apr 24, 2025 -

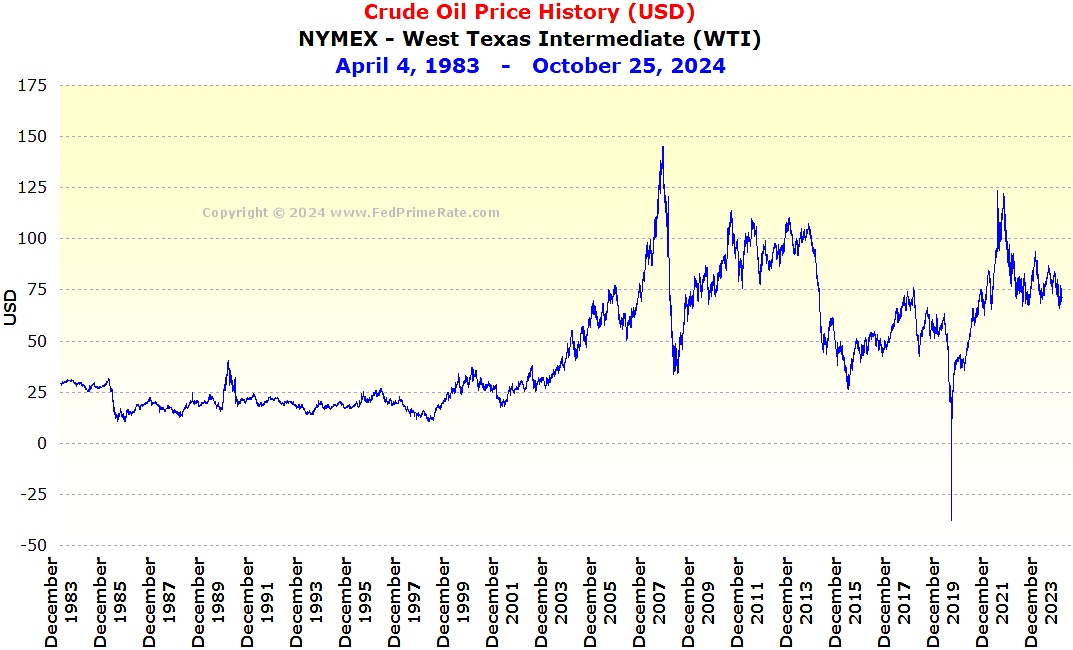

Crude Oil Price Report April 23rd Market News And Insights

Apr 24, 2025

Crude Oil Price Report April 23rd Market News And Insights

Apr 24, 2025 -

John Travolta Addresses Candid Bedroom Photo Shared From 3 M Home

Apr 24, 2025

John Travolta Addresses Candid Bedroom Photo Shared From 3 M Home

Apr 24, 2025 -

Blue Origin Scraps Rocket Launch Due To Subsystem Issue

Apr 24, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Issue

Apr 24, 2025