Hudson's Bay: 65 Leases Attract Significant Interest

Table of Contents

The Appeal of Hudson's Bay's Prime Retail Locations

The 65 Hudson's Bay leases represent a unique investment opportunity due to their strategic locations. These aren't just any retail spaces; they're established, high-performing locations in major Canadian cities, situated within high-traffic areas and boasting desirable demographics. The value proposition extends beyond simply renting out existing spaces. Many locations offer significant potential for redevelopment or repurposing, catering to the evolving needs of the modern retail and commercial landscape. This opens doors for mixed-use developments, enhancing both the value and potential rental income.

- Prime locations in major Canadian cities: These leases are not scattered across the country; they are strategically located in key metropolitan areas, guaranteeing high visibility and accessibility.

- High foot traffic and strong consumer base: The established presence of Hudson's Bay in these locations means there’s already a built-in consumer base, reducing the risk associated with new developments.

- Opportunities for mixed-use developments: The flexibility of many locations allows for creative redevelopment, potentially incorporating residential units, office spaces, or other commercial ventures to maximize returns.

- Potential for significant rental income: The strong existing foot traffic and prime locations translate directly into high potential for consistent rental income streams.

- Strong brand recognition associated with the Hudson's Bay locations: The inherent prestige and trust associated with the Hudson's Bay brand adds an extra layer of value and attractiveness to these properties.

Types of Investors Showing Interest in Hudson's Bay Leases

The interest in these Hudson's Bay leases isn't limited to a single investor type. A diverse range of players are vying for a piece of this lucrative investment opportunity. We're seeing significant activity from:

- Real Estate Investment Trusts (REITs): REITs are actively seeking diversification within their portfolios, and these leases provide an excellent opportunity to expand their holdings in prime Canadian retail space.

- Private equity firms: These firms are attracted by the long-term value appreciation potential of these established properties, particularly given opportunities for redevelopment and repositioning.

- Institutional investors: Seeking stable, high-yield rental income streams, institutional investors see these leases as a secure and reliable investment.

- Foreign investors: The strength of the Canadian economy and the appeal of prime retail real estate are drawing significant interest from foreign investors looking to expand their global portfolios.

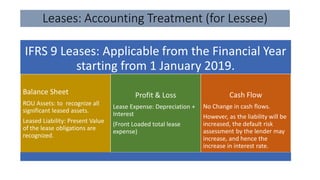

Financial Implications and Potential Returns on Investment for Hudson's Bay Leases

The financial projections for these Hudson's Bay leases paint a compelling picture for investors. Rental income projections are robust, considering the prime locations and established tenant base. Moreover, the potential for significant capital appreciation over the long term is substantial, especially considering the potential for redevelopment and adaptation to changing market demands.

- Projected rental income streams: Based on current market rates and the high demand for retail space in these locations, rental income is expected to be considerable and consistent.

- Estimated capital appreciation potential: The potential for value appreciation is substantial, driven by both market forces and opportunities for strategic enhancements.

- Risk assessment and potential downsides: While the potential returns are significant, a comprehensive risk assessment considering market fluctuations and potential economic downturns is crucial.

- Comparison with other similar investment opportunities: When compared to other retail investment opportunities in Canada, the Hudson's Bay leases often emerge as particularly attractive due to their prime location and the inherent strength of the brand.

The Future of Hudson's Bay Company after the Lease Sale

The sale of these 65 leases represents a strategic shift for HBC. The proceeds from these sales will likely be used to optimize the company's financial position and potentially fuel future growth initiatives.

- Debt reduction strategies for HBC: A significant portion of the proceeds could be allocated towards reducing HBC's debt burden, improving its financial stability and flexibility.

- Potential reinvestment in other business areas: The capital generated could be reinvested in other aspects of HBC's business, such as e-commerce development, enhancing its online presence and competitiveness.

- Impact on HBC's retail footprint: The sale will naturally reduce HBC's physical retail footprint, but this strategic move may allow them to focus on key locations and enhance profitability.

- Future growth prospects for HBC: By streamlining its operations and optimizing its financial position, HBC positions itself for future growth and expansion in the evolving Canadian retail market.

Conclusion: Investing in the Future of Canadian Retail with Hudson's Bay Leases

The significant investor interest in the 65 Hudson's Bay leases reflects the undeniable appeal of these prime retail properties. The strategic locations, potential for redevelopment, strong rental income prospects, and the associated prestige of the Hudson's Bay brand combine to create a highly attractive investment opportunity. For investors, this represents a chance to secure a piece of Canadian retail history and capitalize on the potential for substantial returns. For HBC, this strategic move allows for financial restructuring and refocusing on core business initiatives. Learn more about the exciting investment opportunities surrounding Hudson's Bay leases and secure your piece of Canadian retail history!

Featured Posts

-

The Los Angeles Wildfires And The Growing Market For Disaster Related Wagers

Apr 24, 2025

The Los Angeles Wildfires And The Growing Market For Disaster Related Wagers

Apr 24, 2025 -

Ella Bleu Travoltas Stunning Transformation A Fashion Magazine Debut

Apr 24, 2025

Ella Bleu Travoltas Stunning Transformation A Fashion Magazine Debut

Apr 24, 2025 -

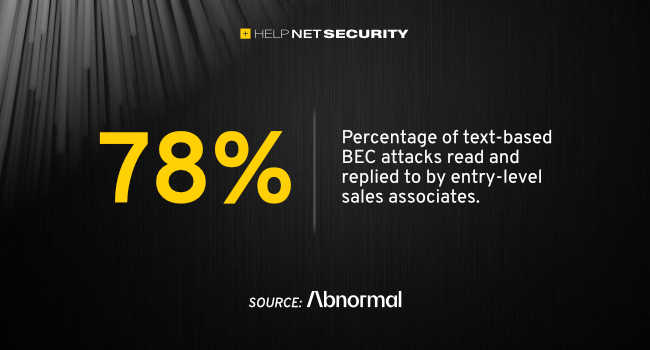

Cybercriminals Office 365 Exploit Nets Millions Investigation Reveals

Apr 24, 2025

Cybercriminals Office 365 Exploit Nets Millions Investigation Reveals

Apr 24, 2025 -

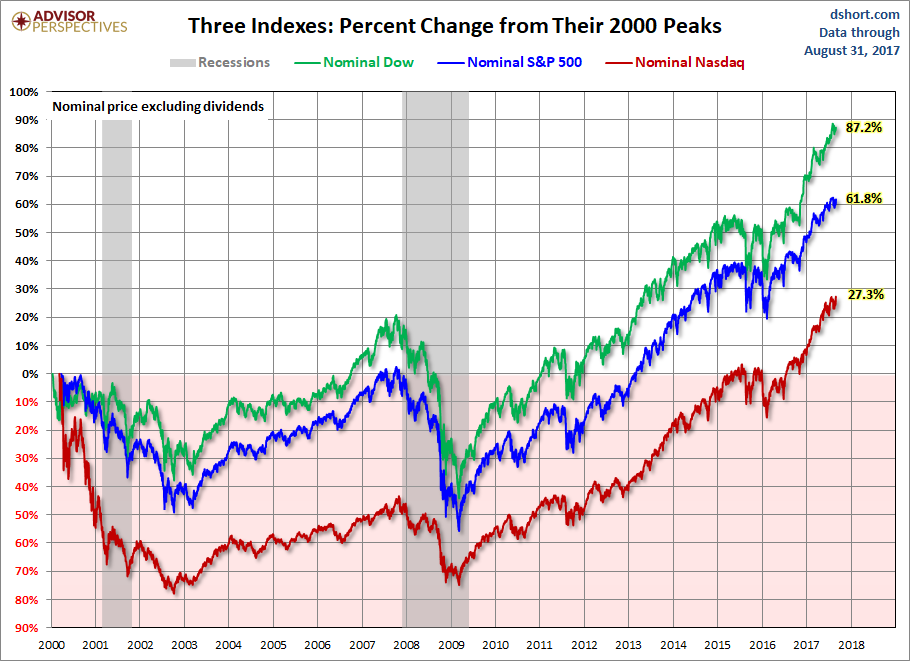

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025 -

Trumps Budget Cuts Increase Tornado Risk During Severe Weather Season

Apr 24, 2025

Trumps Budget Cuts Increase Tornado Risk During Severe Weather Season

Apr 24, 2025