India And Saudi Arabia Joint Venture: Two New Oil Refineries Planned

Table of Contents

Project Details: Location, Capacity, and Investment

The India-Saudi Arabia joint venture represents a massive undertaking in the petroleum sector. The project's success hinges on several key aspects, including the refineries' locations, their refining capacity, and the substantial investment required.

Refinery Locations

While precise locations haven't been officially announced, the strategic selection of sites within India is paramount. The chosen locations will likely prioritize factors such as proximity to crude oil import terminals, existing infrastructure, and access to a skilled workforce. The "refinery location" will need to offer a "geographic advantage" and a "strategic location" for optimal efficiency and logistical ease. Speculation points towards coastal areas to facilitate easy import and export of petroleum products.

Refining Capacity and Output

Each refinery is anticipated to possess a substantial "refining capacity," likely measured in hundreds of thousands of barrels per day. The "crude oil processing" will focus on producing a diverse range of "petroleum products," including gasoline, diesel, jet fuel, and petrochemicals. The precise "production output" of each refinery will depend on market demand and economic feasibility studies. The joint venture aims to cater to India's growing domestic needs while potentially exporting surplus products to regional markets.

Investment and Funding

This mega-project necessitates a colossal "project investment," estimated to run into tens of billions of dollars. Both Indian and Saudi Arabian entities will contribute significantly to the "funding," with a likely breakdown involving a combination of equity investments and potentially loans from international financial institutions.

- Estimated cost of the project: $50 billion (estimated figure, subject to change).

- Breakdown of investment from each partner: Details still under negotiation, but likely a roughly equal split.

- Funding sources: A mix of equity contributions from both partners and potential loans from international banks and development institutions.

Economic Benefits for India and Saudi Arabia

The proposed oil refineries are expected to yield substantial economic benefits for both India and Saudi Arabia, fostering stronger bilateral relations and regional influence.

Benefits for India

For India, this "India-Saudi Arabia joint venture" translates to a significant boost in "energy independence." The reduced reliance on oil imports will enhance "energy security" and contribute to "economic growth." The project will create numerous "jobs" across various sectors, including construction, refining, and related industries. Furthermore, it fosters the development of "domestic production," supporting the expansion of downstream industries.

Benefits for Saudi Arabia

Saudi Arabia stands to benefit from increased "oil exports" and a strengthened "bilateral relations" with India, a major energy consumer. The venture allows for "diversification" of its revenue streams, reducing its dependence on a single market. This "economic cooperation" underscores the mutually beneficial nature of the partnership, solidifying their "strategic partnership."

- Specific economic indicators to show growth in India: Increased GDP growth, reduced trade deficit, higher employment rates.

- Potential for increased trade between the two countries: Expansion of trade in petroleum products and other related goods and services.

- Strengthened diplomatic ties and regional influence: Enhanced cooperation on energy security and regional stability.

Technological and Infrastructure Aspects

The successful implementation of this project hinges on advancements in "oil refining technology" and a robust supporting infrastructure.

Technology Transfer and Expertise

The joint venture presents a unique opportunity for "technology transfer" from Saudi Arabia to India. Saudi Aramco, renowned for its expertise in oil refining, is expected to share its advanced technologies with Indian partners. This "expertise sharing" will enhance India's technological capabilities in the petroleum sector and propel "advanced technology" adoption.

Infrastructure Development

Significant "infrastructure development" will be necessary. This includes the construction of pipelines to transport crude oil from import terminals to the refineries, efficient "transportation" networks to distribute refined products, and modern storage facilities. The development of this robust "pipeline network" and improved logistics are crucial to the project's success.

- Specific technologies to be implemented in the refineries: Advanced refining processes, efficient energy management systems, and environmental protection technologies.

- Infrastructure projects related to the refinery project: New pipelines, transportation networks, storage tanks, and supporting utilities.

- Environmental impact assessments and mitigation strategies: Comprehensive environmental studies and implementation of sustainable practices to minimize the environmental footprint.

Geopolitical Implications of the Joint Venture

The "India-Saudi Arabia joint venture" carries significant "geopolitical implications," shaping regional dynamics and influencing the global energy market.

Strengthening Bilateral Ties

The joint venture signifies a substantial strengthening of the "strategic partnership" between India and Saudi Arabia. This collaboration enhances "regional stability" and promotes closer "energy cooperation" within the region. It fosters mutual trust and understanding, paving the way for future collaborations in diverse sectors.

Global Energy Market Impact

The venture's impact on the "global energy market" will be notable. The increased refining capacity will influence "oil prices" and potentially shift global "supply chain" dynamics. Increased competition in the refining sector could lead to more affordable petroleum products for consumers. The joint venture's impact on "market competition" and energy security will be felt globally.

- Potential impact on oil prices in the region and globally: Potentially lower oil prices due to increased supply.

- Changes in global energy supply dynamics: Improved diversification of supply sources and enhanced energy security.

- Potential influence on regional power dynamics: Strengthened strategic partnerships and enhanced regional stability.

Conclusion

The planned construction of two new oil refineries through the "India-Saudi Arabia joint venture" represents a landmark achievement, promising substantial economic and geopolitical benefits for both nations. The project's technological and infrastructural components will require substantial investment and careful planning. This strategic partnership will redefine the energy landscape of the region, enhancing energy security and promoting economic growth. This "India-Saudi Arabia oil refinery joint venture" is not merely an economic undertaking; it is a powerful symbol of growing cooperation and a testament to the shared vision for a secure and prosperous future.

Call to Action: Stay informed about the latest developments in the "India-Saudi Arabia oil refinery joint venture." Follow reputable news sources and industry publications for updates on this significant project and similar energy initiatives shaping the global energy landscape. Learn more about the future of energy partnerships and their global impact.

Featured Posts

-

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

Exclusive Investigation Launched Into World Economic Forum Founder Klaus Schwab

Apr 24, 2025

Exclusive Investigation Launched Into World Economic Forum Founder Klaus Schwab

Apr 24, 2025 -

The Countrys Hottest New Business Locations A Comprehensive Map

Apr 24, 2025

The Countrys Hottest New Business Locations A Comprehensive Map

Apr 24, 2025 -

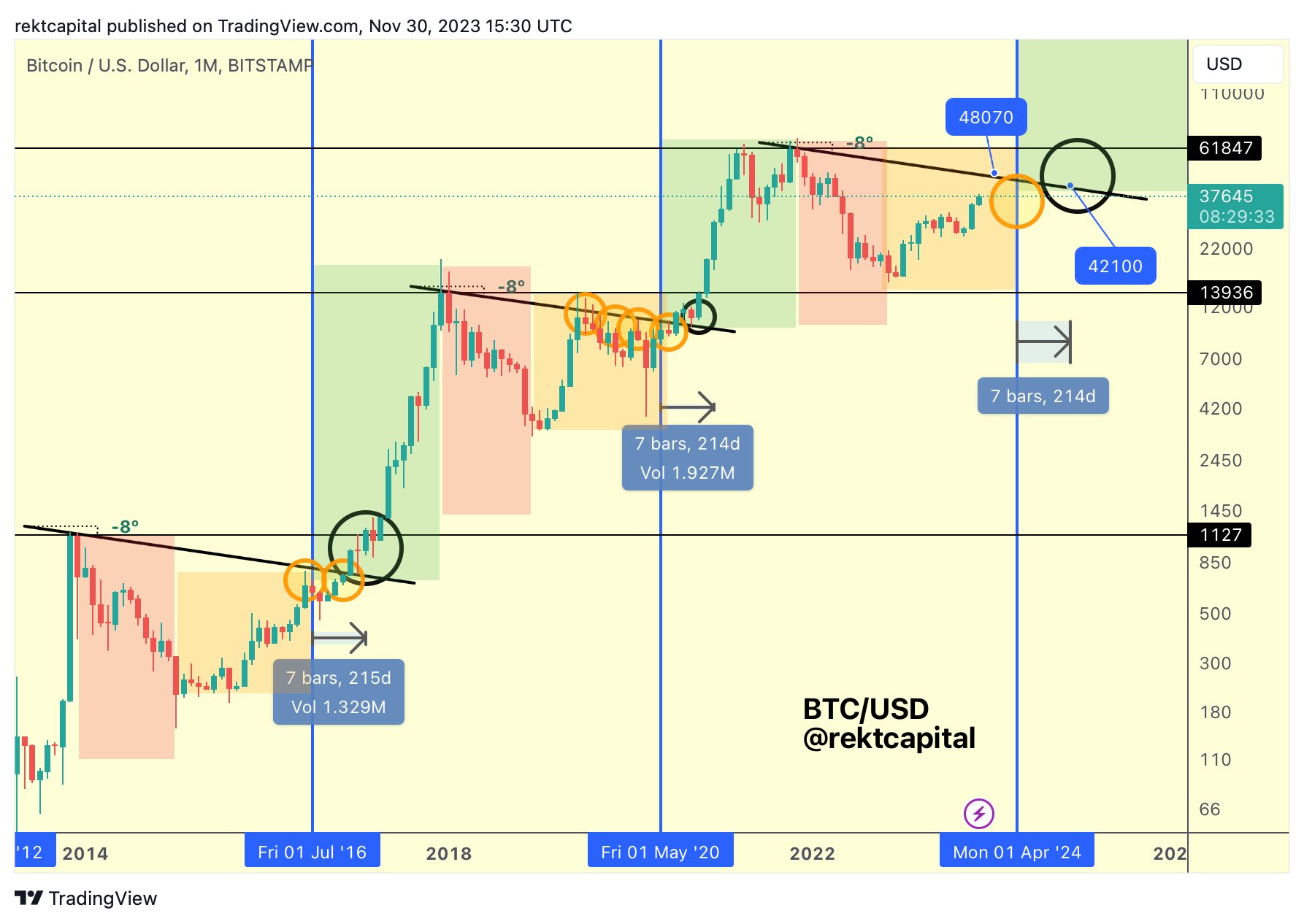

Bitcoin Btc Rally How Trumps Actions And Fed Decisions Are Affecting The Market

Apr 24, 2025

Bitcoin Btc Rally How Trumps Actions And Fed Decisions Are Affecting The Market

Apr 24, 2025 -

Body Found After Swimmer Vanishes Near Shark Infested Israeli Beach

Apr 24, 2025

Body Found After Swimmer Vanishes Near Shark Infested Israeli Beach

Apr 24, 2025