Impact Of China's Steel Output Curbs On Global Iron Ore Prices

Table of Contents

China's Steel Production Cuts: The Driving Force

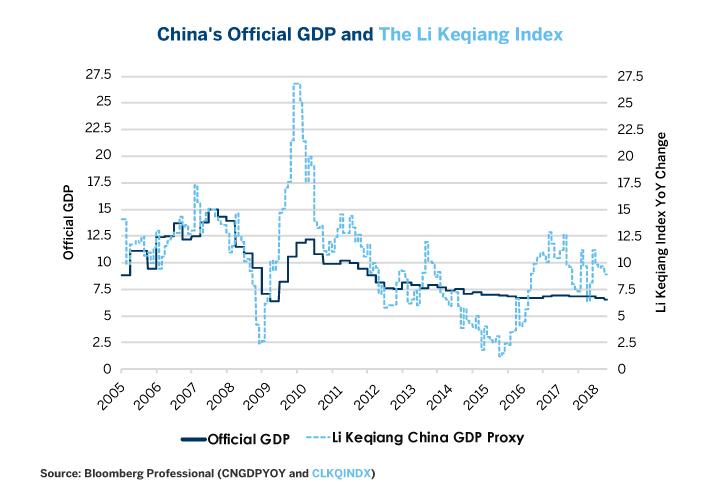

The dramatic reduction in China's steel production is driven by a confluence of factors, primarily focused on environmental concerns and economic adjustments. The Chinese government has implemented stringent policies aimed at reducing carbon emissions and curbing overcapacity within its steel sector. These policies include stricter environmental regulations, limitations on production permits, and increased scrutiny of polluting industries. Simultaneously, a slowdown in China's construction activity – a major driver of steel demand – has further dampened the need for raw materials.

- Specific examples of government policies and their impact: The implementation of the "carbon peak" and "carbon neutrality" goals has directly led to production quotas and penalties for exceeding emission limits. This has forced many steel mills to curtail operations or even shut down completely.

- Statistics on the percentage reduction in steel production: Reports indicate a double-digit percentage reduction in China's steel output in recent quarters, with specific figures varying depending on the source and the type of steel considered. (Note: Insert specific data from reputable sources here.)

- Analysis of the effect on different types of steel: The impact has not been uniform across all steel types. Construction steel, being heavily impacted by reduced construction, has seen a more significant drop in demand compared to specialized steel used in other industries.

The Ripple Effect: Impact on Global Iron Ore Demand

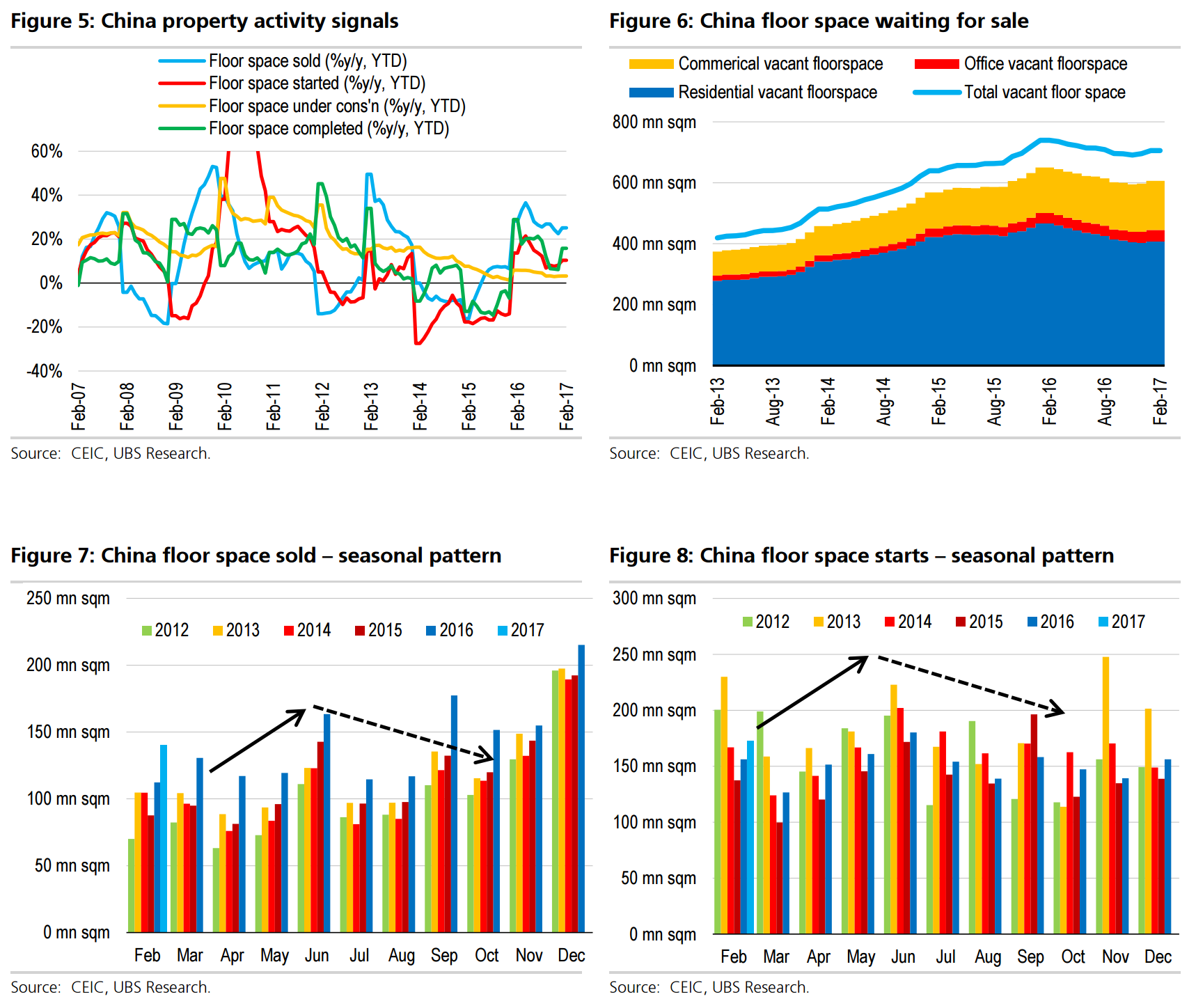

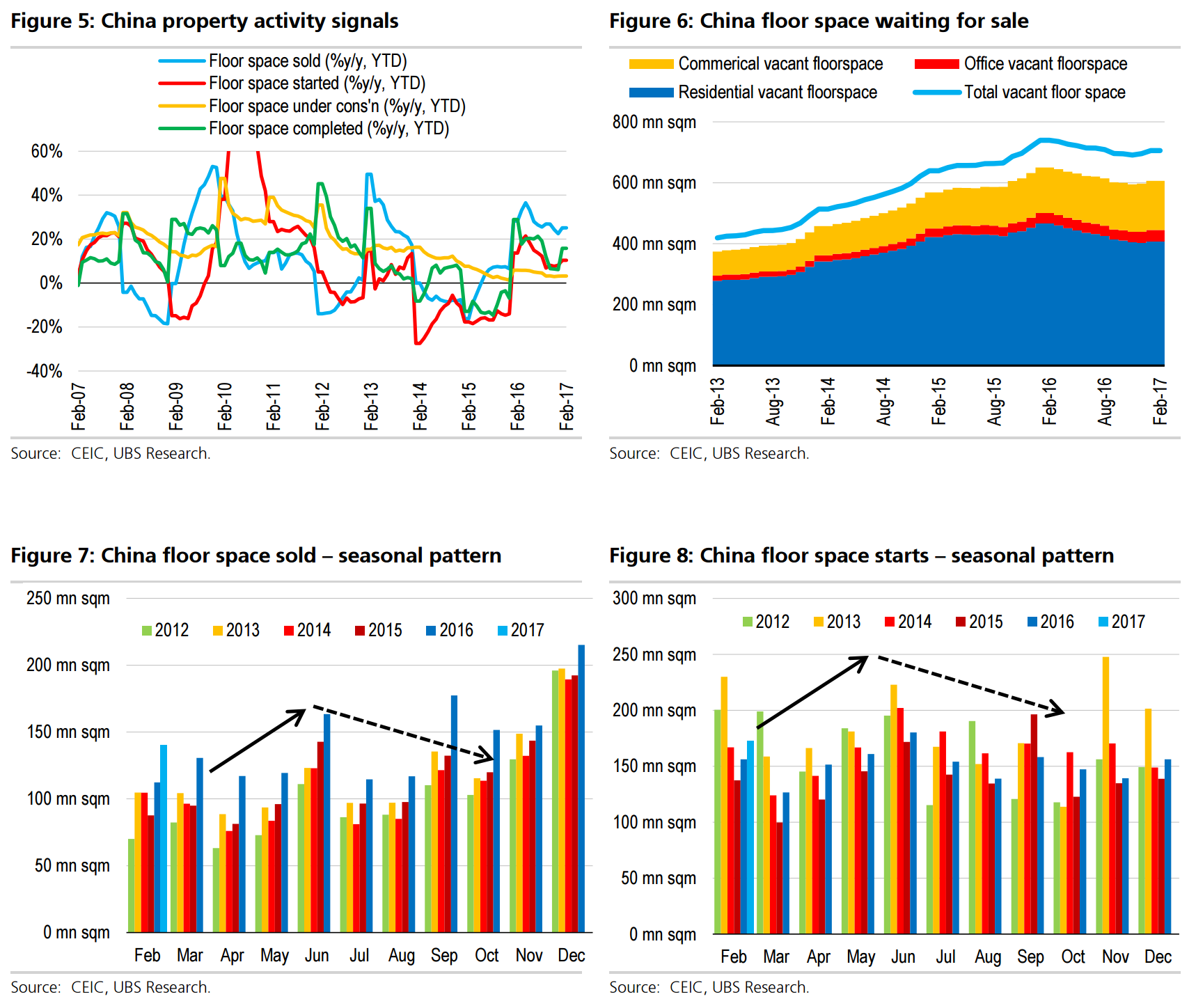

The immediate and significant consequence of reduced Chinese steel production is a sharp decrease in global iron ore demand. China accounts for a massive proportion of global iron ore imports, and the contraction in its steel industry directly translates to less demand for this crucial raw material. This reduced demand has created significant price volatility in the iron ore market. Major iron ore producing nations, particularly Australia and Brazil, which heavily rely on Chinese exports, are feeling the pinch. The disruption to established supply chains is also becoming increasingly apparent.

- Data illustrating the decrease in iron ore imports by China: (Insert data showing the percentage decrease in iron ore imports by China from reputable sources.) This data will clearly demonstrate the direct link between China’s steel production cuts and the reduced demand for iron ore.

- Analysis of price fluctuations in iron ore since the implementation of the curbs: The price of iron ore has experienced significant fluctuations since the introduction of the production curbs. (Include a chart or graph illustrating these price fluctuations, referencing reliable sources for the data).

- Discussion of the impact on different grades of iron ore: The impact varies across different grades of iron ore, with higher-grade ores, typically preferred by steel mills, seeing a more pronounced price drop compared to lower-grade ores.

Market Reactions and Future Outlook: Navigating Uncertainty

Market reactions to the reduced steel output have been mixed. While some anticipate a short-term price recovery driven by market speculation and potential supply constraints from producing nations, others foresee a sustained period of lower prices due to the fundamental shift in Chinese demand. The short-term iron ore price forecast remains uncertain. However, longer-term predictions point towards a gradual adjustment in the market. The steel industry might see a shift toward more sustainable production methods and the exploration of alternative materials to reduce reliance on iron ore.

- Predictions for iron ore prices in the coming months and years: (Include predictions from reputable market analysts and forecasting firms, acknowledging the inherent uncertainty in such predictions.)

- Discussion of investor sentiment and market speculation: The reduced Chinese demand has increased uncertainty for investors, impacting investment decisions related to iron ore mining and steel production.

- Analysis of potential long-term changes in the steel industry: The long-term effects will likely include increased pressure for sustainable steel production practices, the exploration of alternative materials, and a reshaping of global supply chains for steel and iron ore.

Conclusion: Navigating the Shifting Sands of the Global Steel Market

China's steel output curbs have undeniably impacted global iron ore prices, creating significant volatility and uncertainty in the market. The long-term implications are far-reaching, affecting major iron ore producers, global steel manufacturers, and investors alike. Monitoring China's steel policies and their subsequent effect on demand remains crucial for accurate predictions of global iron ore prices. Staying informed about this evolving situation is essential, particularly for those with investments in the iron ore or steel sector. Conduct thorough research and consider the implications of China's steel output curbs on your investment strategies. Understanding the impact of China's steel policy on the iron ore market outlook is key to navigating this turbulent landscape.

Featured Posts

-

Transgender Experiences Under Trump Administration Policies

May 10, 2025

Transgender Experiences Under Trump Administration Policies

May 10, 2025 -

Bubble Blasters And The Ripple Effect Of Trade Wars On Chinese Goods

May 10, 2025

Bubble Blasters And The Ripple Effect Of Trade Wars On Chinese Goods

May 10, 2025 -

Analyzing Figmas Ai Powered Design Tools A Competitive Landscape Review

May 10, 2025

Analyzing Figmas Ai Powered Design Tools A Competitive Landscape Review

May 10, 2025 -

Taiwans Vice President Lai Warns Of Growing Totalitarian Threat In Ve Day Speech

May 10, 2025

Taiwans Vice President Lai Warns Of Growing Totalitarian Threat In Ve Day Speech

May 10, 2025 -

Apple At The Ai Tipping Point A Competitive Assessment

May 10, 2025

Apple At The Ai Tipping Point A Competitive Assessment

May 10, 2025

Latest Posts

-

Broadcoms V Mware Acquisition At And T Details A Staggering 1050 Price Increase

May 10, 2025

Broadcoms V Mware Acquisition At And T Details A Staggering 1050 Price Increase

May 10, 2025 -

V Mware Costs To Skyrocket At And T Reports 1050 Price Hike From Broadcom

May 10, 2025

V Mware Costs To Skyrocket At And T Reports 1050 Price Hike From Broadcom

May 10, 2025 -

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 10, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 10, 2025 -

East Palestines Toxic Legacy Building Contamination After The Train Derailment

May 10, 2025

East Palestines Toxic Legacy Building Contamination After The Train Derailment

May 10, 2025 -

Toxic Chemical Residue From Ohio Derailment Months Long Impact On Buildings

May 10, 2025

Toxic Chemical Residue From Ohio Derailment Months Long Impact On Buildings

May 10, 2025