India's Stock Market Today: Choppy Trading Despite Flat Close

Table of Contents

Key Indices Performance

India's major stock market indices experienced a rollercoaster ride today. While the market ultimately closed near its opening levels, significant fluctuations marked the session. Let's examine the performance of the Nifty 50 and the Sensex, two key indicators of India's Stock Market performance.

-

Nifty 50: The Nifty 50 index closed at [Insert Closing Value] today, representing a [Insert Percentage Change]% change from its previous closing. Trading volume reached [Insert Volume Traded], indicating [Insert Interpretation of Volume – e.g., moderate activity, high volatility].

-

Sensex: Similarly, the Sensex closed at [Insert Closing Value], showing a [Insert Percentage Change]% change from yesterday's close. The volume traded was [Insert Volume Traded], suggesting [Insert Interpretation of Volume – e.g., a relatively active trading day].

The relatively flat closing values, despite significant intraday swings, suggest a battle between bullish and bearish sentiments within the Indian Stock Market Indices. Analyzing the high and low values throughout the day (Nifty 50 High: [Insert High Value], Low: [Insert Low Value]; Sensex High: [Insert High Value], Low: [Insert Low Value]) further emphasizes the market's volatility. The overall market sentiment reflected in these closing values appears cautious, awaiting further cues.

Sectoral Trends

A closer look at sectoral performance reveals a mixed bag. While some sectors thrived, others struggled, highlighting the diverse dynamics within India's Stock Market Sectors.

-

IT Sector: The IT sector experienced a [Insert Percentage Change]% change, [Insert Reason - e.g., driven by positive global tech outlook/concerns about slowing global growth]. This sector remains sensitive to global macroeconomic factors and currency fluctuations.

-

Banking & Finance Sector: The Banking & Finance sector saw a [Insert Percentage Change]% change, [Insert Reason - e.g., influenced by RBI policy decisions/concerns about credit growth]. This sector's performance is often a barometer of the overall economic health of the country.

-

FMCG Sector: The FMCG sector exhibited a [Insert Percentage Change]% change, [Insert Reason - e.g., largely stable due to consistent consumer demand/ impacted by rising input costs]. This sector is generally considered less volatile compared to others.

-

Pharma Sector: The Pharma sector saw a [Insert Percentage Change]% change [Insert Reason - e.g., driven by positive regulatory updates/ concerns about pricing pressures]. The performance is often linked to regulatory changes and global demand.

Other significant sector movements included [Mention other significant sector movements and their reasons]. This analysis of sectoral trends provides a deeper understanding of the factors shaping India's Stock Market Trends.

Factors Influencing Market Volatility

The choppy trading witnessed today was influenced by a confluence of factors impacting India Stock Market Volatility.

-

Global Interest Rate Hikes: Continued global interest rate hikes by major central banks are impacting investor sentiment and increasing borrowing costs, thereby influencing investment decisions in India.

-

Crude Oil Prices: Fluctuations in crude oil prices have a ripple effect on various sectors in India, especially impacting inflation and impacting business costs. The current price trends are [Insert Current Trend and its Impact].

-

Geopolitical Events: Ongoing geopolitical uncertainties [Insert Specific Geopolitical Events] are adding to market uncertainty, creating a risk-averse environment.

-

Earnings Reports: Recent earnings reports from major companies [Insert Specific Company and its impact] have had a significant effect on market sentiment, influencing investor perceptions.

-

FII Activity: The activity of Foreign Institutional Investors (FII) is crucial for India's stock market. [Insert details about FII activity and its impact – e.g., net selling/buying pressure].

Expert Opinion and Predictions

Market analysts offer diverse perspectives on the near-term outlook for India's Stock Market Forecast.

-

"[Quote from a renowned market analyst],” stated [Analyst's Name], highlighting [Key takeaway from the quote].

-

Predictions for the coming week/month range from [Mention range of predictions, e.g., cautious optimism to moderate correction], depending on the unfolding of global and domestic events.

-

The advice for investors based on expert opinions leans towards [Summarize investor advice, e.g., maintaining a diversified portfolio, adopting a wait-and-watch approach]. Understanding expert analysis is crucial for informed Investment Advice India.

Conclusion

Today's session in India's stock market showcased significant volatility, resulting in choppy trading despite a relatively flat close. Key indices like the Nifty 50 and Sensex experienced considerable intraday swings, reflecting the interplay of global macroeconomic factors, sectoral trends, and specific company news. The influence of global interest rate hikes, crude oil prices, geopolitical events, earnings reports, and FII activity all contributed to the day's uncertainty. Market experts offer a mixed outlook, advising investors to remain cautious and well-informed.

Stay informed about the dynamic developments in India's stock market by regularly checking our website for up-to-date news and analysis on India's stock market performance and trends. Understand the intricacies of India's stock market to make informed investment decisions. Keep track of the latest updates on India's Stock Market News and India Stock Market Analysis for a better understanding of this complex and dynamic market.

Featured Posts

-

2025 Hurun Global Rich List Elon Musks Billions Lost But Still Number One

May 10, 2025

2025 Hurun Global Rich List Elon Musks Billions Lost But Still Number One

May 10, 2025 -

Weight Watchers Bankruptcy Filing Amidst Weight Loss Drug Rise

May 10, 2025

Weight Watchers Bankruptcy Filing Amidst Weight Loss Drug Rise

May 10, 2025 -

Bondi Faces Scrutiny Senate Democrats Allege Concealment Of Epstein Documents

May 10, 2025

Bondi Faces Scrutiny Senate Democrats Allege Concealment Of Epstein Documents

May 10, 2025 -

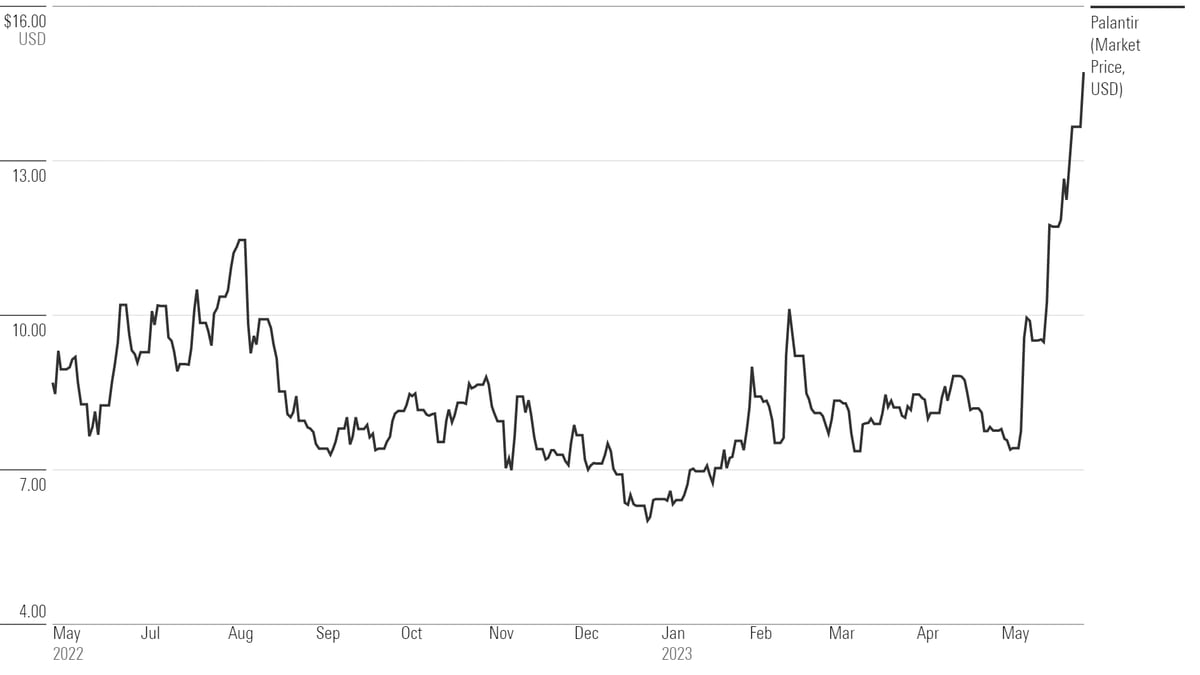

Two Stocks Poised To Surpass Palantirs Value In 3 Years

May 10, 2025

Two Stocks Poised To Surpass Palantirs Value In 3 Years

May 10, 2025 -

Who Is Jeanine Pirro Education Net Worth And Professional Achievements

May 10, 2025

Who Is Jeanine Pirro Education Net Worth And Professional Achievements

May 10, 2025