Impact Of GOP's Student Loan Plan: Analysis Of Pell Grant And Repayment Changes

Table of Contents

Proposed Changes to Pell Grants under the GOP Student Loan Plan

The GOP's student loan plan may significantly alter the landscape of Pell Grant funding and eligibility. These changes could have profound consequences for low-income students seeking higher education.

Potential Funding Cuts

- Specific examples of proposed cuts: While specific figures may vary depending on the specific GOP proposal, many plans suggest reducing overall federal spending on higher education, which would likely impact Pell Grant funding. This could mean a decrease in the maximum Pell Grant award amount or a reduction in the number of students eligible for the grant.

- Impact on low-income students: Reduced Pell Grant funding would disproportionately affect low-income students who rely heavily on these grants to cover tuition and other educational expenses. Many might find college inaccessible without sufficient financial aid.

- Implications for college access: Decreased funding could lead to a decline in college enrollment among low-income students, widening existing inequalities in higher education access. This could have long-term consequences for social mobility and economic opportunity.

- Current Pell Grant allocation and usage: In 2023, the maximum Pell Grant award was $7,395. Millions of students rely on these grants annually. Any reduction in funding would significantly impact these individuals.

- Alternative funding sources: Some GOP proposals might suggest shifting funding towards private scholarships or merit-based aid, however, these alternatives might not sufficiently address the needs of low-income students.

Eligibility Requirements

- Changes to income thresholds: The GOP might propose stricter income thresholds for Pell Grant eligibility, potentially excluding students from families who currently qualify.

- GPA requirements: Some proposals might introduce or increase GPA requirements, limiting access for students who struggle academically but demonstrate financial need.

- Other eligibility factors: Further restrictions could include changes to the types of institutions eligible for Pell Grant funding, possibly excluding for-profit colleges or institutions with high default rates.

- Impact on the number of eligible students: Stricter eligibility criteria would inevitably lead to a reduction in the number of students eligible for Pell Grants, potentially exacerbating college affordability issues.

- Unintended consequences: Restricting eligibility could inadvertently punish students from families who experience temporary financial hardship, discouraging them from pursuing higher education.

Impact on College Affordability

- Increased reliance on private loans: Reduced Pell Grant funding would force more students to rely on private loans, often with higher interest rates and less favorable repayment terms, leading to increased student debt.

- Potential rise in student debt: The combination of reduced grants and increased borrowing could dramatically worsen the already substantial student loan debt crisis.

- Effect on college enrollment rates: Higher costs and reduced financial aid could significantly decrease college enrollment rates, particularly among low-income and minority students.

- Data on student debt and college affordability: Existing data consistently shows a strong correlation between Pell Grant access and college affordability. Any changes to the program would likely further exacerbate this issue.

Repayment Plan Modifications under the GOP Student Loan Plan

The GOP student loan plan may also significantly impact repayment options for existing borrowers. These proposed modifications could have serious long-term financial consequences.

Income-Driven Repayment (IDR) Changes

- Changes to repayment calculations: The GOP might propose changes to the formulas used to calculate monthly payments under income-driven repayment (IDR) plans, potentially increasing payments for many borrowers.

- Loan forgiveness thresholds: Proposed changes could increase the income requirements for loan forgiveness, meaning borrowers would need to make significantly more payments before qualifying for forgiveness.

- Impact on monthly payments: Higher monthly payments could place an immense strain on borrowers' budgets, potentially leading to delinquency and default.

- Impact on borrowers with high debt burdens: Borrowers with substantial student loan debt would be disproportionately affected by these changes, facing increased financial hardship.

- Impact on borrowers in different income brackets: Even those in higher income brackets could face higher payments, negating the perceived benefits of income-driven repayment.

Loan Forgiveness Programs

- Changes to PSLF, Teacher Loan Forgiveness, etc.: The GOP may propose eliminating or significantly restricting existing loan forgiveness programs such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness.

- Impact on public service workers and educators: The elimination of these programs would severely impact individuals who dedicated their careers to public service, significantly reducing their financial incentive to pursue these fields.

- Economic implications: Eliminating loan forgiveness programs could hinder the ability of public service organizations to recruit and retain qualified personnel, potentially impacting vital services.

Impact on Student Debt Burden

- Increased defaults: Increased monthly payments and reduced loan forgiveness options could lead to a surge in student loan defaults, exacerbating the already significant student debt crisis.

- Impact on credit scores: Defaults would negatively impact borrowers' credit scores, making it difficult to secure loans for housing, cars, or other essential needs in the future.

- Implications for the economy: A widespread increase in student loan defaults would have broader economic consequences, potentially slowing economic growth and impacting financial markets.

- Statistics on student loan debt levels and default rates: The current student loan debt crisis is already affecting millions. Further changes under the GOP student loan plan could worsen the situation exponentially.

Conclusion

The GOP student loan plan's potential impact on Pell Grants and repayment options is multifaceted. While some might argue that proposed changes encourage fiscal responsibility, the potential consequences for low-income students and borrowers with significant debt are considerable. Reduced Pell Grant funding could limit access to higher education, while changes to repayment plans could lead to increased defaults and financial hardship for millions. Understand the full implications of the GOP student loan plan before forming an opinion. Stay updated on changes to Pell Grants and loan repayment, and actively participate in discussions about student financial aid and debt relief. Learn more about the potential impact on your student loans and advocate for policies that ensure fair and affordable access to higher education.

Featured Posts

-

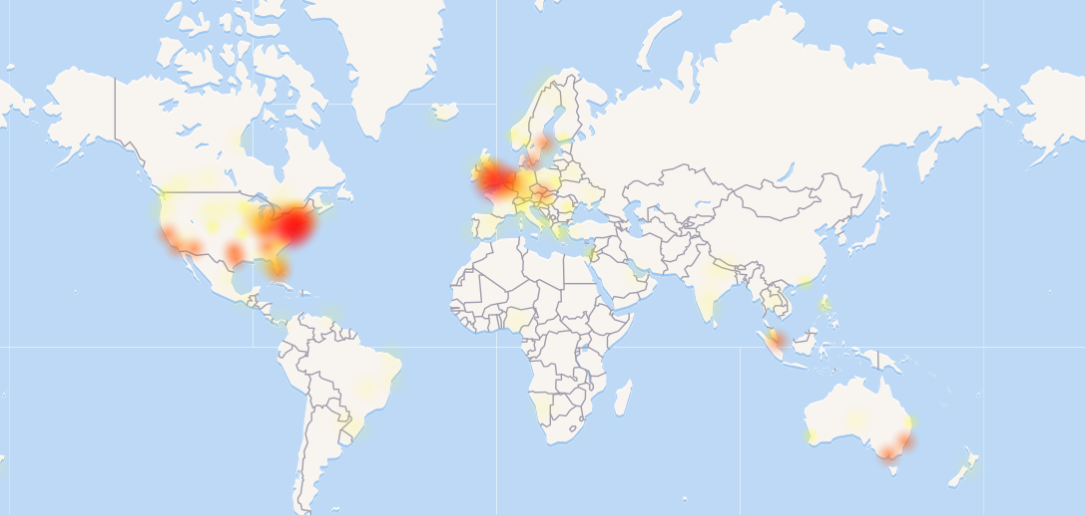

Reddit Outage A Comprehensive Report

May 17, 2025

Reddit Outage A Comprehensive Report

May 17, 2025 -

Reta Nba Situacija Teisejas Pripazista Lemiama Klaida Pistons Knicks Mace

May 17, 2025

Reta Nba Situacija Teisejas Pripazista Lemiama Klaida Pistons Knicks Mace

May 17, 2025 -

Ultraviolette Tesseract Three Key Features You Need To Know

May 17, 2025

Ultraviolette Tesseract Three Key Features You Need To Know

May 17, 2025 -

Trump And Student Loan Privatization Exploring The Possibilities

May 17, 2025

Trump And Student Loan Privatization Exploring The Possibilities

May 17, 2025 -

Offre Limitee Trottinette Electrique A Prix Reduit Moins De 200 E Chez Cdiscount

May 17, 2025

Offre Limitee Trottinette Electrique A Prix Reduit Moins De 200 E Chez Cdiscount

May 17, 2025