Individual Investors And Market Corrections: A Case Study Of Recent Trends

Table of Contents

Understanding Market Corrections and Their Causes

Defining Market Corrections

A market correction is generally defined as a drop of 10% or more in a major market index, such as the S&P 500, from its recent peak. It's important to distinguish a correction from a bear market, which is a more sustained and significant decline of 20% or more. Corrections are typically shorter-lived and less severe than bear markets, often representing a temporary pullback within a longer-term upward trend. For example, the S&P 500 experienced several corrections in 2022, each lasting varying amounts of time and resulting in different percentage drops. These served as valuable learning experiences for navigating stock market volatility.

Common Causes of Market Corrections

Several factors can trigger market corrections. These often act in concert to create a perfect storm of negative sentiment leading to selling pressure. Some of the most common causes include:

- Economic recessions: A slowdown or contraction in economic activity often leads to decreased corporate profits and investor pessimism, driving down stock prices. The 2008 financial crisis is a prime example of a correction driven by an economic downturn.

- Geopolitical instability: Events such as wars, trade disputes, or political uncertainty can create market volatility and trigger sell-offs. The Russian invasion of Ukraine in 2022 significantly impacted global markets.

- Unexpected inflation surges: High inflation erodes purchasing power and can lead to central banks raising interest rates, impacting corporate earnings and investor confidence. The rapid inflation experienced in many countries in 2022 was a key driver of market corrections.

- Changes in monetary policy: Interest rate hikes by central banks to combat inflation can increase borrowing costs for businesses, slowing economic growth and impacting stock valuations. The Federal Reserve's interest rate increases in 2022 are a case in point.

- Overvaluation of assets: When asset prices (stocks, bonds, real estate) become significantly overvalued, a correction can occur as investors re-evaluate valuations and adjust their portfolios. The dot-com bubble burst in 2000 is a classic example.

Identifying Early Warning Signs

While predicting market corrections with certainty is impossible, several indicators may foreshadow a potential downturn:

- Inverted yield curve: When short-term interest rates exceed long-term rates, it's often seen as a recessionary signal.

- Weakening economic data: Decreasing consumer confidence, falling manufacturing output, and rising unemployment claims can all be warning signs.

- Increased market volatility: Sharp price swings and increased trading volume can indicate growing uncertainty and potential for a correction.

- Shifts in investor behavior: A surge in bearish sentiment, increased selling pressure, and a flight to safety (e.g., increased demand for government bonds) can precede a correction.

Strategies for Individual Investors During Market Corrections

Maintaining a Long-Term Perspective

The most crucial strategy during market corrections is maintaining a long-term perspective. Short-term market fluctuations are normal, and focusing on long-term goals is key. Avoid emotional decision-making based on short-term market noise.

- Importance of a diversified portfolio: A well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) can help mitigate losses during market downturns.

- Benefits of dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of market conditions, helps reduce the impact of volatility.

- Ignoring short-term market noise: Focus on your long-term investment plan and avoid making impulsive decisions based on daily market fluctuations.

Effective Risk Management Techniques

Effective risk management is crucial during market corrections. Strategies to mitigate losses include:

- Diversification across asset classes: Spreading investments across various asset classes reduces the overall portfolio's vulnerability to any single market segment's downturn.

- Appropriate asset allocation based on risk tolerance: Align your investment portfolio with your risk tolerance. More conservative investors should have a higher allocation to less volatile assets.

- Setting stop-loss orders: These orders automatically sell a security when it reaches a predetermined price, limiting potential losses.

- Hedging strategies: Techniques like using options or inverse ETFs can help protect against potential downside risk.

Opportunities During Market Downturns

Market corrections present opportunities for savvy investors. Undervalued assets can be purchased at discounted prices, potentially leading to significant long-term gains.

- Identifying undervalued stocks: Research companies with strong fundamentals whose stock prices have fallen disproportionately during the correction.

- Strategic asset allocation shifts: Rebalance your portfolio by shifting allocations towards assets that have underperformed and are now undervalued.

- Exploring alternative investments: Consider exploring alternative investment options, such as real estate or precious metals, which may offer diversification benefits during market corrections.

The Impact of Behavioral Finance on Individual Investor Decisions During Market Corrections

Emotional Investing and its Consequences

Fear and greed heavily influence investor behavior during market corrections. Fear can lead to panic selling, locking in losses, and missing out on potential recovery. Greed can cause investors to chase after quick gains, potentially leading to risky investments.

Cognitive Biases and Their Influence

Cognitive biases, such as confirmation bias (seeking information confirming pre-existing beliefs) and anchoring bias (over-reliance on initial information), can significantly distort investment decisions during market downturns.

Strategies to Overcome Emotional Biases

To manage emotions and make rational investment decisions:

- Develop a disciplined investment plan: Stick to your plan, even during market volatility.

- Seek professional advice: Consult a financial advisor for objective guidance.

- Practice mindfulness: Stay informed but avoid constant market monitoring, which can heighten anxiety.

Conclusion

Navigating market corrections requires a long-term perspective, effective risk management, and an understanding of behavioral finance. Sticking to a well-defined investment plan, diversifying your portfolio, and managing emotional biases are crucial for success. Remember that market corrections are a normal part of the investment cycle, and they present opportunities as well as challenges. By understanding the causes, identifying early warning signs, and employing sound investment strategies, individual investors can not only survive market downturns but potentially thrive. Learn more about navigating market corrections and developing a resilient investment strategy for your future financial success.

Featured Posts

-

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 28, 2025

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 28, 2025 -

Uae Travel Sim 10 Gb Data 15 Abu Dhabi Attraction Savings

Apr 28, 2025

Uae Travel Sim 10 Gb Data 15 Abu Dhabi Attraction Savings

Apr 28, 2025 -

Nascar Jack Link 500 Props And Best Bets Talladega Superspeedway 2025 Predictions

Apr 28, 2025

Nascar Jack Link 500 Props And Best Bets Talladega Superspeedway 2025 Predictions

Apr 28, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Solution For Repetitive Documents

Apr 28, 2025

Turning Poop Into Podcast Gold An Ai Powered Solution For Repetitive Documents

Apr 28, 2025 -

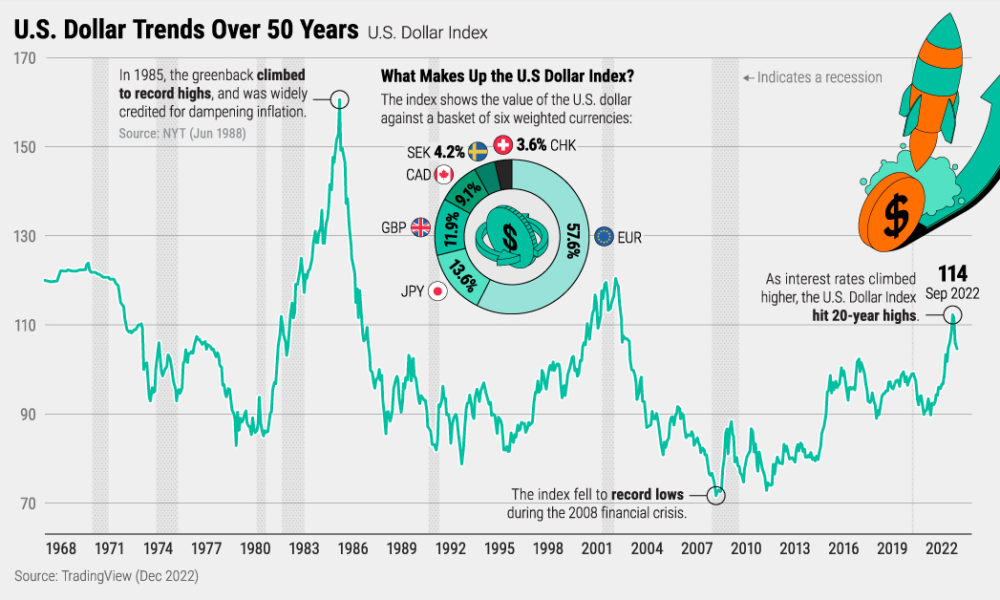

Nixons Shadow Evaluating The U S Dollars Performance After 100 Days

Apr 28, 2025

Nixons Shadow Evaluating The U S Dollars Performance After 100 Days

Apr 28, 2025