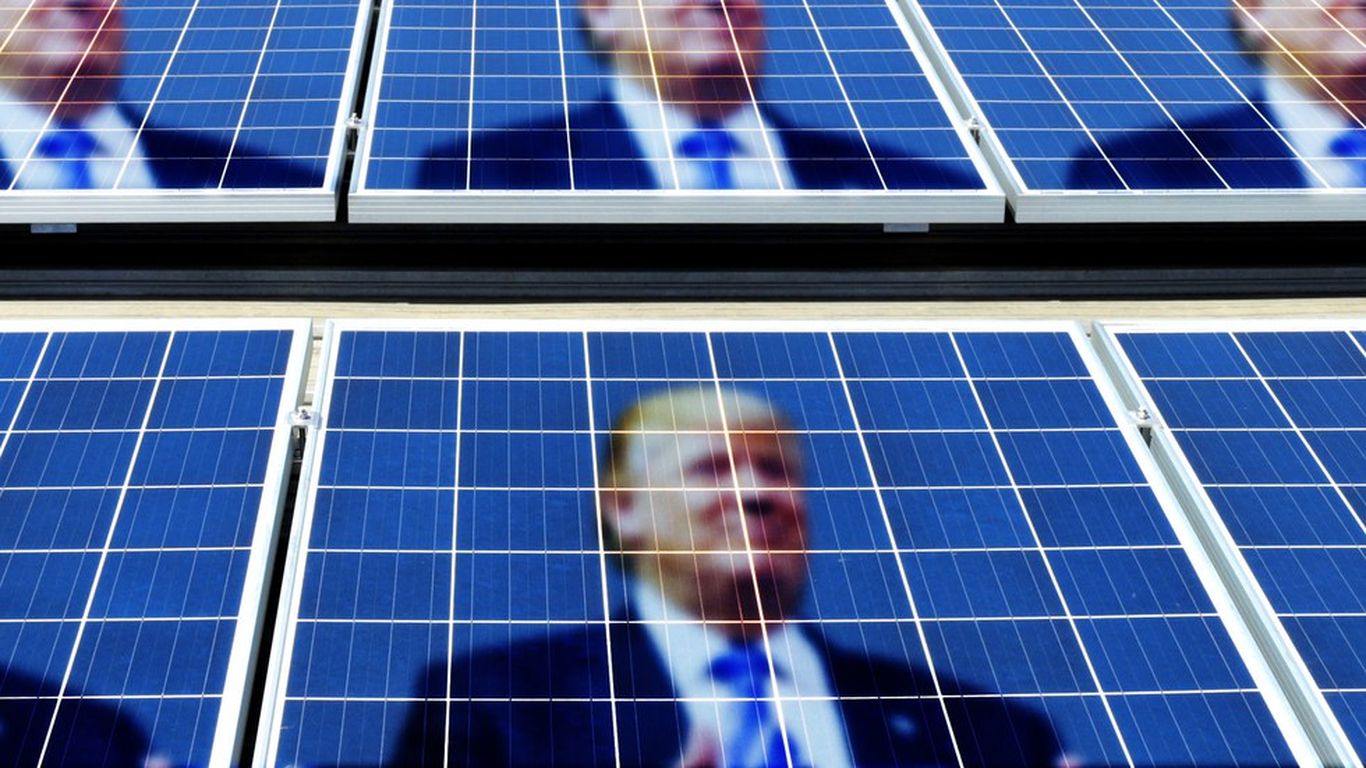

How Trump's Southeast Asia Tariffs Affected Indian Solar Equipment Exporters

Table of Contents

Pre-Tariff Landscape: Indian Solar Exports to Southeast Asia

Before the implementation of Trump's tariffs, the Indian solar equipment export market in Southeast Asia was thriving. Indian exporters enjoyed a significant competitive advantage due to their cost-effectiveness and substantial production capacity. Key export products included solar panels, inverters, and mounting structures. India had successfully established itself as a reliable and affordable supplier, capturing a considerable portion of the market.

- Market Share: Indian exporters held a substantial market share (specific percentages would require further research and data), particularly in countries like Vietnam, Thailand, and the Philippines, before the tariffs were imposed.

- Growth Trajectory: The Indian solar export market to Southeast Asia experienced consistent double-digit growth in the years leading up to the tariff implementation. This was fueled by increasing demand for renewable energy within the region.

- Key Trading Partners: Major trading partners included Vietnam, Thailand, Malaysia, the Philippines, and Indonesia, each presenting unique opportunities and challenges for Indian exporters.

The Impact of Trump's Southeast Asia Tariffs

The Trump administration's tariffs, specifically targeting solar products from certain Southeast Asian nations, dramatically altered the playing field. These tariffs significantly increased the cost of Indian solar equipment in these markets, making them less competitive compared to other global suppliers. This ripple effect resulted in reduced demand and intensified competition for Indian exporters.

- Tariff Rates and Pricing: The specific tariff rates varied depending on the product and the country of origin. However, even modest percentage increases had a substantial impact on the final price, making Indian products less attractive to buyers in Southeast Asia.

- Affected Companies and Responses: Several prominent Indian solar companies faced significant challenges adjusting to these tariffs. Many were forced to re-evaluate their pricing strategies and explore alternative markets. Specific examples and their responses would need further investigation.

- Decline in Exports: Quantifiable data showcasing the decline in Indian solar exports to Southeast Asia following the tariff implementation is crucial to fully understanding the impact (this data needs to be researched and added).

Responses from Indian Solar Equipment Exporters

Faced with these significant challenges, Indian solar equipment exporters adopted various strategies to mitigate the negative impact of the tariffs. Diversification became a crucial element, with many companies actively seeking new markets beyond Southeast Asia. Some also engaged in lobbying efforts and sought government support to navigate the turbulent trade landscape.

- Successful Diversification: Some Indian companies successfully diversified into markets in Africa, Latin America, and the Middle East, reducing their reliance on the Southeast Asian market. Specific case studies highlighting successful strategies are needed here.

- Government Support: The Indian government implemented various policies aimed at supporting the solar industry, such as financial incentives and export promotion initiatives. Details about these policies would be beneficial.

- Challenges in Adaptation: Despite diversification efforts, adapting to the changed market dynamics proved challenging. Competition from other global suppliers intensified, and navigating new regulatory landscapes in different countries required significant investments and expertise.

Long-Term Consequences and Future Outlook

The long-term impact of Trump's Southeast Asia tariffs on the Indian solar industry's competitiveness is still being assessed. While some recovery has likely occurred, the industry's share of the Southeast Asian market is likely lower than pre-tariff levels. The emergence of new competitors within Southeast Asia, possibly spurred by the tariffs, further complicates the landscape.

- Changes in Market Share: A detailed analysis of the changes in market share held by Indian exporters post-tariffs is needed to quantify the long-term consequences.

- Emergence of New Competitors: The tariffs may have inadvertently fostered the growth of domestic solar manufacturing capabilities in Southeast Asia, creating new and potent competitors for Indian exporters.

- Future Growth Predictions: Forecasting the future growth of the Indian solar equipment export market to Southeast Asia requires careful consideration of various factors, including global trade policies, technological advancements, and regional energy demand.

Conclusion: Understanding the Lasting Effects of Trump's Southeast Asia Tariffs on Indian Solar Exports

Trump's Southeast Asia tariffs inflicted significant damage on Indian solar equipment exporters, causing decreased exports, price increases, and a loss of market share in a crucial region. The industry's response, marked by diversification and government support, demonstrated resilience. However, the long-term consequences still need further analysis. Understanding these trade dynamics is vital for future planning and investment within the Indian solar energy sector. Further research into the impact of trade policies on Indian solar exports, the Southeast Asian solar market, and the impact of trade tariffs is crucial for industry stakeholders. Analyzing the effects of these tariffs and adapting strategies based on the lessons learned will be key to navigating the complexities of the global solar market.

Featured Posts

-

Harga Kawasaki Ninja 500 Series Bersolek Melebihi Rp 100 Juta

May 30, 2025

Harga Kawasaki Ninja 500 Series Bersolek Melebihi Rp 100 Juta

May 30, 2025 -

Experience Gorillaz House Of Kong 25th Anniversary Exhibition

May 30, 2025

Experience Gorillaz House Of Kong 25th Anniversary Exhibition

May 30, 2025 -

Understanding Elevated Economic Uncertainty The Impact Of Inflation And Unemployment

May 30, 2025

Understanding Elevated Economic Uncertainty The Impact Of Inflation And Unemployment

May 30, 2025 -

Media Advisory Joy Smith Foundations Inaugural Launch

May 30, 2025

Media Advisory Joy Smith Foundations Inaugural Launch

May 30, 2025 -

President Trumps Clemency Decisions Impact And Implications

May 30, 2025

President Trumps Clemency Decisions Impact And Implications

May 30, 2025