Indian Stock Market Rally: 5 Key Factors Behind Sensex And Nifty's Sharp Increase

Table of Contents

Foreign Institutional Investor (FII) Inflows

Foreign Institutional Investors (FIIs) have played a pivotal role in the recent Indian stock market rally. Increased FII investment, a critical component of portfolio investment in India, signals strong international confidence in the Indian economy. Several factors have contributed to this surge in foreign investment:

- Positive Economic Outlook: India's robust economic growth projections, despite global uncertainties, have attracted significant FII interest. The consistent expansion of the Indian economy makes it an attractive destination for long-term investment.

- Improving Corporate Earnings: Strong corporate earnings from numerous Indian companies have further solidified the appeal of the Indian stock market. High profit margins and consistent revenue growth indicate a healthy and expanding business environment.

- Attractive Valuations: Compared to other global markets, the Indian stock market has presented attractive valuations, making it a compelling investment opportunity for FIIs seeking higher returns.

- Government Reforms: Pro-business reforms implemented by the Indian government have fostered a more investor-friendly environment, bolstering confidence and encouraging greater FII participation.

Data from the past few months reveals a significant increase in FII inflows, bolstering the Sensex and Nifty's upward trajectory and contributing significantly to the overall Indian stock market increase.

Robust Corporate Earnings

The impressive performance of Indian companies has been another major driver of the recent stock market rally. Strong corporate earnings, marked by significant profit growth and expanding revenue streams across various sectors, have fueled investor optimism and underpinned the remarkable rise in the Sensex and Nifty.

- Top-Performing Sectors: Key sectors like Information Technology, Pharmaceuticals, and Financials have demonstrated exceptional performance, contributing substantially to the overall market increase.

- Increased Domestic Demand: Robust domestic demand, fueled by a growing middle class and rising disposable incomes, has significantly boosted the revenues of many Indian companies.

- Successful Exports: Successful exports to global markets have added to the impressive earnings of several Indian companies, further underpinning investor confidence and driving stock prices higher.

Charts illustrating the impressive earnings growth across various Sensex and Nifty companies vividly demonstrate the positive trend that has propelled the Indian stock market rally.

Government Initiatives and Reforms

The proactive role of the Indian government in implementing economic reforms and fostering a business-friendly environment has played a crucial role in the current market surge. Several key government initiatives have directly contributed to the positive sentiment surrounding the Indian stock market:

- Infrastructure Development: Significant investments in infrastructure projects across the country have improved connectivity, logistics, and overall economic efficiency, attracting investment and boosting growth.

- Tax Reforms: Various tax reforms aimed at simplifying the tax structure and promoting ease of doing business have created a more conducive environment for businesses to flourish.

- Ease of Doing Business Initiatives: Continuous efforts to improve the ease of doing business in India have made the country a more attractive destination for both domestic and foreign investment, boosting the overall Indian growth story.

Specific government announcements and policy changes have directly influenced market sentiment, contributing to the recent surge and further cementing the positive outlook for the Indian stock market.

Positive Global Sentiment

Positive global economic indicators and a relatively stable geopolitical environment have also contributed to the buoyancy of the Indian stock market. The favorable global climate has created a more optimistic outlook for international investors, leading to increased investments in emerging markets like India.

- Easing Inflation (in some regions): Easing inflation in certain major economies has reduced concerns about global economic slowdown, creating a more conducive environment for global investment.

- India's Relative Stability: Compared to other global markets experiencing greater volatility, India's relative stability and consistent growth trajectory have made it an attractive haven for international investors.

Increased Domestic Investor Participation

The increasing participation of domestic investors, including retail investors and mutual funds, has been another critical factor in the recent Indian stock market rally. This growing involvement reflects increased awareness, improved accessibility to investment platforms, and the attractive returns generated by the market.

- Role of Mutual Funds: Mutual funds have played a crucial role in attracting a wider range of domestic investors by providing convenient and diversified investment options.

- Growing Retail Investor Base: Data indicates a significant increase in the number of retail investors participating in the stock market, further contributing to the market's upward momentum.

This surge in domestic investment reflects a growing confidence in the Indian economy and its potential for long-term growth.

Conclusion

The remarkable Indian stock market rally, witnessed in the recent performance of the Sensex and Nifty, is a result of a potent combination of factors. Foreign Institutional Investor inflows, robust corporate earnings, supportive government initiatives, positive global sentiment, and increased domestic investor participation have all contributed to this impressive surge. Understanding these key drivers is crucial to analyzing the Sensex and Nifty trends and navigating the Indian stock market effectively. To capitalize on the Indian stock market's growth, stay informed about market developments and consider investing strategically. Further resources and investment advice can be found [insert relevant links here]. Understand the Indian stock market rally and its nuances to make informed investment decisions.

Featured Posts

-

Elon Musks Net Worth Falls Below 300 Billion

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion

May 10, 2025 -

Dakota Johnson Kraujingos Plintos Nuotraukos Kas Nutiko

May 10, 2025

Dakota Johnson Kraujingos Plintos Nuotraukos Kas Nutiko

May 10, 2025 -

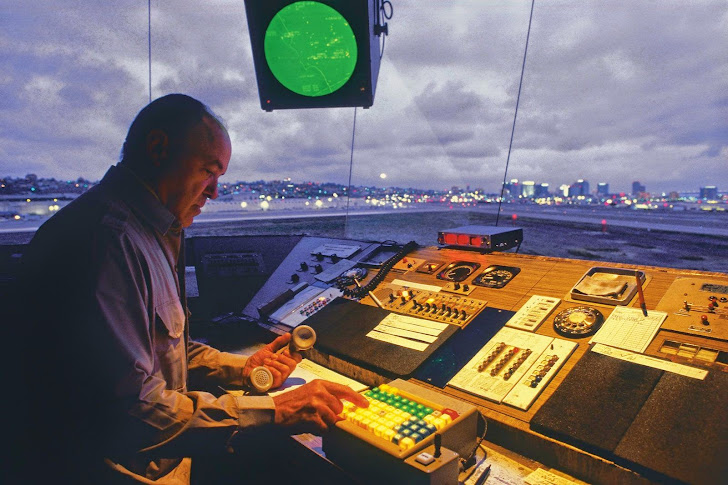

Newark Air Traffic Control System Failure Months Of Prior Safety Concerns Highlighted

May 10, 2025

Newark Air Traffic Control System Failure Months Of Prior Safety Concerns Highlighted

May 10, 2025 -

Uk Visa Crackdown Increased Scrutiny For Nigerian And Other Nationals

May 10, 2025

Uk Visa Crackdown Increased Scrutiny For Nigerian And Other Nationals

May 10, 2025 -

9 Young Nhl Stars With The Potential To Eclipse Ovechkins Goal Total

May 10, 2025

9 Young Nhl Stars With The Potential To Eclipse Ovechkins Goal Total

May 10, 2025