Nixon's Shadow: Evaluating The U.S. Dollar's Performance After 100 Days

Table of Contents

H2: The Immediate Aftermath: Analyzing Short-Term Fluctuations

The immediate aftermath of a major economic event significantly impacting the U.S. dollar is characterized by volatility in the currency markets.

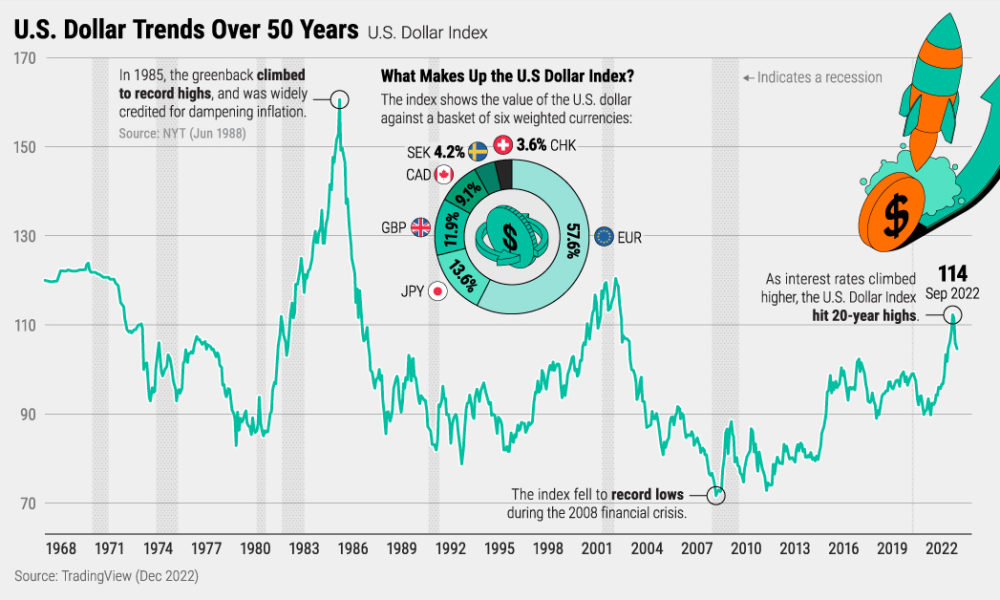

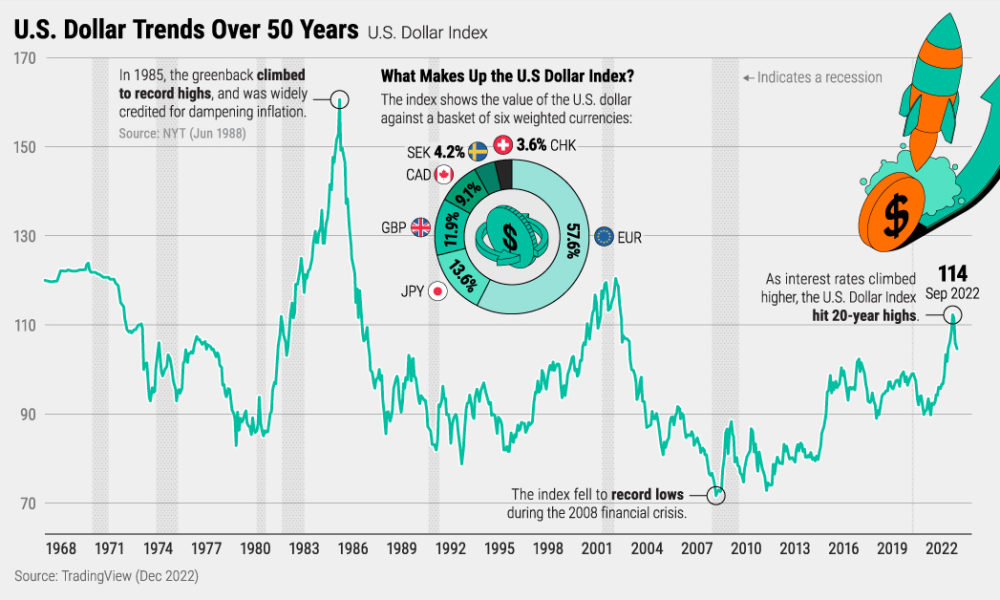

H3: Exchange Rate Volatility: The first 100 days following such an event would see dramatic shifts in the dollar's exchange rate against major world currencies.

- A hypothetical 10% devaluation against the Euro (EUR) could trigger a domino effect, influencing trading pairs like USD/JPY and GBP/USD.

- We might observe a flight to safety, strengthening the Japanese Yen (JPY) and potentially the Swiss Franc (CHF) as investors seek refuge from uncertainty.

- Conversely, emerging market currencies could experience significant depreciation, reflecting increased risk aversion.

[Insert graph here showing hypothetical exchange rate fluctuations of USD against EUR, JPY, and GBP over 100 days.]

H3: Market Reactions: Global financial markets would react swiftly.

- Stock markets could experience sharp declines, reflecting investor uncertainty and decreased confidence in the U.S. economy. The Dow Jones Industrial Average and the S&P 500 would likely show significant volatility.

- Commodity prices, particularly those denominated in USD, such as oil and gold, might experience price swings depending on the nature of the event and market speculation.

- Investor sentiment would plummet, leading to decreased investment in U.S. assets and potentially capital flight. Financial news sources would be filled with predictions and analyses.

H2: Economic Indicators: Inflation, Interest Rates, and GDP Growth

Analyzing key economic indicators provides a clearer picture of the U.S. dollar's performance following a significant event.

H3: Inflationary Pressures: Depending on the event, inflationary pressures could increase dramatically.

- The Consumer Price Index (CPI) might surge, reflecting increased costs of goods and services. This could be fueled by supply chain disruptions or increased demand.

- Producer Price Indices (PPI) would also be affected, showing rising production costs passed on to consumers.

- The potential for stagflation – a combination of slow economic growth and high inflation – becomes a significant concern.

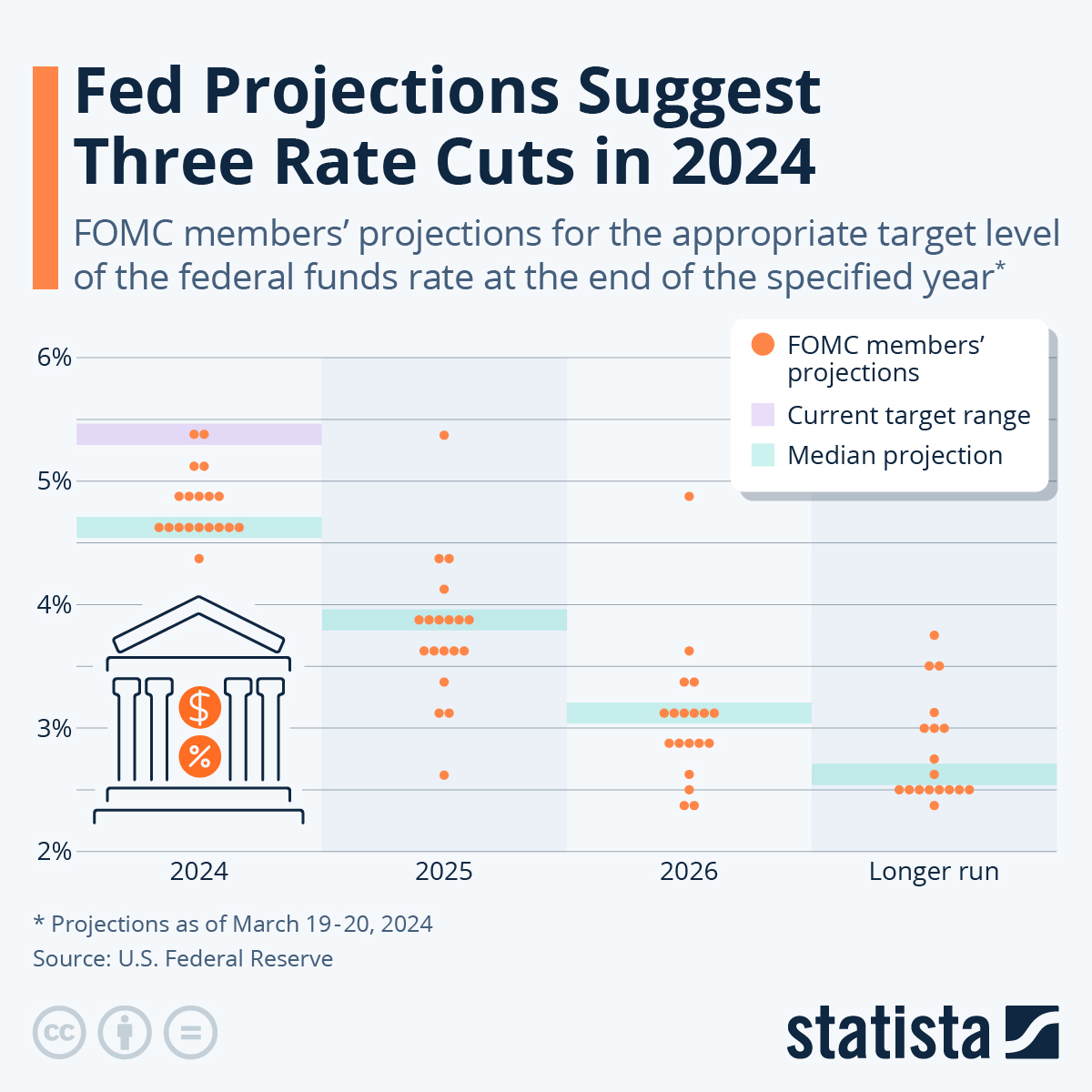

H3: Interest Rate Adjustments: The Federal Reserve (Fed) would likely respond by adjusting monetary policy.

- Interest rate hikes could be implemented to curb inflation, potentially leading to higher borrowing costs for businesses and consumers.

- Conversely, rate cuts might be considered if the event triggered a significant economic slowdown.

- The Fed's actions would be carefully scrutinized by global markets as an indicator of the U.S. economy's health and its ability to manage the crisis. Statements from the Federal Open Market Committee (FOMC) would be key to understanding the direction of monetary policy.

H3: GDP Growth: The early impact on GDP growth would be a key indicator of the severity of the event.

- A contraction in GDP might signal a recession, while a slowdown indicates reduced economic activity.

- Government spending and fiscal policy response might influence GDP growth, potentially mitigating or exacerbating the negative effects.

- Comparing the 100-day GDP figures with historical trends and pre-event forecasts would provide valuable context.

H2: Geopolitical Implications: International Trade and Relations

A major event impacting the U.S. dollar would have significant geopolitical consequences.

H3: Trade Balances: The U.S. trade balance with major trading partners could be significantly affected.

- A weaker dollar might boost exports, making U.S. goods more competitive in international markets. However, this might be offset by increased import costs.

- Trade disputes and retaliatory tariffs could emerge, further complicating the situation and affecting global trade flows.

- Data from the Bureau of Economic Analysis (BEA) would be crucial in monitoring these trade imbalances.

H3: Global Economic Confidence: The event would undoubtedly impact global economic confidence and investor sentiment towards the U.S.

- Statements from international organizations like the International Monetary Fund (IMF) and the World Bank would provide insight into the global economic outlook.

- Investor confidence indices would reflect the level of risk aversion in global financial markets. A decline in these indices would signal decreased confidence in the U.S. economy and its currency.

- Economists and geopolitical analysts would weigh in with their perspectives, providing further analysis and context.

3. Conclusion: Assessing the Long-Term Shadow of the Event on the U.S. Dollar

The 100-day analysis reveals the multifaceted impact of a significant economic event on the U.S. dollar. Short-term fluctuations in exchange rates, coupled with changes in inflation, interest rates, and GDP growth, illustrate the immediate consequences. Furthermore, geopolitical repercussions, including shifts in trade balances and global confidence, highlight the complex interplay between domestic and international factors influencing the currency’s performance. While the short-term effects are significant, the long-term shadow cast by such an event could have lasting implications for the US dollar's global dominance and stability.

The precise long-term consequences remain uncertain, depending on policy responses, global economic conditions, and the resilience of the U.S. economy. However, the initial 100-day performance provides crucial insights into the trajectory of the U.S. dollar’s future. Stay informed about the evolving impact of this hypothetical event on the U.S. dollar's future, and continue monitoring its trajectory. The strength of the U.S. dollar and the stability of global markets are intrinsically linked and deserve close attention.

Featured Posts

-

Alex Cora Tweaks Red Sox Lineup For Doubleheader Opener

Apr 28, 2025

Alex Cora Tweaks Red Sox Lineup For Doubleheader Opener

Apr 28, 2025 -

Tesla And Tech Stocks Drive U S Market Surge

Apr 28, 2025

Tesla And Tech Stocks Drive U S Market Surge

Apr 28, 2025 -

Zyart Tfqdyt Lqayd Eam Shrtt Abwzby Wthnyt Llmnawbyn

Apr 28, 2025

Zyart Tfqdyt Lqayd Eam Shrtt Abwzby Wthnyt Llmnawbyn

Apr 28, 2025 -

Grim Retail Sales A Sign Of Rate Cuts To Come

Apr 28, 2025

Grim Retail Sales A Sign Of Rate Cuts To Come

Apr 28, 2025 -

Abwzby Mnst Ealmyt Lerd Ahdth Abtkarat Tb Alhyat Alshyt Almdydt

Apr 28, 2025

Abwzby Mnst Ealmyt Lerd Ahdth Abtkarat Tb Alhyat Alshyt Almdydt

Apr 28, 2025