India's Stock Market Surge: A Deep Dive Into The Nifty's Rally

Table of Contents

Economic Fundamentals Driving the Nifty's Rise

Several robust economic fundamentals have fueled the Nifty's impressive climb. These factors contribute to a positive economic outlook, attracting both domestic and international investment.

Strong GDP Growth

India's robust GDP growth has been a significant catalyst for the Nifty's rally. The Indian economy has consistently demonstrated impressive growth figures, exceeding expectations in several quarters.

- GDP Growth Rates: India's GDP growth has consistently hovered around X% in recent quarters, showcasing the resilience of the Indian economy.

- Contributing Sectors: Key sectors like manufacturing, services, and technology have been major contributors to this strong GDP growth.

- Positive Forecasts: Experts predict continued growth, further bolstering investor confidence and contributing to the positive economic outlook. This strengthens the belief in a sustained Nifty rally. These positive economic indicators directly impact investor sentiment and drive market performance.

Increased Foreign Institutional Investor (FII) Investments

The influx of Foreign Institutional Investor (FII) investments has played a crucial role in boosting the Nifty's performance. These global investment flows are indicative of growing confidence in the Indian market.

- Quantifying FII Investments: FIIs have invested billions of dollars into the Indian stock market in recent months.

- Reasons for Increased Interest: The attractive valuations of Indian stocks, coupled with the positive economic outlook, have attracted significant foreign portfolio investment. The robust growth story of the Indian economy makes it an appealing investment destination.

- Potential Risks: While FII inflows are positive, dependence on them presents a risk. Changes in global market sentiment or geopolitical events could lead to capital outflows, impacting market capitalization.

Government Policies and Reforms

Government initiatives aimed at economic reforms and infrastructure development have also significantly influenced investor confidence and market performance.

- Specific Policies: The government's focus on infrastructure development, ease of doing business reforms, and digitalization initiatives have created a positive investment climate.

- Impact on Investor Confidence: These policies signal a commitment to long-term economic growth, attracting both domestic and foreign investment, contributing to a positive market sentiment. This improved ease of doing business has resulted in increased foreign investment flows.

Sector-Specific Performances Contributing to the Nifty Rally

The Nifty's rise isn't solely driven by macroeconomic factors; strong performances within specific sectors have significantly contributed to the overall rally.

IT Sector Boom

The Information Technology (IT) sector has been a star performer, significantly bolstering the Nifty's growth.

- Key Players: Leading IT companies have reported strong earnings, driven by increased global demand for IT services and technological advancements.

- Growth Drivers: The global demand for software and IT services, coupled with technological advancements in areas like AI and cloud computing, has fueled the sector's growth. Software exports continue to increase significantly.

- Future Prospects: Experts anticipate continued growth in the IT sector, contributing to the positive outlook for the Nifty. Tech stocks continue to be a leading factor in the increase of the market capitalization.

Financial Services Sector Growth

The financial services sector, encompassing banking, insurance, and Non-Banking Financial Companies (NBFCs), has also experienced substantial growth, impacting the overall market positively.

- Growth Drivers: Increased credit growth, rising insurance penetration, and improving financial inclusion have fueled the growth of the financial services sector.

- Challenges: While showing strong growth, this sector also faces challenges like managing non-performing assets (NPAs) and adapting to evolving regulations.

Other Key Performing Sectors

Besides IT and financial services, other sectors have also contributed to the Nifty's rally, including:

- Pharmaceutical Industry: The pharmaceutical sector has benefited from increased demand both domestically and internationally.

- Consumer Goods: The consumer goods sector reflects the growing purchasing power and consumption patterns of the Indian population.

- Manufacturing Sector: The manufacturing sector's growth shows the overall strength of the Indian economy and further enhances a positive economic outlook.

Potential Risks and Future Outlook for the Nifty

While the Nifty's performance has been impressive, several potential risks and uncertainties could impact its future trajectory.

Global Economic Headwinds

Global economic headwinds pose a significant risk to the Indian stock market.

- Inflation: Global inflation and interest rate hikes could impact investment flows and investor sentiment.

- Geopolitical Risks: Geopolitical uncertainties and conflicts can create volatility in the market.

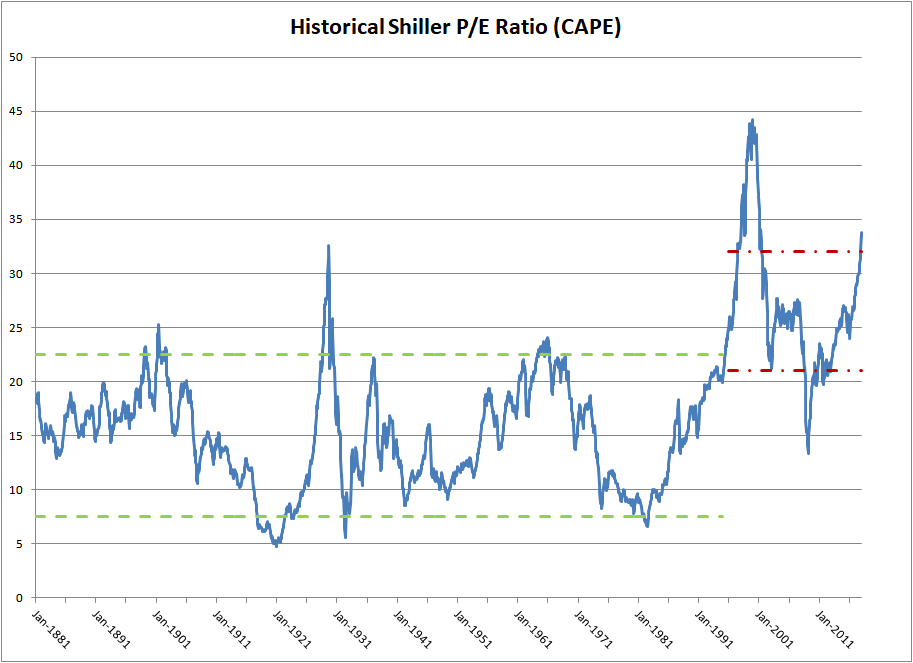

Valuation Concerns

The current Nifty valuations need careful consideration.

- Price-to-Earnings Ratio: Analyzing price-to-earnings ratios (P/E) and other valuation metrics is crucial to assess whether the current levels are sustainably high.

- Stock Market Corrections: Potential market corrections are a possibility, highlighting the need for careful risk management.

Predicting Future Trends

Predicting future trends for the Nifty requires a cautious approach, considering both potential growth areas and challenges.

- Potential Growth Areas: Continued strong economic fundamentals, government reforms, and technological advancements could drive further growth.

- Potential Challenges: Global economic uncertainty, valuation concerns, and potential market corrections pose challenges to the sustained upward trend.

Conclusion: Navigating India's Stock Market Surge: Understanding the Nifty's Rally

The Nifty's impressive rally is a result of a confluence of factors: strong economic fundamentals, increased FII investments, and robust sector-specific performances, particularly in the IT and financial services sectors. However, potential risks like global economic headwinds and valuation concerns need careful consideration. Understanding these underlying factors is crucial for investors navigating India's dynamic stock market. Before making any investment decisions, thorough research into the Nifty 50 and the broader Indian stock market is essential. Consult with a financial advisor for personalized guidance and explore credible resources for further information on the Indian stock market and the Nifty 50 index. Informed decision-making is paramount in successfully navigating the dynamic landscape of India's stock market surge.

Featured Posts

-

Ella Bleu Travoltas Stunning Transformation A Fashion Magazine Debut

Apr 24, 2025

Ella Bleu Travoltas Stunning Transformation A Fashion Magazine Debut

Apr 24, 2025 -

Understanding The Value Proposition Of Middle Management Benefits For Companies And Their Staff

Apr 24, 2025

Understanding The Value Proposition Of Middle Management Benefits For Companies And Their Staff

Apr 24, 2025 -

Trumps Budget Cuts And The Intensification Of Tornado Season

Apr 24, 2025

Trumps Budget Cuts And The Intensification Of Tornado Season

Apr 24, 2025 -

Bof A On Stock Market Valuations Why Investors Shouldnt Be Alarmed

Apr 24, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Be Alarmed

Apr 24, 2025 -

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025