Credit Suisse Whistleblower Case: $150 Million Settlement

Table of Contents

The Allegations: What Led to the $150 Million Settlement?

The $150 million settlement resulted from allegations of serious fraudulent activity within Credit Suisse. These allegations, brought to light by a whistleblower, involved a range of serious regulatory violations, including potential tax evasion, money laundering, and breaches of internal controls. The specifics of the allegations remain partially confidential due to ongoing investigations, but the scale of the potential wrongdoing was significant enough to warrant such a substantial financial penalty.

- Description of the alleged illegal activities: The reported illegal activities encompassed a variety of financial crimes, including facilitating transactions that violated sanctions, aiding in tax evasion schemes, and potentially engaging in money laundering activities. The exact details of these activities remain partially undisclosed to protect the ongoing investigations and the identities of those involved.

- The scale and impact of the alleged fraud: The alleged fraud involved potentially billions of dollars in illicit transactions, impacting not only Credit Suisse's reputation but also potentially harming investors and undermining global financial stability.

- The individuals and departments involved (if known): While specific names haven't been publicly released, the allegations suggest involvement across multiple departments within Credit Suisse, indicating systemic failures in internal controls and oversight.

- The potential damage to Credit Suisse's reputation and financial standing: The scandal severely damaged Credit Suisse's reputation, leading to investor losses, a decline in its stock price, and increased regulatory scrutiny. The $150 million settlement represents a significant financial blow, highlighting the severe consequences of such misconduct.

The Whistleblower's Role: Courage and Confidentiality

The whistleblower played a crucial role in exposing this alleged misconduct. Their courage in coming forward, despite the potential risks of retaliation, is a testament to the importance of ethical conduct within the financial industry. The whistleblower’s actions triggered investigations by regulatory bodies like the SEC and potentially the FCA (Financial Conduct Authority), leading to the substantial settlement.

- How the whistleblower discovered the alleged fraud: The whistleblower, likely an employee or former employee, uncovered the alleged fraud through their day-to-day work, observing patterns or irregularities that pointed to illegal activity.

- The process of reporting the information (internal and/or external): The whistleblower likely followed internal reporting procedures before potentially going to external authorities like the SEC, showcasing the importance of both internal and external reporting channels.

- The challenges faced by the whistleblower (potential retaliation, etc.): Whistleblowers often face significant challenges, including potential job loss, social stigma, and legal repercussions. Protection laws are designed to mitigate these risks.

- The importance of whistleblower protection laws: Laws protecting whistleblowers are essential to encourage individuals to report suspected wrongdoing without fear of reprisal. The substantial reward in this case underscores the importance of these protections.

The Settlement: A Record-Breaking Amount and its Implications

The $150 million settlement represents a record-breaking amount in a whistleblower case involving a major financial institution. This reflects the seriousness of the allegations and the scale of the potential harm caused. The settlement includes significant financial penalties aimed at deterring future misconduct and addressing the damage caused.

- The breakdown of the settlement amount (fines, restitution, etc.): The settlement likely comprises a combination of fines levied by regulatory bodies and potentially restitution to compensate for losses caused by the alleged fraudulent activity. The exact breakdown remains partially confidential.

- The precedent this sets for future whistleblower cases: This settlement sets a significant precedent, demonstrating that authorities are willing to pursue and penalize financial institutions for serious misconduct, incentivizing both better corporate governance and further whistleblower actions.

- The impact on Credit Suisse's financial performance: The settlement significantly impacted Credit Suisse's financial performance, adding to existing pressures on the institution.

- The potential for further investigations and legal action: The settlement doesn't preclude further investigations or potential legal action against individuals involved in the alleged misconduct.

Strengthening Corporate Compliance: Lessons Learned

The Credit Suisse case underscores the urgent need for improved corporate compliance and risk management within financial institutions. The case highlights significant failures in internal controls and oversight.

- Importance of robust internal controls and reporting mechanisms: Strong internal controls and readily accessible reporting mechanisms are crucial for detecting and preventing financial crime.

- Need for effective ethics and compliance training programs: Comprehensive ethics and compliance training programs for all employees are essential to foster a culture of integrity and accountability.

- The value of independent audits and risk assessments: Regular independent audits and risk assessments help identify vulnerabilities and ensure compliance with regulations.

- Strengthening anti-money laundering and know-your-customer procedures: Robust anti-money laundering (AML) and know-your-customer (KYC) procedures are critical for preventing illicit financial activities.

Conclusion

The Credit Suisse whistleblower case, resulting in a record-breaking $150 million settlement, underscores the critical role whistleblowers play in uncovering financial wrongdoing. The case highlights the significant financial penalties corporations face when failing to maintain robust compliance programs and the substantial rewards available to those who expose illegal activities. This landmark settlement sends a strong message about the importance of ethical conduct and transparency within the financial industry. Understanding the implications of this Credit Suisse whistleblower case is crucial for financial institutions and individuals alike. Learn more about whistleblower protection laws and report any suspected financial misconduct immediately. Protect your organization and report suspected fraudulent activities. Don't hesitate – become a part of the solution by understanding the power of whistleblower action.

Featured Posts

-

How Figmas Ai Is Disrupting The Design Industry

May 10, 2025

How Figmas Ai Is Disrupting The Design Industry

May 10, 2025 -

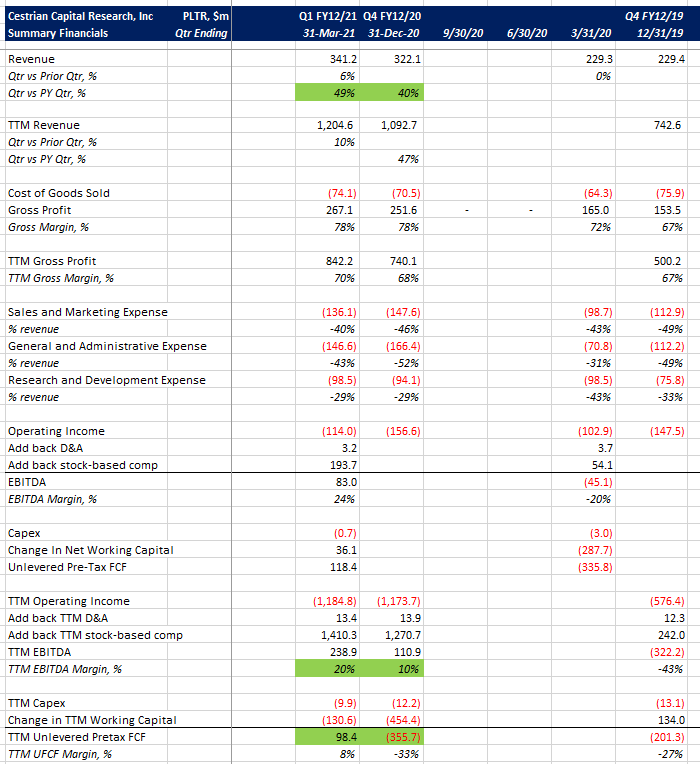

Should I Invest In Palantir Stock A Risk Assessment

May 10, 2025

Should I Invest In Palantir Stock A Risk Assessment

May 10, 2025 -

Putin Mask Ta Tramp Stiven King Vislovlyuye Oburennya Zradoyu

May 10, 2025

Putin Mask Ta Tramp Stiven King Vislovlyuye Oburennya Zradoyu

May 10, 2025 -

Credit Suisse Whistleblower Case 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case 150 Million Settlement

May 10, 2025 -

Elections Municipales Dijon 2026 Le Projet Ecologiste

May 10, 2025

Elections Municipales Dijon 2026 Le Projet Ecologiste

May 10, 2025