IMF Review Of Pakistan's $1.3 Billion Package: Tensions With India & Other News

Table of Contents

IMF's Conditions and Pakistan's Economic Reforms

The IMF's approval of the $1.3 billion tranche hinges on Pakistan's commitment to stringent economic reforms. These reforms are designed to address the country's deep-seated fiscal imbalances and structural weaknesses, laying the groundwork for long-term economic stability.

Fiscal Reforms and Austerity Measures

The IMF's demands include a comprehensive overhaul of Pakistan's fiscal policies, necessitating significant austerity measures. These measures are aimed at reducing the country's massive fiscal deficit and unsustainable public debt.

- Increased Taxation: The IMF is pushing for broader tax collection, targeting previously untaxed sectors and individuals to boost government revenue. This includes cracking down on tax evasion and improving tax administration.

- Reduced Energy Subsidies: The government is expected to significantly reduce energy subsidies, leading to increased energy prices for consumers and businesses. This painful step aims to curb energy consumption and reduce the strain on public finances.

- Spending Cuts: Further cuts to government spending are anticipated, impacting various social programs and potentially leading to social unrest.

These austerity measures are likely to have profound social and political consequences. Increased inflation and reduced social welfare spending could spark public protests and further destabilize the already fragile political landscape. Pakistan's current fiscal deficit stands at [Insert current data on Pakistan's fiscal deficit] and its public debt at [Insert current data on Pakistan's public debt], highlighting the urgency of these reforms.

Structural Reforms and Governance

Beyond fiscal adjustments, the IMF is demanding significant structural reforms aimed at improving governance, tackling corruption, and fostering a more conducive business environment.

- Improved Transparency: The IMF is pushing for enhanced transparency in government operations and financial transactions to reduce corruption and improve accountability.

- Strengthening Institutions: Strengthening independent regulatory bodies and judicial institutions is crucial to ensuring a fair and efficient business environment.

- State-Owned Enterprises Reform: Restructuring and privatization of inefficient state-owned enterprises are also on the agenda.

Implementing these reforms faces considerable challenges. Powerful vested interests may resist changes that threaten their power and influence. The lack of strong institutional capacity and widespread corruption further complicate the reform process. Achieving meaningful progress requires strong political will and effective implementation mechanisms, aligning with international best practices for economic governance.

Geopolitical Tensions with India and Regional Instability

The ongoing tensions between Pakistan and India cast a long shadow over Pakistan's economic prospects and its ability to meet the IMF's conditions.

Impact of India-Pakistan Relations

The strained relationship with India significantly impacts Pakistan's economy. The potential for further economic sanctions or disruptions to bilateral trade adds to the pressure on Pakistan’s already strained resources. Any escalation in tensions could further jeopardize the IMF program. [Insert details on recent diplomatic events and their economic repercussions].

Other Regional Challenges

Beyond the India-Pakistan dynamic, other regional challenges further complicate Pakistan's economic situation.

- Climate Change: Pakistan's vulnerability to climate change, evidenced by devastating floods, significantly impacts agricultural production and infrastructure, hindering economic recovery.

- Energy Security: Energy shortages and dependence on imported fuel create a significant drain on the nation's finances.

- Internal Political Challenges: Political instability and internal security threats add to the economic uncertainty, making it harder to attract foreign investment and implement reforms.

These regional challenges exacerbate the difficulties Pakistan faces in meeting the IMF's requirements. International support and aid are crucial to address these multifaceted issues and provide stability for the nation.

The Future of Pakistan's Economy and the IMF Bailout

The success of the IMF program depends heavily on Pakistan's ability to implement the agreed-upon reforms effectively and timely.

Success or Failure of the IMF Program

Two key scenarios emerge:

- Success: Successful implementation could lead to stabilization of the economy, unlocking further financial assistance and fostering long-term growth. This will require strong political will, effective implementation of reforms, and a supportive global environment.

- Failure: Failure to meet the IMF's conditions could result in a default, triggering a deeper economic crisis and potentially leading to further instability.

Expert opinions on Pakistan's economic outlook are varied, with some expressing cautious optimism and others warning of significant challenges ahead. [Insert expert opinions and forecasts here].

Alternative Economic Strategies

If the IMF program fails, Pakistan will need to explore alternative economic strategies, which might include:

- Seeking assistance from other international financial institutions: Exploring alternative sources of funding such as the World Bank or Asian Development Bank.

- Debt restructuring: Negotiating a restructuring of Pakistan's debt obligations with its creditors.

- Domestic reforms: Implementing a more radical set of domestic reforms to improve governance and economic efficiency.

These alternative approaches have their own advantages and disadvantages, and the choice will depend on the specific circumstances prevailing at the time.

Conclusion: Analyzing the IMF's Decision and the Future of Pakistan's Economy

The IMF review of Pakistan's $1.3 billion loan package is a critical juncture for the nation's economy. The success hinges not only on the implementation of necessary economic reforms but also on navigating the complex geopolitical landscape and addressing pressing regional challenges. The $1.3 billion loan package is a lifeline, but its effectiveness depends on a multifaceted approach that addresses both economic and political factors. Understanding the interplay between economic reforms and geopolitical risks is crucial to predicting Pakistan's economic future. Stay updated on the latest developments regarding the IMF review of Pakistan’s $1.3 billion package and the ongoing geopolitical tensions to better comprehend the trajectory of this vital South Asian economy. Keywords: Pakistan economic crisis, IMF loan disbursement, geopolitical impact.

Featured Posts

-

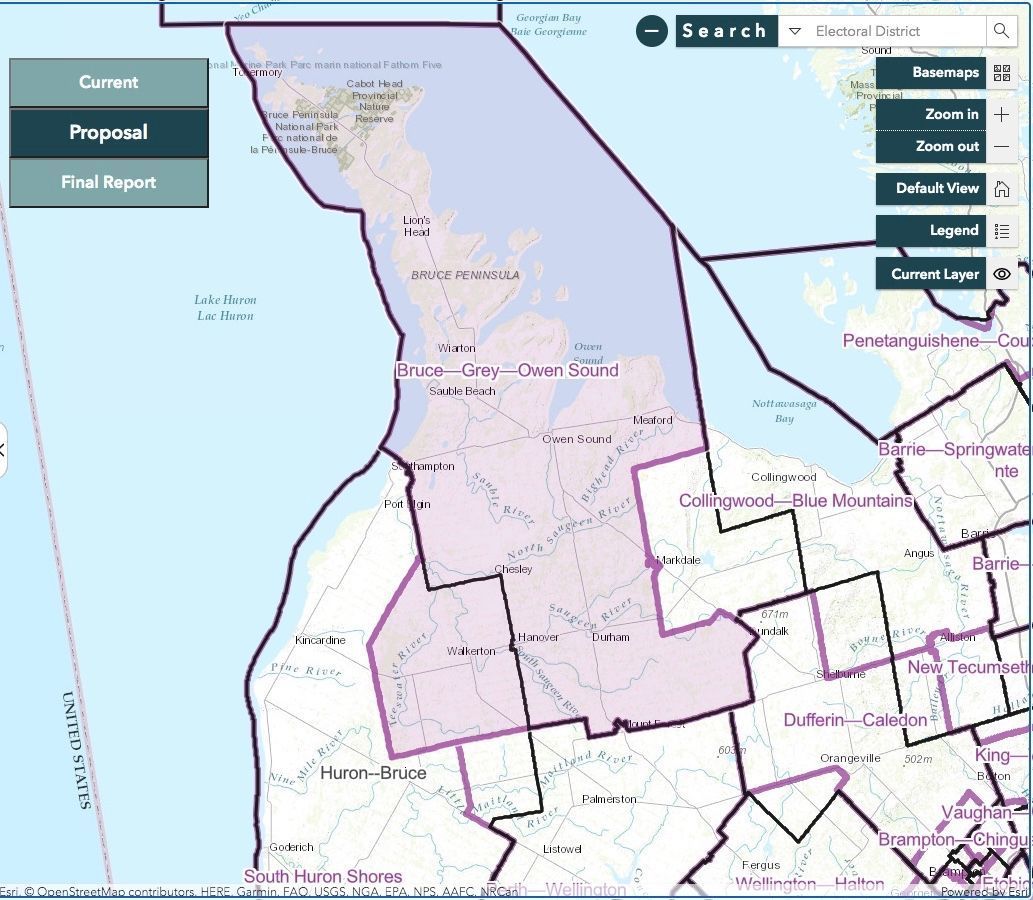

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025 -

Family Left In Ruins Following Senseless Racist Murder

May 10, 2025

Family Left In Ruins Following Senseless Racist Murder

May 10, 2025 -

The Cost Of Supporting Trump Tech Billionaires 194 Billion Loss

May 10, 2025

The Cost Of Supporting Trump Tech Billionaires 194 Billion Loss

May 10, 2025 -

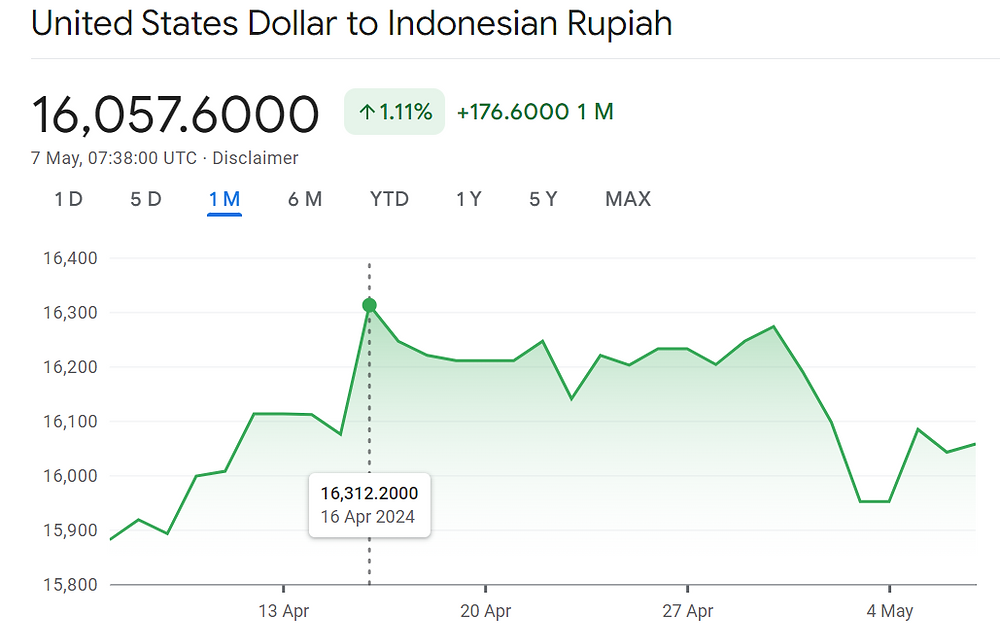

Sharp Decline In Indonesias Reserves Impact Of Rupiah Depreciation

May 10, 2025

Sharp Decline In Indonesias Reserves Impact Of Rupiah Depreciation

May 10, 2025 -

Space Xs Booming Value 43 Billion Ahead Of Musks Tesla Stake

May 10, 2025

Space Xs Booming Value 43 Billion Ahead Of Musks Tesla Stake

May 10, 2025