Trump And Student Loan Privatization: Exploring The Possibilities

Table of Contents

Arguments for Student Loan Privatization under a Trump-esque Approach

Proponents of student loan privatization often cite increased efficiency and market-driven solutions as key benefits. A Trump-esque approach, emphasizing reduced government involvement and free-market principles, would likely view privatization favorably.

Increased Efficiency and Reduced Government Spending

- Private companies may be more efficient in managing loans, potentially reducing administrative costs for the government. Private sector expertise in streamlining processes could lead to significant cost savings compared to the often-bureaucratic government system.

- Privatization could free up government resources for other priorities. The savings achieved through increased efficiency could be reallocated to other essential areas, aligning with a fiscally conservative approach.

- The potential cost savings are substantial and could be substantial. Consider the Trump administration’s emphasis on budget cuts and its focus on streamlining government operations. This perspective suggests that redirecting resources away from student loan administration could be viewed as a positive outcome.

Innovation and Competition in the Lending Market

- Private lenders might offer more innovative loan products and repayment options. The private sector's competitive environment often fosters innovation. This could translate to more flexible repayment plans and tailored loan products catering to individual student needs.

- Competition among lenders could drive down interest rates for borrowers. Increased competition naturally leads to a "race to the bottom" in pricing, theoretically benefiting borrowers with lower interest rates.

- Innovative loan products, such as income-share agreements or deferred repayment plans, are already being explored in the private sector. This increased competition could potentially lead to a significant reduction in interest rates compared to the current federal student loan rates.

Market-Based Solutions to the Student Debt Crisis

- Privatization can be framed as a market-driven solution to address the growing student debt problem. Instead of relying solely on government intervention, a market-based approach aims to leverage private sector investment and efficiency to manage the debt crisis more effectively.

- This approach highlights the potential for private sector investment in education and student success programs. Private companies might be incentivized to invest in initiatives that improve student outcomes, ultimately leading to better repayment rates.

- A market-based solution may offer a more sustainable and potentially quicker way to address the escalating student debt crisis. However, this requires careful consideration of potential risks and the need for robust regulatory frameworks to prevent exploitation.

Arguments Against Student Loan Privatization under a Trump-esque Approach

Despite the potential advantages, significant concerns exist regarding the privatization of student loans, especially under an administration that prioritizes deregulation and limited government oversight.

Potential for Increased Costs and Predatory Lending

- Private lenders may charge higher interest rates and fees, increasing the overall cost of borrowing. The profit motive of private companies may lead to higher costs for borrowers compared to the currently subsidized federal loan programs.

- The potential for predatory lending practices targeting vulnerable students needs to be addressed. Without strong regulatory oversight, vulnerable students might be subjected to exploitative loan terms and high-interest rates.

- The history of the subprime mortgage crisis serves as a cautionary tale. Without proper regulations and consumer protection, the privatization of student loans could lead to similar predatory practices, devastating the financial well-being of countless students.

Reduced Access to Loans for Low-Income Students

- Private lenders might be less willing to lend to students with low credit scores or limited income. Profit-driven institutions are likely to prioritize borrowers with lower risk profiles, potentially excluding low-income students who might most need financial assistance.

- This could exacerbate existing inequalities in access to higher education. Restricting access to loans based solely on creditworthiness might disproportionately affect students from disadvantaged backgrounds, perpetuating the cycle of inequality.

- The accessibility of higher education is already a significant issue. Privatization could exacerbate this inequality, widening the gap between those from affluent backgrounds and those from underprivileged communities.

Lack of Accountability and Transparency

- Private companies might be less accountable to the public than government agencies. The lack of public oversight and accountability could lead to less transparency and potentially unethical lending practices.

- This could lead to a lack of transparency in lending practices and repayment terms. The complexity of private loan agreements could make it difficult for borrowers to understand the terms and conditions, leaving them vulnerable to hidden fees and unfavorable interest rates.

- Ensuring accountability and transparency in a privatized system is crucial. However, enforcing regulations and ensuring consumer protection in a deregulated environment poses significant challenges.

Potential Impacts and Unforeseen Consequences

The long-term economic consequences of student loan privatization are difficult to predict with certainty. It could potentially lead to increased overall debt burdens for borrowers, reduced access to higher education for lower-income students, and increased risks to the financial stability of the higher education sector as a whole. Politically, such a move could lead to significant public backlash, especially if the anticipated cost savings fail to materialize or if predatory lending practices become widespread. The effects on the higher education system could include increased tuition costs driven by a decreased reliance on government-subsidized loans.

Conclusion: The Future of Student Loan Privatization under Similar Political Ideologies

The debate surrounding student loan privatization is multifaceted and complex. While arguments for increased efficiency and market-driven solutions hold merit, significant concerns regarding increased costs, reduced access for low-income students, and a lack of accountability cannot be ignored. Understanding the potential risks and benefits requires careful consideration of the various perspectives. Understanding the intricacies of Trump and student loan privatization is crucial for shaping future policy discussions. Stay informed and participate in the debate!

Featured Posts

-

College Costs Parents Shifting Attitudes And Reliance On Student Loans

May 17, 2025

College Costs Parents Shifting Attitudes And Reliance On Student Loans

May 17, 2025 -

Mariners First Inning Explosion Leads To 14 0 Rout Of Marlins

May 17, 2025

Mariners First Inning Explosion Leads To 14 0 Rout Of Marlins

May 17, 2025 -

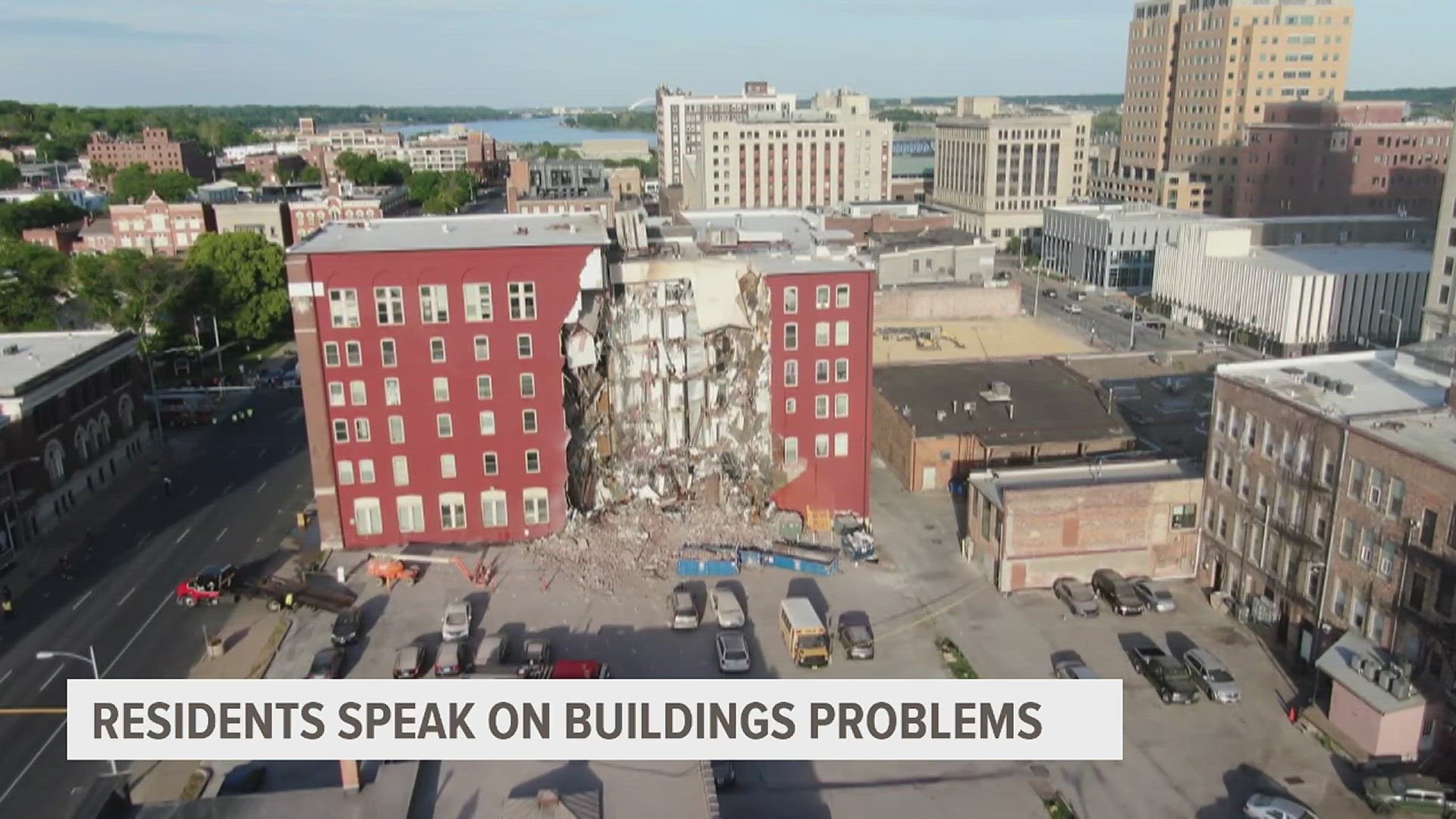

Davenport Council Votes To Demolish Apartment Building

May 17, 2025

Davenport Council Votes To Demolish Apartment Building

May 17, 2025 -

Gold Xauusd Price Rebound Weak Us Data Fuels Rate Cut Expectations

May 17, 2025

Gold Xauusd Price Rebound Weak Us Data Fuels Rate Cut Expectations

May 17, 2025 -

Comprehensive Moto News Gncc Mx Sx Flat Track And Enduro Action

May 17, 2025

Comprehensive Moto News Gncc Mx Sx Flat Track And Enduro Action

May 17, 2025