India's Greenko: Founders Target Orix Stake Acquisition

Table of Contents

Greenko's Current Position and Growth Trajectory

Greenko Group has rapidly established itself as a leader in India's renewable energy sector. Its diverse portfolio includes a significant presence in wind, solar, and hydro energy projects, making it a key contributor to India's ambitious renewable energy targets. Greenko's impressive growth trajectory is fueled by its strategic investments, technological advancements, and commitment to sustainable practices. The company's success is evident in its current market position and its ambitious expansion plans.

Greenko's energy portfolio boasts substantial renewable energy capacity, making it a dominant force in the Indian renewable energy market. Their strategic approach to project development and operation is key to their success.

- Successful completion of the 1.2 GW wind farm project in Andhra Pradesh.

- Leadership position in the solar energy segment, with multiple large-scale projects operational across the country.

- Planned expansion into the burgeoning renewable energy market of Gujarat and Rajasthan.

- Significant investment in energy storage solutions to enhance grid stability and reliability.

This consistent growth reflects Greenko's commitment to expanding its renewable energy capacity and its strong presence within the Indian renewable energy market. Their continued success underscores their position as a major player in the sector's ongoing development.

Orix Corporation's Stake and its Strategic Value

Orix Corporation holds a significant stake in Greenko, representing a substantial investment in the Indian renewable energy market. The precise percentage of Orix's stake remains undisclosed but is speculated to be substantial. Orix's involvement has provided Greenko with crucial financial backing and strategic expertise, contributing significantly to its growth. The strategic rationale behind Orix's potential divestment is likely a combination of factors, including their overall investment strategy and potentially taking profits from a successful investment.

For Greenko's founders, acquiring Orix's stake offers several key strategic benefits:

- Enhanced control and decision-making power: A complete acquisition would give founders full autonomy over the company's future direction.

- Elimination of potential future conflicts: This move would streamline the company's ownership structure.

- Strengthened financial position: Consolidating ownership could lead to improved access to further funding.

Key aspects of Orix's involvement include:

- Percentage of stake held by Orix: (Specific percentage to be inserted once disclosed)

- Duration of Orix's investment: (Specific timeframe to be inserted once disclosed)

- Reasons speculated for Orix's potential exit: (Potential reasons to be added based on further information).

Implications of the Acquisition for the Indian Renewable Energy Sector

The acquisition’s implications extend far beyond Greenko, potentially impacting the entire Indian renewable energy sector. Increased market share for Greenko could intensify competition, spurring innovation and investment from other players. The deal could signal increased confidence in the Indian renewable energy market, attracting further foreign direct investment (FDI) and accelerating the country's progress towards its renewable energy targets. It could also influence government policies and regulations, perhaps prompting supportive measures to boost further development in the sector.

Potential consequences of this acquisition include:

- Increased market share for Greenko, potentially leading to changes in market dynamics.

- Impact on other renewable energy players, potentially forcing them to adapt and innovate to stay competitive.

- Potential for further investment in the sector, attracting both domestic and international investors.

- Significant contribution to India's ambitious renewable energy targets.

Financing and the Acquisition Process

The financing of this substantial acquisition is a crucial aspect. Various options are likely under consideration, including a mix of debt financing (loans) and equity financing (raising additional capital). The acquisition process itself will involve several steps, including due diligence, regulatory approvals, and negotiations between the parties involved. The timeline for completion remains uncertain, dependent on the complexities of such a large-scale transaction.

Key aspects of the financing and acquisition process include:

- Potential funding sources: A mix of debt and equity financing is likely.

- Estimated acquisition cost: (Specific figure to be added once disclosed)

- Regulatory approvals required: Significant regulatory hurdles are expected, given the scale of the deal.

Conclusion

The potential acquisition of Orix's stake by Greenko's founders represents a significant development in India's renewable energy sector. This deal could reshape the competitive landscape, attract further investment, and accelerate the country's transition to cleaner energy sources. It highlights the growing importance of the Indian renewable energy market on a global scale, attracting substantial international investment. Greenko's ambitious growth strategy and the implications of this acquisition will undoubtedly shape the future of renewable energy in India.

Stay updated on the latest developments in the Greenko Orix stake acquisition and its impact on India's renewable energy future. Follow us for more insights on Greenko's growth and the Indian renewable energy market.

Featured Posts

-

Canadian Tire Acquires Hudsons Bay Brand Assets For 30 Million

May 17, 2025

Canadian Tire Acquires Hudsons Bay Brand Assets For 30 Million

May 17, 2025 -

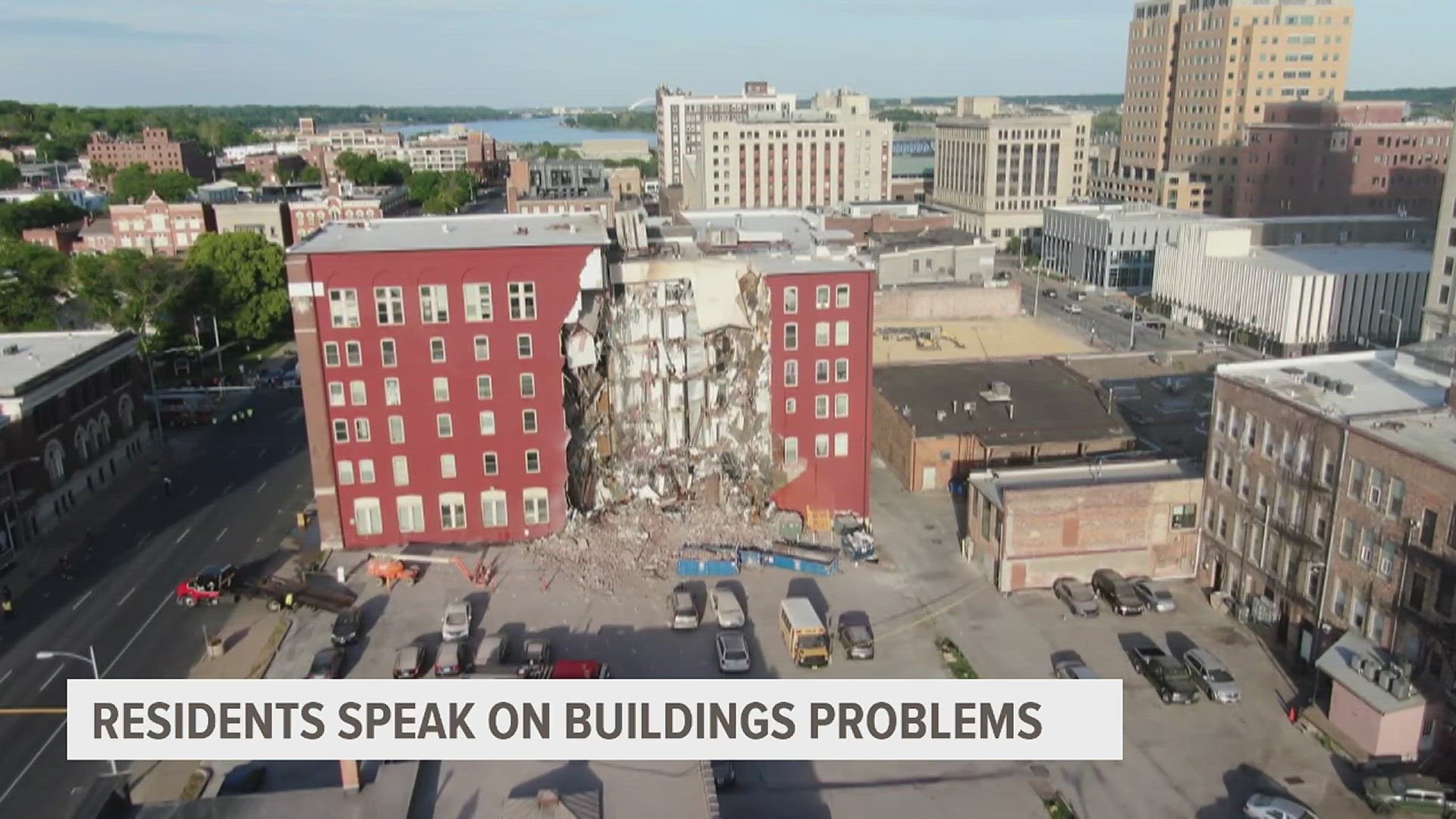

Davenport Council Votes To Demolish Apartment Building

May 17, 2025

Davenport Council Votes To Demolish Apartment Building

May 17, 2025 -

Donors Promised Exclusive Vip Experience At Military Events Featuring Trump

May 17, 2025

Donors Promised Exclusive Vip Experience At Military Events Featuring Trump

May 17, 2025 -

Andor Season 2 Timeline The Possibility Of Rebels Crossovers

May 17, 2025

Andor Season 2 Timeline The Possibility Of Rebels Crossovers

May 17, 2025 -

Justes Jocytes Karjeros Etapas Vilerbane Oficialus Pabaigos Patvirtinimas

May 17, 2025

Justes Jocytes Karjeros Etapas Vilerbane Oficialus Pabaigos Patvirtinimas

May 17, 2025