Two Stocks Poised To Surpass Palantir's Value In 3 Years

Table of Contents

Stock #1: Dataminr – The Data Analytics Disruptor

Dataminr is a real-time data analytics company that leverages AI and machine learning to analyze public data streams, providing actionable insights for its clients. Its technology offers a significant competitive advantage over Palantir, making it a strong contender for surpassing Palantir's market valuation.

Superior Technology and Scalability

Dataminr's proprietary technology distinguishes it from competitors. Its AI-powered platform processes vast amounts of unstructured data from public sources, including social media, news articles, and blogs, far exceeding the speed and scale of many traditional data analytics solutions.

- Real-time processing: Dataminr's platform analyzes data in real-time, providing immediate insights, unlike Palantir's more batch-oriented processing approach.

- Advanced AI algorithms: Its unique algorithms identify significant patterns and trends far more efficiently than traditional keyword-based search.

- Global data coverage: Dataminr's platform aggregates data from various global sources, providing a comprehensive and nuanced understanding of events worldwide.

This superior technology allows Dataminr to serve a wide range of clients, from financial institutions needing real-time market intelligence to government agencies requiring rapid threat detection. This scalability positions Dataminr for significant future growth within the rapidly expanding big data and AI markets.

Strong Market Position and Growth Potential

Dataminr boasts an impressive client base, including major financial institutions, news organizations, and government agencies. This strong market position provides a solid foundation for future growth. Analyst reports predict strong revenue growth in the coming years, fueled by increasing demand for real-time data analytics solutions.

- High customer retention: Dataminr enjoys high customer retention rates, indicating strong customer satisfaction and the value of its services.

- Expanding market share: The company is actively expanding its market share in both the public and private sectors.

- Significant growth projections: Industry analysts project an annual revenue growth rate exceeding 30% for the next three years, outpacing Palantir's projected growth.

This combination of a strong existing market position and significant growth potential positions Dataminr favorably against Palantir in terms of future valuation.

Financial Performance and Valuation

While Dataminr is a privately held company, its revenue growth and strong client base suggest a substantial valuation, potentially exceeding Palantir's within three years. The company's strong financial performance, characterized by high revenue growth and increasing profitability, supports this projection. Once publicly traded, its market capitalization is predicted to surpass Palantir's based on current growth trajectory.

- High revenue growth: Dataminr demonstrates consistently high year-over-year revenue growth.

- Improving profitability: The company shows signs of increasing profitability as it scales its operations.

- Strategic investments: Strategic investments in research and development further strengthen Dataminr's technological edge and long-term growth prospects.

Stock #2: CrowdStrike – The Emerging Leader in Cybersecurity

CrowdStrike is a leading cybersecurity company providing cloud-native protection against sophisticated cyber threats. Its innovative approach and strong market position make it another prime candidate to surpass Palantir's value within three years.

First-Mover Advantage and Innovation

CrowdStrike’s cloud-native security platform, built from the ground up for the cloud, offers superior protection compared to traditional on-premise solutions. This first-mover advantage gives it a significant competitive edge in the rapidly expanding cybersecurity market.

- Endpoint Detection and Response (EDR): CrowdStrike's EDR solution is highly regarded for its proactive threat detection and response capabilities.

- AI-powered threat intelligence: Its platform leverages AI and machine learning to identify and respond to emerging threats in real-time.

- Scalability and ease of use: CrowdStrike's cloud-based platform is highly scalable and easy to deploy, making it attractive to businesses of all sizes.

Strategic Partnerships and Acquisitions

CrowdStrike has formed several strategic partnerships and made acquisitions to expand its product offerings and market reach, further enhancing its competitive advantage.

- Strategic alliances: Partnerships with other security vendors expand CrowdStrike's ecosystem and enhance its overall security capabilities.

- Strategic acquisitions: Acquisitions have broadened CrowdStrike's product portfolio and expanded its expertise into related security areas.

- Global expansion: CrowdStrike is aggressively expanding its global presence, strengthening its market leadership and revenue streams.

Robust Financial Outlook and Long-Term Vision

CrowdStrike boasts strong financial performance, with high revenue growth and increasing profitability. Its long-term strategic vision focuses on innovation and expansion within the expanding cybersecurity market, positioning it for continued success.

- High revenue growth: CrowdStrike demonstrates consistent and rapid year-over-year revenue growth.

- Increasing profitability: The company is steadily improving its profitability margins.

- Strong investor confidence: High investor confidence is reflected in the company's strong stock performance.

Conclusion: Investing in the Future – Beyond Palantir

Both Dataminr and CrowdStrike exhibit strong technological capabilities, impressive market positions, and robust financial outlooks. Their innovative approaches, coupled with the rapidly expanding markets they serve, position them as compelling alternatives to Palantir, with the potential to significantly outperform it in the next three years. These two stocks represent compelling investment opportunities for those seeking high-growth potential in the data analytics and cybersecurity sectors. Invest in the future and discover more about these two stocks poised to surpass Palantir's value, and explore alternative investments to Palantir by researching their respective websites and consulting reputable financial news sources. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Top Live Music And Events In Lake Charles During Easter Weekend

May 10, 2025

Top Live Music And Events In Lake Charles During Easter Weekend

May 10, 2025 -

Unprovoked Killing Highlights Rise In Racist Hate Crimes

May 10, 2025

Unprovoked Killing Highlights Rise In Racist Hate Crimes

May 10, 2025 -

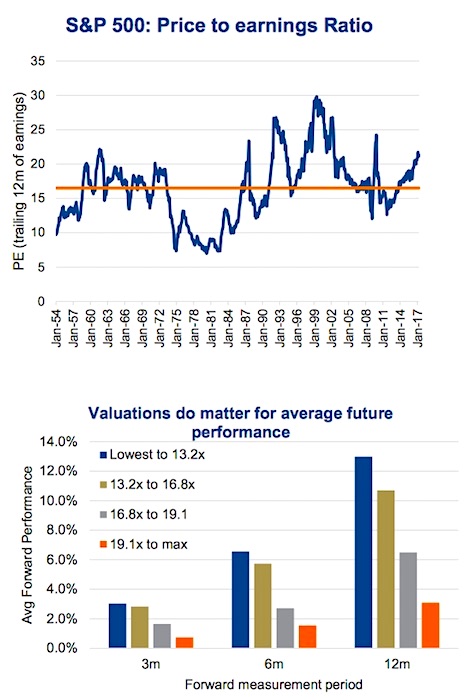

Navigating High Stock Market Valuations Advice From Bof A

May 10, 2025

Navigating High Stock Market Valuations Advice From Bof A

May 10, 2025 -

High Potential Still A Psych Spiritual Powerhouse 11 Years On

May 10, 2025

High Potential Still A Psych Spiritual Powerhouse 11 Years On

May 10, 2025 -

Trumps Greenland Threats A Deeper Look At Denmarks Role

May 10, 2025

Trumps Greenland Threats A Deeper Look At Denmarks Role

May 10, 2025