How Trump's Billionaire Network Fared After The Liberation Day Tariff Hikes

Table of Contents

The Pre-Tariff Landscape: Assessing the Billionaire Network's Holdings

Before examining the impact of the Liberation Day tariffs, it's crucial to understand the pre-existing economic landscape of Trump's billionaire network. Their holdings spanned diverse sectors, but certain industries were particularly vulnerable to the tariff hikes.

Identifying Key Industries Affected

Many billionaires in Trump's network held significant stakes in industries heavily reliant on international trade. This included:

- Manufacturing: Companies involved in producing goods reliant on imported materials or exporting finished products. Examples include steel manufacturers and apparel companies.

- Retail: Businesses dependent on imported goods for sale, impacting pricing and consumer demand. This sector was especially vulnerable to increased import costs.

- Real Estate: While seemingly less directly affected, the real estate sector felt the ripple effects through increased construction costs and decreased consumer spending.

Specific examples include:

- Billionaire X: Heavy investment in steel manufacturing, making them particularly susceptible to retaliatory tariffs.

- Billionaire Y: Significant holdings in retail chains reliant on imported goods from China.

- Billionaire Z: Extensive real estate portfolio potentially affected by increased construction material costs.

The reliance on imported materials and export markets meant many within this network faced significant potential disruption.

Analyzing Pre-existing Economic Diversification

The extent to which billionaires diversified their portfolios played a crucial role in determining the tariff's impact. Some had investments across numerous sectors, mitigating the risk associated with any single industry's downturn. Others, however, were more heavily concentrated in tariff-sensitive sectors.

- Diversified Portfolios: Billionaires with diversified investments often saw less severe impacts, as losses in one sector could be offset by gains in others. Sophisticated investment strategies also played a role.

- Undiversified Portfolios: Those heavily invested in specific tariff-sensitive industries experienced more significant negative consequences. Their financial resilience was directly tied to the performance of those industries.

Immediate Impacts of the Liberation Day Tariff Hikes

The immediate aftermath of the Liberation Day tariff announcements brought noticeable changes across various financial metrics.

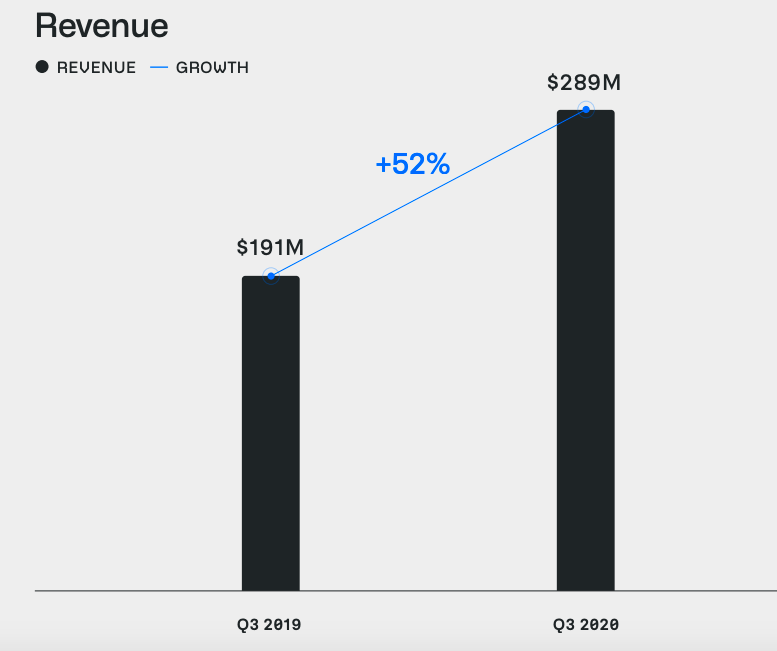

Stock Market Reactions

The stock market reacted swiftly to the tariff announcements. Companies closely linked to Trump's billionaire network experienced varied reactions:

- Some saw immediate stock price drops, reflecting investor concerns about increased costs and reduced competitiveness.

- Others saw relatively little impact, reflecting diversification or less direct exposure to the tariffs.

- A few even experienced short-term gains, perhaps due to anticipation of protectionist benefits or market speculation.

Charts illustrating the performance of specific stocks in the period immediately following the tariff announcements would provide compelling visual evidence of these varied reactions. (Note: Charts would be included here in a published article).

Changes in Business Strategies

Faced with higher import costs and potential retaliatory tariffs, many companies within the billionaire network adjusted their business strategies:

- Relocation: Some companies considered or undertook relocation of manufacturing operations to countries outside the tariff's scope.

- Sourcing Changes: Many companies actively sought alternative suppliers to reduce reliance on tariff-affected countries.

- Pricing Adjustments: To offset increased costs, several companies passed on higher prices to consumers, impacting profitability and market share.

The effectiveness of these adjustments varied widely, depending on factors like the specific industry, the global supply chain, and the competitive landscape.

Long-Term Consequences for Trump's Billionaire Network

The long-term consequences of the Liberation Day tariffs for Trump's billionaire network are still unfolding, but some trends are apparent.

Wealth Accumulation & Changes in Net Worth

Tracking the changes in net worth for prominent figures post-tariffs provides a crucial metric for assessing the overall impact:

- Some billionaires experienced a decrease in net worth due to the tariffs' negative impact on their businesses.

- Others saw relatively little change, indicating resilience through diversification or strong financial management.

- A few might have even seen an increase in net worth, suggesting that certain sectors benefited from the policy changes. Detailed financial data comparing pre- and post-tariff net worth would be needed to quantify these changes.

This analysis needs to be carefully nuanced, considering market fluctuations beyond the direct impact of the tariffs.

Political and Social Ramifications

The economic consequences of the tariffs had far-reaching political and social implications:

- Public perception of the tariffs was divided, with strong opinions on both sides of the issue. Media coverage often reflected this polarization.

- The impact on jobs and wages within tariff-affected industries influenced political discourse and public policy debates.

- The tariffs’ effects on the billionaire network contributed to broader discussions about economic inequality and the influence of wealth on policy decisions.

Conclusion

The Liberation Day tariff hikes had a varied and complex impact on Trump's billionaire network. While some experienced significant financial setbacks due to decreased profitability and reduced competitiveness, others remained largely unaffected or even benefited. Diversification played a significant role in determining the extent of the impact, highlighting the importance of robust economic strategies. Clear winners and losers emerged, illustrating the complexities of large-scale trade policy changes.

Call to Action: To gain a deeper understanding of the complex economic effects of trade policies and their impact on high-net-worth individuals, further research into the financial strategies employed by this network and the broader economic consequences of similar trade policies is crucial. Understanding the impact of Trump's economic policies, including the Liberation Day tariff hikes, is essential for informed economic analysis. Continue exploring the effects of the Liberation Day tariffs and their long-term implications for a more complete picture.

Featured Posts

-

Nhl Recap Vegas Golden Knights Beat Columbus Blue Jackets Hill Shines

May 09, 2025

Nhl Recap Vegas Golden Knights Beat Columbus Blue Jackets Hill Shines

May 09, 2025 -

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025 -

Maldives Holiday Elizabeth Hurleys Bikini Photos

May 09, 2025

Maldives Holiday Elizabeth Hurleys Bikini Photos

May 09, 2025 -

Nordic Spa Development In Edmonton Moves Forward After Rezoning Approval

May 09, 2025

Nordic Spa Development In Edmonton Moves Forward After Rezoning Approval

May 09, 2025 -

Vehicule Projete Contre Un Mur A Dijon Rue Michel Servet Le Conducteur Avoue Les Faits

May 09, 2025

Vehicule Projete Contre Un Mur A Dijon Rue Michel Servet Le Conducteur Avoue Les Faits

May 09, 2025