How Increasing Federal Debt Affects Mortgage Rates And Borrowers

Table of Contents

The Relationship Between Federal Debt and Interest Rates

Understanding the connection between federal debt and interest rates is crucial to grasping the broader implications for mortgage markets. Essentially, increased government borrowing puts upward pressure on interest rates through several key mechanisms. When the government borrows more money, it increases the overall demand for loanable funds. This increased demand competes with other borrowers, including businesses and individuals seeking mortgages, driving up interest rates across the board.

Furthermore, high levels of federal debt can erode investor confidence. If investors perceive a higher risk associated with government bonds due to substantial debt, they demand higher yields to compensate for that risk. This increased demand for higher yields on government bonds ripples through the entire financial system, pushing up interest rates on other types of debt, including mortgages.

Finally, significant government spending fueled by increased borrowing can contribute to inflation. To combat inflation, the Federal Reserve often raises interest rates, further impacting mortgage rates.

- Increased demand for loanable funds: Government borrowing directly competes with private sector borrowing for available capital.

- Reduced investor confidence in government bonds: High debt levels can lead investors to seek higher returns on government bonds, affecting other interest rates.

- Potential for higher inflation: Increased government spending can lead to inflation, prompting the Federal Reserve to raise interest rates.

- Federal Reserve actions to combat inflation: The Federal Reserve's response to inflation often involves raising interest rates, impacting mortgage rates.

How Higher Interest Rates Impact Mortgage Rates

The relationship between general interest rates and mortgage rates is largely direct. When the overall cost of borrowing increases, lenders pass that increased cost onto borrowers through higher mortgage rates. This is largely influenced by the yields on Treasury bonds. These yields act as a benchmark for other borrowing costs, including mortgages. Higher Treasury yields mean higher mortgage rates.

Moreover, the market for mortgage-backed securities (MBS) is heavily influenced by interest rates. MBS are bundles of mortgages sold to investors. When interest rates rise, the value of existing MBS falls, making it more expensive for lenders to issue new mortgages, leading to higher rates for borrowers.

- Increased cost of borrowing for lenders: Higher interest rates increase the cost of funds for lenders, necessitating higher mortgage rates.

- Higher mortgage rates passed on to borrowers: Lenders increase mortgage rates to maintain profitability in a higher interest rate environment.

- Reduced affordability of homeownership: Higher mortgage rates make homeownership less affordable, particularly for first-time buyers.

- Impact on the housing market: Higher rates can cool down a hot housing market, potentially leading to price corrections.

The Impact on Different Borrower Types

The impact of rising mortgage rates is not uniform across all borrowers. First-time homebuyers, often relying on smaller down payments and potentially having less financial flexibility, are disproportionately affected. Higher rates significantly reduce their purchasing power and make it harder to qualify for a mortgage.

Borrowers with adjustable-rate mortgages (ARMs) face increased risk. ARMs have interest rates that adjust periodically based on market conditions. In a rising interest rate environment, their monthly payments can increase substantially, creating financial strain.

Refinancing options also become less attractive when rates rise. Borrowers who were hoping to refinance their existing mortgages at lower rates will find this option less appealing or even infeasible.

- Increased monthly payments: Higher mortgage rates lead to substantially higher monthly mortgage payments.

- Reduced purchasing power: Higher rates limit the price range of homes prospective buyers can afford.

- Difficulty qualifying for a mortgage: Lenders tighten lending standards in higher interest rate environments.

- Increased financial strain: Higher payments can lead to significant financial hardship for many borrowers.

Predicting Future Trends and Mitigation Strategies

Predicting future trends in mortgage rates requires careful consideration of several factors, including the trajectory of federal debt, government policies, and overall economic conditions. Continued increases in federal debt could lead to sustained higher interest rates, making homeownership more challenging for many.

Government policies, including fiscal and monetary policies, significantly influence mortgage rates. Fiscal policy decisions regarding government spending and taxation can impact inflation and interest rates. Monetary policy actions by the Federal Reserve, such as adjusting interest rate targets, directly impact mortgage rates.

Prospective homebuyers can take steps to mitigate the impact of higher mortgage rates. Saving for a larger down payment reduces the amount of money needed to borrow, lessening the impact of higher rates. Improving credit scores can help secure better interest rates. Thorough financial planning and consultation with a financial advisor are also crucial.

- Long-term projections for interest rates: Economic forecasts provide insight into potential future interest rate movements.

- Potential government interventions: Government policies can influence interest rates and the housing market.

- Tips for borrowers to mitigate risk: Strategic planning and financial prudence can help navigate higher rates.

- Importance of financial planning: Careful budgeting and financial planning are crucial in a high-interest rate environment.

Conclusion: Understanding the Impact of Increasing Federal Debt on Your Mortgage

The strong link between increasing federal debt and rising mortgage rates is undeniable. Understanding this relationship is crucial for making informed decisions regarding homeownership. The impact varies across borrower types, with first-time homebuyers and those with ARMs particularly vulnerable to higher rates. Staying informed about economic indicators, government policies, and personal financial health is paramount.

To navigate the complexities of increasing federal debt and its effects on your mortgage, explore further resources and consult financial professionals. Learn more about how federal debt influences mortgage rates and develop strategies for managing the impact of increasing federal debt on your mortgage. Don't underestimate the importance of proactive planning in ensuring your financial security.

Featured Posts

-

London Festivals Under Threat The Potential For A Bleak Future

May 19, 2025

London Festivals Under Threat The Potential For A Bleak Future

May 19, 2025 -

Mlb Rumors Luis Robert Jr Trade Speculation Heats Up Pirates Poised To Profit Arenado Contract Stalemate Continues

May 19, 2025

Mlb Rumors Luis Robert Jr Trade Speculation Heats Up Pirates Poised To Profit Arenado Contract Stalemate Continues

May 19, 2025 -

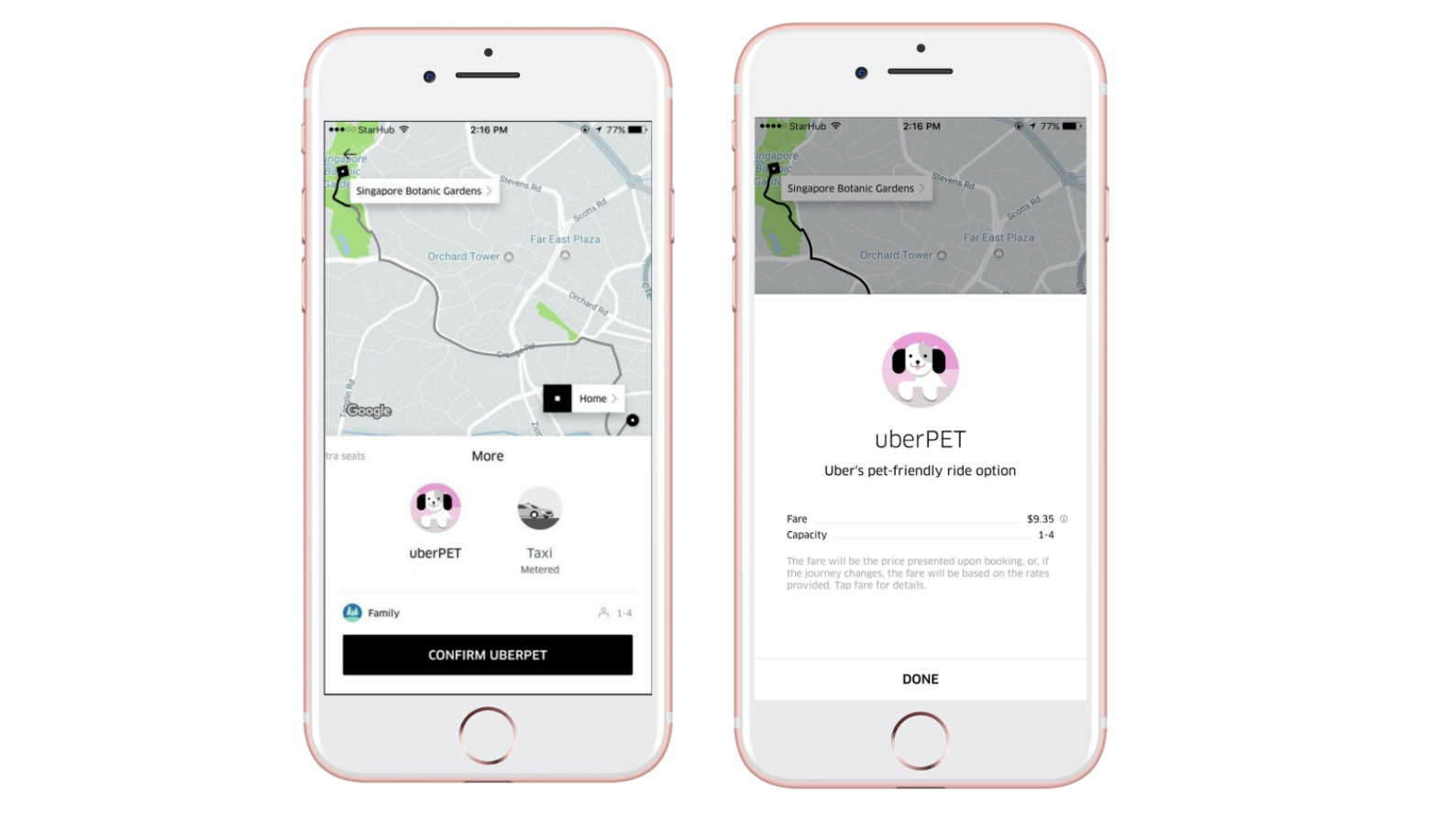

Delhi And Mumbai Pet Owners Rejoice Uber Launches Pet Friendly Rides With Heads Up For Tails

May 19, 2025

Delhi And Mumbai Pet Owners Rejoice Uber Launches Pet Friendly Rides With Heads Up For Tails

May 19, 2025 -

Euro And European Futures Surge Swissquote Bank Analysis

May 19, 2025

Euro And European Futures Surge Swissquote Bank Analysis

May 19, 2025 -

Proteccion Policial En El Cne Medidas De Seguridad Para Elecciones

May 19, 2025

Proteccion Policial En El Cne Medidas De Seguridad Para Elecciones

May 19, 2025